-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Fillable Form W-4 (2023)

Get your Form W-4 (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Ultimate Guide to the W-4 Form 2023: Ensuring Accurate Withholdings

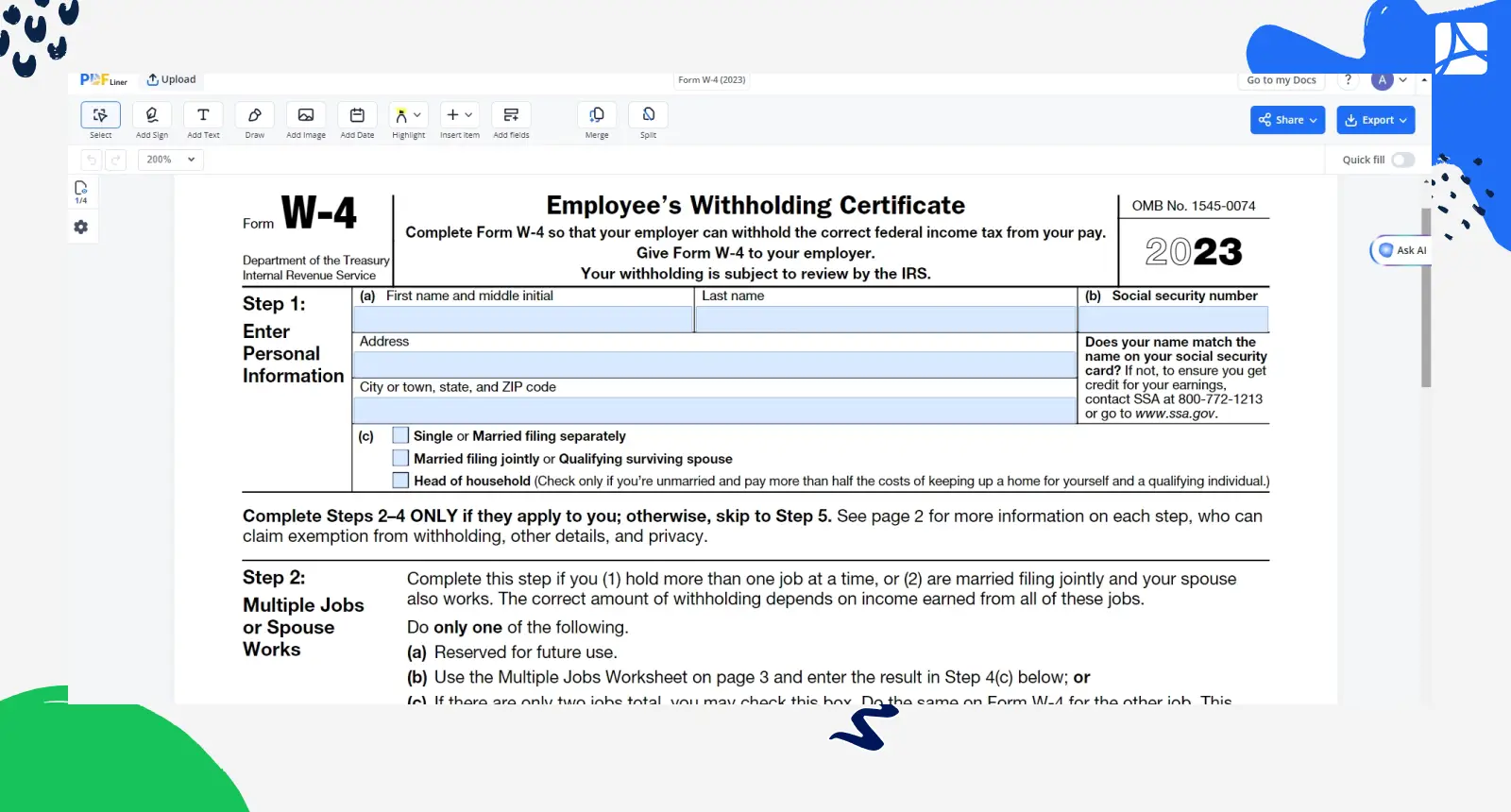

The W-4 Form is a crucial document for both employees and employers as it determines the amount of federal income tax to be withheld from an employee's paycheck. With the 2023 W-4 tax form, understanding how to fill it out correctly is essential to prevent either overpaying taxes and waiting for a refund or owing a large amount at tax time. The IRS updates this form to reflect current tax laws, making the federal W-4 form 2023 version the latest iteration that taxpayers need to be acquainted with.

The Importance of Getting it Right

Filling out the IRS W-4 2023 form accurately cannot be overstated. It directly influences your financial health throughout the year by affecting how much money you take home in each paycheck. Incorrect information can lead to unexpected tax bills or a smaller refund than anticipated. It's especially important when life changes occur—such as marriage, having a child, or starting a second job—as these events can significantly impact your tax situation.

How to Fill Out Form W-4 2023

Step 1: Start by downloading the W 4 form 2023 PDF from the IRS website or obtaining a copy from your employer. This ensures you're using the most current version.

Step 2: Provide your personal information in the first section. This includes your name, address, Social Security number, and tax filing status. Be accurate as this information lays the groundwork for your withholdings.

Step 3: If you have more than one job or if you and your spouse are both employed, you'll need to follow the instructions to adjust your withholdings accordingly. This may involve using the IRS's online Tax Withholding Estimator or completing the Multiple Jobs Worksheet.

Step 4: Claim any dependents if applicable. This section is where you indicate if you have children or other dependents that qualify you for child tax credits or other deductions.

Step 5: Adjust your withholdings further if needed. If, for example, you expect to claim deductions other than the standard deduction or have additional income not subject to withholding, you'll input those details here.

Step 6: Lastly, sign and date the form before submitting it to your employer's payroll or HR department. Remember, you can amend this form anytime your financial situation changes.

Expert Tips for Navigating the W-4

While filling out the W-4 form 2023 might seem straightforward, nuances can make a big difference in your withholdings. Consider using the IRS Tax Withholding Estimator online tool for a tailored calculation, especially if you have multiple income sources. Also, keep in mind the possibility of revising your W-4 throughout the year if significant life events occur, ensuring your withholdings remain accurate.

Fillable online Form W-4 (2023)