-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

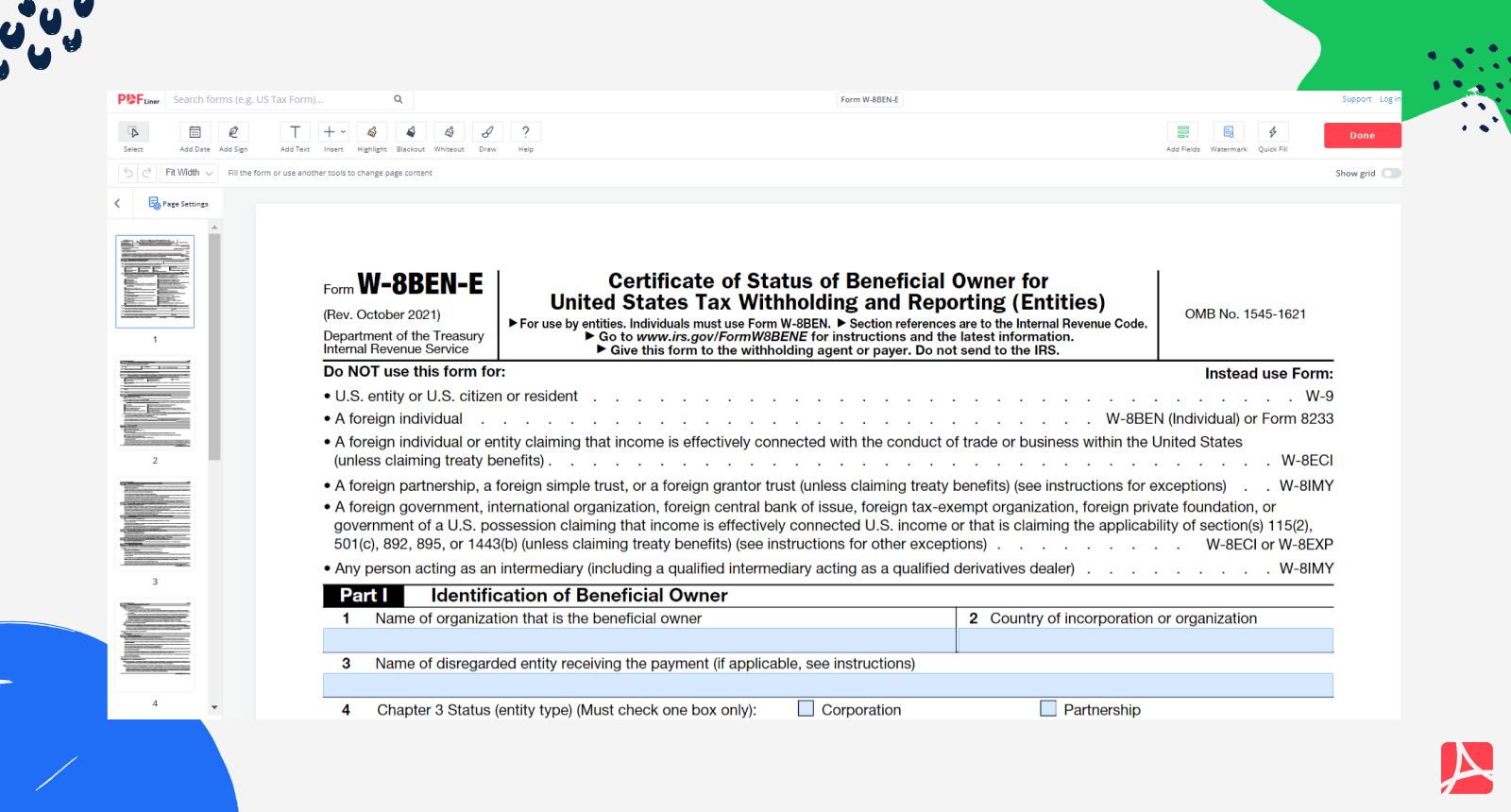

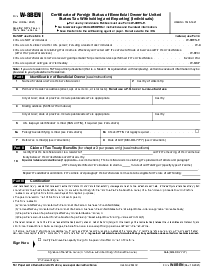

Form W-8BEN-E

Get your Form W-8BEN-E in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form W-8BEN-E?

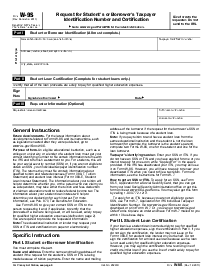

The form W-8BEN-E is also known as the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entitles). The document was created and provided by the Department of the Treasury Internal Revenue Service. However, you can’t send the document directly to the IRS after you’ve filled it.

The W-8BEN-E form must be provided to the withholding payer or the agent. The template can be used only by entities. If you are an individual who needs to make the report, fill out the W-8BEN form.

The IRS has made the “family” of W-8 forms that must be filled by foreign businesses or individuals to confirm the country of their residence. Without these tax forms US officials will not be able to certify their work. The US officials take up to 30 percent of taxes withheld from the income that foreign entities receive in the US. The IRS form W-8BEN-E can help foreigners to claim tax reductions if there is a tax treaty between the countries.

What I need the Form W-8BEN-E for?

- Only foreign entities that work within the US must learn what is a W-8BEN-E form used for. You have to use the form as their representative to provide the information on the taxes withheld from the total income;

- You need to find W 8BEN E fillable form in case you want to receive a tax reduction for the company. If your country is in a tax treaty with the US government you can expect to lower the tax amount you pay;

- If you have not provided the form on behalf of the entity, you will need to pay the total 30 percent tax rate automatically.

How to Fill Out Form W-8BEN-E?

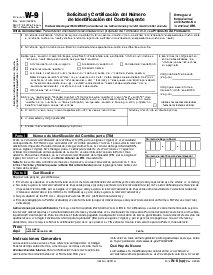

You can find the W 8BEN E form PDF on IRS official website. The document is not that simple and requires your total attention. On the IRS portal, you can open the form and learn the basics. You can even find form W-8BEN-E instructions there. However, once you decide to complete the document, you need to find another service that allows you to do it online.

You can choose PDFLiner which usually offers a wide range of tools, including the ability to create your electronic signature and send the document to other parties. The service offers you to complete the template and save it to your device, keep it in the library, and send the copy to anyone you need. You can always use the W 8BEN E form download option available there. However, before you do it, you have to learn what to include inside the document:

- Read the restrictions for people who can’t use the document at the beginning of the template;

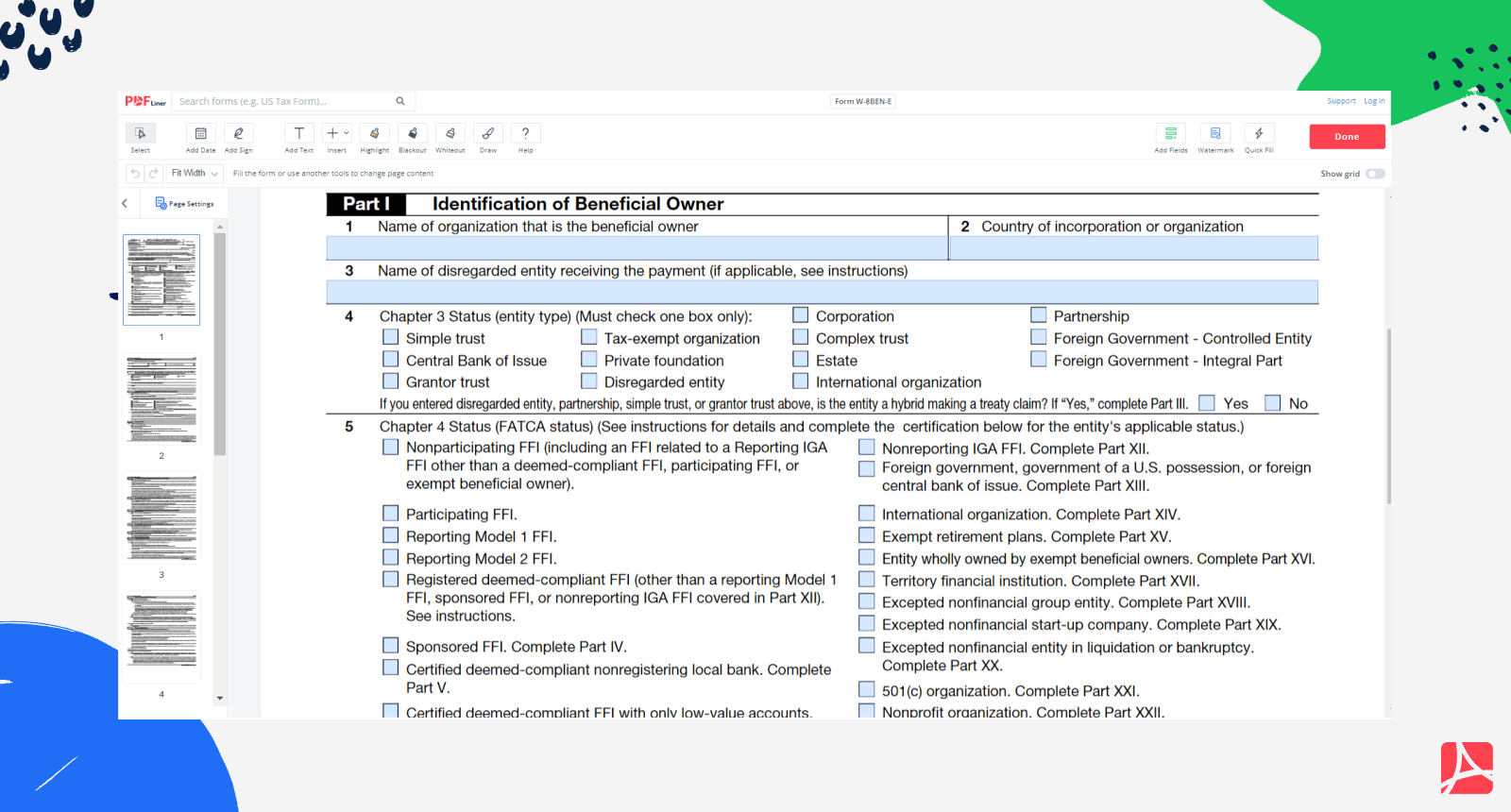

- Fill in Part 1 with the information on the beneficial owner. Provide the name, address, status type, and TIN;

- Provide information on the disregarded entity in part 2, including the status, and the address;

- Describe the claim for the tax treaty benefits you have in the part 3;

- Share the information on the sponsored FFI in part 4;

- Provide information on the certified deemed-compliant non-registering bank you work with;

- Share information on the FFI with the low-value account in part 6;

- Share the date on the closely held investment vehicle in part 7, the deemed-compliant life debt investment company in part 8, and the entities that do not have financial accounts in part 9;

- Put the ticks in the boxes that match your situation in the sections from 10 to 28;

- Describe the substantial American owners of passive NFFE in part 29;

- Put the signature and date.

Organizations that work with Form W-8BEN-E

- Department of the Treasury Internal Revenue Service.

Who needs to fill out a W-8BEN-E form?

The form can be used only by entities from abroad that work in the US. These entities can fill out the form to avoid paying the full 30 percent tax from the income. If the local government where the entity resides has a treaty with the US the entity can expect to cut taxes. The document is required from any foreign institution that has business there. If you are an individual who has a business in the US you have to fill out another form created by the IRS for specific occasions.

Fillable online Form W-8BEN-E