-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1120-F (2023)

Get your Form 1120-F (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 1120-F?

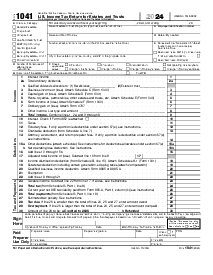

Form 1120-F, namely U.S. Income Tax Return of a Foreign Corporation, is a tax document used by foreign corporations to report their U.S. income, profits, losses, credits, and deductions. It also serves to assess their U.S. income tax liability in a way a domestic corporation would report their tax return.

What do I need the IRS Form 1120-F for?

- If you received income from some US-based source and didn’t entirely pay the tax on it;

- To make a shielding filing;

- For making treaty-related claims;

- To protect the foreign corporation’s rights to get credits and deductions;

- To report the foreign corporation’s U.S. income, losses, deductions, and credits;

- Your income is connected with an American trade or business.

Form 1120-F due date varies based on whether a foreign corporation has a place of business in the U.S. or not. If yes, the filing date for this fillable form is the 15th of March. Otherwise, the form must be filed by the 15th of June, but a 6-month extension is requested with Form 7004.

Organizations that work with Form 1120-F

- The IRS.

Related to Form 1120-F Documents

How to fill out Form 1120-F?

- Press a big, blue button on this page to get a tax blank and complete it online.

- There are 8 pages to fill out with the required information.

- The first page is related to the Computation of Tax Due or Overpayment.

- Pages 2 and 3 include yes-or-no boxes concerning the corporation’s income method.

- Section I is for income from U.S. sources not effectively connected with the conduct of business in the U.S. Section 2 is for those connected with it.

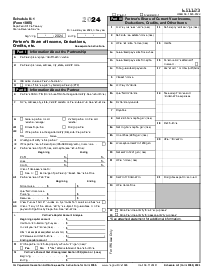

- Fill out the additional Schedules: С is for Dividends and Special Deductions, J — for Tax Computation, L — Balance Sheet per Books, W — for Overpayment Resulted From Tax Deducted and Withheld Under Chapters 3 and 4.

- Section III specifies Branch Profit Tax and Tax on Excess Interest.

- Click the red Done button to save the ready printable PDF file on your device.

Form Versions

2021

Fillable Form 1120-F for 2021 tax year

Fillable online Form 1120-F (2023)