-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

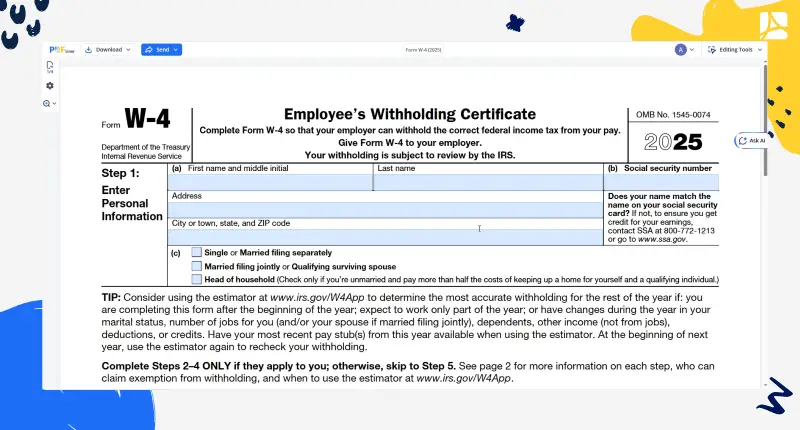

Form W-4 (2025)

Get your Form W-4 (2025) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a W-4 Form 2025

The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxes.

What you need IRS form W-4 for

The W-4 form is crucial for businesses with employees because the document assists them in taking the right amount of taxes from their employers’ paychecks. The form must be submitted on a yearly basis, or whenever your current personal/financial state of affairs changes significantly.

Here’s why completing the IRS Form W-4 regularly and accurately is crucial:

- The IRS demands we pay taxes on our income in a gradual manner during the year; if you don’t withhold enough tax, the amount of money you could owe to the IRS in April may be way too hefty;

- On the other hand, completing the IRS W-4 in the correct way will save you from overpaying your taxes and, i.e., prevent excessive tightening of your monthly budget.

Who Should Fill Out Form W-4?

Form W-4 is completed by employees and is used to calculate the amount of taxes that should be withheld from their paychecks. If you claim zero allowances on your W-4, the highest amount of taxes will be withheld from your paycheck.

Employees should complete form W-4 when they start a new job to provide information about your tax status, so employers can withhold the right amount. They can also update their W-4 at any time if their personal or financial information changes.

Fill Out W4 Online in 2026

Make sure you take your time and complete the document with maximum concentration in mind. The editable W4 form is relatively simple to complete without any assistance. In case you feel you need help, you can always ask your bookkeeper to do that with you.

Organizations That Work with IRS Form W-4

Internal Revenue Service (IRS)

IRS Form W-4 Resources

- Download blank form W-4

- IRS Instructions for W-4

- How to get a W-4 Form

- How to fill out W-4

- How to sign IRS W-4

How to Fill Out IRS Form W-4 2025

Step 1: Take a look at the Sample W 4 forms.

Step 2: Open the document with PDFLiner by clicking the Fill this form button.

Step 3: Follow these guidelines that will lead you through the procedure:

- Provide your name and contact details;

- Specify your Social Security Number;

- Indicate your marital status;

- Specify recent name changes (if there were any);

- Answer a few questions to fill out the Allowances section.

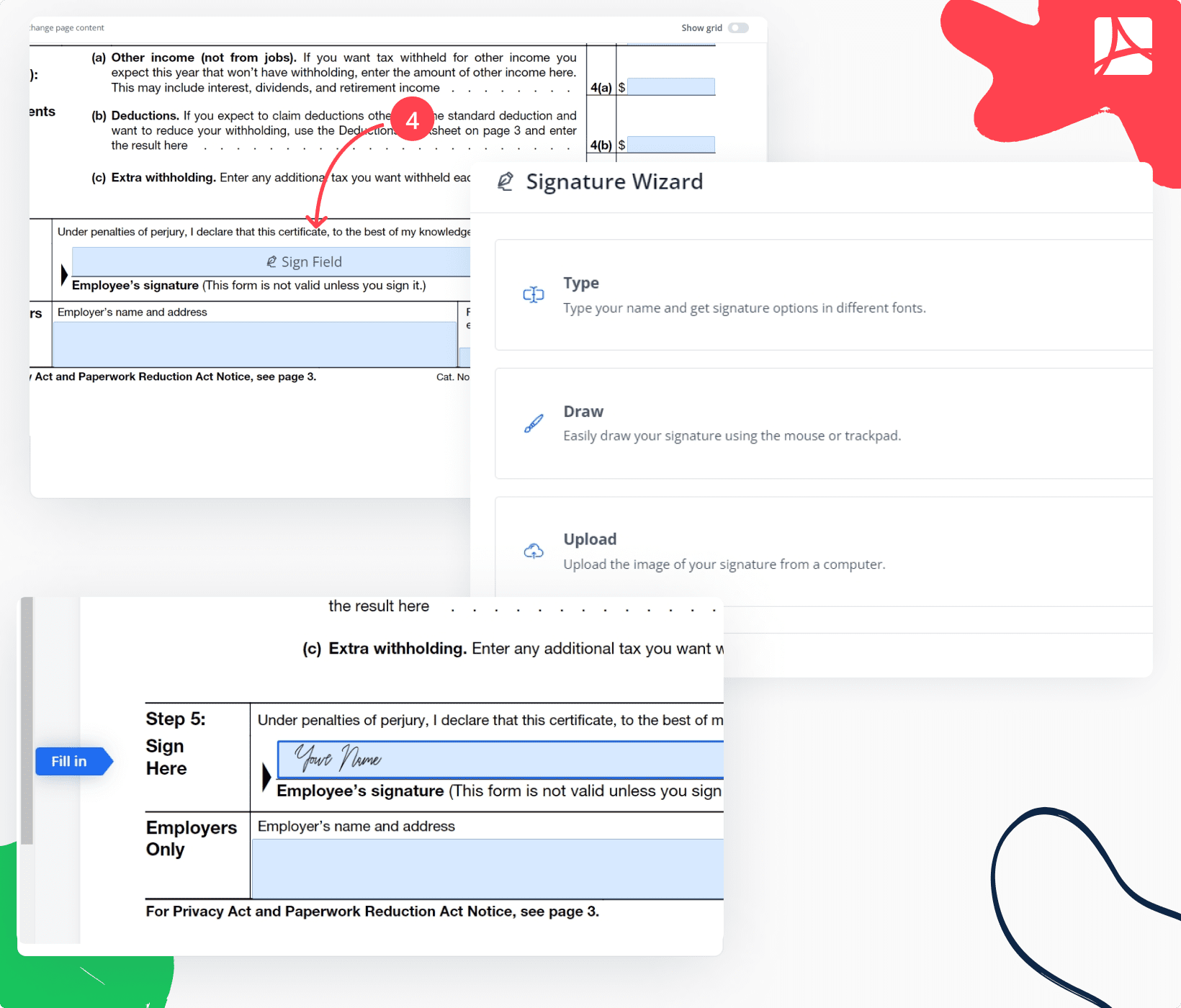

Step 4: Sign your W-4 electronically by clicking on the Sign Field at the end of the first page.

Step 5: Click Done to save and download your W-4 form.

Form Versions

2024

Fillable Form W-4 for 2024

2021

Fillable Form W-4 (2021)

FAQ: Form W-4 Popular Questions

-

What is the purpose of the W-4 form?

The file is used by employees to inform their employers about the amount of tax to be deducted from their paychecks based on their dependents, filing status, estimated deductions, and similar factors.

-

What are the changes to the 2023 Form W-4?

If an employee had the year 2019 or earlier Form W-4 on file with their employer, those withholding elections could remain in place; however, if an employee wanted to make any changes to their federal withholding elections in 2022 or 2023, they’ll have to use the new one.

-

Do I need to get an updated Form W-4 from all my employees for 2023?

Yes, you will need to get an updated Form W-4 from your employees for 2023.

-

What is the difference between a W-2 and a W-4?

The former is to be filled out by the employer to report the costs earned by and withheld from their employees, while the latter is a report each employee is to submit to their employer.

-

How to file a W-4?

According to the IRS, employers are allowed to set up an electronic system for receiving W-4 forms from their employers. The document must be filled out completely and correctly.

-

Who can claim exemptions on their W-4?

Employees with no tax liability in the past and current years (i.e. those who received and are expecting a full refund) can claim exemptions.

Fillable online Form W-4 (2025)