-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

State Tax Forms - page 14

-

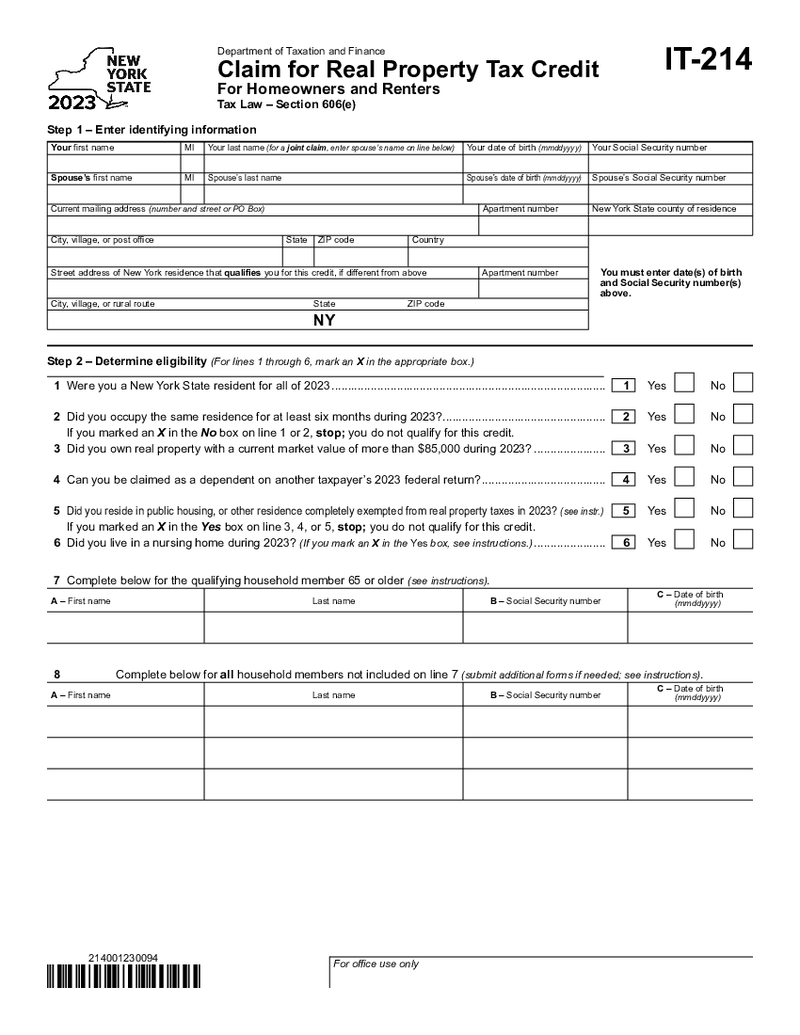

New York Form IT-214

What is a New York Form IT-214 2023?

Titled Claim for Real Property Tax Credit for Homeowners and Renters, form IT-214 pertains to individuals/househ

New York Form IT-214

What is a New York Form IT-214 2023?

Titled Claim for Real Property Tax Credit for Homeowners and Renters, form IT-214 pertains to individuals/househ

-

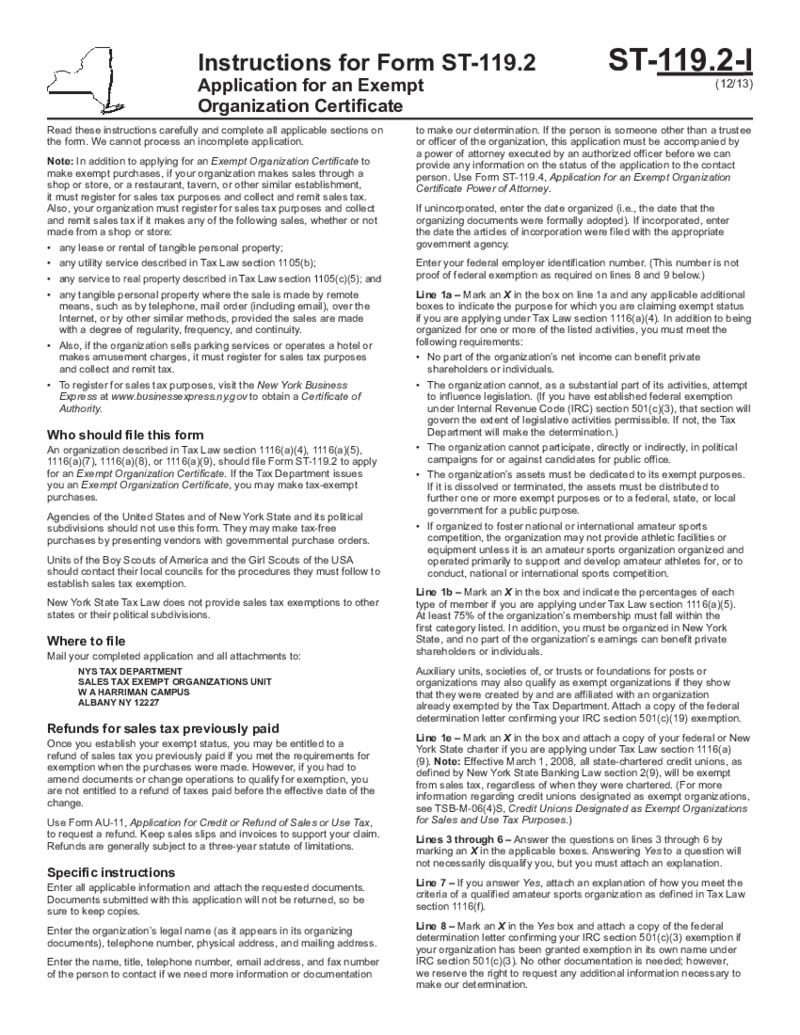

Form ST-119.2

Application for an Exempt Organization Certificate

To apply for an Exempt Organization Certificate using Form ST-119.2, you should first understand all sections and requirements. Incomplete applications cannot be processed.

Who Should File

Form ST-119.2

Application for an Exempt Organization Certificate

To apply for an Exempt Organization Certificate using Form ST-119.2, you should first understand all sections and requirements. Incomplete applications cannot be processed.

Who Should File

-

Form MO-1120V - Corporation Income Tax Payment Voucher

Overview: Form MO-1120V

Managing corporate taxes can be a meticulous process, but with the right forms and understanding, it can be simplified. One such document that facilitates this is Form MO-1120V, which plays a vital role in the tax payment process f

Form MO-1120V - Corporation Income Tax Payment Voucher

Overview: Form MO-1120V

Managing corporate taxes can be a meticulous process, but with the right forms and understanding, it can be simplified. One such document that facilitates this is Form MO-1120V, which plays a vital role in the tax payment process f

-

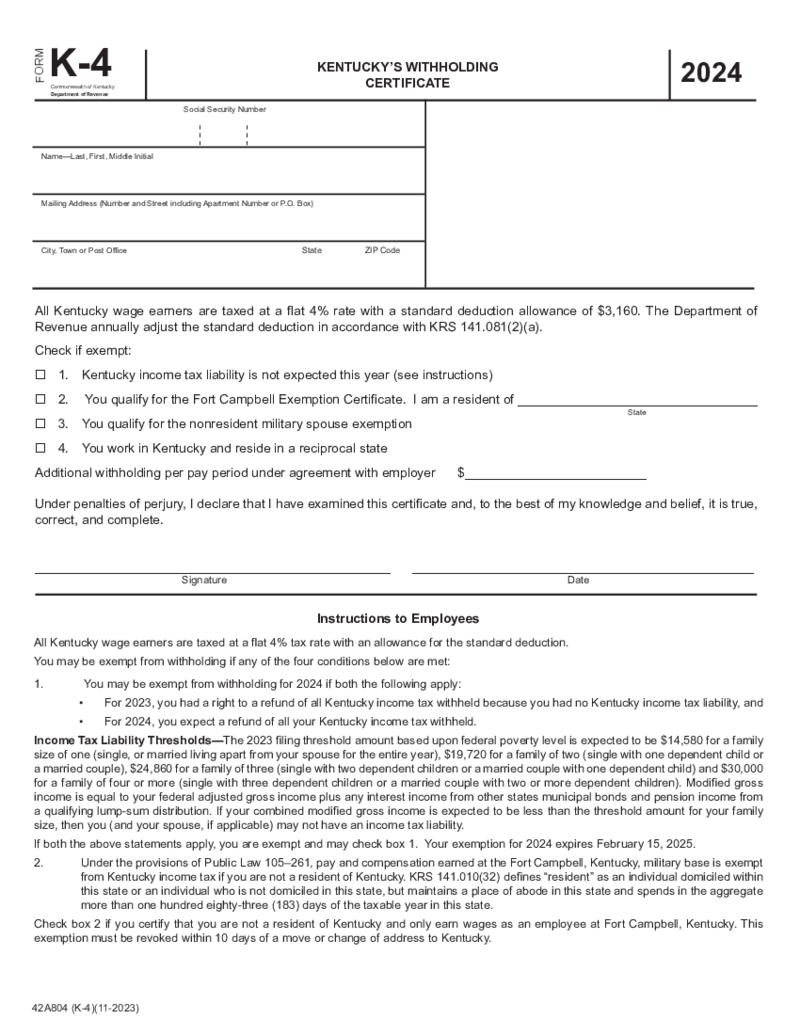

Kentucky Withholding Certificate - Form K-4

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's

Kentucky Withholding Certificate - Form K-4

What Is the K 4 Form Kentucky?

The Kentucky K 4 withholding certificate is a state-specific document designed to help employers withhold the correct amount of Kentucky income tax from their employees' wages. This form accounts for an individual's

-

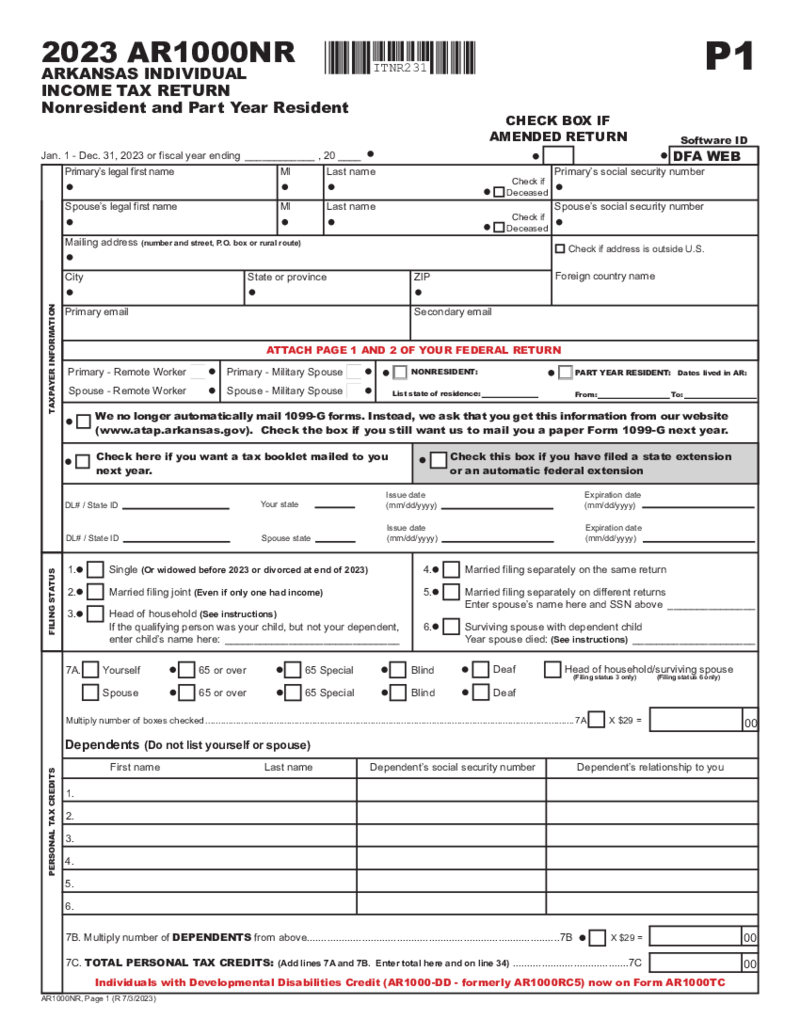

Arkansas Form AR1000NR Part Year or Non-Resident Individual Income Tax Return

What Is AR1000NR Form?

When it comes to tax season, understanding the specific forms required by each state can be a complex task. For those who have moved to or from Arkansas or have earned income within the state without being a full-year resident, the

Arkansas Form AR1000NR Part Year or Non-Resident Individual Income Tax Return

What Is AR1000NR Form?

When it comes to tax season, understanding the specific forms required by each state can be a complex task. For those who have moved to or from Arkansas or have earned income within the state without being a full-year resident, the

-

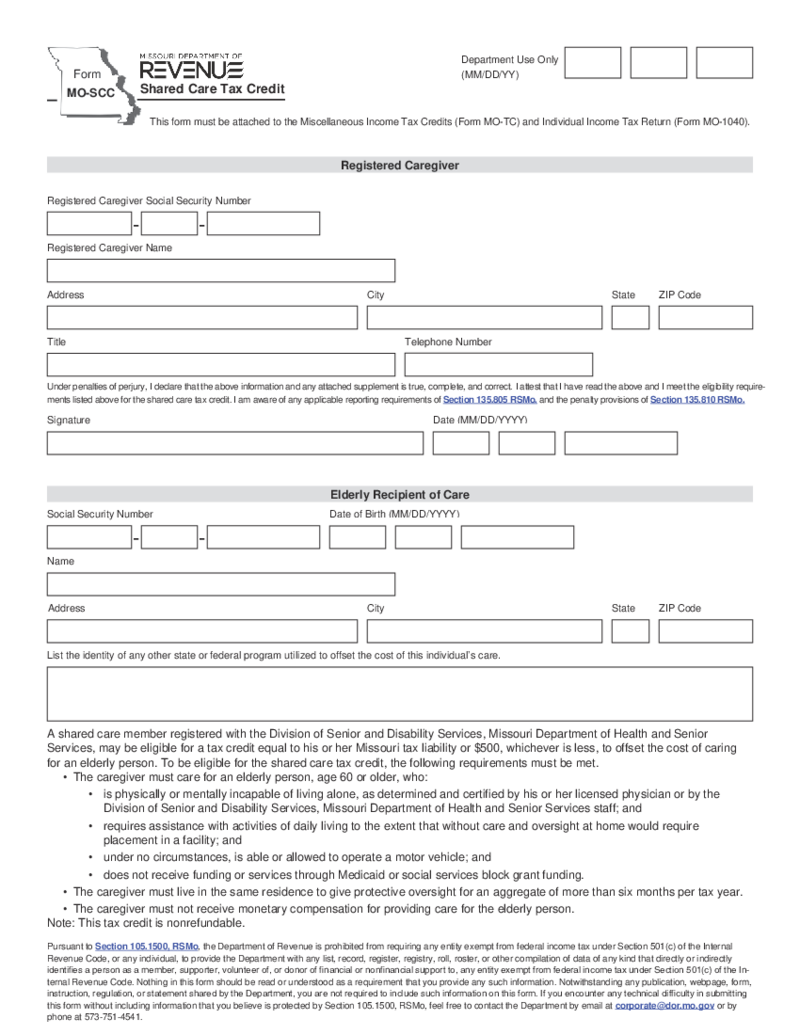

Form MO-SCC - Shared Care Tax Credit

Overview: Form MO-SCC

In Missouri, the Shared Care Tax Credit, also known as Form MO-SCC, is a financial incentive provided to eligible taxpayers. It supports those who care about older family members in their own homes instead of placing them in long-ter

Form MO-SCC - Shared Care Tax Credit

Overview: Form MO-SCC

In Missouri, the Shared Care Tax Credit, also known as Form MO-SCC, is a financial incentive provided to eligible taxpayers. It supports those who care about older family members in their own homes instead of placing them in long-ter

-

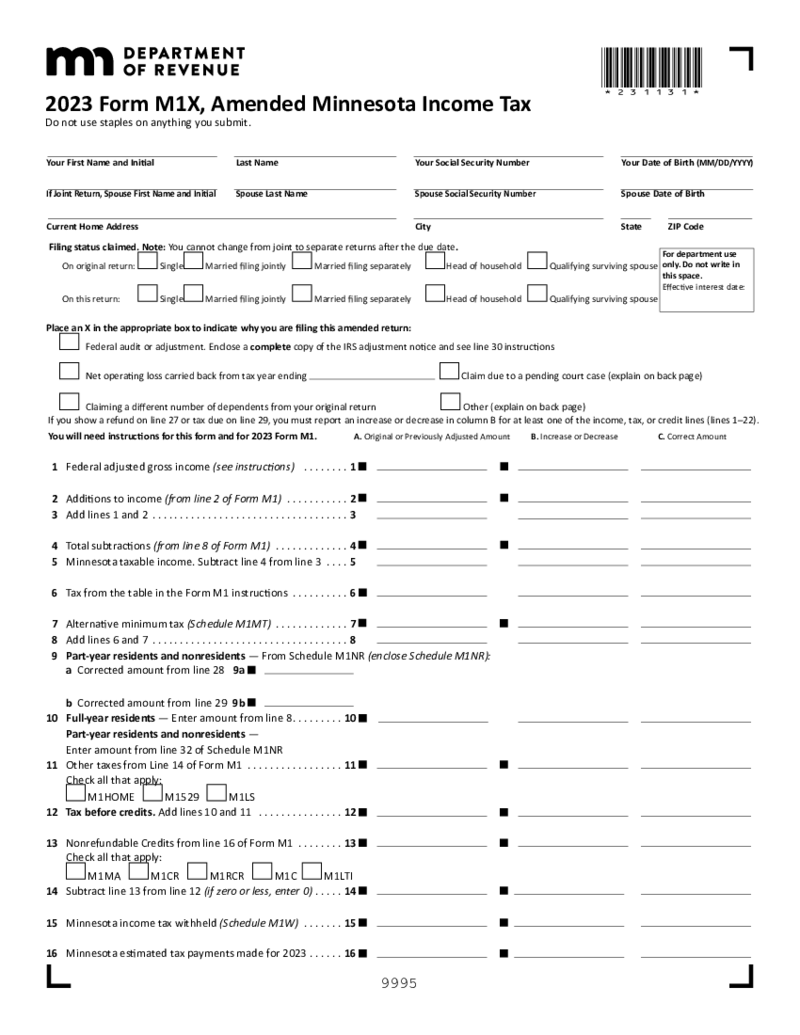

Minnesota Form M1X

Understanding M1X Minnesota Tax Form

When it comes to amending your state tax returns, understanding the Minnesota Form M1X is crucial. This document is used by Minnesota residents to make changes to their already filed state income tax returns. Whether y

Minnesota Form M1X

Understanding M1X Minnesota Tax Form

When it comes to amending your state tax returns, understanding the Minnesota Form M1X is crucial. This document is used by Minnesota residents to make changes to their already filed state income tax returns. Whether y

-

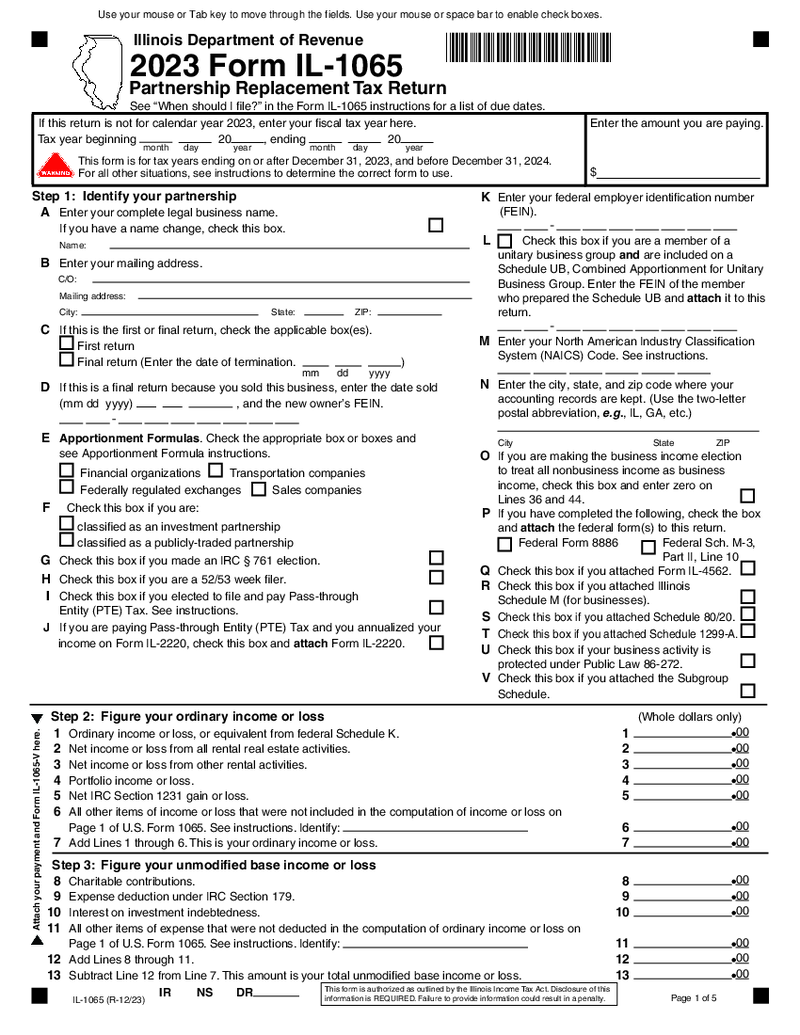

Form IL-1065 (2023)

How to Redact and Fill Out Form IL-1065 Online in 2023?

To redact and fill out Illinois form il-1065 online, you will need to follow these steps:

Obtain a copy of Form IL-1065: This form is used by partnerships to report their income, ga

Form IL-1065 (2023)

How to Redact and Fill Out Form IL-1065 Online in 2023?

To redact and fill out Illinois form il-1065 online, you will need to follow these steps:

Obtain a copy of Form IL-1065: This form is used by partnerships to report their income, ga

-

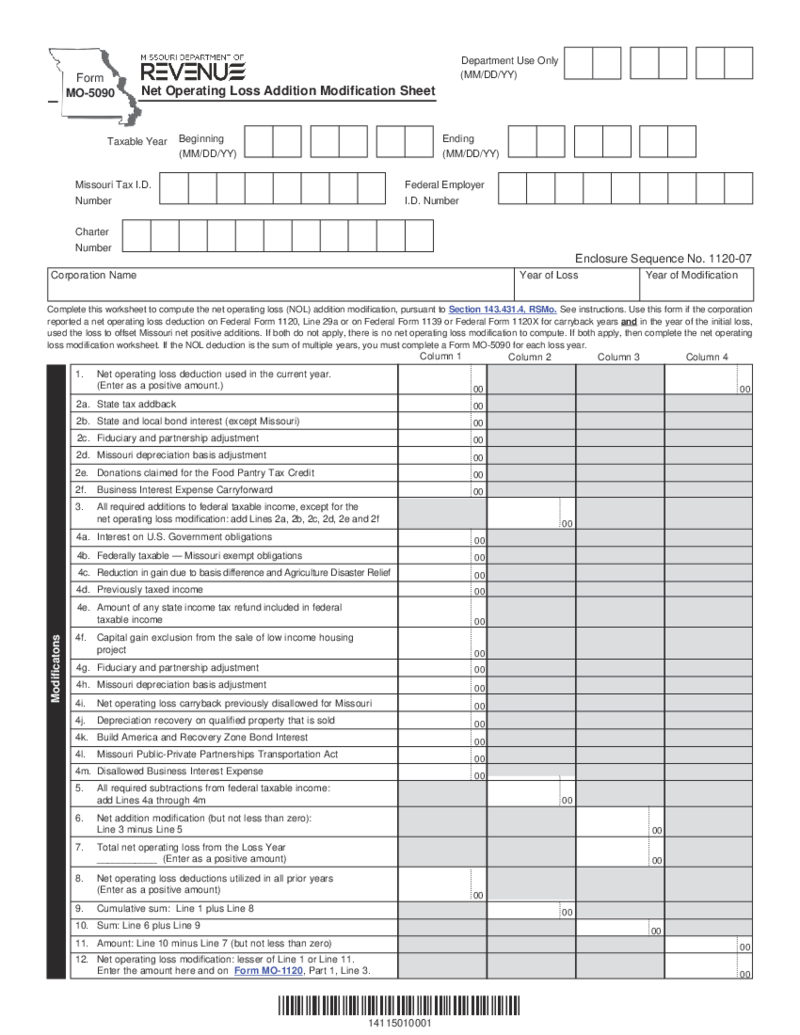

Form MO-5090 - Net Operating Loss Addition Modification Worksheet

What Is Form MO 5090?

For Missouri taxpayers, especially those seeking to adjust their taxes due to various credits, deductions, or discrepancies in their original filings, Form MO-5090 is an important document. This Missouri document helps as a means to

Form MO-5090 - Net Operating Loss Addition Modification Worksheet

What Is Form MO 5090?

For Missouri taxpayers, especially those seeking to adjust their taxes due to various credits, deductions, or discrepancies in their original filings, Form MO-5090 is an important document. This Missouri document helps as a means to

-

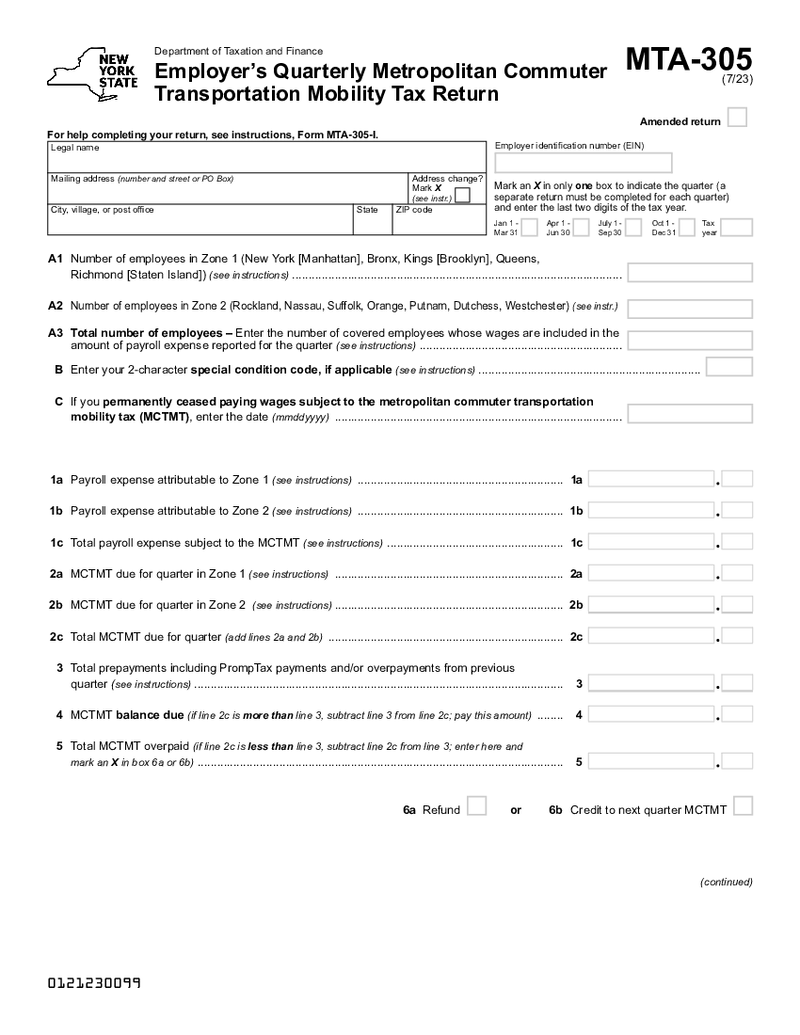

NY Form MTA-305

What Is NY MTA 305 Tax Form?

The NY MTA 305 tax form, also known as the Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return, is designed for employers within the MCTD. This dist

NY Form MTA-305

What Is NY MTA 305 Tax Form?

The NY MTA 305 tax form, also known as the Employer's Quarterly Metropolitan Commuter Transportation Mobility Tax Return, is designed for employers within the MCTD. This dist

-

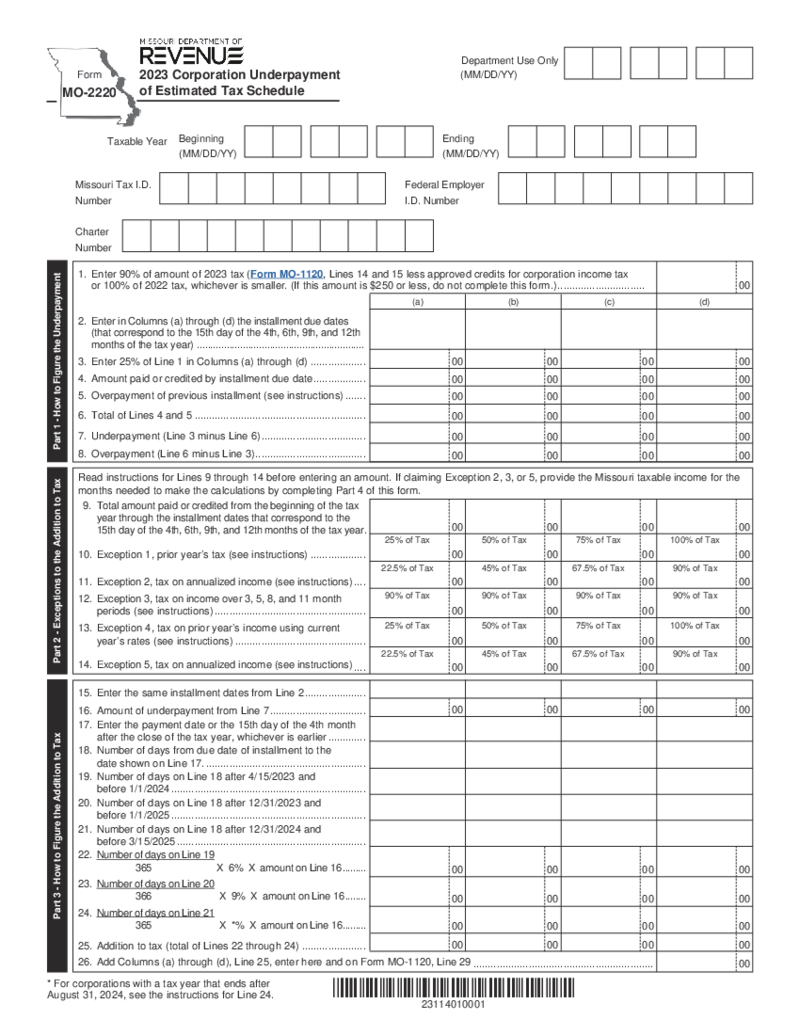

Form MO-2220 - Corporation Underpayment of Estimated Tax Schedule

What Is 2220 Form?

Form MO-2220 is utilized by corporations in Missouri when they need to compute the penalty for underpaying estimated taxes throughout the tax year. Estimated taxes are payments made in advance on income that isn't subject to withhol

Form MO-2220 - Corporation Underpayment of Estimated Tax Schedule

What Is 2220 Form?

Form MO-2220 is utilized by corporations in Missouri when they need to compute the penalty for underpaying estimated taxes throughout the tax year. Estimated taxes are payments made in advance on income that isn't subject to withhol

-

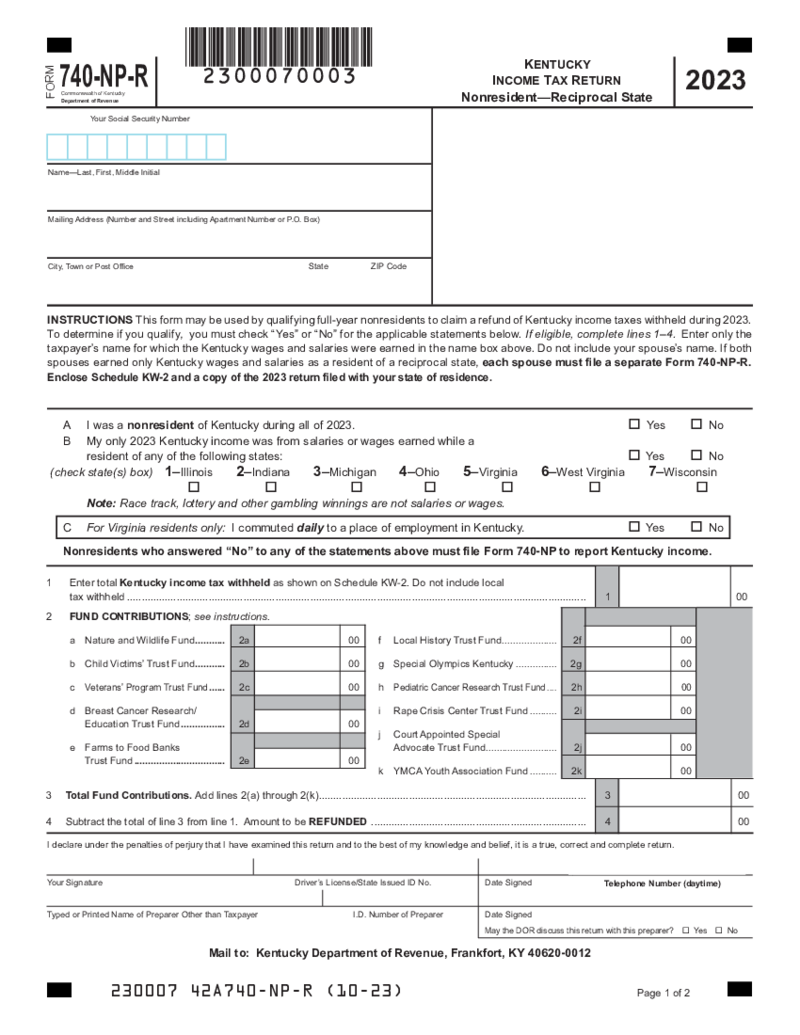

Kentucky Form 740-NP-R

Overview of Kentucky Form 740 NP R

Kentucky Form 740-NP-R is an income tax return form used by non-residents who have earned income from Kentucky sources but are not required to file a standard resident tax return in the state. This form enables non-resid

Kentucky Form 740-NP-R

Overview of Kentucky Form 740 NP R

Kentucky Form 740-NP-R is an income tax return form used by non-residents who have earned income from Kentucky sources but are not required to file a standard resident tax return in the state. This form enables non-resid

Search by State

FAQ

-

When will state tax forms be available?

While a multitude of IRS forms are up for grabs at the sunrise of tax season, there are files or schedules that become available some time later. State tax forms are available within different time frames. That depends on certification requirements and tax law amendments. With that said, the answer to your question is determined by the exact form you need. To always stay updated on the topic, monitor it either in the corresponding section of our website or on your state Department of Revenue site.

-

How do I print state tax forms?

Use the corresponding PDFLiner feature if you want to print out any of the forms you’ll find and fill out here. Just make sure the printer is on and connected to your device. With our digital file editing beast, it’s as easy as ABS.