-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Fillable Form W-2 (2023)

Get your Form W-2 (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

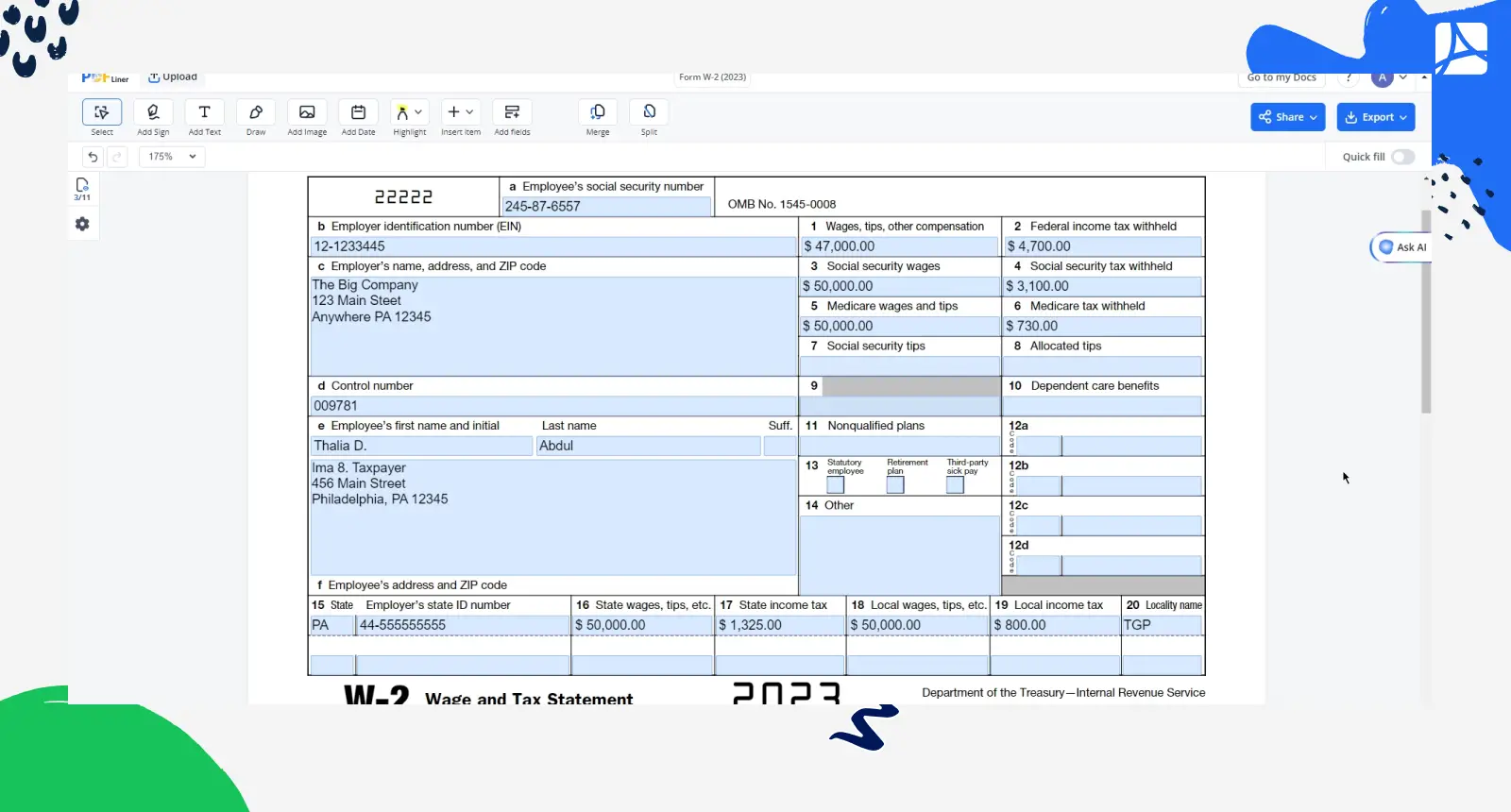

How to Properly Fill Out the W-2 Form 2023

Tax season can be a daunting time for employers and employees alike. With the IRS requiring detailed reporting of wages and taxes withheld, the W-2 form is a critical document in the tax filing process. The W-2 Form 2023 is an essential piece of this puzzle, as it outlines the salary paid, and taxes withheld from an employee's paycheck. In this guide, we'll provide a comprehensive overview of how to accurately fill out the W-2 Form 2023, ensuring that your tax reporting is as seamless as possible.

Understanding the W-2 Form 2023

Before diving into the "how to fill out" section, it's crucial to grasp what the W-2 Form 2023 entails. This document is employed by employers to report annual wages and the amount of taxes withheld from their employees' paychecks to the IRS. It serves as a proof of income and tax payment for the employee and is indispensable when filing annual tax returns. The W-2 Form 2023 pdf can be easily accessed online for those who prefer a digital format.

How to Obtain Your Blank W-2 Form 2023

Acquiring a blank W-2 form 2023 is straightforward. Employers can download the W 2 2023 PDF directly from the IRS website or order hard copies. For simplicity and efficiency, the digital PDF version allows for easier access and quicker completion. It's recommended to have a blank template on hand early to prepare for the tax season adequately.

How to Fill Out

- When it comes to actually filling out the form, follow these step-by-step instructions to avoid any errors:

- Start by downloading the W-2 Form 2023 PDF from the official IRS website or obtain a physical copy.

- Fill in the employer information in Boxes B, C, and D, including the Employer Identification Number (EIN), name, and address.

- Enter the employee's social security number, name, and address in Boxes A, E, and F.

- Accurately report wages, tips, and other compensation in Box 1 and the amount of federal income tax withheld in Box 2.

- Complete Boxes 3 through 6 with the relevant social security and Medicare wages and taxes withheld.

- Boxes 7 and 8 pertain to tips; fill these out if applicable.

- Additional compensation and deductions such as dependent care benefits and contributions to retirement plans should be reported in Boxes 10 and 12, respectively.

- Finally, complete the state and local income tax information in Boxes 15-20 as necessary.

Conclusion

Filling out the IRS W-2 Form 2023 may appear intricate at first glance but becoming familiar with the boxes and the required information can simplify the process. Whether you’re filling out a digital W-2 2023 PDF or a paper form, precision and accuracy are key. By following the steps outlined in this guide, employers can ensure they provide their employees with correctly completed W-2 forms, paving the way for a smooth tax filing season.

Form Versions

2021

Fillable W-2 Form (2021)

Fillable online Form W-2 (2023)