-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Tax Form 1040-NR 2024

Get your Form 1040-NR (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is an IRS Form 1040-NR 2024: The Outline

Form 1040-NR is a variation of the standard income tax Form 1040 that lets you file your income tax return to the IRS if you are a nonresident alien in the United States, and you receive income from business operations within the country. The form includes 5 pages and one schedule. You also have to file the form if you represent a deceased person who has been obliged to file 1040-NR or a trust/estate that has to file the form but can’t do it for a valid excuse.

What is new in 1040-NR 2024 - 2025

This year, you should consider the changes and remember that the gross income limitation has increased for a child or stepchild of a qualifying widow(er), a relative who qualifies for the tax credit of a child, and for entities who pay student loan interest deductions. The limit is now $4,200 instead of $4,150. Other changes include the AMT exemption amount increase, qualified disability trust exemption increase, and more.

For detailed information on the Form 1040-NR improvements, visit the official IRS website. For more details on filling out, read below. You can also use our website to download Form 1040-NR fillable PDF to print it or fill and file the entire form online. Now, let’s figure out how to do it correctly. We also have a fillable 1040 NR EZ available on our website.

Tips for filling out 1040-NR Form and other tax returns

While you fill out the Nonresident Alien Income Tax Return you should follow the tips:

- Be focused on the paper;

- Read the entire form before filling it;

- Double-check all the figures you enter;

- Validate the form with your signature when it’s complete;

- Hire a tax expert if the process seems too difficult.

When is 1040-NR Due

When the form is complete, you have to file it to the IRS by mail or file online via e-mail. We recommend you to use the second option to deliver the form to the IRS faster and avoid accidental mail loss. As for the deadline, it is different from the original form 1040. Nonresident aliens who earn profits within the US during the financial year have to file 1040-NR on the 15th day of the 4th month after the main tax year last day. You have to check the due date for 2026 on the IRS website or on our tax calendar.

IRS Form 1040-NR Resources

Relevant to 1040-NR Form Documents

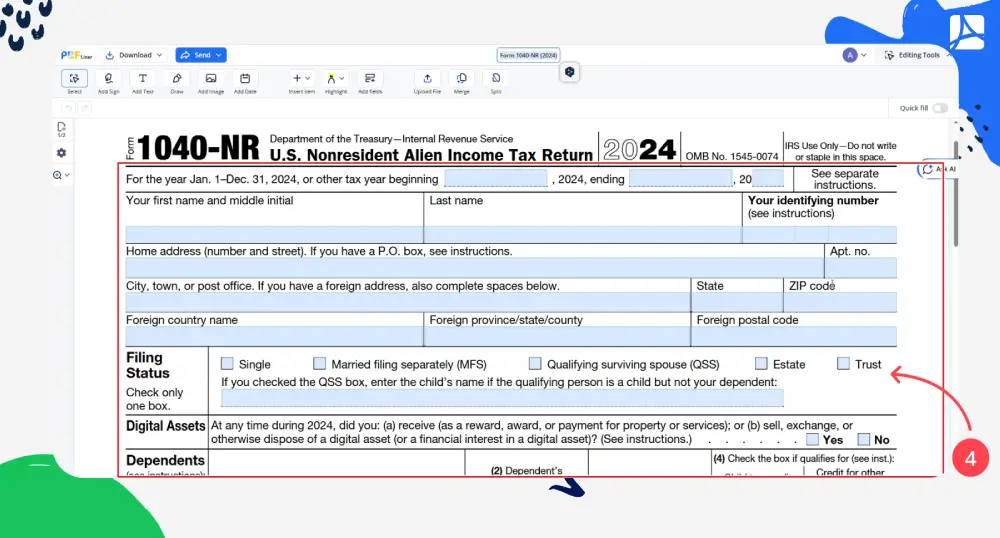

How to Fill Out Form 1040-NR?

Step 1: First of all, you should gather all the needed documents to get valid information from them. You need IRS forms W-2 and 1099 along with your personal information, such as your real name, actual address, Social Security Number (SSN), etc. Nonresidents may also be required to fill forms 8833, 8840, 8843, 8938, or one of them.

Step 2: Next, decide what filing status matches your current situation. You are allowed to apply for one or several statuses if needed, but it’s recommended to concentrate on one of them to cut tax liability.

Step 3: Click the "Fill Out Form" button to start filling.

Step 4: Enter your information first.

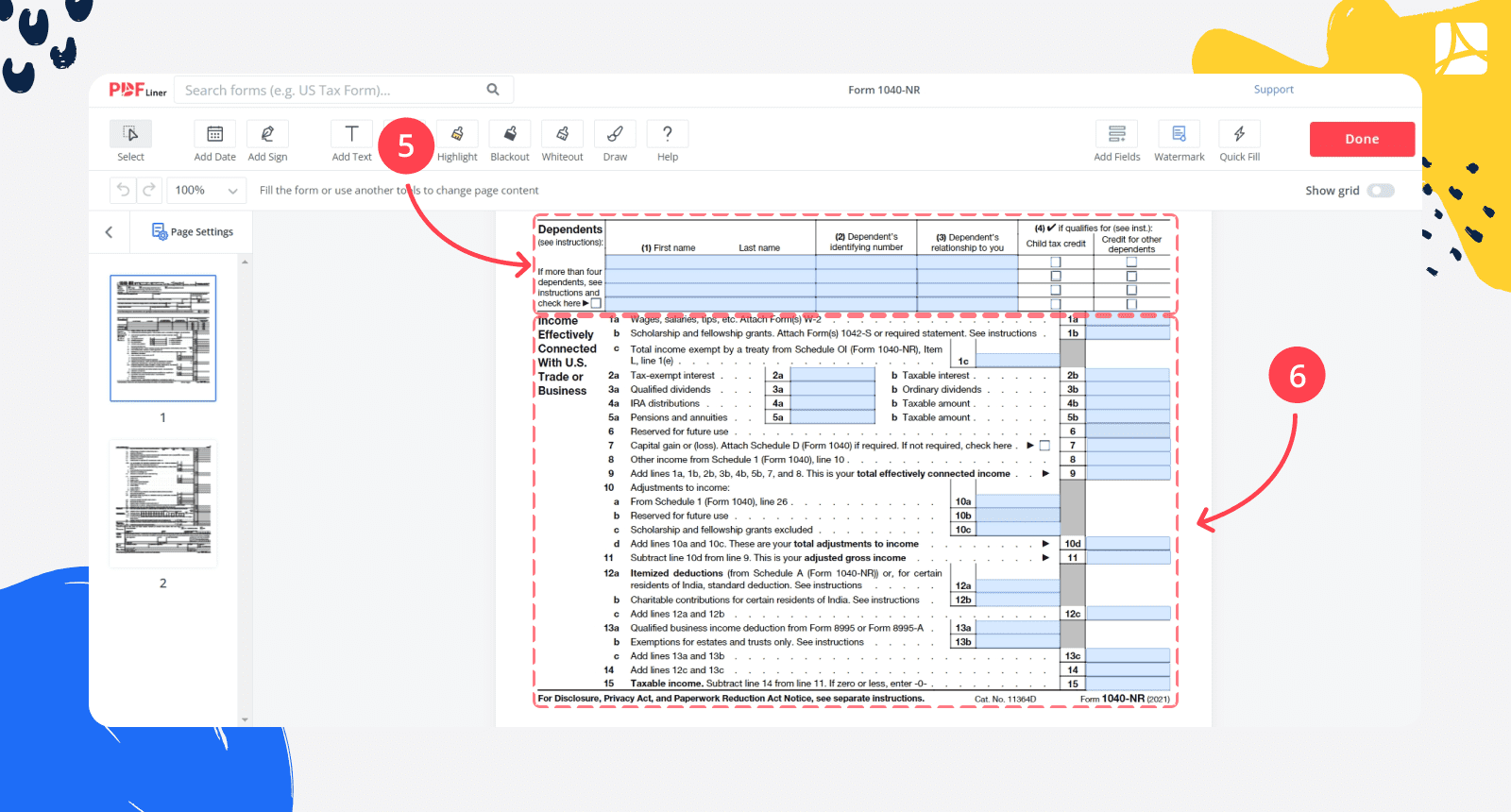

Step 5: Fill out the separate section for exemptions and one more for dependents’ information. You have to fill them if you have any.

Step 6: Provide all the needed information related to different types of income and necessary refunds. Be attentive to the captions for each box to avoid mistakes.

Step 7: In the Tax section, enter all the deductions and calculate totals to finish.

Step 8: Calculate whether you overpaid or if you owe something.

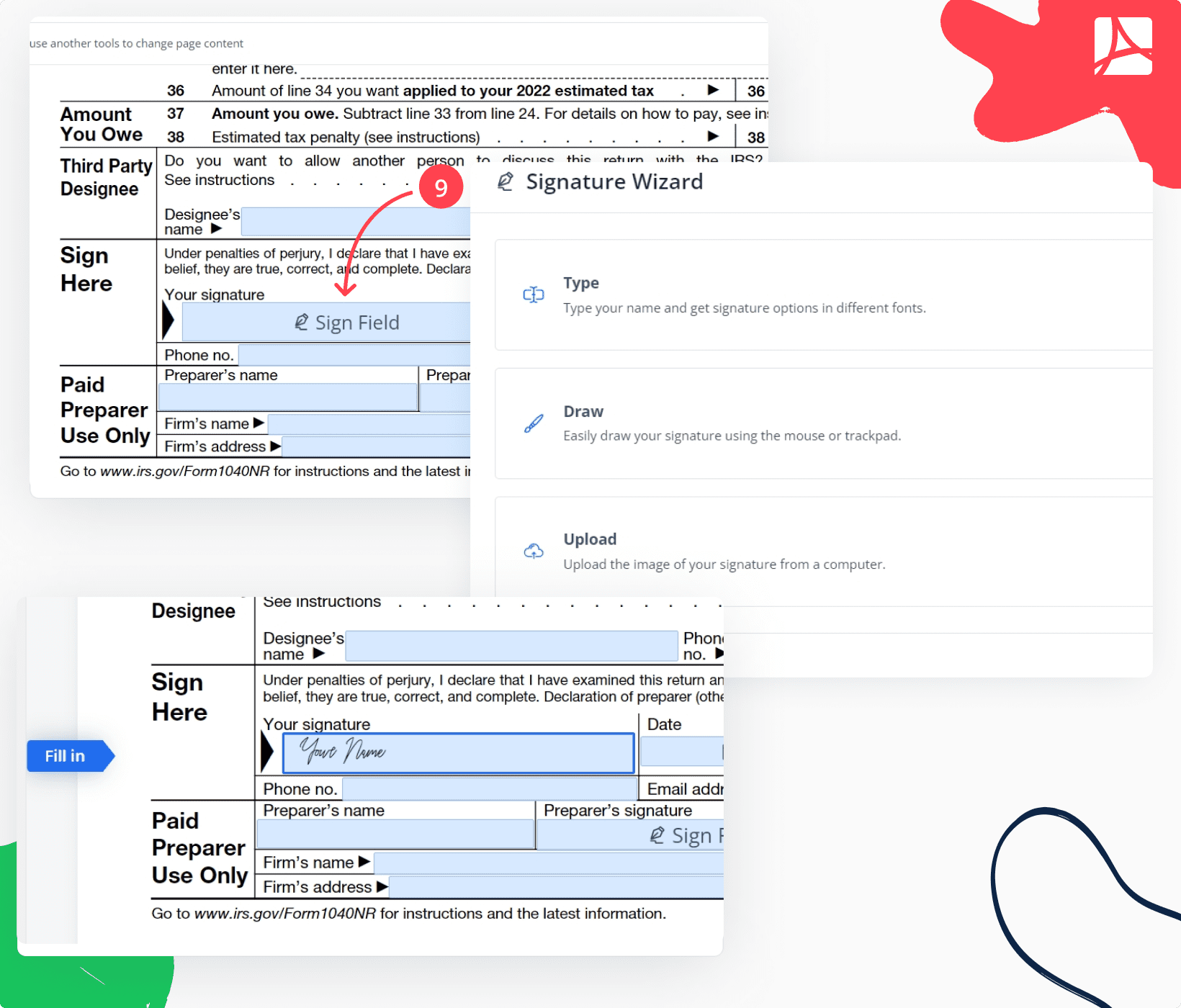

Step 9: Sign your 1040-NR by clicking on the "Sign Field" and add a date.

Step 10: Double-check the information and click "Done"

Form Versions

2020

Form 1040-NR for 2020 tax year

2021

Form 1040-NR for 2021 tax year

2022

Form 1040-NR for 2022 tax year

2023

Form 1040-NR for 2023 tax year

FAQ: 1040-NR Form Popular Questions

-

Where to send 1040-NR?

The 1040-NR should be mailed to the IRS on the fallowing address:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC, 28201-1303, USA

-

Who files 1040 NR?

The form 1040 NR can be filed by nonresident aliens (a person who has not passed the green card test or the substantial presence test and is not a U.S. citizen). 1040-NR can also be filed by a third party representative.

-

How to calculate my 1040 NR taxes manually?

You can calculate your taxes using the form 1040-NR. Simply calculate your total taxable income in the first part of the form and use federal income tax brackets to calculate how much taxes you should pay. After that add to that amount other taxes that might apply to you and then enter the amount in the line 16.

Fillable online Form 1040-NR (2024)