-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

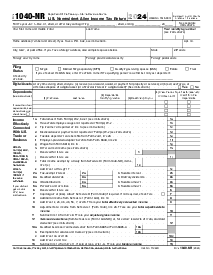

Form 1040-NR (2019)

Get your Form 1040-NR (2019) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Form 1040 NR 2019

Form 1040 NR 2019 is an Internal Revenue Service (IRS) form tailored for nonresident aliens engaged in business in the United States or otherwise earning income from U.S. sources. This form allows these individuals to file their federal tax returns, detailing their income, deductions, and the taxes owed or refunds due for 2019. It's crucial for persons not holding U.S. citizenship and not qualifying as resident aliens to understand the necessity of using this specific form to comply with U.S. tax laws

When to Use 1040 NR Form For 2019

Several situations necessitate the use of the 1040 NR Form For 2019. If you find yourself in any of the following scenarios, you should complete this form:

- You are a nonresident alien engaged in business in the U.S. during the year.

- You received income from U.S. sources, but not from a business or trade.

- You represent a deceased person who would have been required to file Form 1040 NR.

- You represent an estate or trust that requires this form.

How To Fill Out 1040 NR Ex Form 2019

Filling out the 1040 NR Ex Form 2019 can initially seem daunting, but following a step-by-step guide can complete it accurately and efficiently.

- Start by filling in your personal information, including your name, address, SSN, or ITIN.

- Document your income sources on lines 1 through 22. This includes wages, interests, dividends, and scholarship or fellowship grants exempt by the treaty.

- These can range from educator expenses, certain business expenses for reserves, performing artists, and fees and expenses for income generation. Calculate these carefully to determine your adjusted gross income.

- Report any taxes already paid or credited to your account. This includes income tax withholding and estimated tax payments.

- Don't forget to sign and date the bottom of the form. If you're filing on behalf of someone else, ensure that you tick the appropriate box stating your relationship to the taxpayer.

When to File 1040 NR Ez Form 2019

The deadline for filing the 1040 NR Ez Form 2019 was typically April 15, 2020. However, for those who earned wages subject to U.S. income tax, the deadline could be extended to June 15, 2020, under certain circumstances. It's essential for individuals needing to file this form to be mindful of these dates to avoid potential penalties for late filing.

By understanding when and how to use these forms, nonresident aliens can confidently navigate the complexity of U.S. tax law, ensuring they meet their obligations while maximizing their return potential.

Form Versions

2021

Fillable Form 1040-NR for 2021 tax year

2020

Fillable Form 1040-NR for 2020 tax year

Fillable online Form 1040-NR (2019)