-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

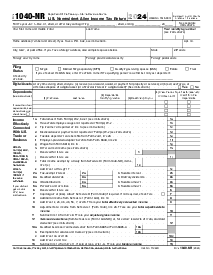

Form 1040-NR-EZ

Get your Form 1040-NR-EZ in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is 1040-NR or form 1040NR-EZ: Brief Outline

Wondering about the details of IRS form 1040 NR EZ? It’s a basic variation of the IRS tax return for foreigners (officially known as nonresident aliens). Now, let’s get the ‘alien’ term straight first. An ‘alien’ is an individual who’s outside the U.S. citizen or national category. A nonresident alien refers to a foreign national who hasn’t met either of the two tests: the Green Card test or Substantial Presence Test and, i.e. has not yet become a permanent resident.

Each U.S. resident must stick with form 1040, while foreigners must submit either form 1040NR or 1040NR-EZ. Thus, if you’re a foreigner and your U.S.-based earnings are generated from salary- or tip-based income, as well as scholarship and fellowship awards, and the like, you should stay with form 1040NR-EZ.

Bear in mind that the ‘EZ’ doc should not be your choice if you have dependents or qualify as a dependent on another filer’s federal income tax return. Read on to get to grips with filling out this form, as well as discover the distinctions between forms 1040NR and 1040NR-EZ. Or feel free to make the best of our portal to find a fillable PDF of the needed form to print it or complete it online.

How to Fill Out Form 1040NR-EZ: Tips & Hacks

Form 1040NR-EZ consists of two pages. On the first page, you’re going to need to indicate your personal details: your name, details on where you live, verification of your filing status, and extensive data about your earnings. The 2nd page is where you need to disclose your nationality, along with your residential and immigration details. Since form 1040NR-EZ is utilized solely by individuals with particular income kinds, it doesn’t require details about the U.S.-based business-related earnings.

Here are some practical tips on completing form 1040NR-EZ:

- maintain a laser-like focus when filling out the paper;

- read the whole doc before completing it;

- gather all the required information prior to completing the doc;

- include all the proper certification and signatures;

- download 1040 NR EZ form.

Remember when filing form 1040NR-EZ:

- keep a copy of it (you may need it for future reference);

- ask the post office for delivery confirmation;

- contact an expert if you have trouble sorting out the doc.

1040NR vs 1040NR-EZ: What is difference between 1040NR and 1040NR EZ?

Both docs 1040NR and 1040NR-EZ are for foreigners. The former consists of five pages and covers all types of income, while the latter is restricted to specific conditions. Basically, form 10NR-EZ is utilized if your sole income from the U.S. is generated from salaries, tip income, fellowship awards, and similar sources. For example, the majority of overseas students submit this form — because they are foreigners whose situation suits the criteria existing within the document.

Naturally, you should file this important doc strictly on time. Make sure you look up your state filing and payment deadline data, for it may differ from that of the federal. If you don’t manage to file form 1040NR-EZ (or opt for the wrong kind of document), you may end up facing some serious sanctions and penalties.

Therefore, if you come across any difficulties while filling out the form, seek professional help. To avoid the annoying paperwork, feel free to fill in form 1040NR-EZ via PDFLiner. We’re here to make your tax burden easier and less stressful.

IRS Form 1040NR-EZ Resources

https://www.irs.gov/forms-pubs/about-form-1040-nr-ez

Relevant to tax form 1040 NR EZ Documents

FAQ: IRS Form 1040 NR EZ Popular Questions

-

How do I file a non resident tax return?

Nonresident tax returns can be filed online or through the mail. To file online, visit the IRS website and select the “Nonresident Tax Returns” option. To file through the mail, download the necessary forms from the IRS website and send them to the appropriate address.

-

Who needs to file form 1040 NR EZ?

Form 1040NR-EZ is a tax form for certain nonresident aliens with no dependents who meet the criteria to file this form instead of Form 1040NR.

-

Where to file form 1040 NR EZ?

Form 1040 NR EZ is filed with the IRS. It can be sent by mail or e-filed.

Send the form to the following address:Internal Revenue Service

P.O. Box 1303

Fresno, CA 93715-1303 -

Where to send form 1040 NR EZ?

Form 1040 NR EZ should be sent to the address listed on the form.

Fillable online Form 1040-NR-EZ