-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Tax Forms

-

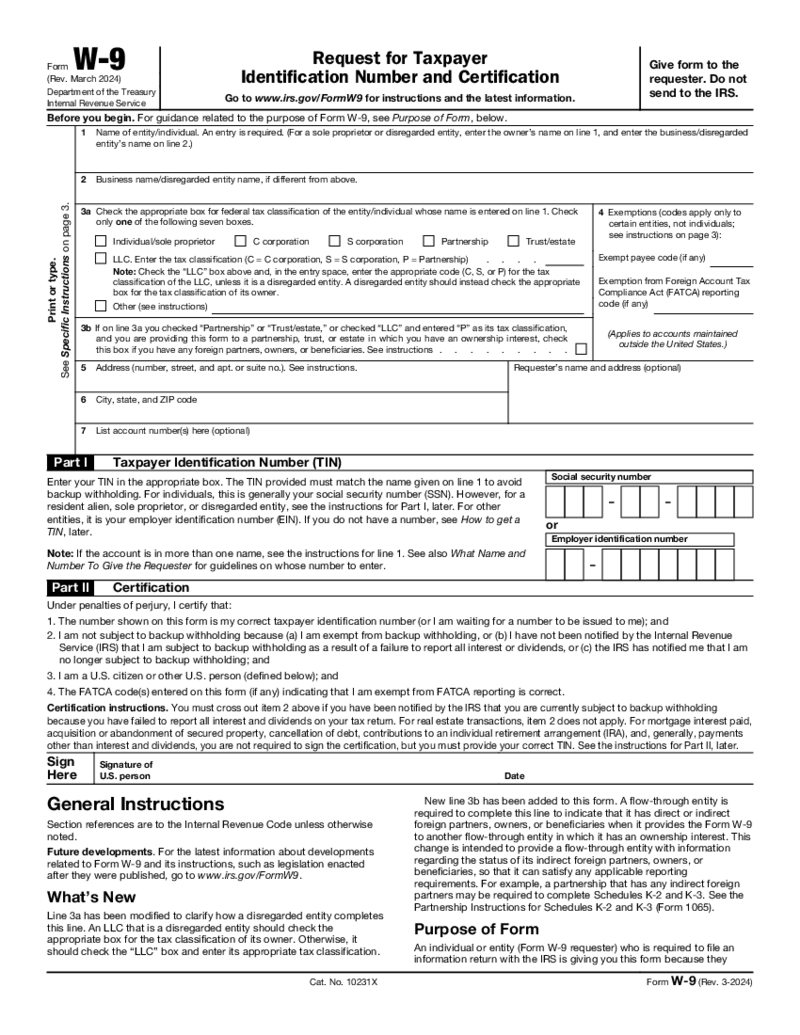

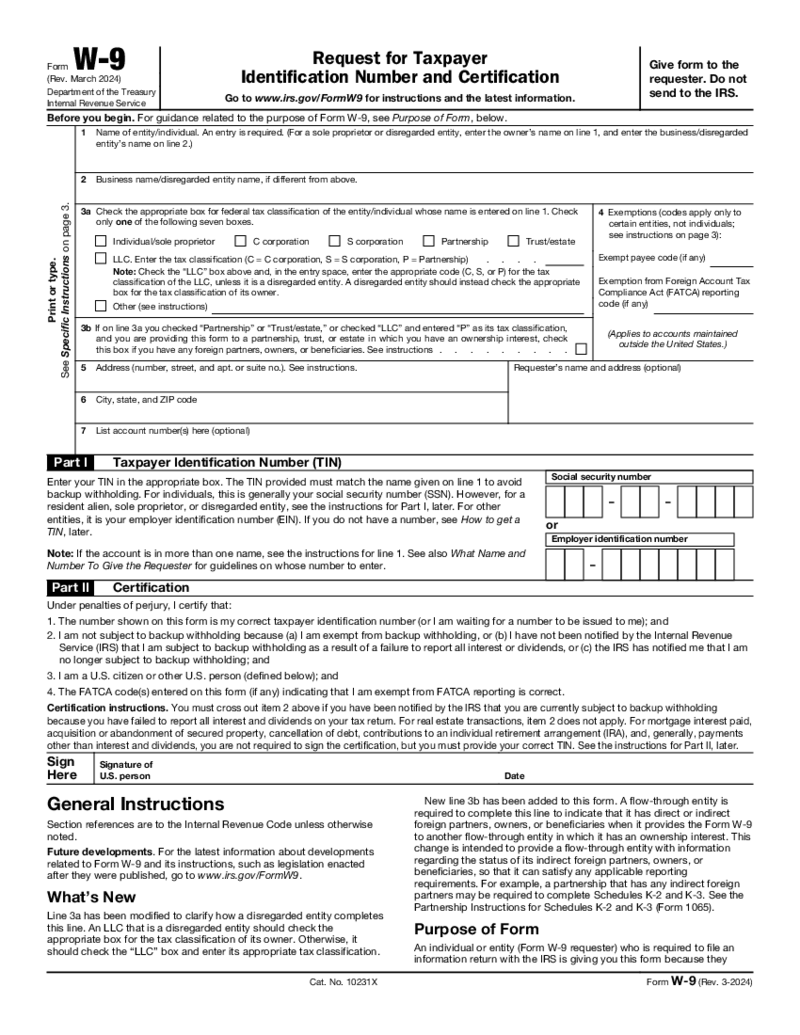

W-9 Form (Rev. March 2024)

How to Complete W-9 Form Online

The W-9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is crucial in U.S. business operations. Here's what you need to know:

Purpose:

🔹&n

W-9 Form (Rev. March 2024)

How to Complete W-9 Form Online

The W-9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is crucial in U.S. business operations. Here's what you need to know:

Purpose:

🔹&n

-

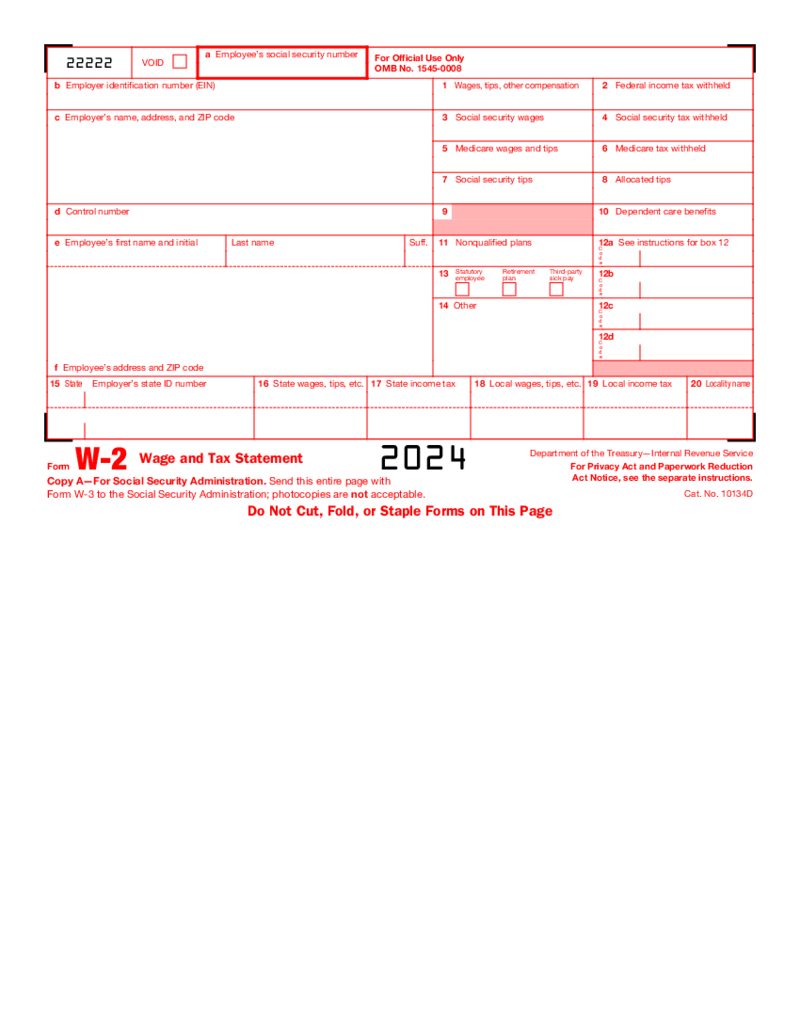

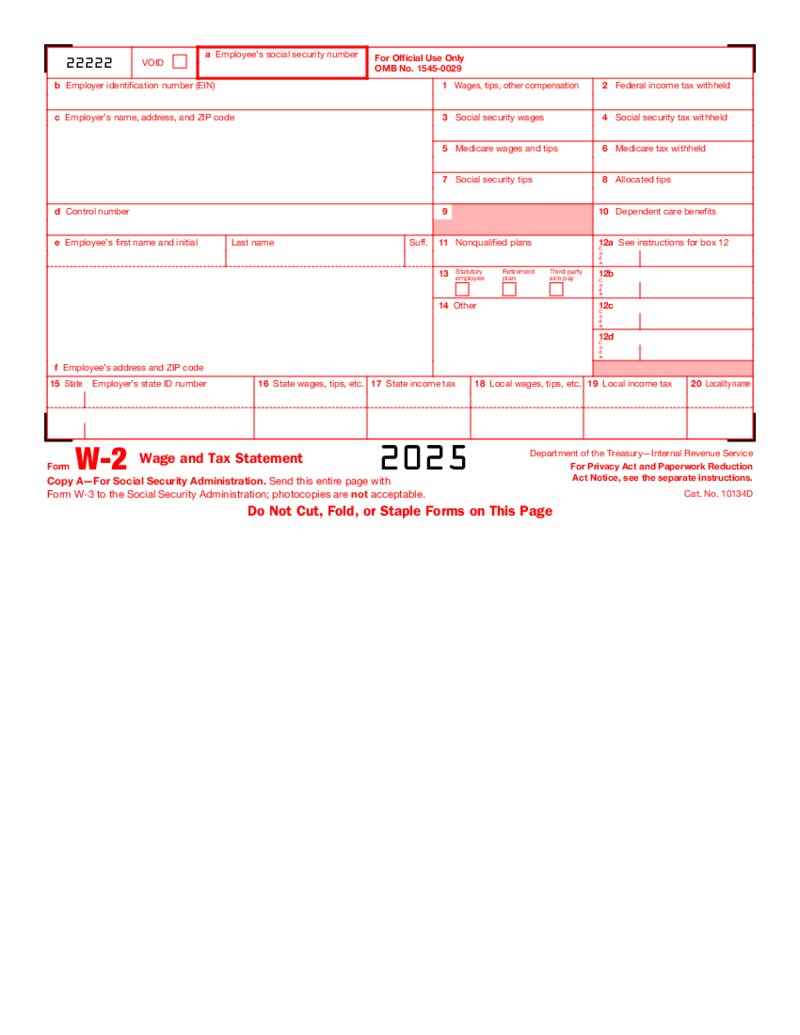

W-2 Form 2025

How to Fill Out a W-2 Form PDF

The printable W2 form (also known as Wage and Tax Statement) provides the correct sum paid to the employee and the taxes withheld from their paychecks during the year. Every employer should fill out this form by the end of t

W-2 Form 2025

How to Fill Out a W-2 Form PDF

The printable W2 form (also known as Wage and Tax Statement) provides the correct sum paid to the employee and the taxes withheld from their paychecks during the year. Every employer should fill out this form by the end of t

-

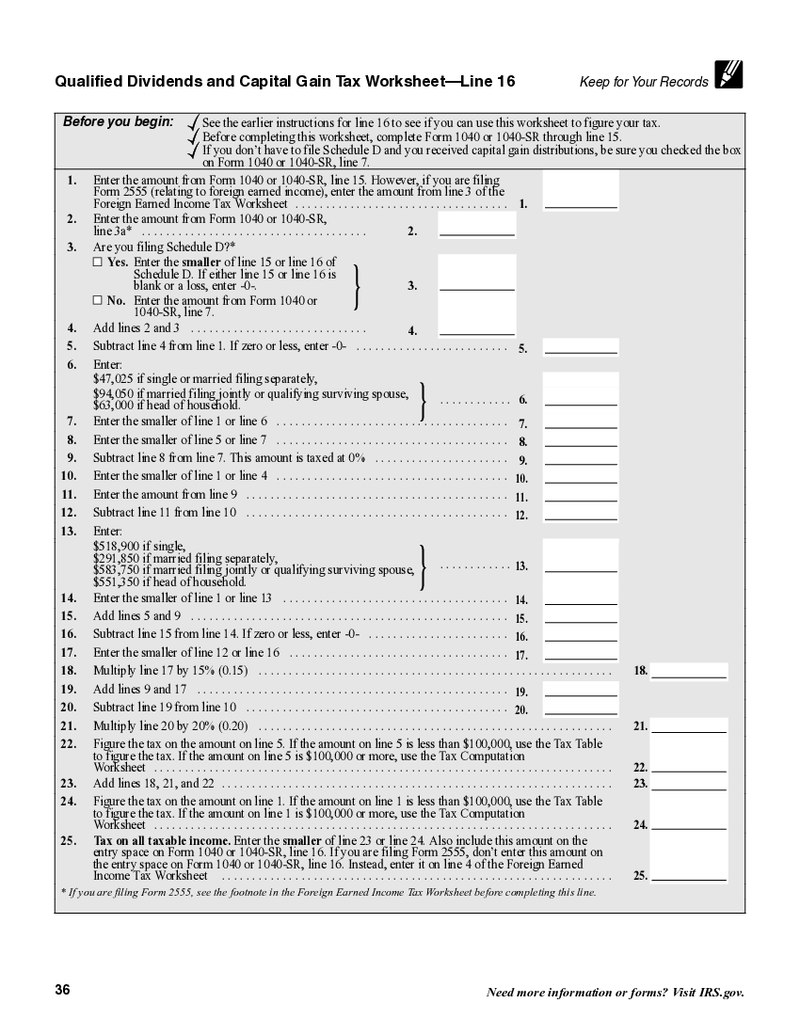

Qualified Dividends and Capital Gain Tax Worksheet 2024

What Is Qualified Dividends and Capital Gain Tax Worksheet 2024-2025?

This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term cap

Qualified Dividends and Capital Gain Tax Worksheet 2024

What Is Qualified Dividends and Capital Gain Tax Worksheet 2024-2025?

This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term cap

-

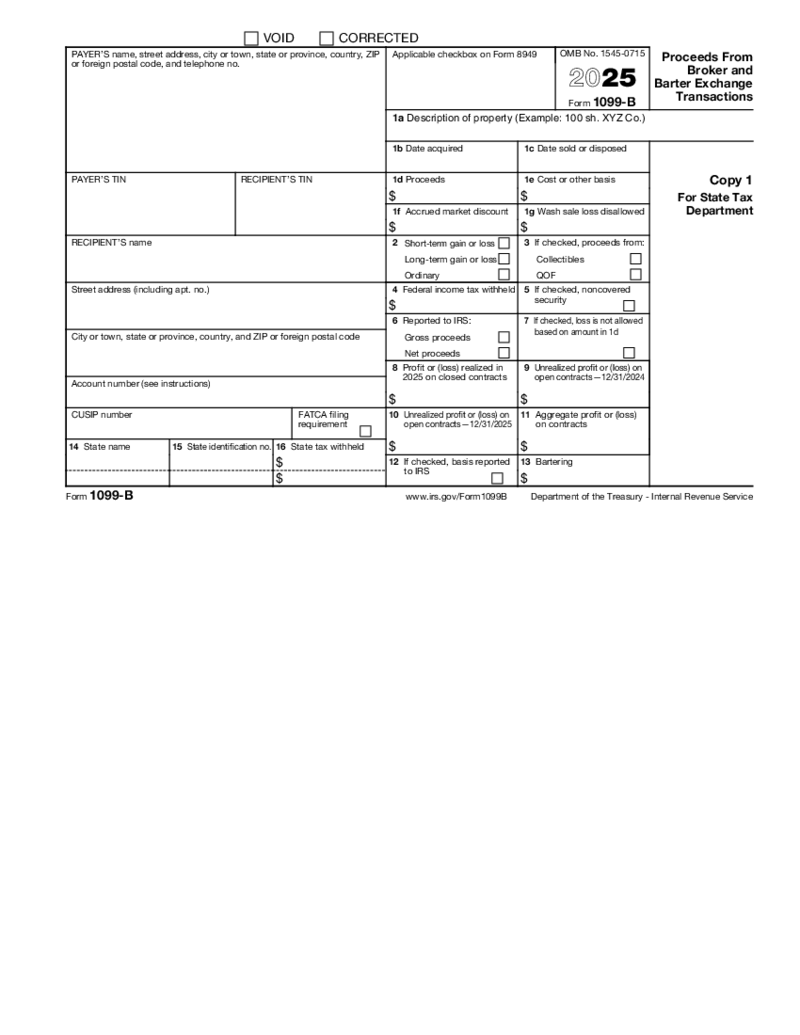

Form 1099-B (2025)

What Is Form 1099-B (2026)?

Form 1099-B, or Proceeds from Broker and Barter Exchange, is a document used by brokers or barter exchanges to record clients’ profits and losses throughout a tax year. Taxpayers use the data from IRS Form 1099-B to calcu

Form 1099-B (2025)

What Is Form 1099-B (2026)?

Form 1099-B, or Proceeds from Broker and Barter Exchange, is a document used by brokers or barter exchanges to record clients’ profits and losses throughout a tax year. Taxpayers use the data from IRS Form 1099-B to calcu

-

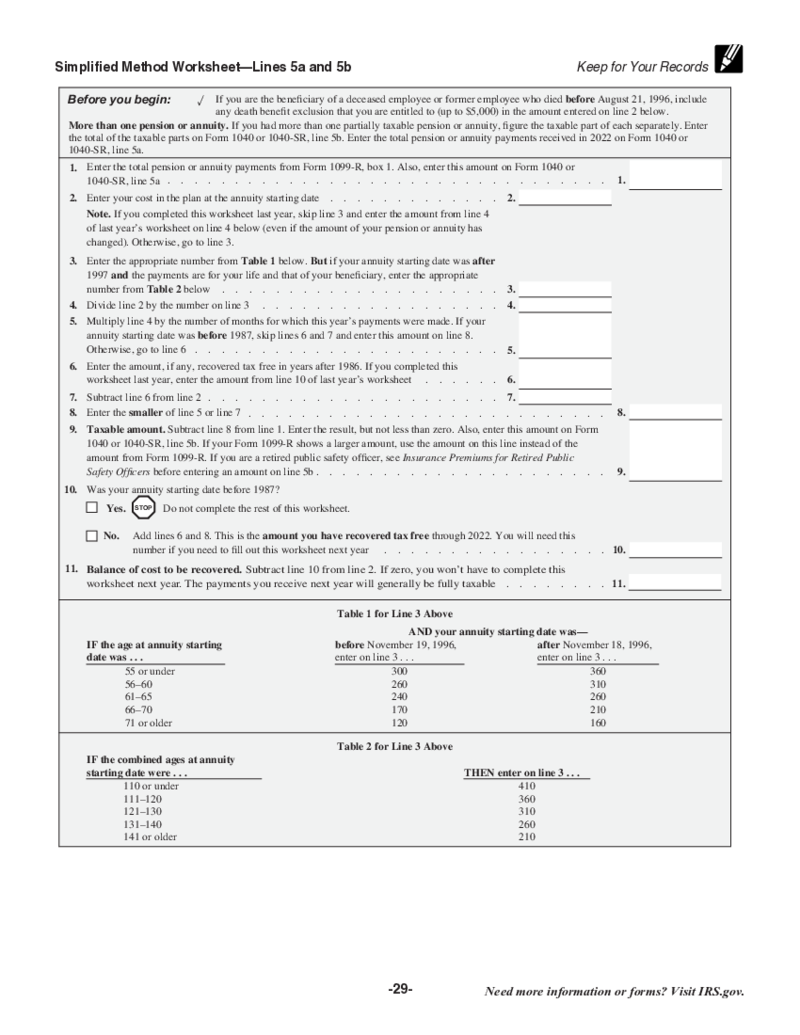

Simplified Method Worksheet

What Is the Simplified Method Worksheet

The Simplified Method Worksheet is an IRS tax form that helps determine the taxable pension and annuity payments amount. It is used to calculate the portion of pension and annuity income that is taxable for federal

Simplified Method Worksheet

What Is the Simplified Method Worksheet

The Simplified Method Worksheet is an IRS tax form that helps determine the taxable pension and annuity payments amount. It is used to calculate the portion of pension and annuity income that is taxable for federal

-

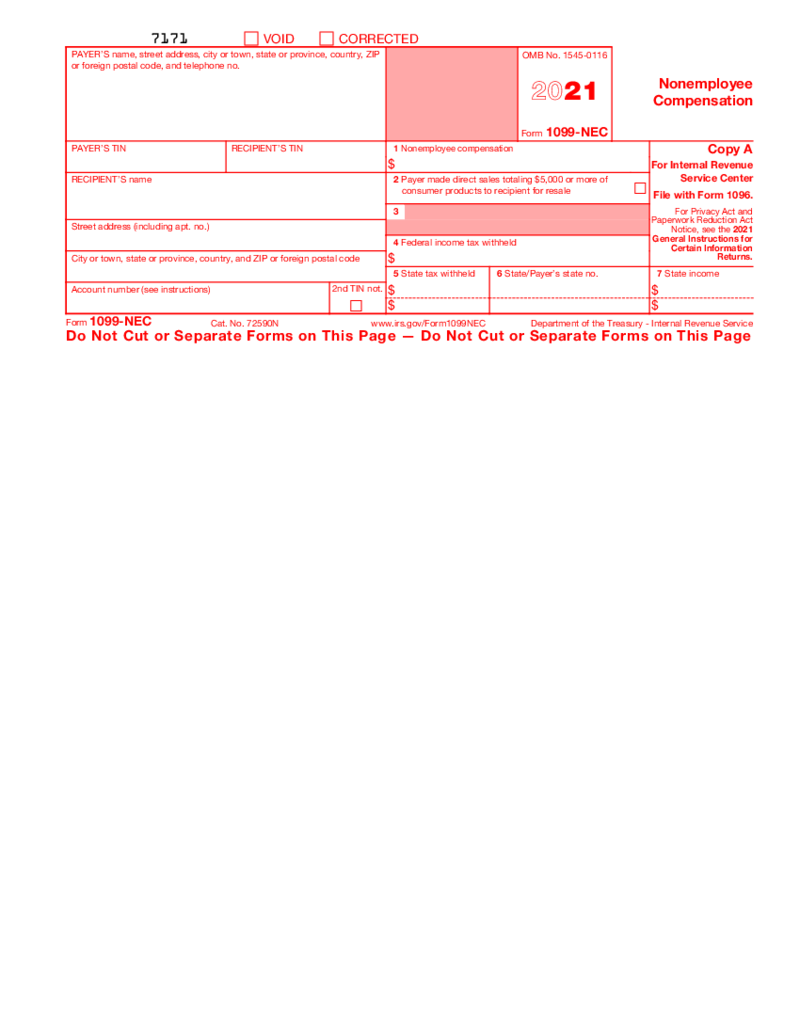

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

-

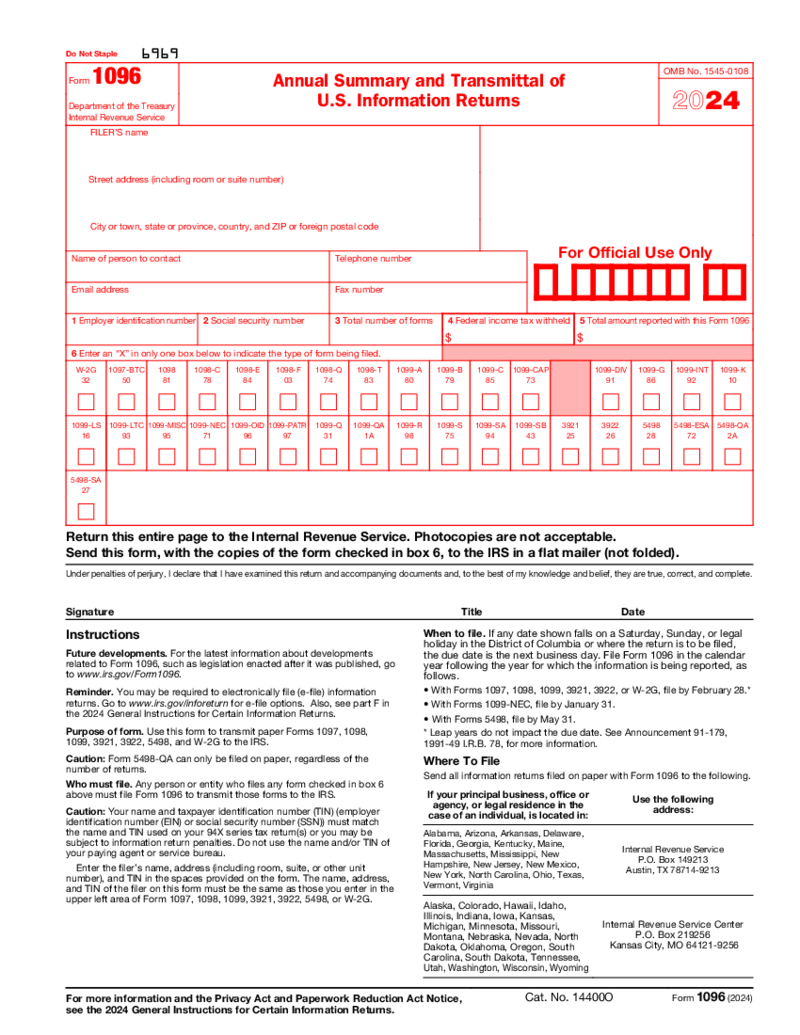

IRS 1096 Form

What is IRS 1096 2026?

Form 1096 is a file that provides results with all information documents you may already have submitted to recipients and Internal Revenue Service. If you provided information to recipients, no matter which docs you use, you must su

IRS 1096 Form

What is IRS 1096 2026?

Form 1096 is a file that provides results with all information documents you may already have submitted to recipients and Internal Revenue Service. If you provided information to recipients, no matter which docs you use, you must su

-

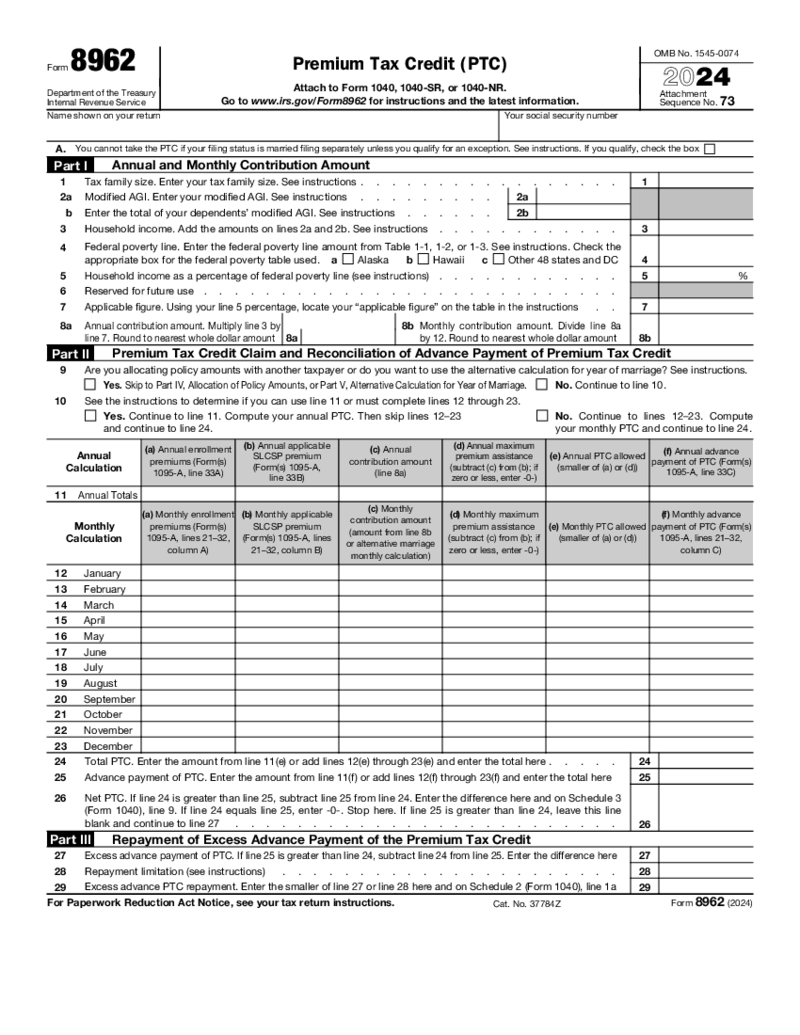

Form 8962

What is an 8962 Form (2024)

IRS 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. This form can be completed only if you need t

Form 8962

What is an 8962 Form (2024)

IRS 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. This form can be completed only if you need t

-

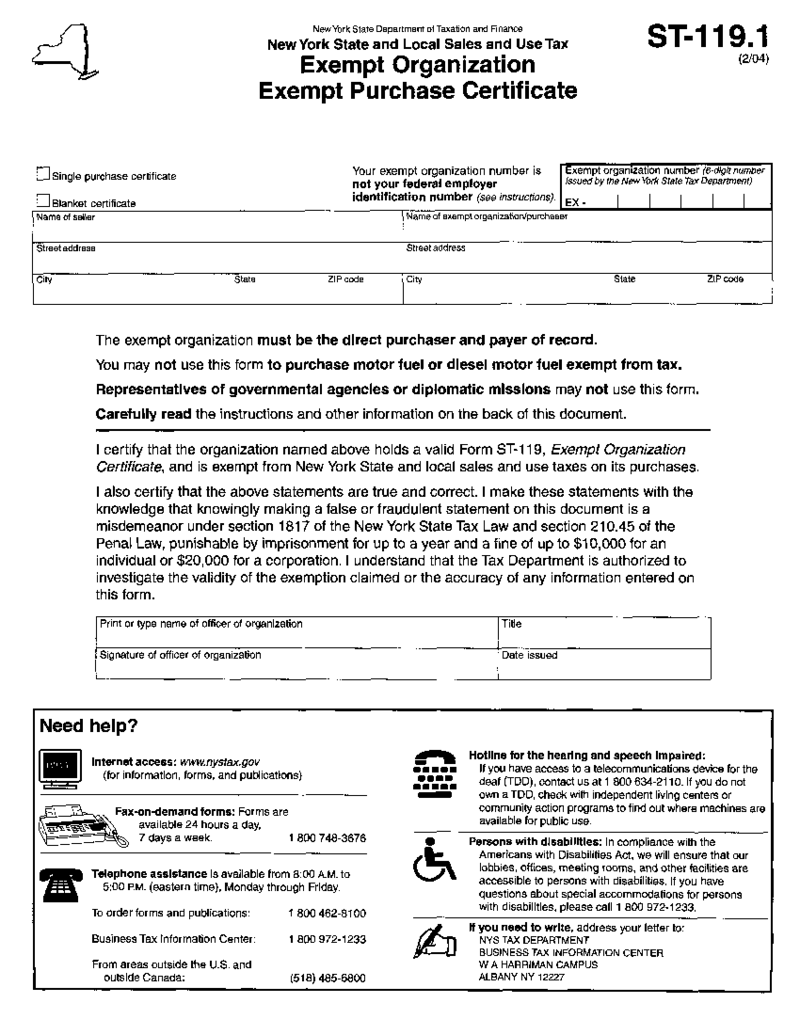

Form ST-119.1, Exempt Organization, Exempt Purchase Certificate

How to Obtain Form ST 119.1?

Complete the ST-119.2 Form Application.

Submit th

Form ST-119.1, Exempt Organization, Exempt Purchase Certificate

How to Obtain Form ST 119.1?

Complete the ST-119.2 Form Application.

Submit th

-

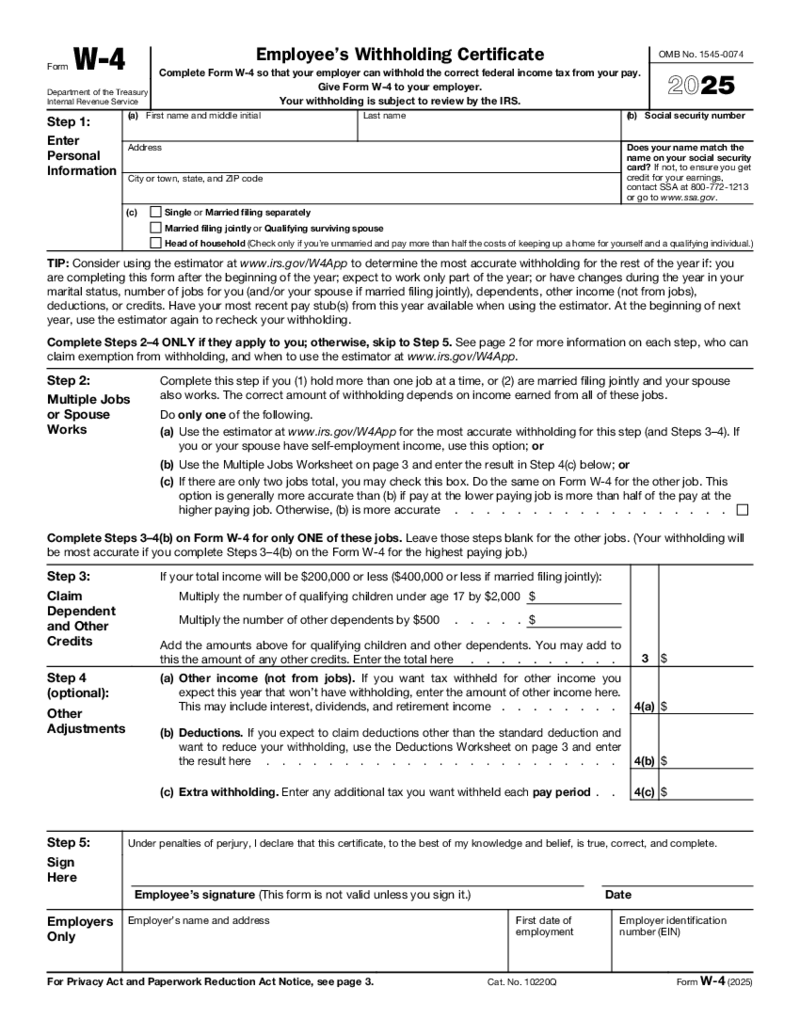

Form W-4 (2025)

What Is a W-4 Form 2025

The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxe

Form W-4 (2025)

What Is a W-4 Form 2025

The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxe

Search by State

What Are IRS Tax Forms?

IRS tax forms PDF files are documents utilized by individual taxpayers and companies for the purpose of reporting their income- and expenses-related data to the corresponding authorities. This, in its turn, calculates how much tax they owe to the federal government. IRS Tax forms 2024 printable come in an array of formats and configurations. Some of them are a breeze to fill out, while others are a bit on the complex side. In any case, we always recommend that you consult an expert prior to deciding to complete your tax forms under your own steam. That way, you’ll achieve maximum accuracy and thus, have yourself a peaceful tax season.

What Documents Do I Need to File My Taxes?

Whether you’re on the prowl for tax templates for the current or previous periods, PDFLiner has invariably got you covered. In our ample catalog, you’ll find a treasure trove of pre-made IRS printable tax forms online and get the possibility to fill them out digitally, without having to scan or print out anything.

Here are the IRS gov tax forms you should keep laser-like focus on:

- Form 1040. This is among the most crucial files US taxpayers deal with. It is utilized to report your total yearly income to the authorities, as well as to determine the amount of your annual tax refund. In simple terms, the form reveals how much money you earned throughout the previous tax year. The document features several sections and comes in a few iterations. The exact iteration you need is determined by the taxpayer type or group you belong to.

- Schedule C (Form 1040). This one is a must-file, especially if you’re a freelancer or small business owner. Briefly speaking, it’s a doc for reporting a business’s financial activity. If you operate a sole proprietorship or single-member LLC, you’re going to need to fill out and file it digitally or manually with Form 1040.

- Form W-9. This document is used for accurately estimating the taxes owed by contract workers throughout a certain tax year. With that said, when they hire you as a contractor for a business or when you start working as a freelancer, they may require you to fill out this form and forward it to the company that will send you compensation for your work. When completing this form, you’re going to need to indicate your name, contacts, and taxpayer group you belong to. Upon signing the form, you agree that you will comply with everything it entails, otherwise you’ll face penalties. The data provided in this form is sensitive, so it should not be publicly revealed by either party.

- Form 1099-MISC. If your organization paid someone who is not an independent contractor, filing this form is what you’ll most likely deal with. It’s a document utilized for reporting an array of miscellaneous payments that exceed $600. Rents, awards, medical transactions, legal expenses are examples of those payments. Just like with all the aforementioned forms, you can fill out and file this document online via our PDF editing tool. We offer free IRS estimated tax forms, along with the possibility to fill them out online.

- Form W-4. Simply put, this document pinpoints how much tax will be taken from your paycheck. Focus on maximum accuracy if you want to ward off overpaid taxes on your side. Bear in mind that whenever you start a new job, you’re going to need to sort out this form.

Whether you’re searching for any of the aforementioned forms or need a different template, our huge gallery of files is always at your fingertips. Our fillable and printable IRS tax forms are a cakewalk to customize and infuse with branding elements.

Where to Get IRS New Tax Forms?

PDFLiner is your go-to place for finding any niche-specific form and filling it out online. Save loads of your treasured time by picking any of the forms straight on this page, hitting the Fill Online button, and completing the form when the service loads. Make the most of the tools the platform showers you with in order to polish even the most complex document to perfection and maximum precision. Don’t forget to add the necessary signatures and print out the form if needed. Here, we’ve prepared the most current versions of the United States IRS tax forms for you.

Where To Send IRS Gov Fillable Tax Forms?

In the majority of cases, you’re going to need to send your completed IRS business tax forms to the corresponding tax authorities. You can choose one of the two methods for sending the files: digital or offline. In the former case, the process will be fast and effective. In the latter case, the file can get lost or damaged on the way to the IRS, which is highly undesirable. With that said, going digital is your best bet in this respect. Don’t forget that aside from all the afore-described perks, PDFLiner also grants you the possibility to sign your files online. It’s fast and smooth, as well as perfectly legitimate.

FAQ

-

When will the IRS finalize forms for 2023-2024?

April 18, 2024, is the last day for submitting your returns. Go the extra mile if necessary to file the needed forms in a timely manner if you want to avoid penalties and preserve peace of mind as this upcoming tax year is finalized.

-

How to mail tax forms to the IRS?

You can use your usual email account to send your online IRS tax forms to your assigned IRS employee at their email address. Not feeling comfortable emailing your sensitive files? Send the docs with eFax or via regular mail.

-

Where to find IRS tax forms?

You can find the templates on their official website. As a fine alternative, find the necessary templates on PDFLiner and fill them out online. Our platform offers super handy tools for adjusting any PDF file to suit your most intricate needs.

-

How to request tax forms from the IRS?

In the majority of cases, you won’t have to request those forms. Most of them are available for free on their official site. They’re not as convenient as PDF templates offered here, though. Simply because our templates are fully fillable and modifiable in the digital format. That’s what we call convenience.

-

How to check if the IRS received tax forms?

There are several methods of doing it. First, you can utilize their application called Where’s My Refund. Second, you can check your IRS account details. Third, you can call them by phone. Ultimately, you can check out updates within the e-filing service of your choice. Simple as that.