-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

A Stress-free Way to File Your Taxes

1. Fill Out Form 1040

15 min

Input your personal details, income information, deductions, and credits easily with our user-friendly interface.

2. Sign and Print

2 min

Finish by clicking the "Sign Field" at the bottom of the form for secure eSignature, then click the “Export” button and choose “Print File.”

3. Mail To The IRS and Save For Your Records

2 min

You're all set to mail your tax return to one of the IRS addresses and save the form in your PDFLiner account for future inquiries.

What you need to know:

- 📎 Use the tax preparation checklist or create your own.

- 📎 Gather all the info about your income, deductions, and tax forms that you have.

- 📎 Your filing status is vital in determining your tax liability, so review the options carefully.

- 📎 You can prepare the tax return yourself if you have a simple tax situation (like W-2 income only). It's easier than you think.

- 📎 The deadline for the form is April 15, 2025.

- 📎 Attach all the additional forms and schedules to the completed 1040 before filing.

- 📎 Double-check all the information and calculations before submitting.

Filling Out the IRS 1040 Form 2024 - 2025: Guide with Example

Form 1040 is the standard tax form individuals in the United States use to file annual income tax returns. This form is issued by the Internal Revenue Service (IRS) and is used to report various types of income, deductions, and credits. If you are a freelancer, contractor, or individual taxpayer with a simple tax situation, you can fill out the form yourself without hiring a tax professional.

Here are step-by-step instructions to complete a 1040 fillable form, along with a simple example:

Step 1: Assemble the paperwork

Before filling out the 1040 form, collect all the necessary documents and information. These may include:

W-2 forms from your employers.

1099 forms for any freelance or contract work.

All the needed 1040 Schedules.

Records of any other income, such as rental income, interest, or dividends.

Receipts for deductible expenses, like charitable donations or medical expenses.

Information about any tax credits you may be eligible for.

In our example, Samantha Smith is a full-time employee who also received interest from her bank deposit, so she needs to gather her W-2 and 1099-INT forms.

Step 2: Get a printable 1040 form

To get started, you will need to access the 1040 form PDF. Click the “Fill Out & Print 1040” button on this page and start filing your taxes immediately. You can also go to the official IRS website and download the PDF.

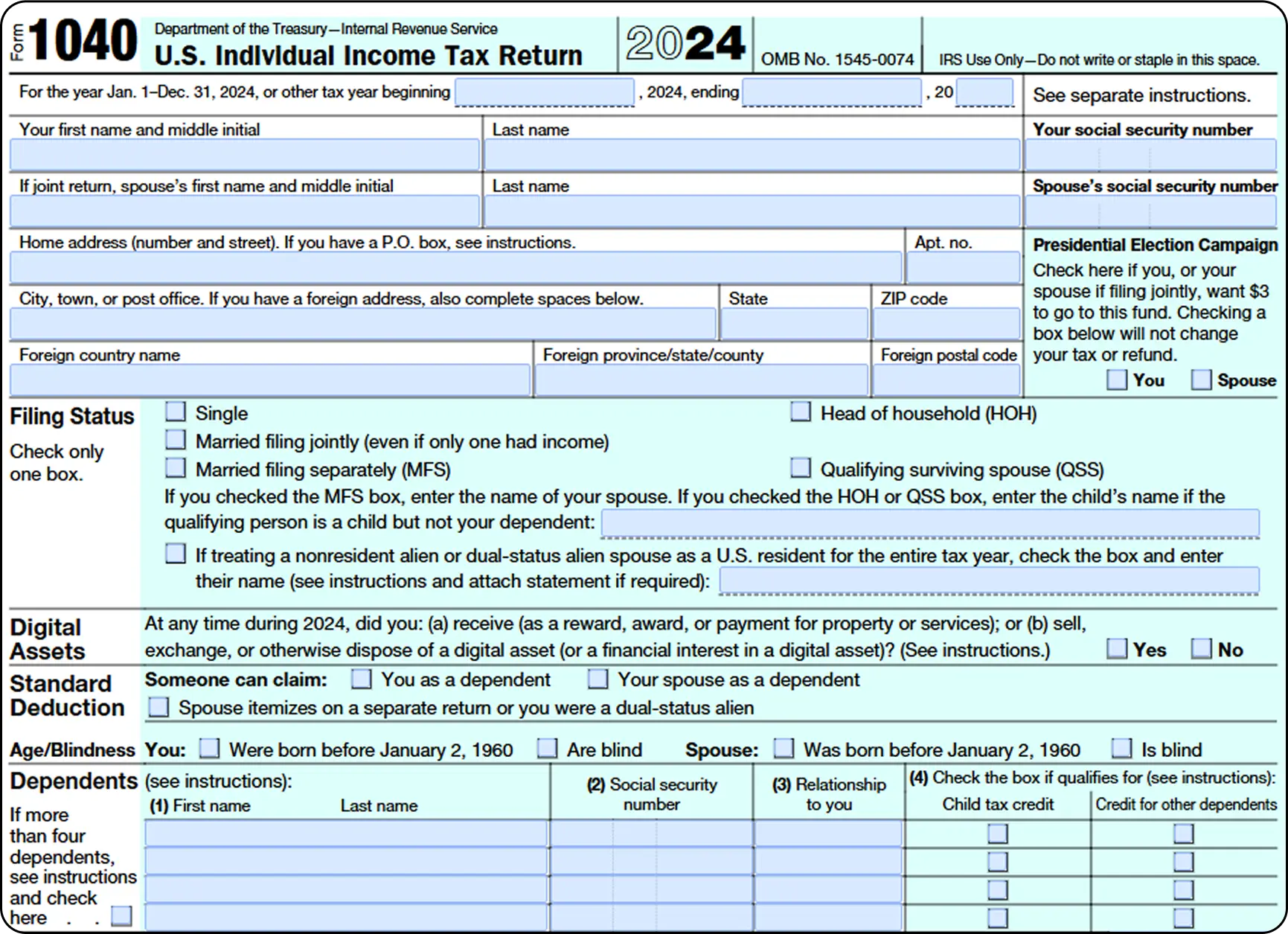

Step 3: Specify fiscal year (optional)

Suppose your fiscal year follows a schedule other than the standard January 1 through December 31, 2024 timeframe. In that case, you can indicate your fiscal cycle's beginning and ending months in the space provided at the top of page 1.

In our example, Samantha files for a standard tax year, so we leave these fields blank.

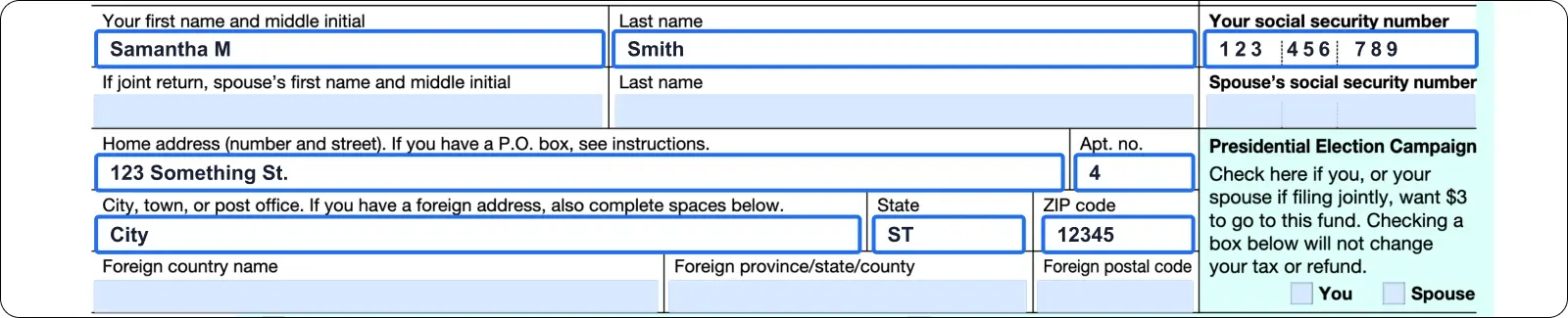

Step 4: Personal information

Enter your filing status, name, address, and Social Security number. If you are married and filing a joint return, you must include your spouse's information.

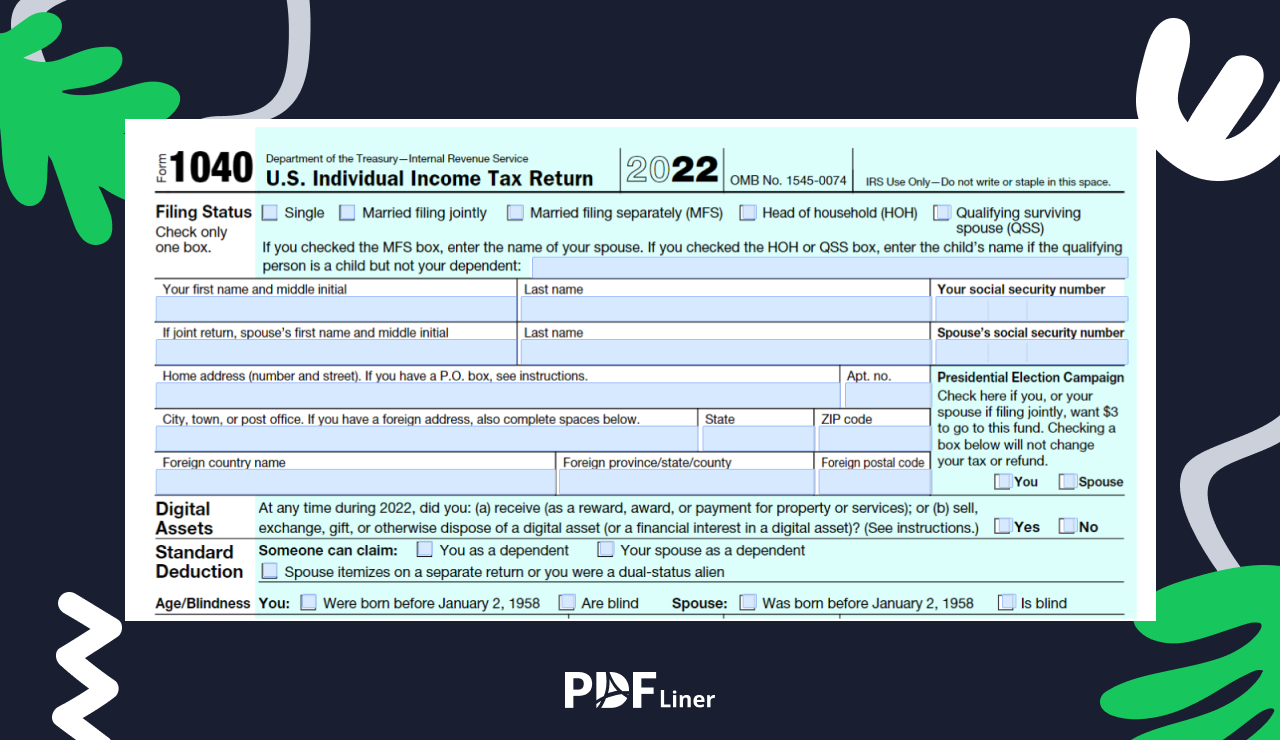

Step 5: Figure out your filing status

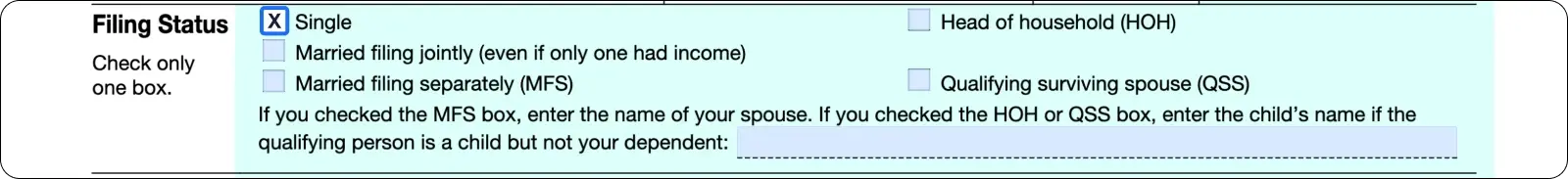

Deciding your filing status is crucial to completing Form 1040, as it directly influences your tax rates, standard deduction amounts, and eligibility for certain tax credits and deductions.

There are five options to choose from:

- Single – typically, according to state law, if you're unmarried, divorced, or legally separated.

- Married Filing Jointly – for married couples, combining their income and deductions onto one tax return. This status often results in lower tax rates and higher deduction limits.

- Married Filing Separately – if you're married but choose to file your taxes separately. This might be beneficial if one spouse has significant medical expenses or miscellaneous deductions.

- Head of Household – generally for unmarried taxpayers who provide more than half of the household expenses for themselves and a qualifying person (like a child or dependent).

- Qualifying Widow(er) with Dependent Child – if your spouse passed away during one of the previous two years and you have a dependent child, this status may offer you benefits similar to those of Married Filing Jointly.

Samantha is single, so she marks it as her filing status and only adds her information.

Note:

To accurately select your filing status, carefully review the criteria for each option. Your choice plays a vital role in calculating your tax liability and determining how much you may owe or receive as a refund. If you're uncertain about which status fits your situation best, consider using the IRS's Interactive Tax Assistant online tool for guidance or consult with a tax professional.

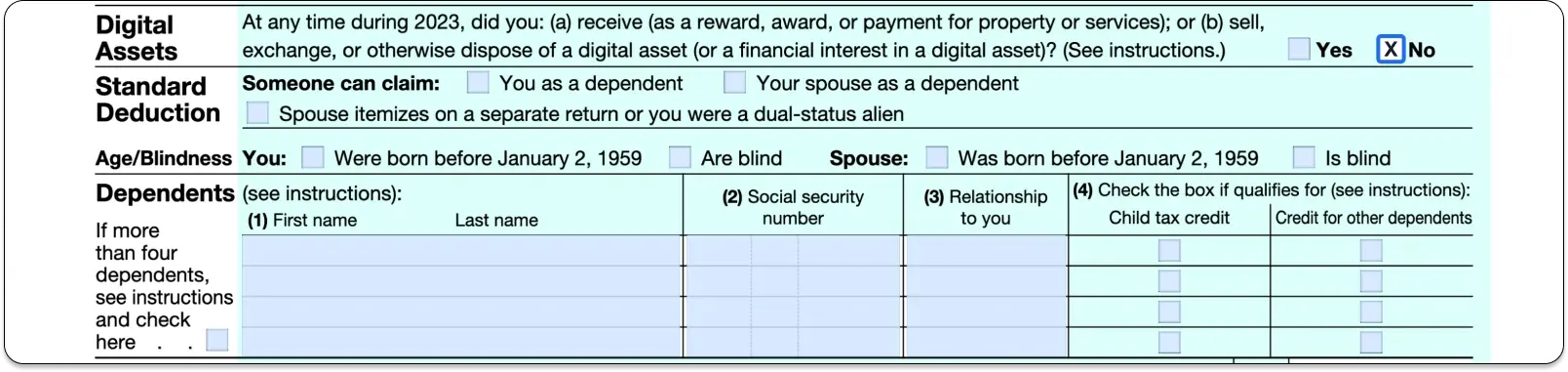

Step 6: Additional information and dependents

Specify if you received or sold any digital assets during the year. For example, digital assets include NFTs and virtual currencies, such as cryptocurrencies and stablecoins.

In the next section, you should provide information about your dependents if you have them. If you are not dependent or don't have any dependents, leave it blank.

In this example, Samantha has no income from digital assets and marks the answer “No.” Also, she is not a dependent and has no dependents, so she leaves the rest blank.

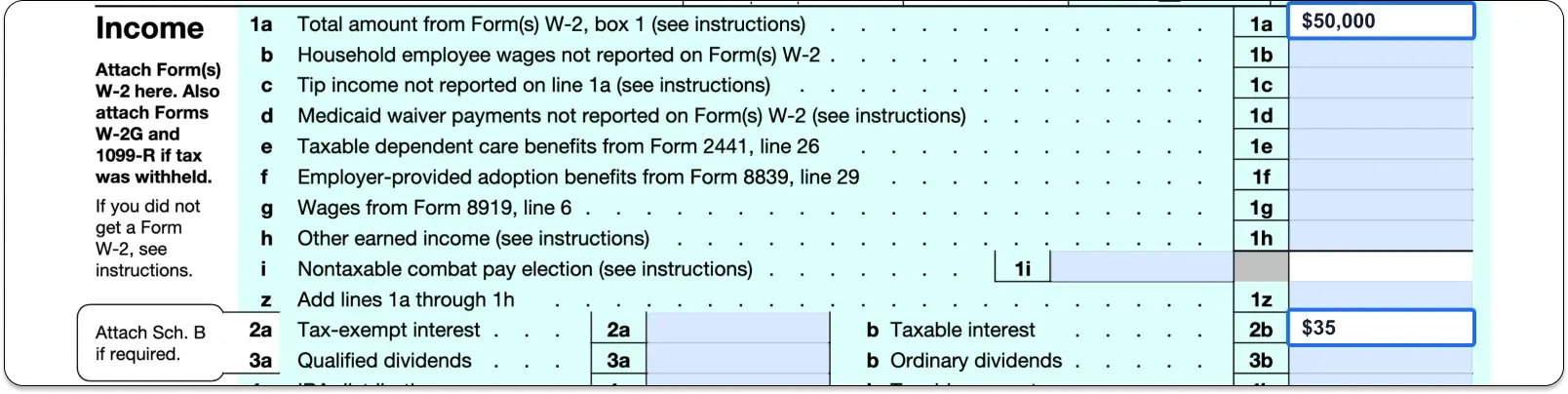

Step 7: Report income

In the next section of your tax return, you would need to calculate your total taxable income:

- Lines 1: If you are an official employee, report all your wages and benefits here. Get the information from your W-2 form and forms stated in these lines.

- Lines 2: If you received tax-exempt or taxable income during the year, report it here. Find this information on Forms 1099-INT and 1099-OID.

- Lines 3: Report all the dividends you received along with Form 1099-DIV.

- Lines 4 and 5: If you have Form 1099-R, report the amount from line 1 on one of these lines, depending on the type of income.

- Lines 6: If you were receiving Social Security benefits, use the Social Security Benefits worksheet to see if they are taxable.

- Line 7: If you sold a capital asset, such as a stock or bond, enter the amount from box 16 of Schedule D here.

- Line 8: Enter all other income calculated with Schedule 1 here.

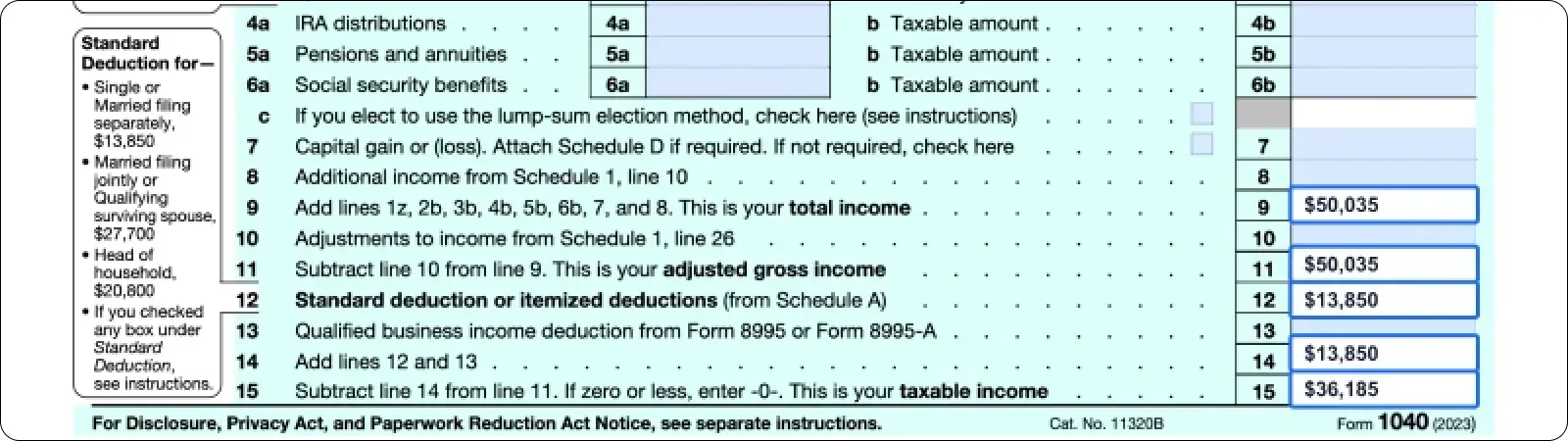

- Line 9: Calculate total income by adding lines 1z, 2b, 3b, 4b, 5b, 6b, 7, and 8.

- Line 10: If any adjustments from box 26 of Schedule 1, write them here.

- Line 11: Calculate adjusted gross income by subtracting line 10 from 9.

- Line 12: Choose to take either the standard deduction or itemize your deductions. The standard deduction is a fixed amount, depending on your filing status. Find the amount on the left side of the form. Itemized deductions include expenses such as mortgage interest, state and local taxes, and charitable donations. Compare the standard deduction to your total itemized deductions to determine which option will result in a lower taxable income.

- Line 13: If your business qualifies for a deduction, enter it here.

- Line 14: Calculate the total deduction by adding lines 12 and 13, or, as in most cases, just copy the amount from line 12.

- Line 15: Calculate the taxable income by subtracting line 14 from 11.

Note:

This section does not report income from self-employed individuals who get 1099-NEC instead of W-2. It should be reported with Schedule C of Form 1040.

Samantha only received her wages and bank deposit interest during the year. So she enters $50,000 on lines 1a and 1z (from box 1 of her W-2) and $35 on line 2b (from box 1 of 1099-INT).

Her total income is $50,035 (added 1z and 2b), which she enters on lines 9 and 11 because there are no adjustments. She chooses standard deduction, so in 2023, it's $13,850 that goes on lines 12 and 14. And finally, her taxable income is $36,185 (subtracted 14 from 11).

Here are three main formulas that you need for calculations in this block:

- Total Income = Line 1z + 2b + 3b + 4b + 5b + 6b + 7 + 8

- Adjusted Gross Income = Line 9 - 10

- Taxable Income = Line 11 - 14

Step 8: Calculate your tax liability

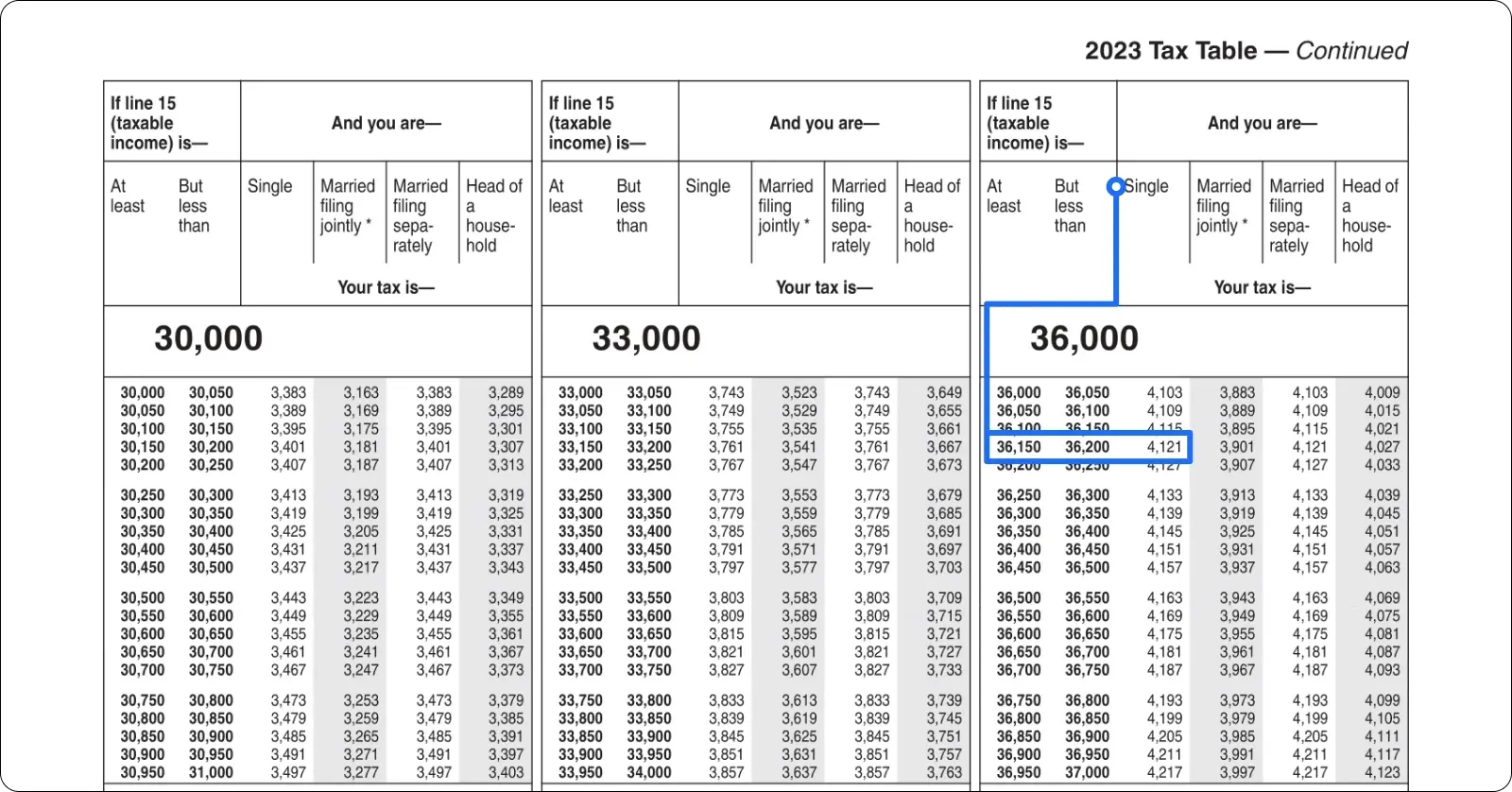

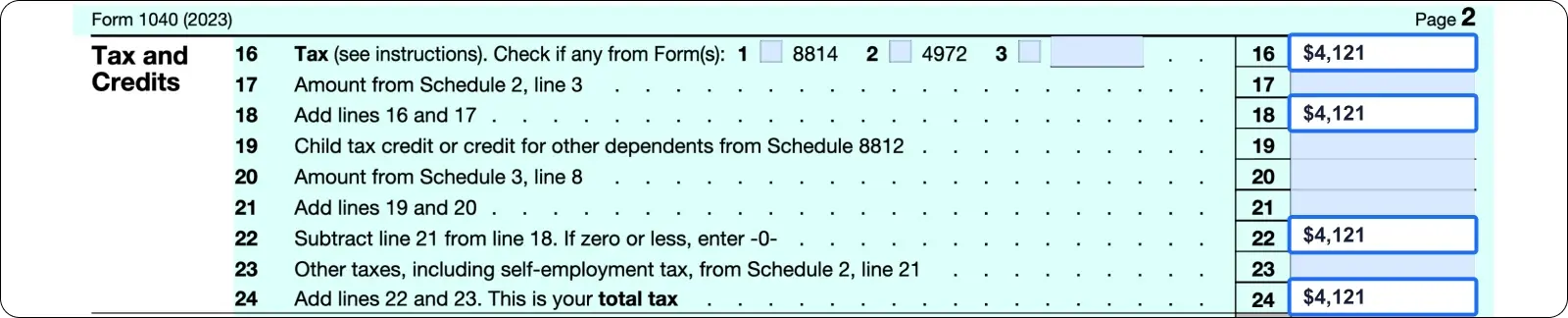

Use the tax tables provided by the IRS to determine your tax liability based on your taxable income and filing status. They can be found on page 65 of Form 1040 instructions. Write the amount on line 16.

Calculate additional taxes, including self-employment tax, using Schedule 2 and write the amount on lines 17 and 23.

After adding your taxes, review any tax credits you may be eligible for. Tax credits directly reduce the tax you owe, so you must claim all the credits you qualify for.

Common tax credits include the Earned Income Tax Credit, Child Tax Credit, and education credits. Calculate them using forms Schedule 8812 and Schedule 3. Enter these amounts on lines 19 and 20.

At the end of the section, calculate the total tax liability and enter it in line 24.

In our example, Samntha's tax liability is $4,121 (according to tax tables 2023) as her income is more than $36,150 but less than $36,200, and her filing status is single.

This amount goes to lines 16, 18, 22, and 24 because Samantha has no additional taxes or credits.

Step 9: Report payments

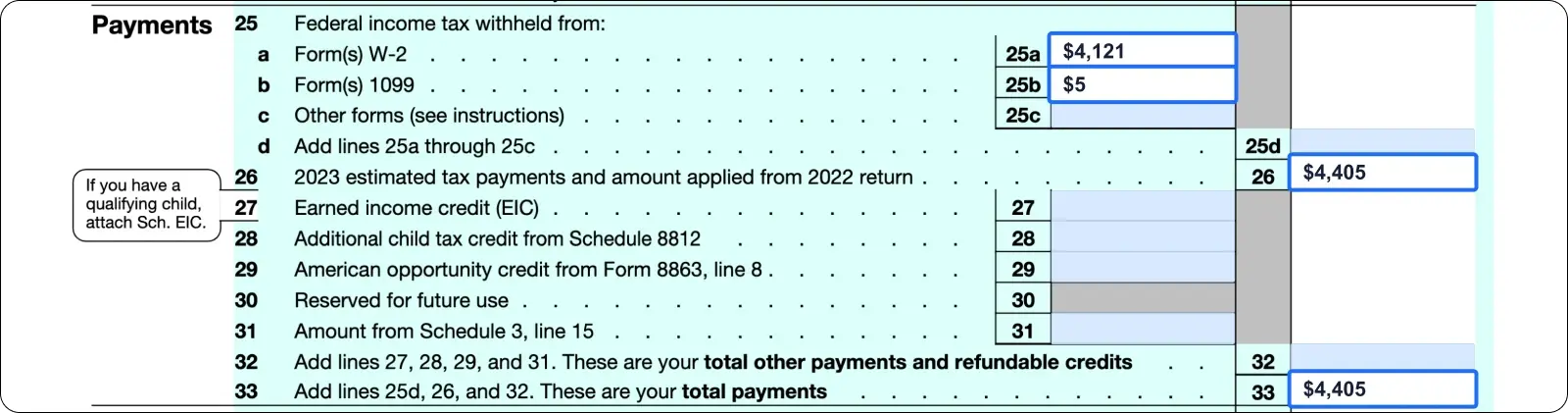

In this section, you should report all payments you made to the IRS during the year. In most cases, you would need to provide the following info:

- Line 25a is for employees who receive W-2s. Copy the amount from box 2 of W-2.

- Line 25b is for non-employees who receive 1099s. The amount withheld is shown in box 4 of your 1099.

- Line 25c is for all other taxes withheld. For example, reported on box 4 of Form W-2G.

- Line 25d is a total federal income tax withheld.

- Line 26 is to report the total amount of estimated payments (Form 1040ES) and the amount applied from the previous return.

- Line 33 is the total payments made to the IRS during the tax year. If you don't have any other payments and refundable credits, this is the same amount as on 25d.

Samantha reports withholdings made by her employer and her bank on lines 25a and 25b. It's $4,400 and $5 accordingly. So she adds these amounts and writes $4,405 on lines 25d and 33.

Step 10: Determine your refund or amount owed

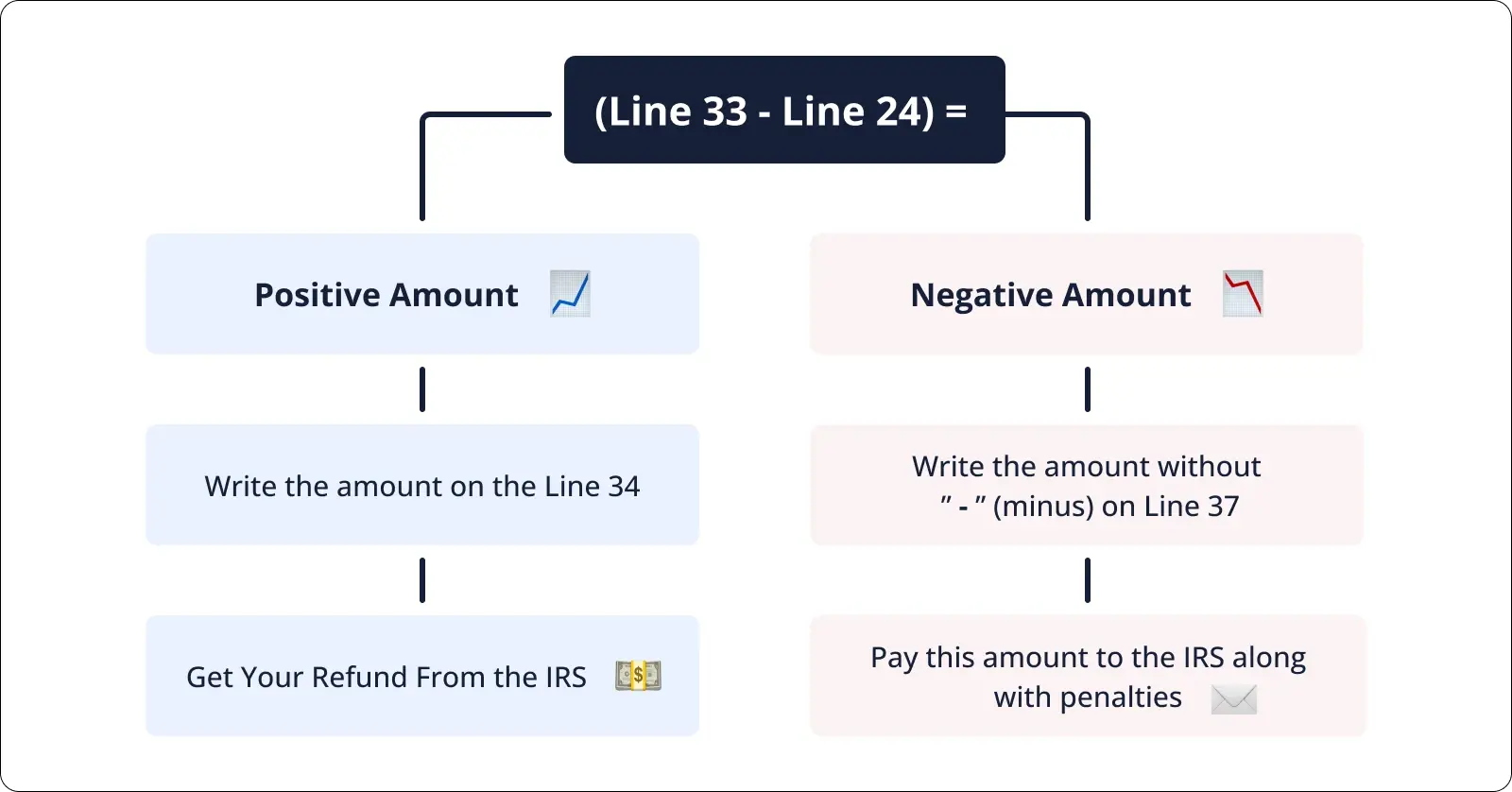

Subtract the total tax liability (Line 24) from total payments (Line 33) to determine whether you should get a refund or owe some taxes.

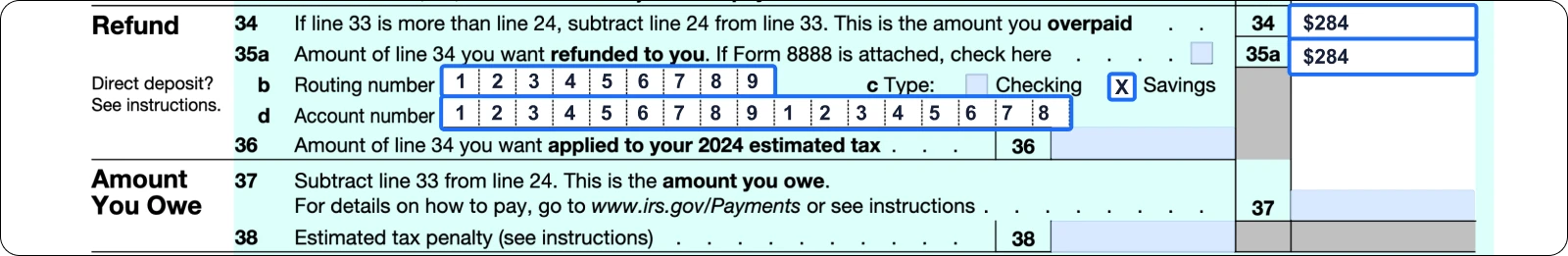

If you have an overpayment, congrats, you'll get your refund! Write that amount on Line 34 and specify whether you need the IRS to issue a refund or if you would like to apply this amount to the following return using Lines 35 and 36.

If the amount is negative, you owe something. Specify the amount on Line 37 and see the instructions to calculate the penalties you should pay and the taxes you owe. In case there are penalties, write the amount on Line 38. You will need to send a check for the amount of taxes you owe + the amount of penalties with your tax return.

In this example, Samantha gets a $284 refund and would like to receive it in her savings account, so we write the amount twice on Lines 34 and 35a and then specify her bank's routing number, accounting number, and the type of account.

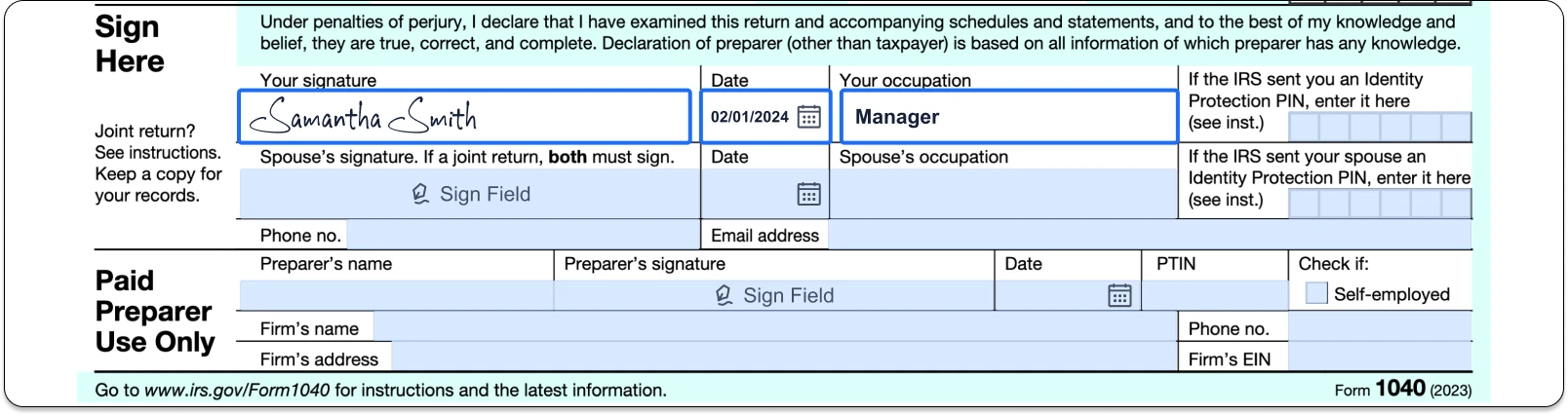

Step 11: Sign and download form

After completing all the necessary sections, review the form for accuracy. Sign and date the form once you are satisfied that everything is correct. If filing jointly, your spouse must also sign.

To sign 1040 with PDFLiner:

- click on the Sign Field,

- choose the signature method,

- create your signature.

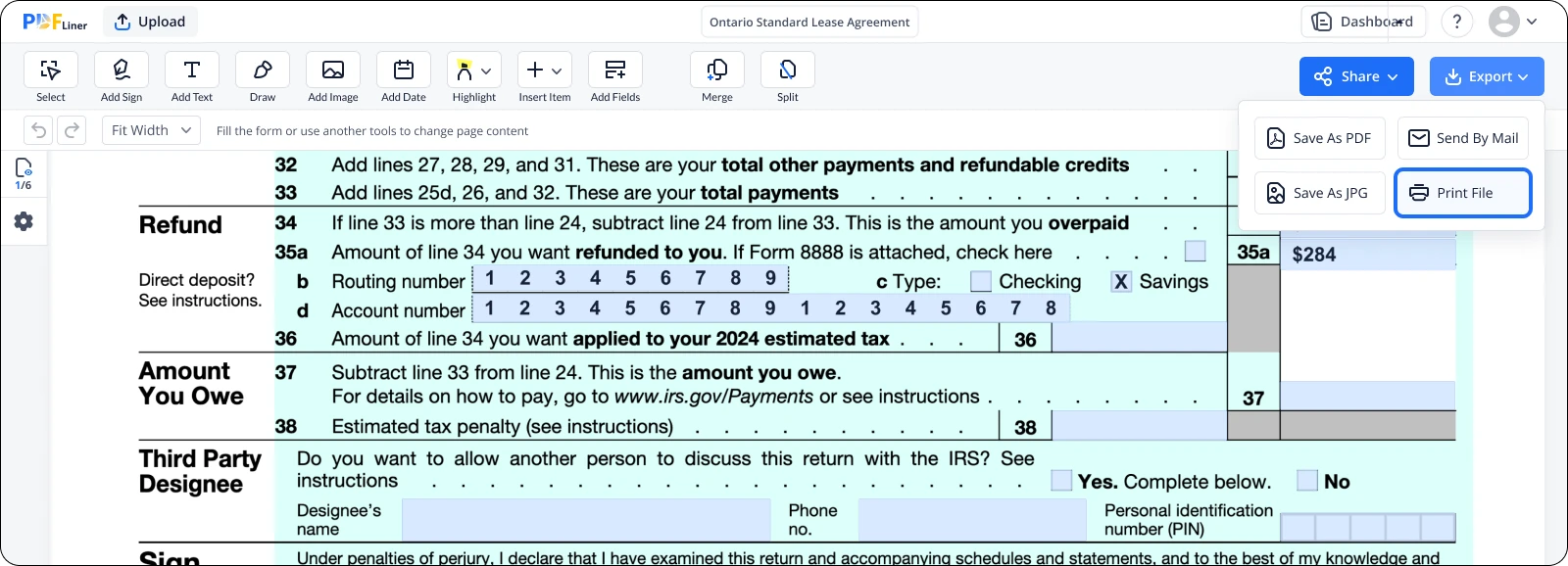

To download the 1040 form, click the Export button and choose one of the methods. You can either print the PDF, share it with your tax advisor to take a look, or download it as PDF.

Submitting the Form 1040

Congratulations! You got to the final point of your tax return. Now, you need to file the 1040 to the IRS before April 15, 2025. There are two ways to do that:

1. By Mail

Print your completed 1040 Form and all the other forms and schedules that need to be filed with it. Send all the paperwork to the IRS office address provided in their instructions. The address depends on your state and whether you need to attach a payment or not.

2. eFiling

If your gross income is $79,000 or less, you can use the IRS Free File tool to submit your tax return electronically. If your tax return is more complicated and your income is higher, you'll need to use an authorized provider or a tax advisor to file the return.

Table of contents

No Distractions, Just You and Form 1040

Put an end to procrastination with our easy-to-use platform. Focus on your 1040 today and get peace of mind tomorrow.

Ready to take tax season off your shoulders?