-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

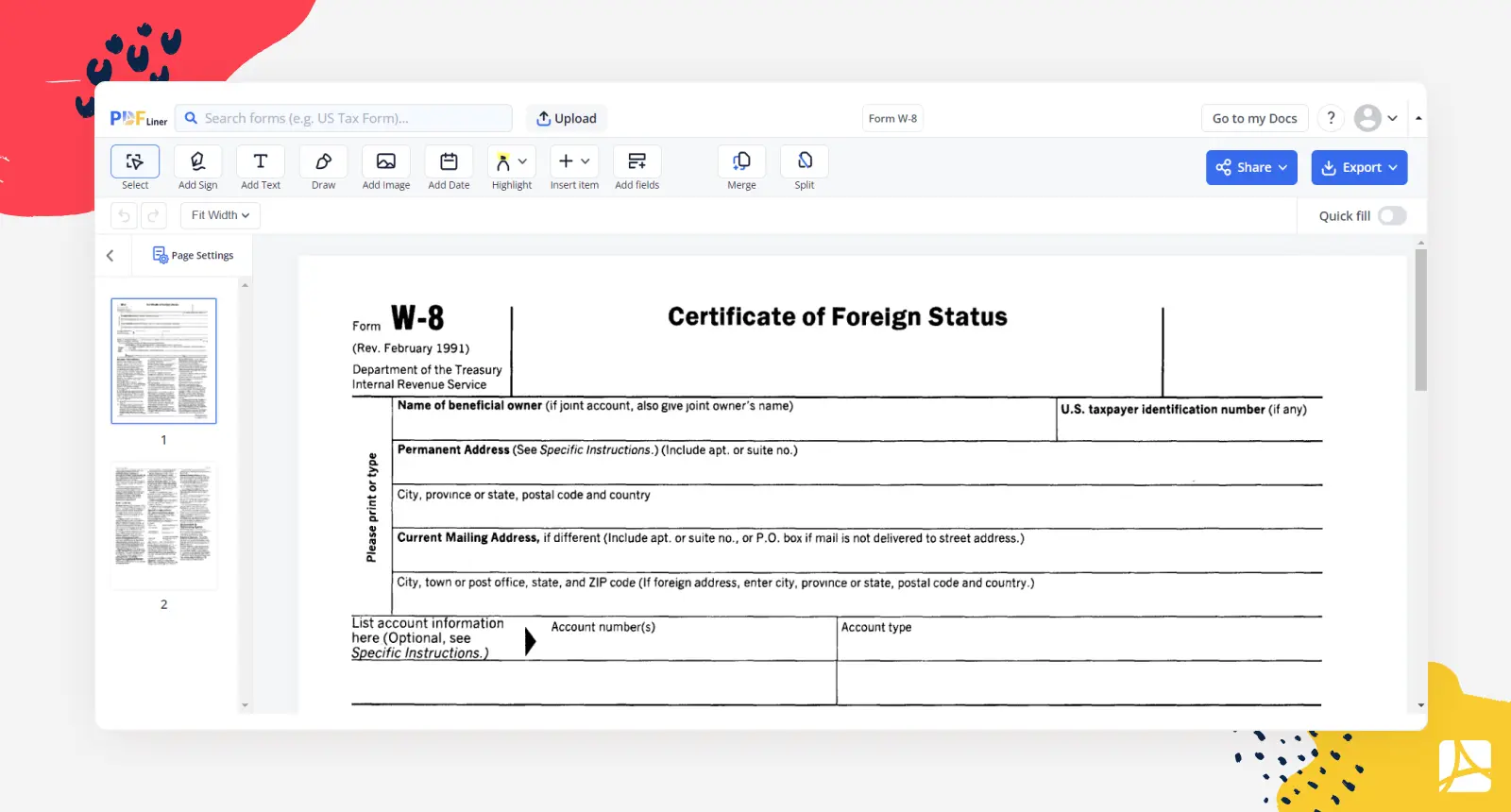

Form W-8

Get your Form W-8 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is a W-8 Form?

The IRS forms W-8 are a series of forms used by foreign entities to certify their non-U.S. status. The W-8 form essentially acts as an official declaration, stating that the entity is not a U.S. person and, therefore, is subject to different tax regulations. Its primary function is to state the entity's country of residence for tax purposes, helping the IRS determine if any tax treaty benefits apply.

Types of W-8 Forms

There are five types of IRS forms W-8:

Each form caters to a different set of circumstances, ranging from individual foreign persons to foreign governments or international organizations. It's essential to use the correct form that aligns with your specific tax situation.

How to Fill Out Form W-8

Step 1: Identification of Beneficial Owner

In this part, you need to provide your name and country of citizenship. If you are a dual citizen, you should mention the country where you are a resident for tax purposes.

Step 2: Address of the Beneficial Owner

Enter your full address here, including the city and country. A P.O. Box is generally not accepted unless it is the only kind of address used in your country.

Step 3: U.S. Taxpayer Identification Number (TIN)

If you have a U.S. TIN, you should enter it in this field. A U.S. TIN could be a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

Step 4: Foreign Tax Identifying Number (FTIN)

Here, you should enter your tax identification number in your country of residence, if you have one. Some countries do not issue a tax identification number, in which case you may leave this field blank.

Step 5: Date of Birth

Provide your date of birth in MM-DD-YYYY format.

Step 6: Claim of Tax Treaty Benefits

If you're eligible for tax treaty benefits between the U.S. and your home country, you can claim them here. This information is crucial because it could lead to reduced withholding taxes.

Step 7: Special Rates and Conditions

If special rates and conditions apply to you, list them here. This section often needs to be filled in under the guidance of a tax advisor.

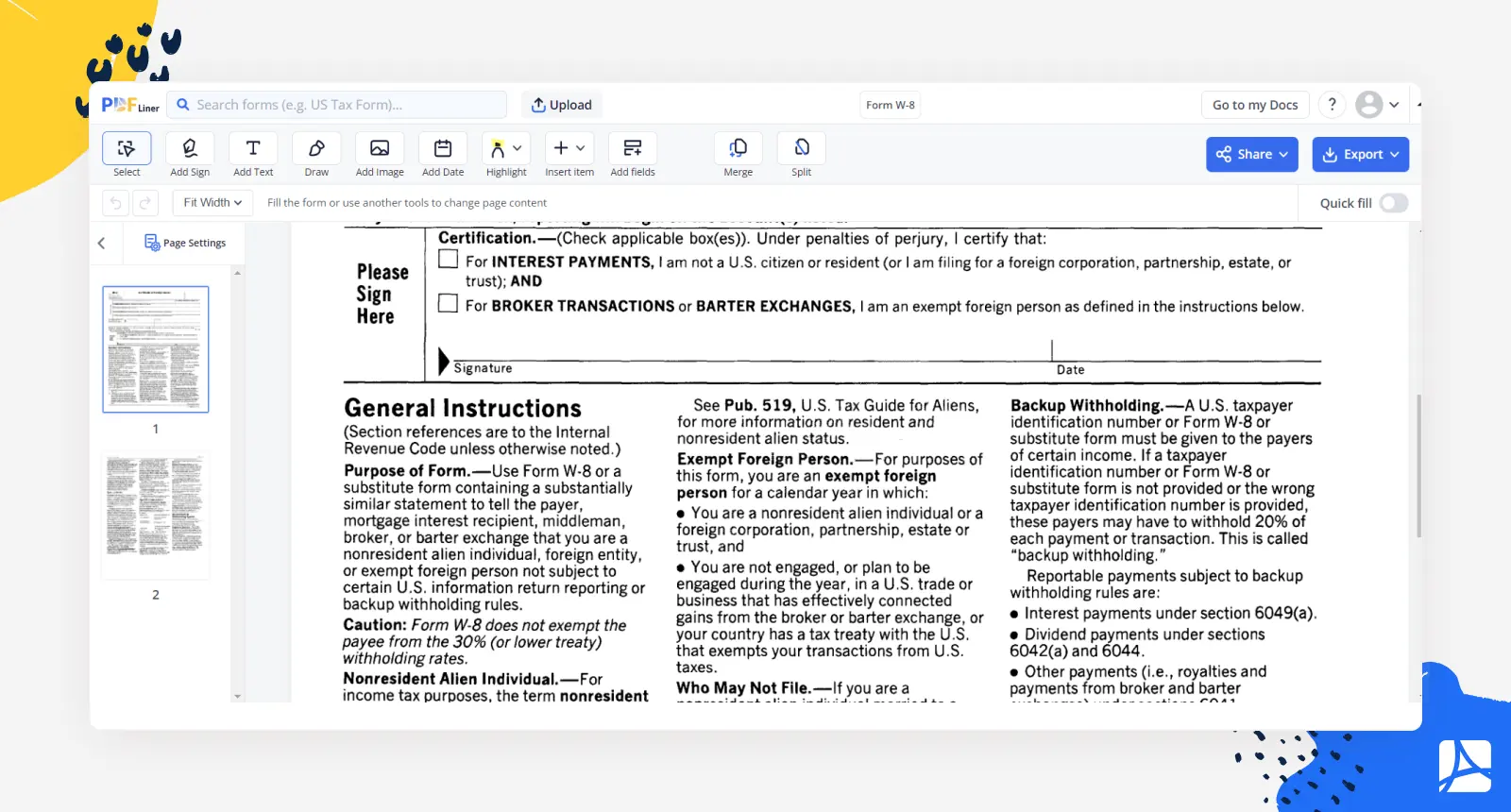

Step 8: Certification

Sign and date the form. By signing, you are certifying that the information provided is accurate to the best of your knowledge.

After completing the form, you should give it to the withholding agent or payer and not send it to the IRS. Remember to keep a copy for your records.

How to Download a W-8 Form

If you want to download W 8 form, you can easily find it on the IRS's official website. They provide free access to the US W-8 form, available in a convenient PDF format.

Here, you can also find the instructions and any updates related to the W-8 tax form, fill out the document and download it by clicking the Export button.

Final Thoughts on the W-8 IRS Form

Navigating the world of U.S. tax laws can be tricky. However, understanding and correctly filling out IRS forms such as the W-8 can save you from potential tax complications down the line. Whether you need a printable W 8 form PDF, a blank W-8 form in PDF, or simply want to download a W-8 form, remember that these resources are readily available to help streamline your tax process.

Fillable online Form W-8