-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 13

-

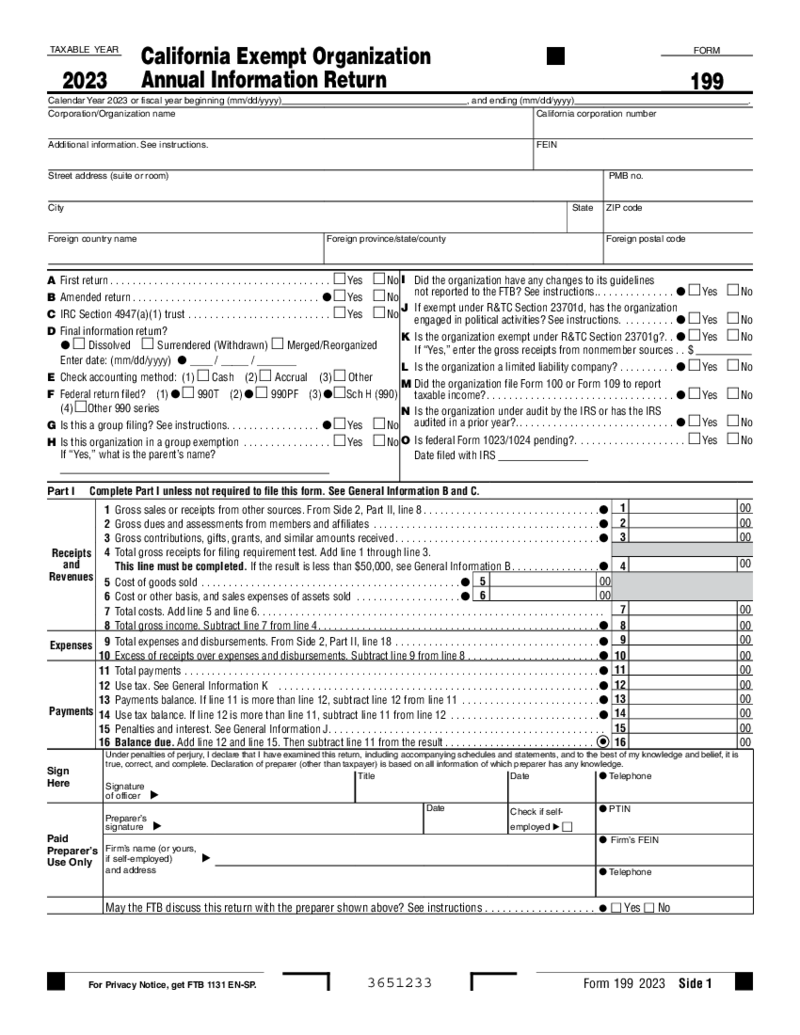

CA Form 199

What Is Form CA 199 2023 - 2024

Also known as California Exempt Organization Annual Information Return, Form CA 199 is a tax document required for tax-exempt organizations operating in California. Its purpose is to collect essential financial and operatio

CA Form 199

What Is Form CA 199 2023 - 2024

Also known as California Exempt Organization Annual Information Return, Form CA 199 is a tax document required for tax-exempt organizations operating in California. Its purpose is to collect essential financial and operatio

-

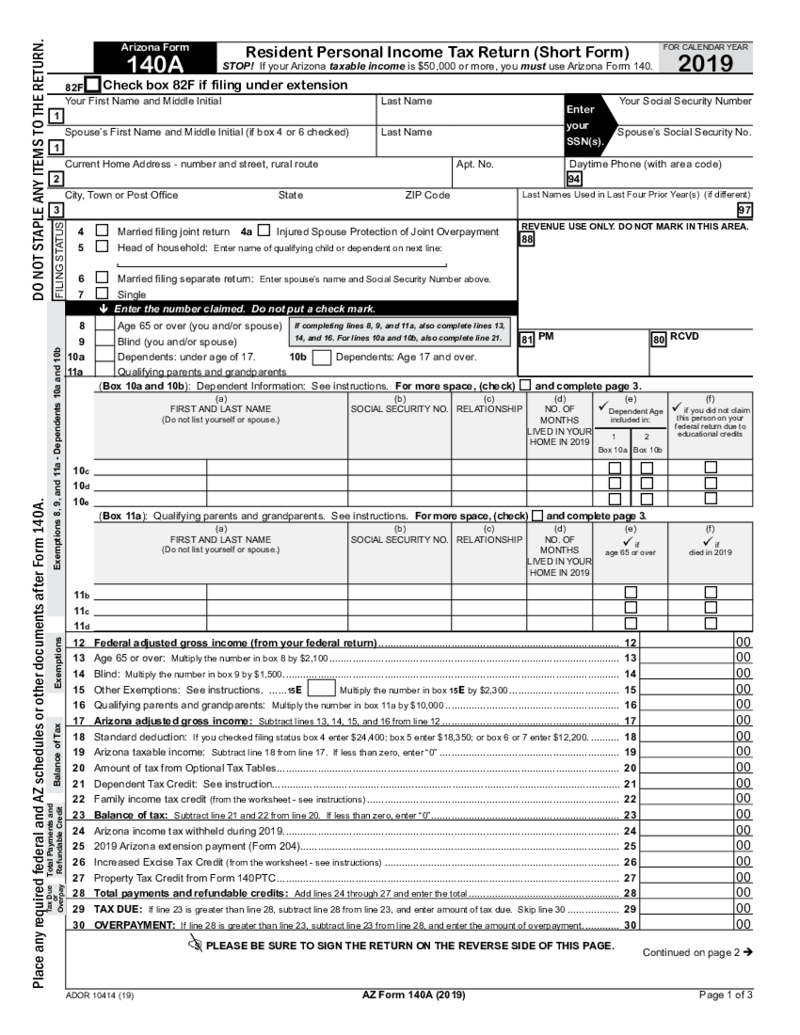

Arizona Form 140A (2019)

What is 140A Form?

The form Arizona 140A as known as Arizona Resident Personal Income Tax is submitted to ADR if your Arizona taxable income is $50,000 or more.

What I need Form 140A for?

If you are an Arizona resident and yo

Arizona Form 140A (2019)

What is 140A Form?

The form Arizona 140A as known as Arizona Resident Personal Income Tax is submitted to ADR if your Arizona taxable income is $50,000 or more.

What I need Form 140A for?

If you are an Arizona resident and yo

-

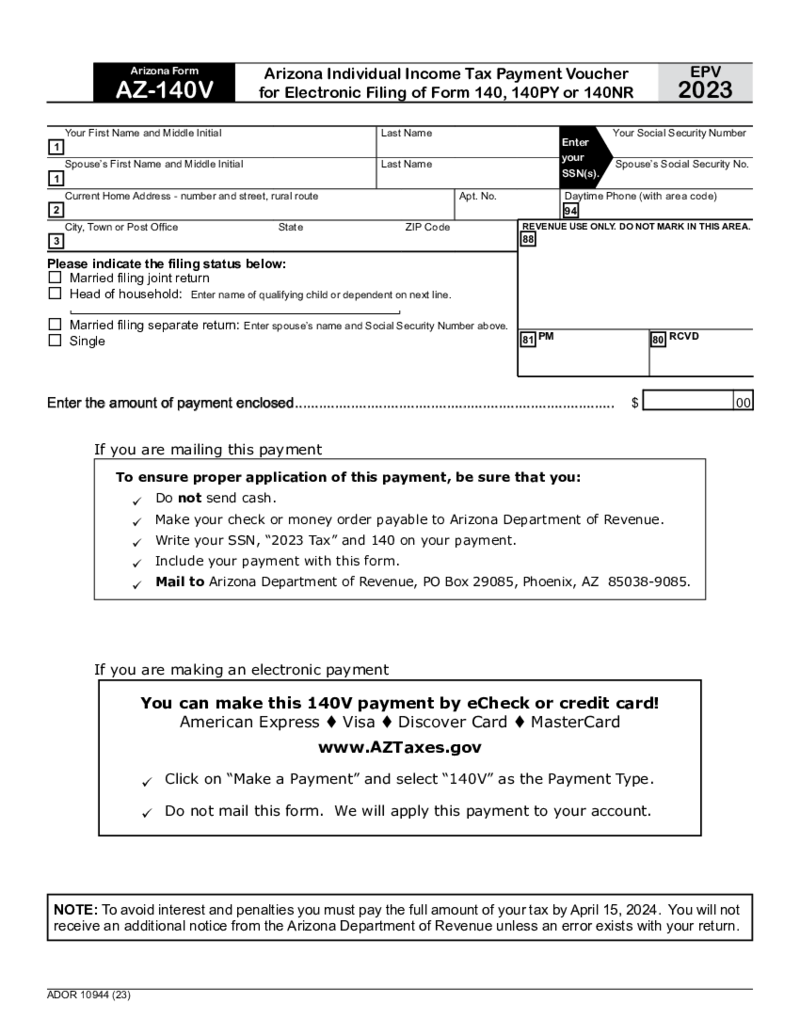

Arizona Form AZ-140V

What Is Form AZ 140V

Form AZ 140V, also known as the Arizona Individual Income Tax Payment Voucher, is a document Arizona residents utilize to accompany their state income tax payments when the payment is not made electronically. This vou

Arizona Form AZ-140V

What Is Form AZ 140V

Form AZ 140V, also known as the Arizona Individual Income Tax Payment Voucher, is a document Arizona residents utilize to accompany their state income tax payments when the payment is not made electronically. This vou

-

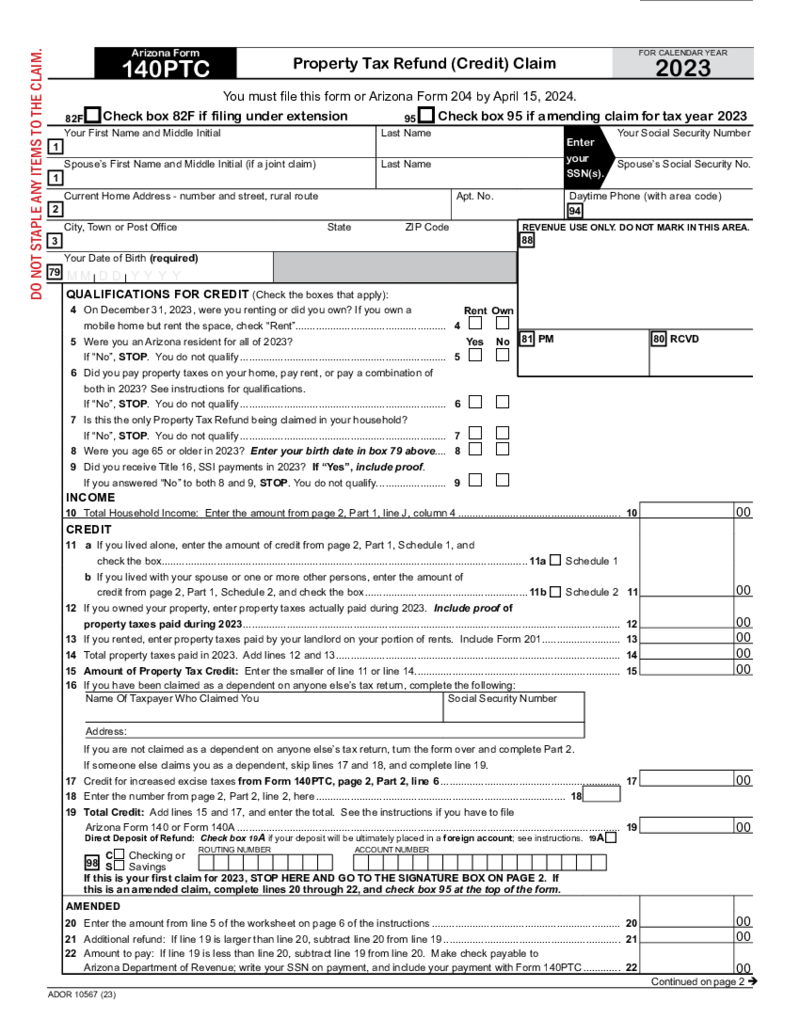

Arizona Form 140 PTC

What Is AZ Form 140 PTC

AZ Form 140 PTC, or the property tax credit form, is pertinent to Arizona. This tax form provides a convenient vehicle for taxpayers over 65 or those receiving supplemental security income to be eligible for a tax

Arizona Form 140 PTC

What Is AZ Form 140 PTC

AZ Form 140 PTC, or the property tax credit form, is pertinent to Arizona. This tax form provides a convenient vehicle for taxpayers over 65 or those receiving supplemental security income to be eligible for a tax

-

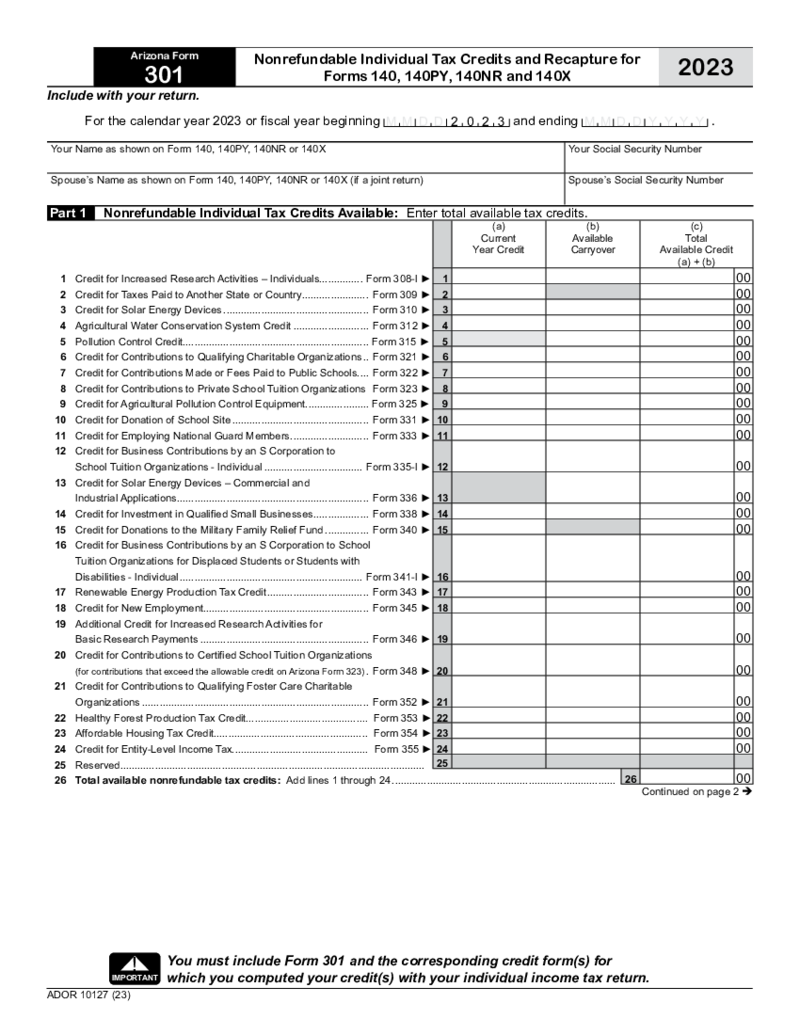

Arizona Form 301

What Is Arizona Form 301?

Arizona Form 301 is the initial document that needs to be prepared by taxpayers in Arizona who intend to claim one or multiple tax credits. It acts as a summary to include all the credits you may be eligible for and must accompan

Arizona Form 301

What Is Arizona Form 301?

Arizona Form 301 is the initial document that needs to be prepared by taxpayers in Arizona who intend to claim one or multiple tax credits. It acts as a summary to include all the credits you may be eligible for and must accompan

-

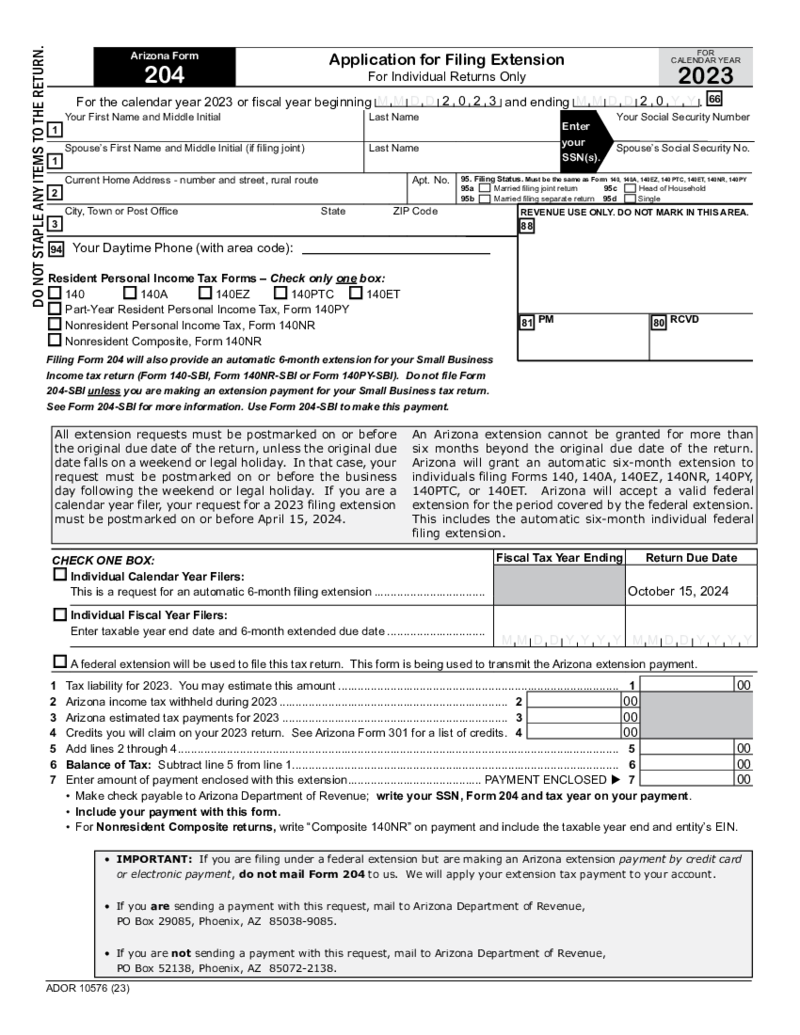

Arizona Tax Extension Form 204

What Is Arizona State Tax Form 204?

Form 204 is a tax extension form specifically for Arizona State filing purposes. Individuals and businesses that require additional time to prepare their income tax returns can submit this form to the Arizona Department

Arizona Tax Extension Form 204

What Is Arizona State Tax Form 204?

Form 204 is a tax extension form specifically for Arizona State filing purposes. Individuals and businesses that require additional time to prepare their income tax returns can submit this form to the Arizona Department

-

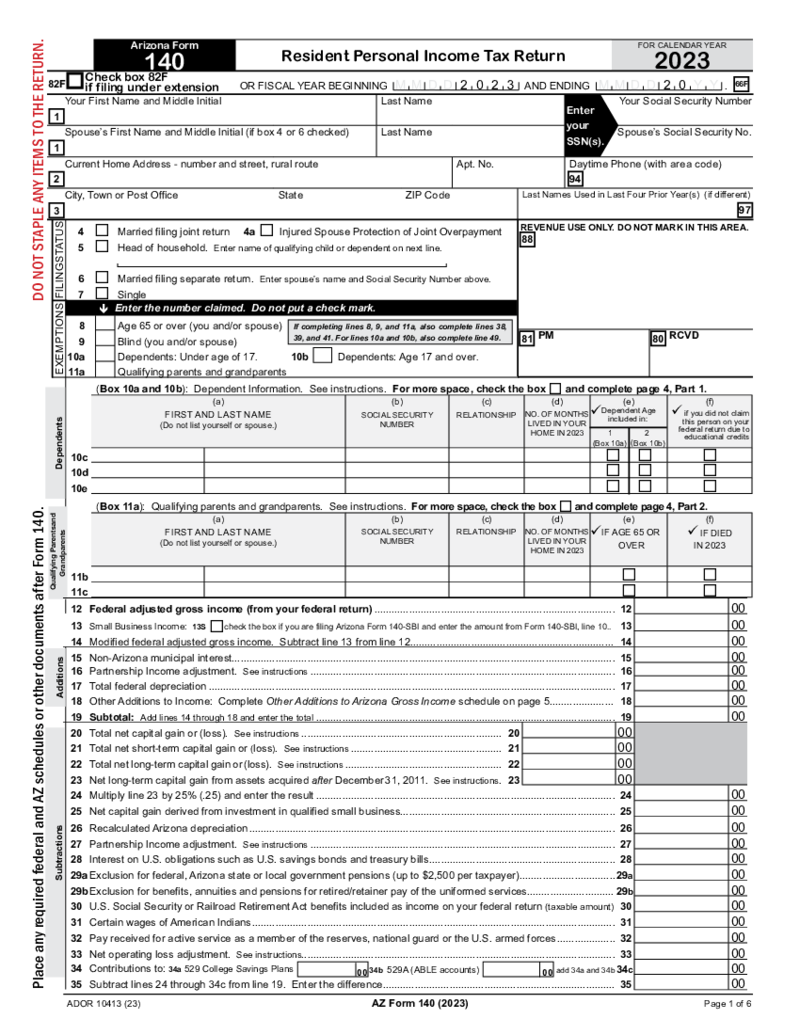

Arizona Form 140 (2023)

Understanding Arizona Form 140 2023

Form 140 is a tax form used by Arizona residents to file their individual income tax returns. It's important to note that Arizona residents who earn income in other states are required to file a nonresident tax

Arizona Form 140 (2023)

Understanding Arizona Form 140 2023

Form 140 is a tax form used by Arizona residents to file their individual income tax returns. It's important to note that Arizona residents who earn income in other states are required to file a nonresident tax

-

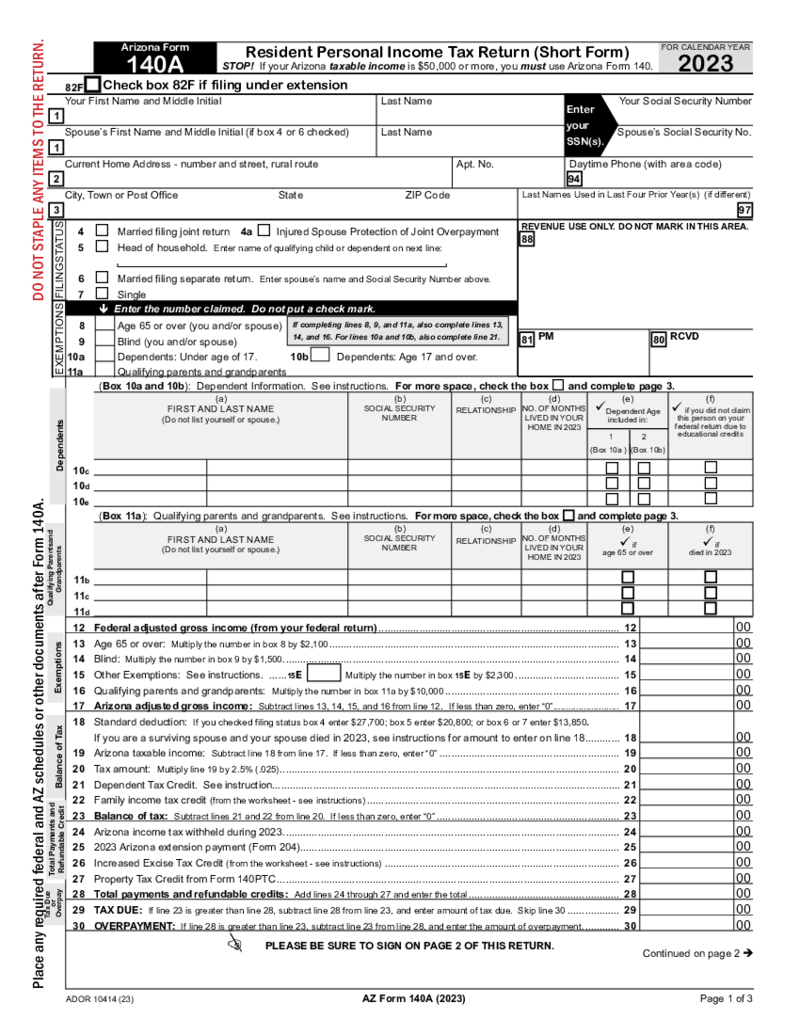

Arizona Form 140A

Overview: Arizona 140A Tax Form

The Arizona 140A tax form is a shorter and simpler tax return form, particularly when compared to other state forms. This is an excellent option for Arizona residents to file their state taxes if they have a straightforward

Arizona Form 140A

Overview: Arizona 140A Tax Form

The Arizona 140A tax form is a shorter and simpler tax return form, particularly when compared to other state forms. This is an excellent option for Arizona residents to file their state taxes if they have a straightforward

-

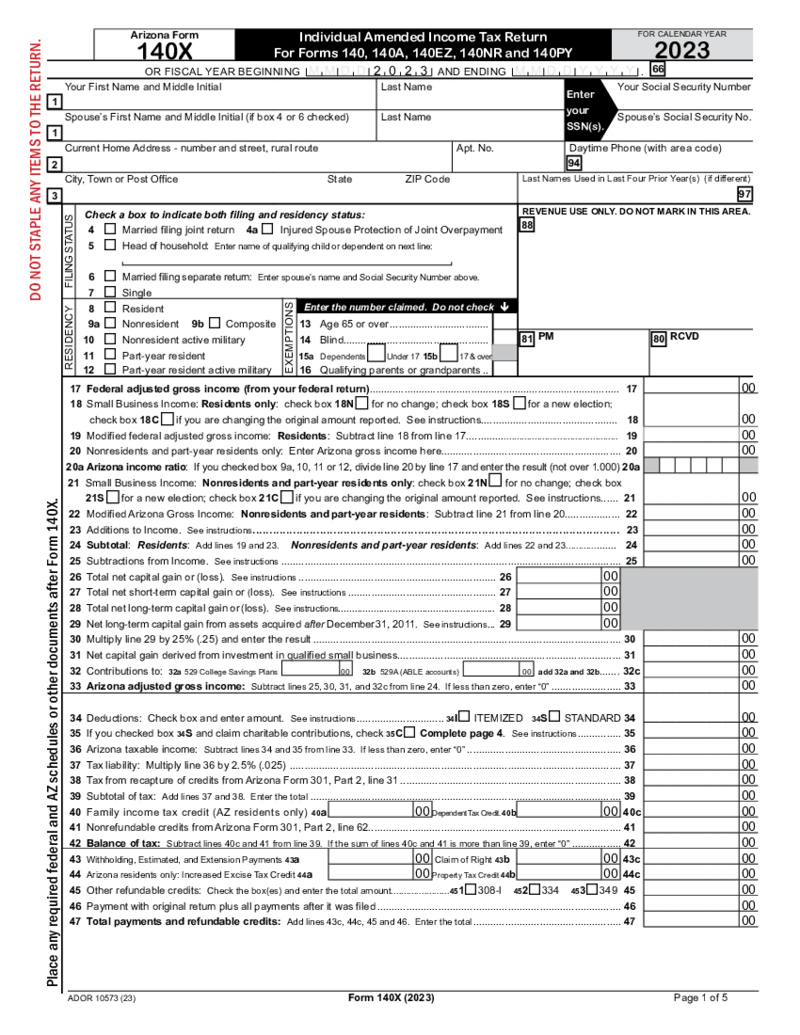

Arizona Form 140X

What Is 140X Form?

Filing taxes is an annual responsibility that sometimes may need corrections post-submission. When an individual in Arizona needs to amend their state tax return, the Arizona Form 140X is the go-to document. Its official title is the &l

Arizona Form 140X

What Is 140X Form?

Filing taxes is an annual responsibility that sometimes may need corrections post-submission. When an individual in Arizona needs to amend their state tax return, the Arizona Form 140X is the go-to document. Its official title is the &l

-

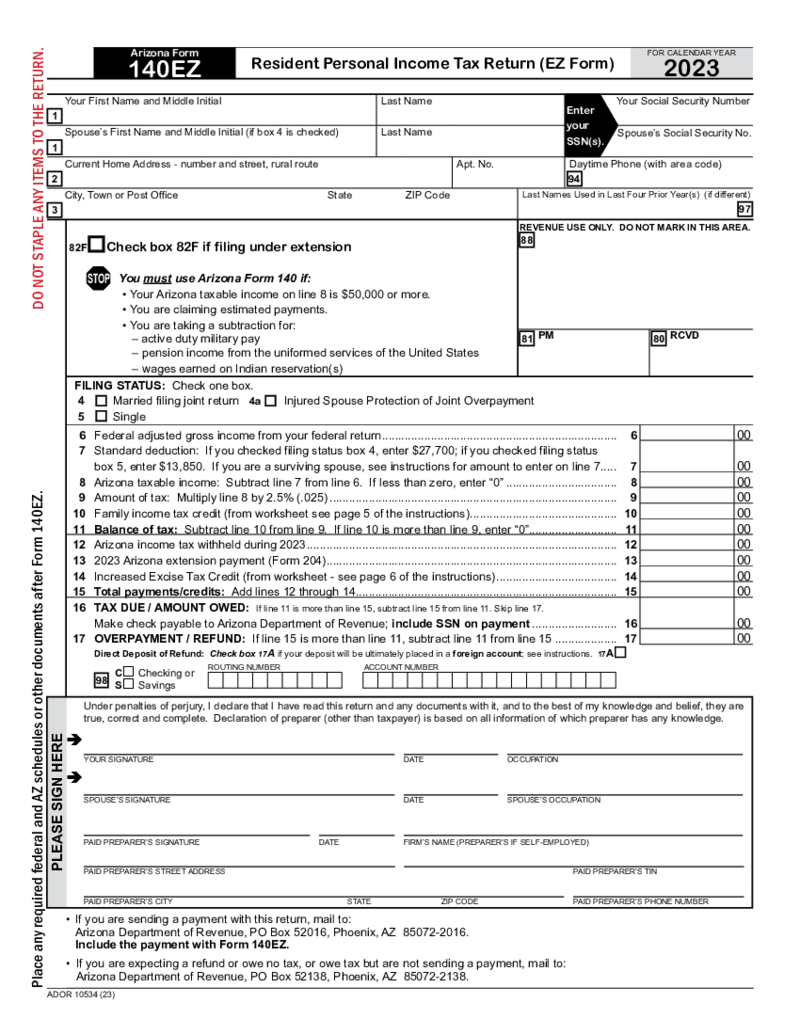

Arizona Form 140EZ

What Is the Arizona Form 140EZ?

The Arizona 140EZ form is a streamlined tax return form for eligible residents in Arizona. Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a relatively straightforwar

Arizona Form 140EZ

What Is the Arizona Form 140EZ?

The Arizona 140EZ form is a streamlined tax return form for eligible residents in Arizona. Designed for simplicity, the form is geared toward taxpayers with less than $50,000 in annual income and a relatively straightforwar

-

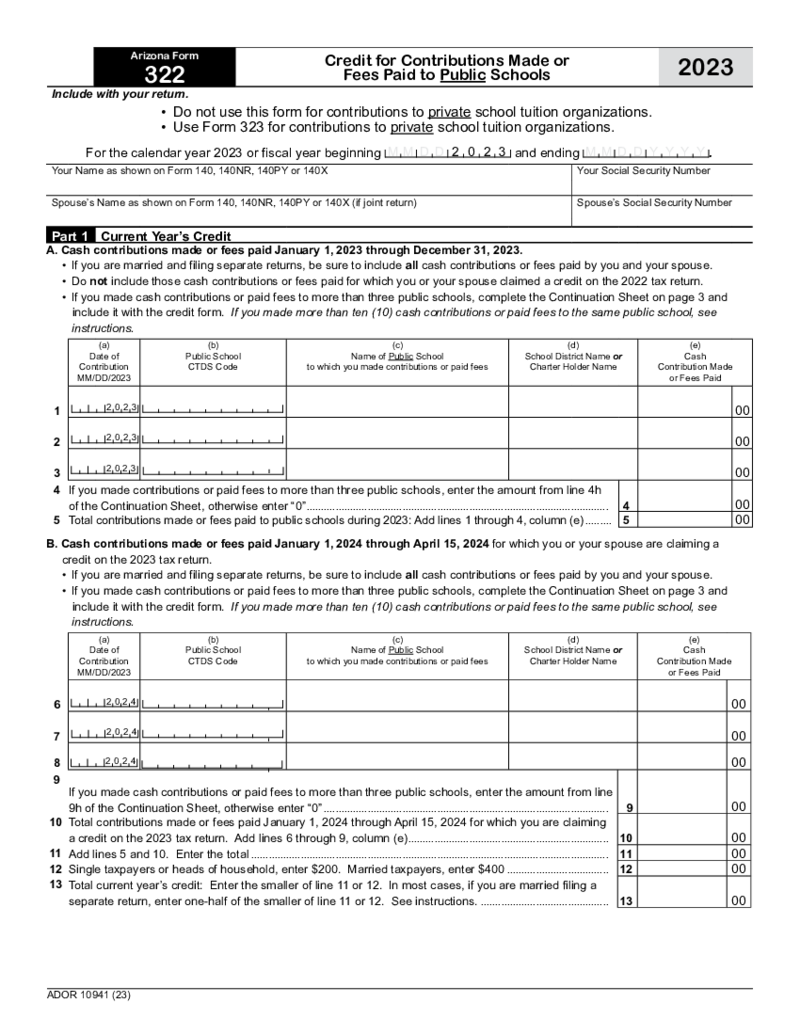

Arizona Tax Form 322

Understanding Arizona State Tax Form 322

State of Arizona Form 322, also known as Form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their Arizona income tax return. This form is for individuals w

Arizona Tax Form 322

Understanding Arizona State Tax Form 322

State of Arizona Form 322, also known as Form 322, is a tax document utilized by taxpayers who are claiming a credit for taxes paid to other states on their Arizona income tax return. This form is for individuals w

-

Alabama Form 40 (2023)

What Is an Alabama Tax Form 40?

Alabama individual income tax form 40 is a state income tax return form used by residents of Alabama to file their state income taxes. Alabama tax form 40 is used to report an individual's taxable income and to calculat

Alabama Form 40 (2023)

What Is an Alabama Tax Form 40?

Alabama individual income tax form 40 is a state income tax return form used by residents of Alabama to file their state income taxes. Alabama tax form 40 is used to report an individual's taxable income and to calculat

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.