-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form W-2, Wage and Tax Statement

Please note that Copy A of this form is not scannable. Do not file it with SSA. You can use this form to send other copies to the recipients and keep Copy D for your records.

How to Fill Out a W-2 Form PDF

The printable W2 form (also known as Wage and Tax Statement) provides the correct sum paid to the employee and the taxes withheld from their paychecks during the year. Every employer should fill out this form by the end of the year. The amounts of taxes withheld and employees’ info are based on the information they provided with a W-4 Form.

Step 1: Employer’s and Employee’s Information

On the left part of the blank W-2 form, you need to add data shown on your tax return and on the employee’s W-4:

- Employee’s SSN;

- Your EIN;

- Your business name and address;

- Employee’s name and address;

- Control number (optional).

Step 2: Wages, Tips, and Compensation

Next, move to the right part and enter the employee's total wages earned during the year, including regular wages, tips, bonuses, and other forms of compensation on line 1.

If the amount doesn’t exceed the 2025 wage base ($176,100), copy it to lines 3 and 5. In case total wages are higher, enter $176,100 on line 3 and copy the amount from line 1 to line 5.

Suppose the employee received tips directly from customers and reported them as Social Security tips; write that amount on line 7. And if you distribute a portion of the tips received among employees by yourself, show this amount on line 8.

On line 10, report any dependent care benefits you provided during the year. This may include:

- Dependent care assistance programs (DCAP);

- Employer-provided dependent care;

- Non-taxable employer reimbursements.

Step 3: Withheld Taxes

On line 2, write a total Federal income tax withheld during the year. This amount should be based on the employee’s taxable income and filing status they specified on W-4.

On line 4 report Social Security taxes. In 2025 it’s 6.2% of the SS wages (box 3).

On line 6 enter Medicare taxes paid during the year. This year's tax rate is 1.45% of Medicare wages (box 5).

Step 4: Lines 11 - 14

Line 11 is used to report your distributions from a nonqualified deferred compensation plan to the employee. This information is needed for SSA.

Lines 12 are to report other compensations or deductions using single or double letter codes that correspond to each. In the W-2 template, we use code D to show the employee’s retirement plan contributions.

Check one of the boxes 13 if they apply:

- Statutory employees are the ones whose earnings are subject to SS and Medicare taxes but not federal income taxes.

- Retirement plan box is for employees who contributed to their plans during the year.

- Third-party sick pay box is to report that the third-party payer made the sick payments.

On line 14, you can include any additional information you wish to communicate to your employee.

Step 5: State and Local Taxes

If your state or locality requires income tax withholding, you will need to report the amount withheld on Form W-2. Check the specific tax regulations for your jurisdiction to determine the reporting requirements and ensure compliance.

Once you are done, print W2 form and send it to your employees.

Form W-2 2025 Deadlines

1. To Employees

Employees should receive their copies B, C, and 2 of Form W-2 by January 31, following the end of the tax year (or the next business day if January 31 falls on a weekend or holiday).

2. To SSA

As an employer, you must file Copy A of the downloadable W 2 form, along with the transmittal form W-3, with the Social Security Administration (SSA) by January 31, following the end of the tax year (or the next business day if January 31 falls on a weekend or holiday), regardless of whether filing on paper or electronically.

Real-Life W-2 Examples

Example 1: Simple Case

Sarah Johnson is an employee of XYZ Company, who earned a total of $170,000 in 2025 and reported $2,000 in tips. Sarah's W-2 form would be filled out as follows:

- The employer's (XYZ Company) and Sarah's information are added on the left side of the form.

- On the right side of the form, under 'Wages, Tips, and Other Compensation,' $170,000 is added to line 1. Since this amount exceeds the 2025 wage base ($176,100), $176,100 is entered on line 3, and $170,000 is added to line 5.

- Sarah reported $2,000 in tips, which is added on line 7.

- Suppose XYZ Company withheld $35,000 in federal income tax over the year. This amount is added on line 2.

- Social Security taxes are reported on line 4, which is 6.2% of the Social Security wages, i.e., $10,453.20.

- Medicare taxes are entered on line 6, which is 1.45% of Medicare wages, i.e., $2,465.

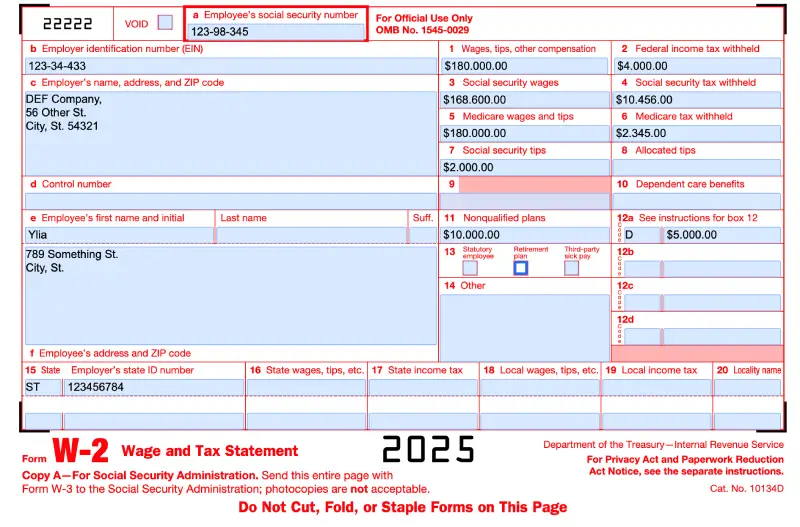

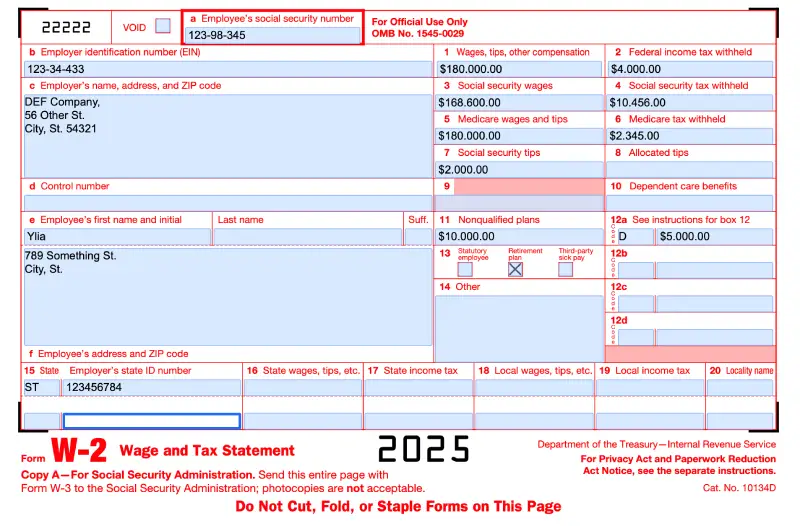

Example 2: Nonqualified compensation and retirement plan

Consider Jane Doe, an employee at DEF Company. In 2025, Jane earned a total wage of $180,000 and received $10,000 as nonqualified deferred compensation as a part of her compensation package negotiated with DEF Company. In addition, she contributed $5,000 to her 401(k) retirement plan.

Here's how Jane's W-2 form would be filled out:

- The employer's (DEF Company) and Jane's information are added on the left side of the form.

- On the right side of the form, under 'Wages, Tips, and Other Compensation,' $180,000 is added to line 1. Since this amount exceeds the 2025 wage base ($176,100), $176,100 is entered on line 3, and $180,000 is added to line 5.

- Suppose DEF Company withheld $40,000 in federal income tax over the year. This amount is added on line 2.

- Social Security taxes are reported on line 4, which is 6.2% of the Social Security wages, i.e., $10,453.20.

- Medicare taxes are entered on line 6, which is 1.45% of Medicare wages, i.e., $2,610.

- On line 11, Jane's $10,000 nonqualified deferred compensation is reported.

- Jane's contribution to her 401(k) retirement plan is indicated in line 12. Code D denotes this contribution so that it would be written as 'D 5000'.

- In line 13, the 'Statutory employee' box would be checked, as Jane falls under this category.

Remember, these examples are simplifications and don't account for all possible deductions and tax situations. It's always important to consult with a tax professional or use reliable tax software to ensure accurate tax reporting.

Useful Tips For Fillable W2

- 📌 Don’t forget about deadlines. Employers should meet specific due dates and provide the necessary information on time.

- 📌 Copy A should be sent to SSA.

- 📌 Copy 1 goes to the state, city, or local tax department.

- 📌 Copies B, C, and 2 go to employees.

- 📌 Copy D should be kept for records by an employer for 4 years.

- 📌 Always double-check everything you enter in the form — especially personal info and calculations.

Table of contents

Fill out and get a W-2 Form