-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

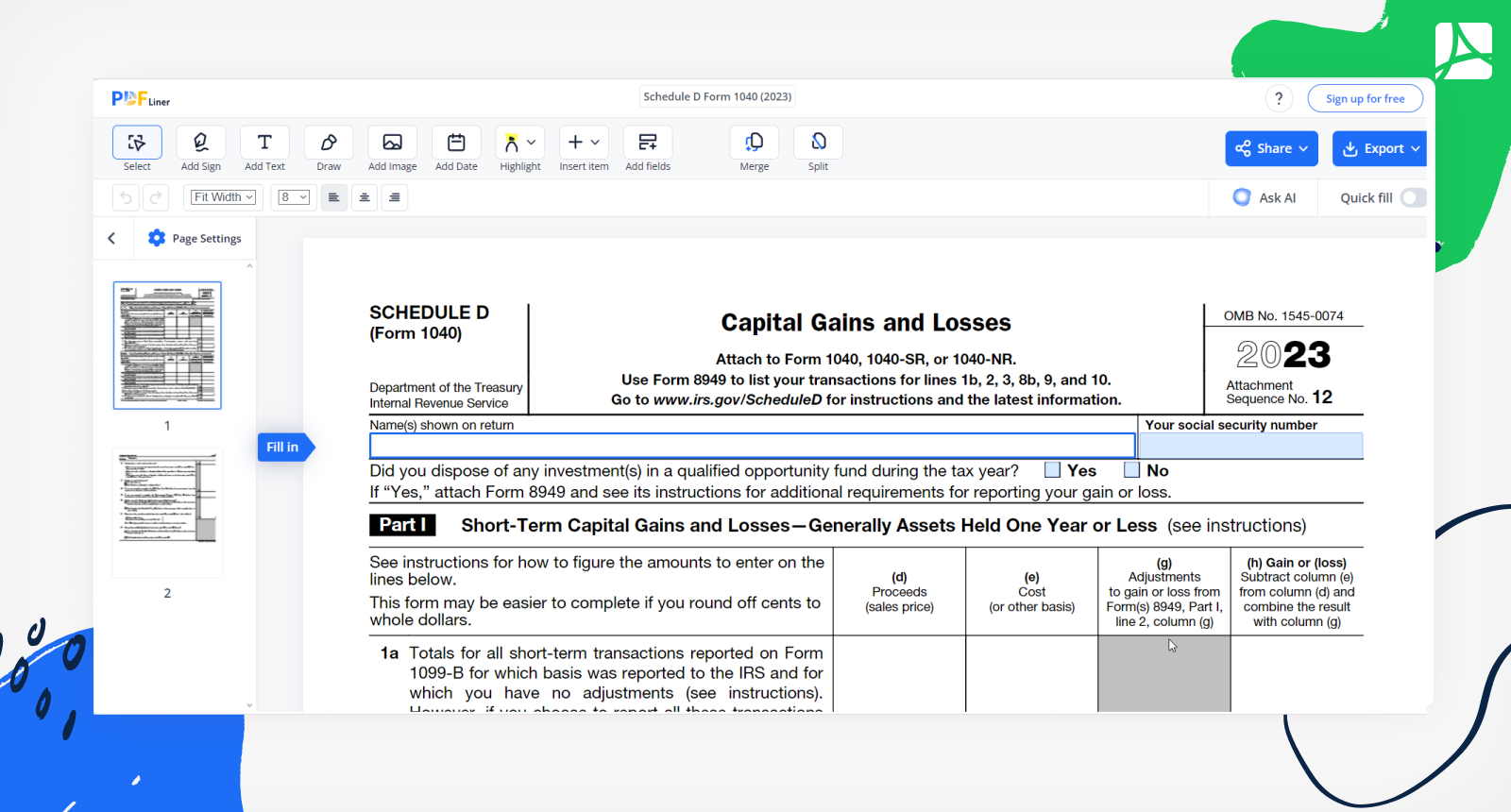

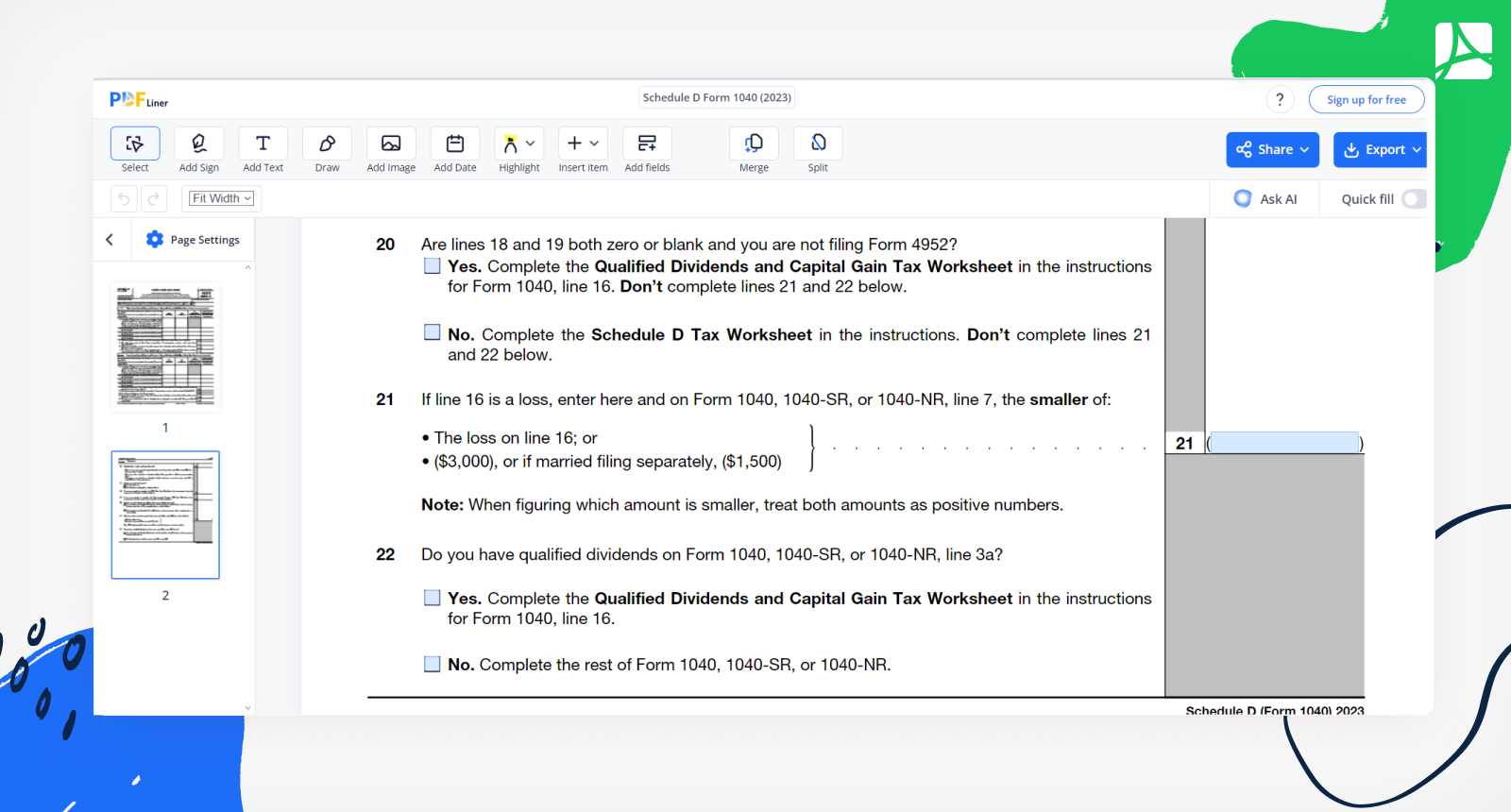

Schedule D Form 1040 (2023)

Get your Schedule D Form 1040 (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Schedule D 1040 Form

1040 Schedule D Form is a tax document individuals use to report capital gains and losses incurred from selling or exchanging certain assets during the tax year. Its primary purpose is to provide a detailed breakdown of these gains and losses, allowing taxpayers to calculate their net capital gain or loss. This information is crucial for accurately determining tax liabilities and complying with IRS regulations related to capital gains taxation.

What Are Capital Gains and Losses

Capital gains and losses refer to the financial outcomes resulting from selling or disposing of assets like stocks, real estate, or other investments. Here's a concise breakdown:

- Capital Gains. These occur when an asset's selling price exceeds its original purchase price, resulting in a profit.

- Capital Losses. These occur when the selling price is lower than the purchase price, leading to a financial loss.

- Net Capital Gain/Loss. Calculated by subtracting capital losses from capital gains, impacting tax liability.

How to Fill Out Schedule D Form 1040

Schedule D Form 1040 Capital Gains and Losses features two pages. The completion process should not evoke any questions or confusion. Follow these 15 steps to navigate it smoothly:

- Begin by finding the template of the tax form 1040 Schedule D in the PDFLiner database of free pre-designed forms.

- Gather your financial records, including purchase and sale information for assets such as stocks, real estate, or investments.

- Identify short-term and long-term capital gains and losses based on the holding period of each asset.

- Utilize the appropriate columns on the form to input the details of each transaction, including date, description, cost, and sale price.

- Calculate the gains or losses for each asset individually.

- Summarize the totals for both short-term and long-term gains and losses.

- Determine your net capital gain or loss by subtracting total losses from total gains.

- Apply any capital loss limitations or deductions as specified by IRS guidelines.

- Transfer the net capital gain or loss amount to your Form 1040.

- Ensure accuracy by double-checking all calculations and entries.

- If applicable, include additional supporting documents like brokerage statements or purchase/sale receipts.

- Sign and date the doc as required.

- Include the completed form with your overall Form 1040 tax return.

- Keep a copy of the filled-out form and associated documentation for your records.

- If filing electronically, follow the platform's instructions for submission. If filing by mail, ensure you include all necessary forms and documentation.

Taking these steps ensures the accurate reporting of your capital gains and losses, facilitating smooth tax preparation and compliance with IRS regulations.

Related to Schedule D Form 1040 Documents

Form Versions

2020

Schedule D Form 1040 for 2020 tax year

2021

Schedule D Form 1040 for 2021 tax year

2022

Schedule D Form 1040 for 2022 tax year

FAQ: IRS Schedule D Form 1040 Popular Questions

-

When must I file Schedule D?

It's essential to meet the IRS tax filing deadline, usually April 15th, unless an extension is granted.

-

What is capital gain distribution on Schedule D?

Capital gain distribution on the IRS 1040 form Schedule D refers to profits earned by mutual funds or real estate investment trusts (REITs). These gains, resulting from their sales of assets, are reported by fund managers to investors, who must then include them in their tax returns.

-

How to know if you need to file Schedule D?

You should file Federal Income Tax Form 1040 Schedule D if you've sold or exchanged assets like stocks, property, or investments during the tax year. Calculate your gains and losses; if they exceed IRS thresholds, you're required to report on Schedule D when filing your tax return.

Fillable online Schedule D Form 1040 (2023)