-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Request W-9 Form in 4 Clicks

1. Email the W-9 form request

1 min

Hit the “Send a W-9 Request” button to send the contractor a link to the fillable form and use our ready-to-go email template or draft a personal message.

2. Get the completed form

5 min

You'll get an email notification when the contractor finishes and signs the form.

3. Manage shared docs

1 min

IRS requires all requesters to keep W-9s for 4 years. Store and manage all the completed forms in one secure place.

What you need to know:

- 📎If you are a contractor or vendor and need to fill out the form yourself you can use the fillable W-9 Template here and send it to the requester once you've added all your info.

- 📎For IRS tax reporting purposes, a W-9 Form is a legal way to collect taxpayer information, including taxpayer identification number (SSN or EIN).

- 📎It should be used by businesses that report to the IRS payments of $600 or more to freelancers, independent contractors, and non-employees.

- 📎This form is essential for accurately filing Form 1099-NEC for services rendered or, in some cases, Form 1099-MISC.

- 📎If your vendor or contractor is not a U.S. citizen or resident, send them a request to fill out Form W-8 instead.

- 📎Incorrectly categorizing an employee can lead to liability for employment taxes.

- 📎PDFLiner allows easy electronic request, filing out, and submission of the W-9.

Purpose of Form W-9

W-9 form is primarily used by businesses to request a U.S. person's Taxpayer Identification Number (TIN), which includes Social Security Numbers (SSNs) or Employer Identification Numbers (EINs). This form is crucial for correctly filing Form 1099-NEC (for non-employee compensation) or, in some cases, Form 1099-MISC for independent contractors and freelance talents.

When To Request a W-9 Form

Send the letter template to get the form in the following cases:

- To Hire independent contractors or freelancers. Before making payment for services provided by non-employees.

- For opening a new business account. Financial institutions often require a W-9 for banking or investment accounts.

- For real estate transactions. Certain dealings involve income reporting to the IRS.

- When you're disbursing interest to individuals, a W-9 is needed to report the interest paid over the tax year.

- Before issuing dividends to shareholders.

- If forgiving a debt that would be income to the debtor, a W-9 is required for reporting purposes.

- Whenever you're obligated to file a 1099 form for reporting non-employee compensation, rent, royalties, or other payments.

Note:

Requesting a W-9 upfront can save time and ensure compliance with IRS reporting requirements. It's crucial in accurately reporting taxable transactions and avoiding penalties for missing or incorrect information.

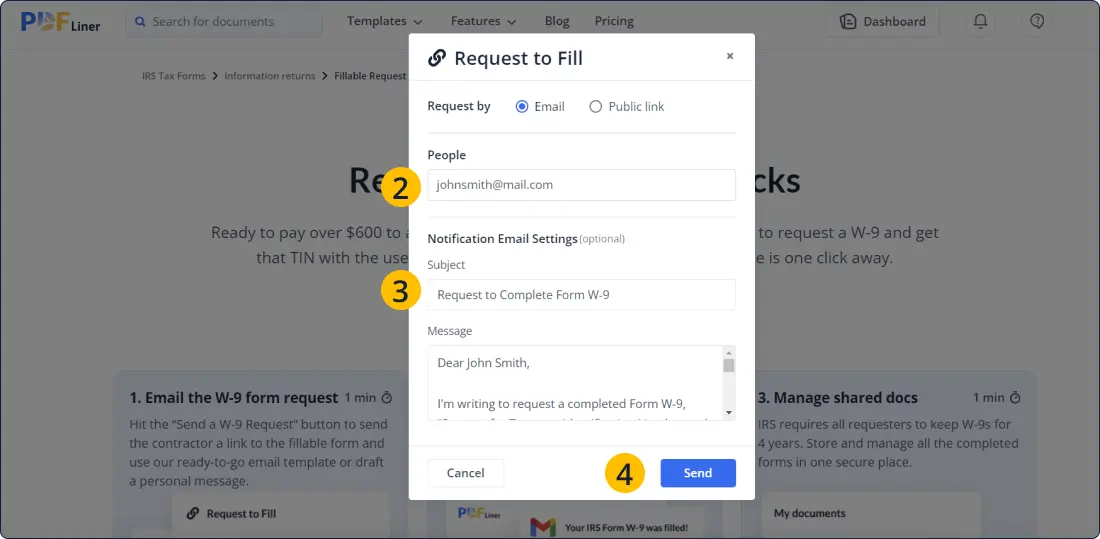

How To Request a W-9 Form via Email

If you are logged in to your PDFLiner account, requesting a W-9 from a vendor or contractor will only take you 4 clicks and 2 pastes.

Step 1: Click the button

Hit the “Request a W-9 form” button on this page to open a “Request to fill” pop-up.

Step 2: Enter the recipient’s email address

Your first paste would be to enter your email address into a “People” field.

Step 3: Add the recipient’s name to a letter template

We prepared a letter template for you, so all you would need to do is replace a placeholder [Recipient's Name] with the actual name and check if the template fits your needs.

Step 4: Hit the “Send” button

To send the email with your request, click the button at the end of the form and receive a confirmation message.

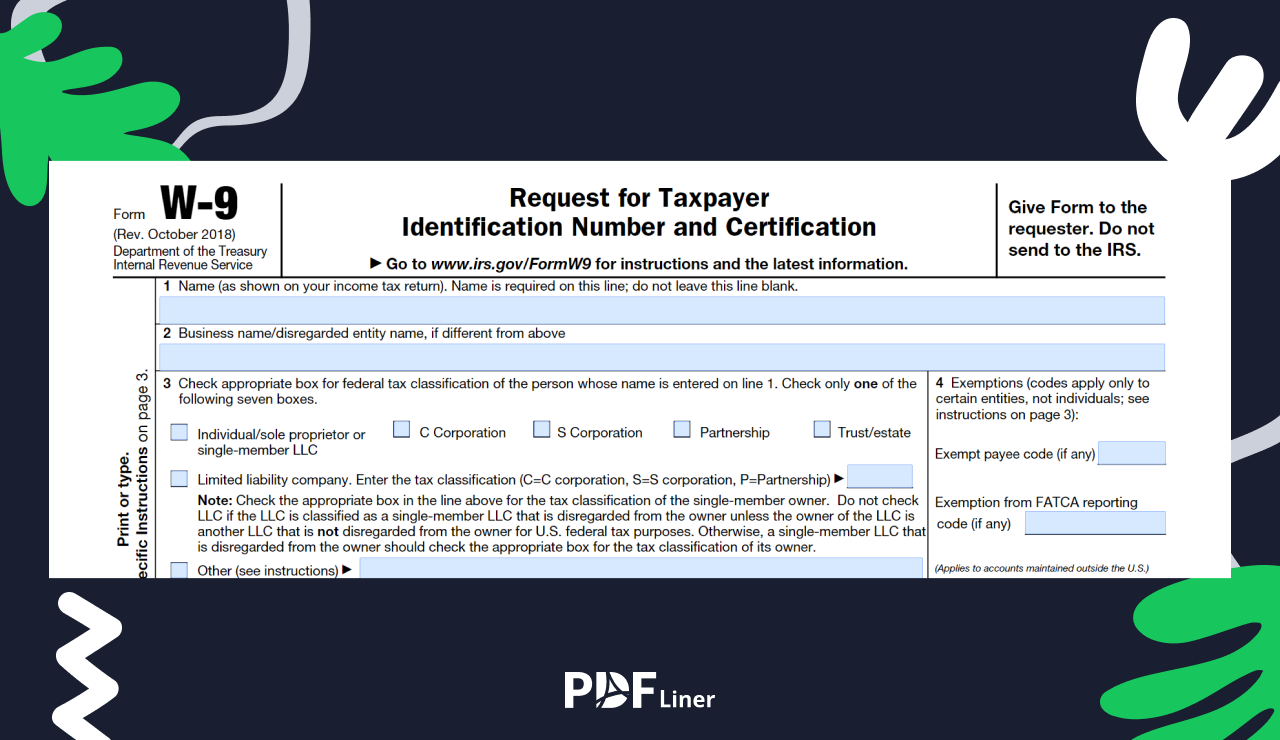

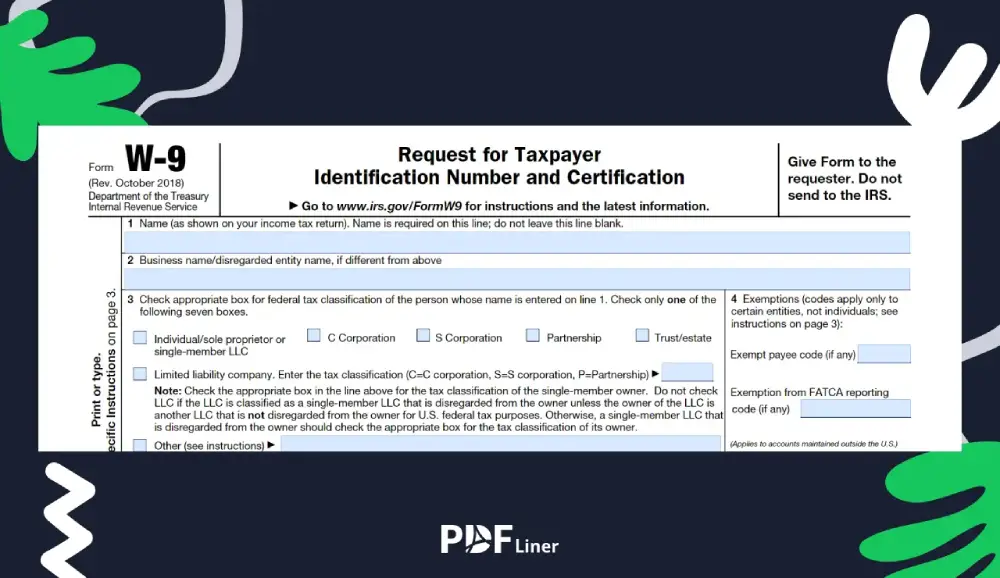

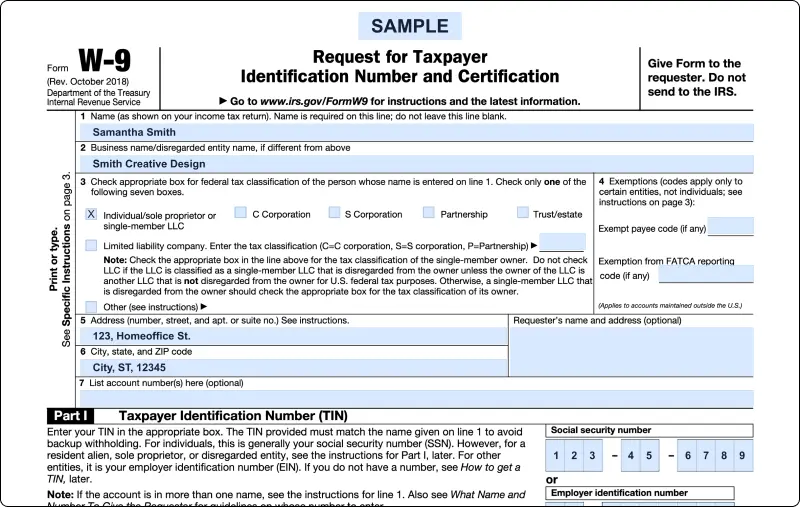

Key Sections of W9

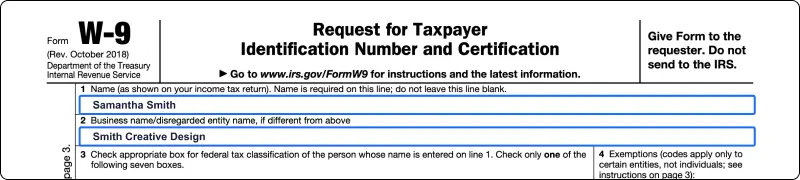

1. Legal and Business Name

Legal name as it appears on your Social Security card or official documents and business name if it’s different.

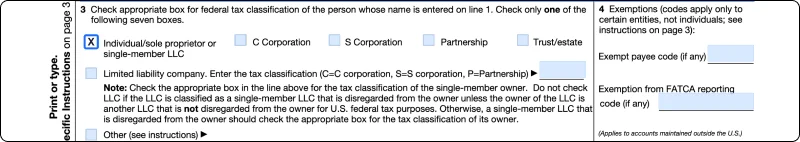

2. Tax Classification

The form should Indicate whether the taxpayer is filing as an individual/sole proprietor, partnership, C Corporation, S Corporation, Trust, or Estate.

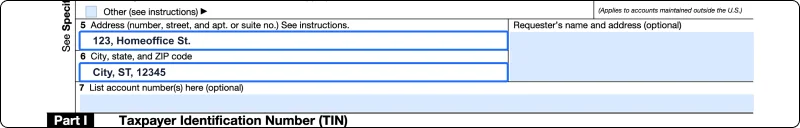

3. Address

Taxpayer’s mailing address for any tax paperwork.

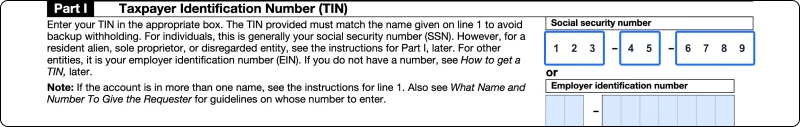

4. Taxpayer ID Number

Freelancers or sole proprietors will use their SSNs, while businesses might use their EINs.

Note:

Misclassifying an employee as an independent contractor without a valid reason can result in liability for that worker's employment taxes.

Table of contents

Simple & Secure Tool For Your W-9s and 1099s

Let us take care of the whole process. Send W-9, get the info, and fill out your 1099s all in one place from any device.

Get filled out W–9s and manage them online