-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

W-9/W-8 Forms

-

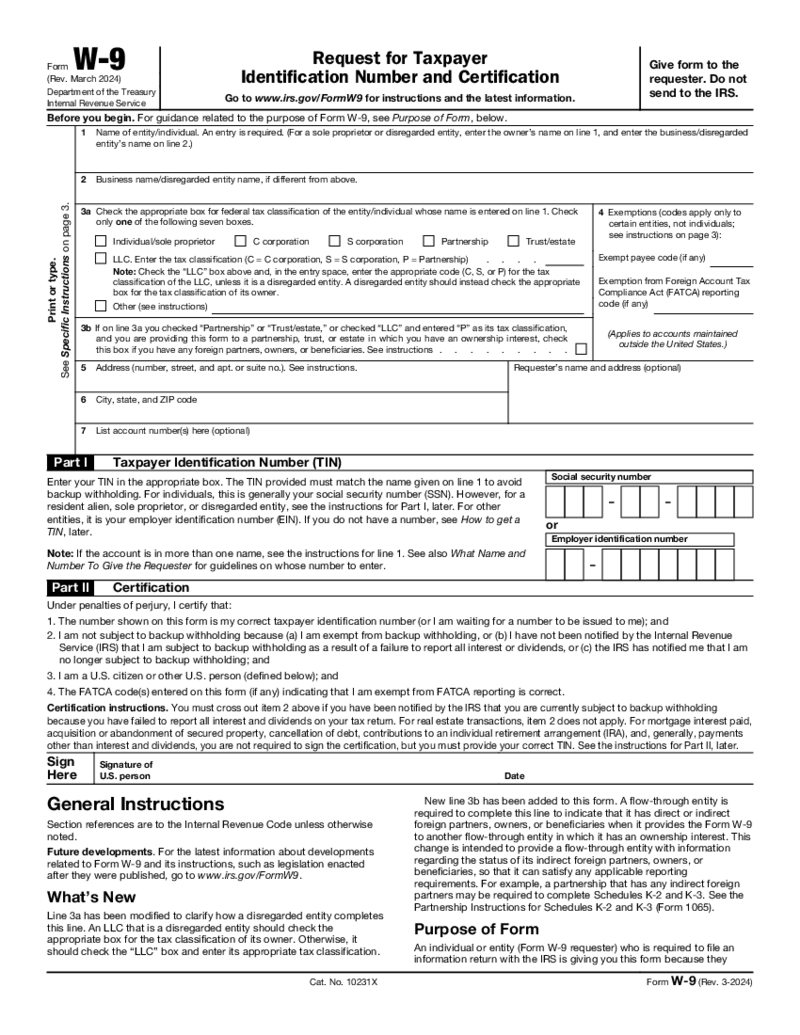

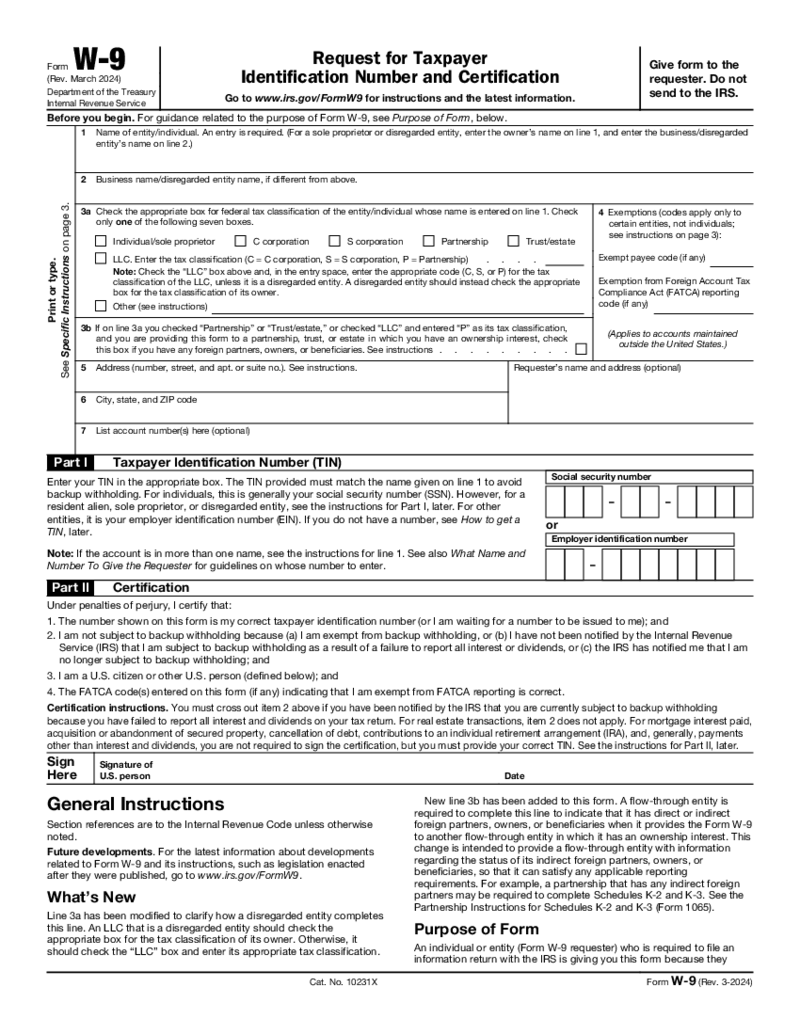

W-9 Form (Rev. March 2024)

How to Complete W-9 Form Online

The W-9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is crucial in U.S. business operations. Here's what you need to know:

Purpose:

🔹&n

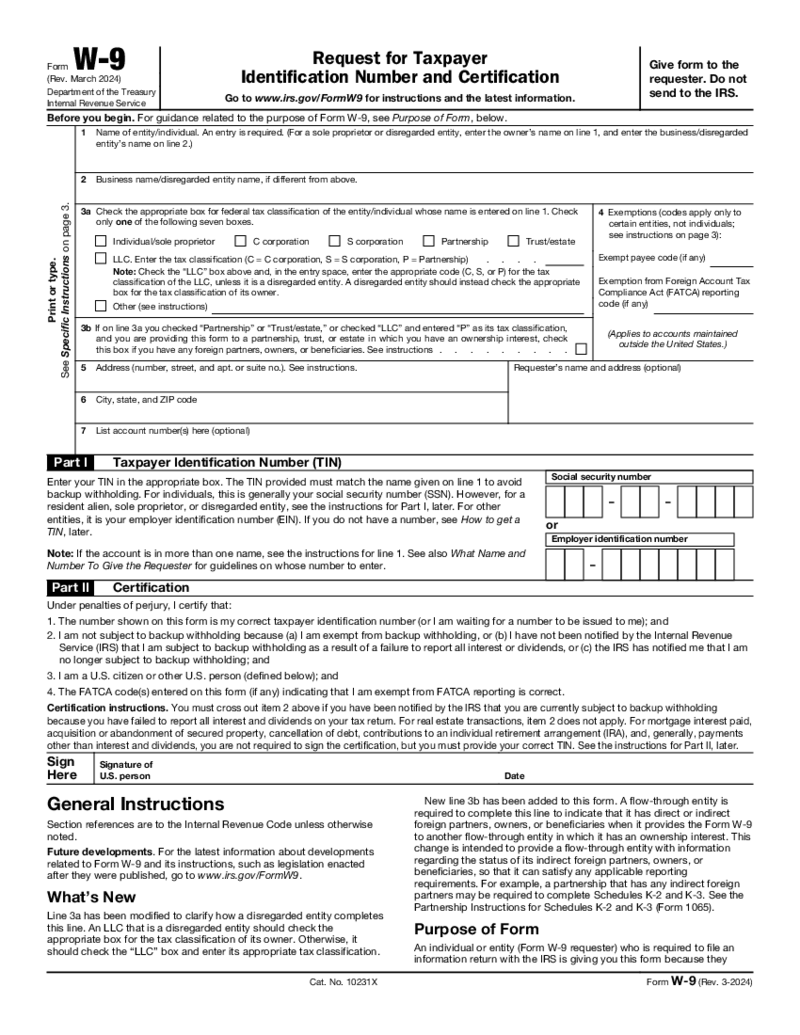

W-9 Form (Rev. March 2024)

How to Complete W-9 Form Online

The W-9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is crucial in U.S. business operations. Here's what you need to know:

Purpose:

🔹&n

-

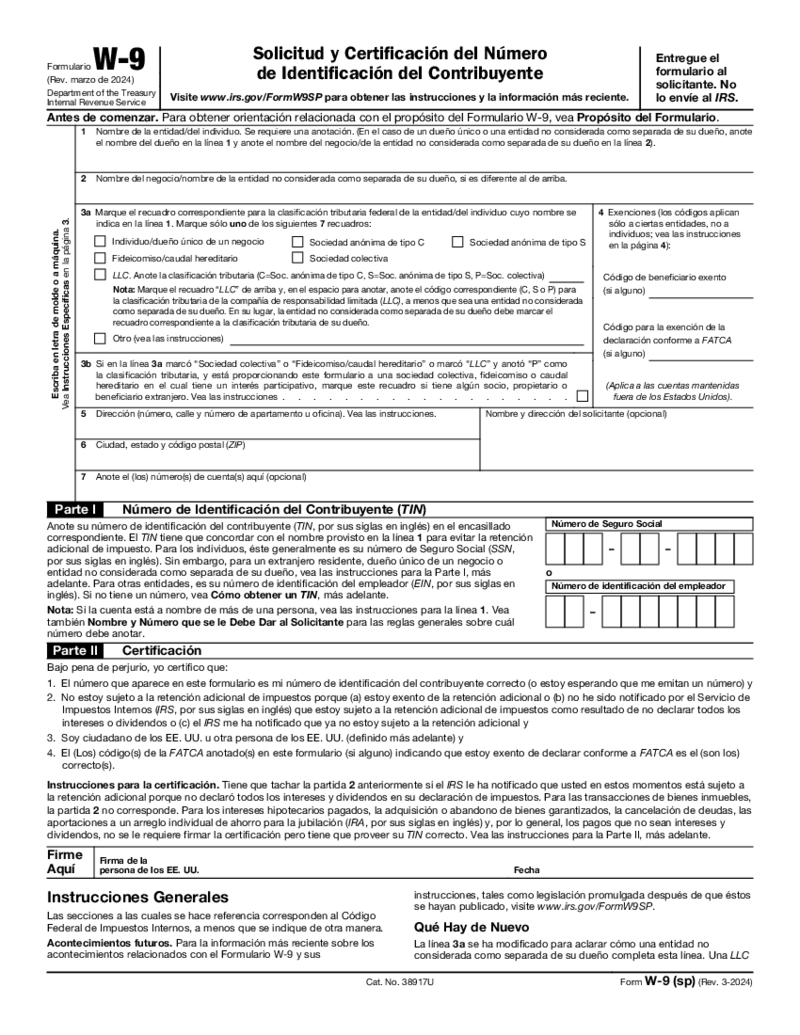

Formulario W-9

Qué es el formulario W-9 2026? - Aspectos básicos

Cuando se es autónomo, los impuestos sobre la renta se declaran de una manera ligeramente diferente, lo que significa que ahora es tu única obligación. Como a

Formulario W-9

Qué es el formulario W-9 2026? - Aspectos básicos

Cuando se es autónomo, los impuestos sobre la renta se declaran de una manera ligeramente diferente, lo que significa que ahora es tu única obligación. Como a

-

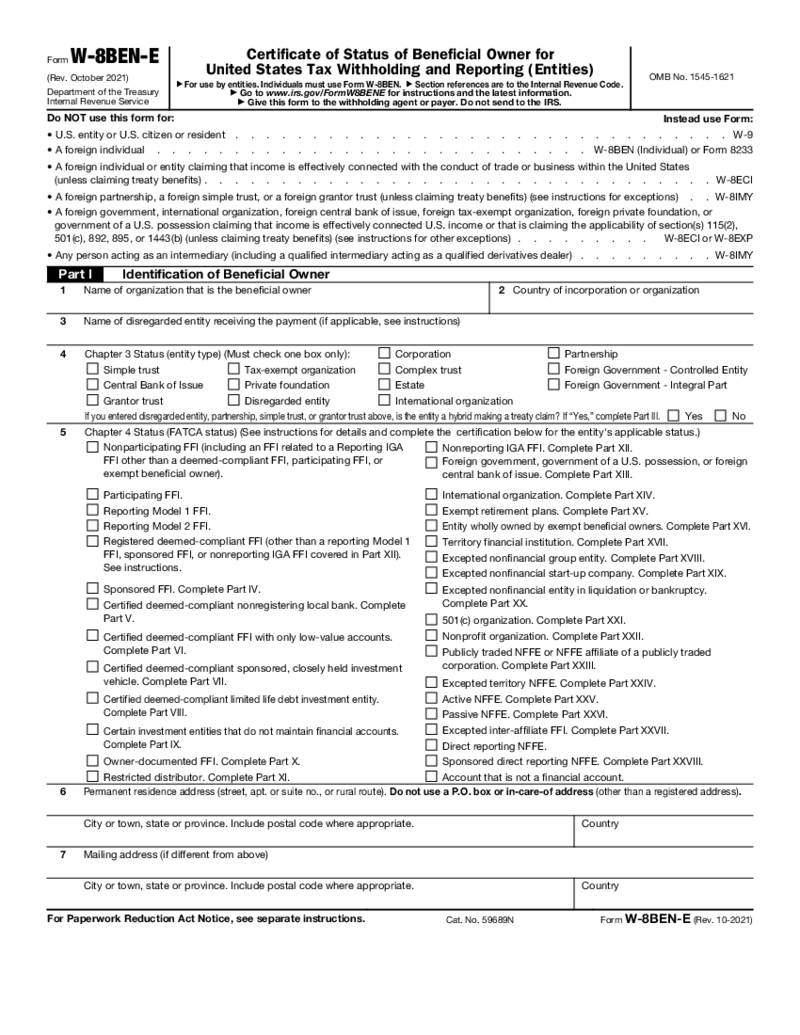

Form W-8BEN-E

What is Form W-8BEN-E?

The form W-8BEN-E is also known as the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entitles). The document was created and provided by the Department of the Treasury Internal Revenue Se

Form W-8BEN-E

What is Form W-8BEN-E?

The form W-8BEN-E is also known as the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entitles). The document was created and provided by the Department of the Treasury Internal Revenue Se

-

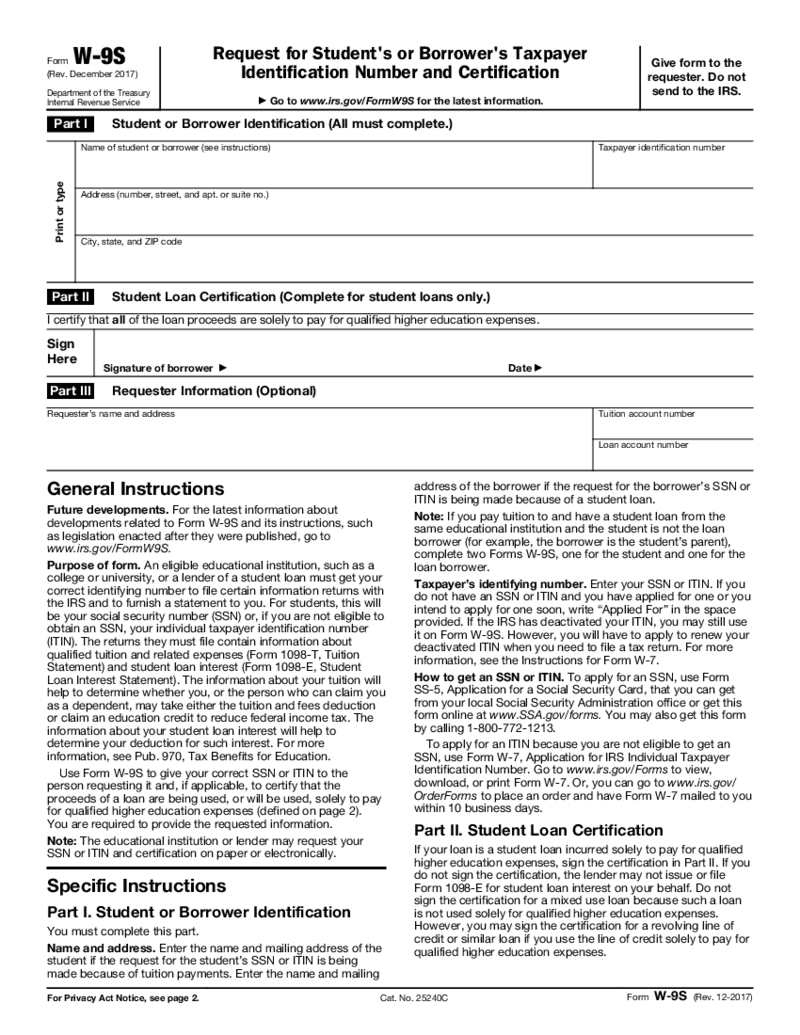

IRS Form W-9S

What is a W-9S Form

W-9S form purpose is similar to a standard W9 Form specifically designed for students or borrowers to provide their TIN and certification. Educational institutions or lenders use this for

IRS Form W-9S

What is a W-9S Form

W-9S form purpose is similar to a standard W9 Form specifically designed for students or borrowers to provide their TIN and certification. Educational institutions or lenders use this for

-

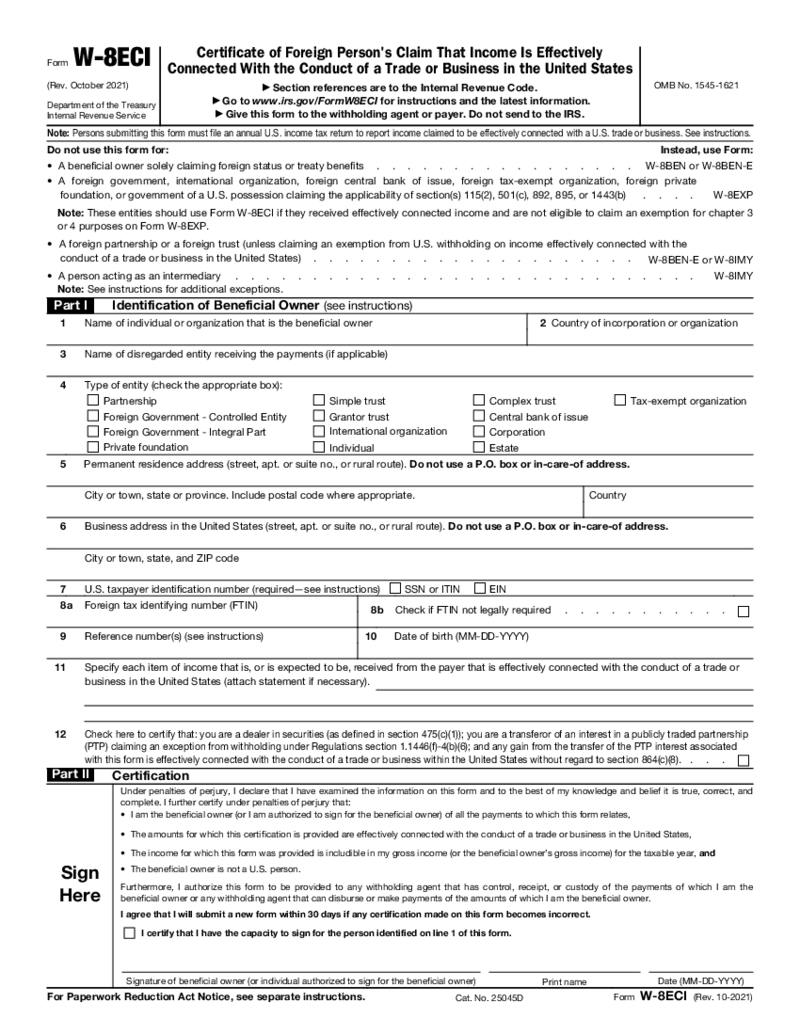

Form W-8ECI

What is Form W-8ECI?

Form W-8ECI, also known as the "Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States," is a tax form issued by the IRS. This form is used

Form W-8ECI

What is Form W-8ECI?

Form W-8ECI, also known as the "Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States," is a tax form issued by the IRS. This form is used

-

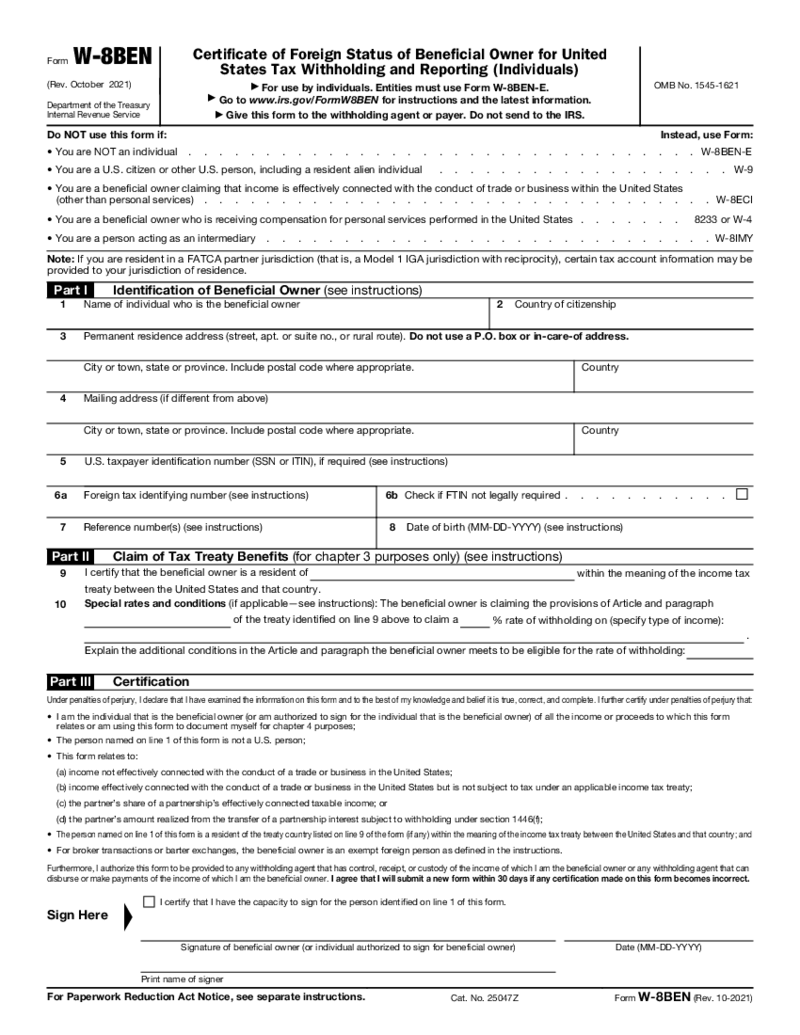

W-8 BEN Form

What Is a W 8 BEN Form

An W-8 BEN Form is a document foreign individuals or entities use to certify their status as non-US taxpayers. A W 8 BEN form purpose is quite simple, and it is required by the Internal Revenue Service (IRS) to ensure that

W-8 BEN Form

What Is a W 8 BEN Form

An W-8 BEN Form is a document foreign individuals or entities use to certify their status as non-US taxpayers. A W 8 BEN form purpose is quite simple, and it is required by the Internal Revenue Service (IRS) to ensure that

-

Request W-9 Form

Purpose of Form W-9

W-9 form is primarily used by businesses to request a U.S. person's Taxpayer Identification Number (TIN), which includes Social Security Numbers (SSNs) or Employer Identification Numbers (EINs). This form is crucial for correctly f

Request W-9 Form

Purpose of Form W-9

W-9 form is primarily used by businesses to request a U.S. person's Taxpayer Identification Number (TIN), which includes Social Security Numbers (SSNs) or Employer Identification Numbers (EINs). This form is crucial for correctly f

Explore everything you need to know about IRS W-9 and W-8 forms. Whether you're a freelancer, contractor, or business owner, these forms help you report your tax information. Learn how to fill out the W-9 form and understand the difference between W-9 and 1099. We also explain W8BEN and W8BEN-E forms and how they apply to non-U.S. individuals and entities. Access the latest versions and helpful tips for completing your forms. Streamline your tax season with our resources for W-9 tax forms and W-8 forms.

W-9 Form: Used to provide your Taxpayer Identification Number (TIN) to entities that will pay you.

W-8BEN: For non-U.S. individuals to certify their foreign status for tax withholding purposes.

W-8BEN-E: For foreign entities to claim tax treaty benefits and certify their foreign status.

PDFLiner W-9 Generator: A simple way to create your W-9 form in minutes.