-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

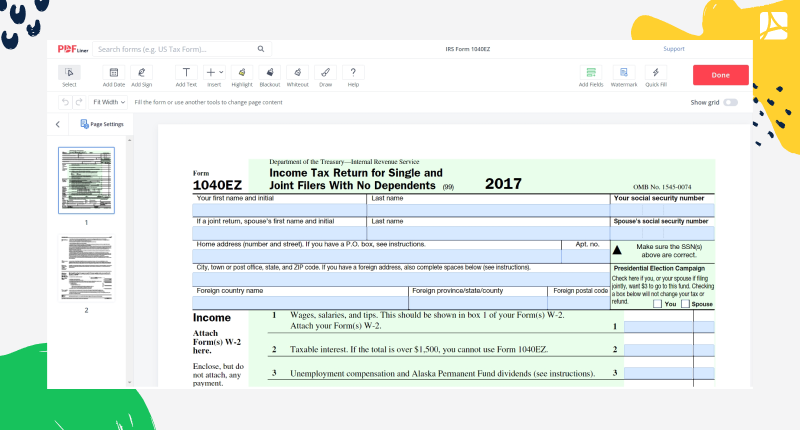

IRS Form 1040EZ

Get your IRS Form 1040EZ in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayers should not use 1040-EZ form, instead they should use the Form 1040 or Form 1040-SR.

What I need Tax Form 1040EZ for?

- Printable 1040 EZ form is a necessary form to declare the incomes of individuals;

- This form is important for establishing the level of taxes that every citizen must pay;

- To know if the individuals need the tax refund.

Who Should Fill out Printable Form 1040EZ:

- All people who want to file jointly;

- Citizens that do not have dependents;

- Individuals with an income of less than $100,000 and interest income less than $1,500.

Do not forget to sign the document. Although the form doesn’t require you to calculate a refund or the amount of money you might owe the IRS, be very attentive while filling it.

Where Can I Get a 1040EZ Form?

The 1040EZ form is available online at the IRS website, or at most tax preparer offices.

Another way to get the printable 1040 EZ form is by clicking the "Fill this form" button on this page and fill out it with the online PDF editor.

Filing the 1040EZ

The 1040EZ is the most basic tax return form and is typically used by those who have a simple financial situation. The 1040EZ is ideal for taxpayers with no dependents and minimal income who are not eligible to claim credits or deductions. It is also a good form to use if you want to file your taxes electronically, as the online filing software will automatically fill in the form for you.

To be eligible to file a 1040EZ, you must meet the following requirements:

- You must have a filing status of single or married filing jointly

- You cannot be a dependent on another person’s tax return

- Your taxable income must be less than $100,000

- You must not be eligible to claim any credits or deductions other than the Earned Income Tax Credit

You cannot file a 1040EZ if you are subject to the Alternative Minimum Tax, if you owe any of the following:

- Household employment taxes

- Unemployment compensation repayments

- Net investment tax

- Self-employment tax

- Educator expenses

- Tuition and fees

- Student loan interest deduction

General Tips

- If you are eligible to file Form 1040EZ, you should do so as it is the simplest and easiest form to complete.

- Be sure to double check your Form 1040EZ for accuracy before you submit it.

- If you have any questions about Form 1040EZ, you can contact the IRS directly for assistance.

Components of an EZ Form

The 1040EZ form is a one-page document that includes the following information:

- The filer's name, address, and Social Security number;

- The name and Social Security number of the filer's spouse, if filing jointly;

- The filer's filing status;

- The filer's total income;

- The amount of federal income tax withheld;

- The filer's signature.

Organizations that work with 1040 Form EZ

The IRS

Relevant to 1040EZ forms 2022

How to fill out a 1040-EZ form ?

Step 1: To open the printable 1040 EZ form, you would need to click the Fill Out Form button.

Step 2: Fill out general personal information (First and Last name, address, and so on).

Step 3: Specify all your incomes (wages, unemployment compensation, taxable interest).

Step 4: Report your credits and other payments;

Step 5: Calculate the amount of money owe.

Step 6: Sign the Form 1040-EZ bu clicking on the Sign Field and add the current date.

Step 7: To save the form click the Done button.

Fillable online IRS Form 1040EZ