-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1040-ES (2025)

Get your Form 1040-ES in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a 1040ES Form 2025 Payment Voucher? — Brief Outline

Form 1040-ES is targeted at freelancers, as well as individuals who work independently within their own businesses, for determining and paying estimated due-to-date taxes for the ongoing financial year. You can get a fillable 1040-ES here, fill it out, file it electronically, or print it easily.

Form 1040-ES vs. Form 1040: Assessing Nuances

If you’re wondering about the difference between Form 1040 and IRS 1040ES, these two docs don’t exclude one another. While Form 1040 aims to report your yearly income tax, blank 1040-ES is used to record quarterly profit and to pay estimated taxes.

By breaking your yearly income tax into quarterly installments, the government focuses on the amount of quarter revenue tax you’ve paid throughout the year. That allows effectively keeping tabs on this stuff as well. Below, we will briefly guide you through the process of completing form 1040-ES.

Estimated Tax Payouts Explained

There are categories of taxpayers whose profit is not formed, so tax payouts are withheld at the source. Independently operating entrepreneurs, freelance workers, for instance, do not have tax withheld from their received payments.

Income from rent payments, various retirement programs, stock sales, dividends, and similar forms of revenue are also not taxed at the source. If your earnings come within the above-mentioned or similar situations, sorting out estimated tax is among your obligations.

Estimated tax payment includes a calculation of your earnings for the ongoing year. Keep in mind, if you underestimate this payment, it will lead to an underpayment, which, in its turn, shall leave you with a penalty. To avert any penalties of this kind, report your current year’s earnings based on your taxes of the previous year.

If you render 100% of the previous year’s tax, you won’t have to pay the penalty. If you overpay, you’re free to apply for a tax refund at the end of the year. Last but not least here: always pay your quarterly tax on time, otherwise you’re going to face more penalties.

When are Estimated Taxes Due

The federal tax payment estimated is the tax payment you expect to owe for the current year. It is generally payable in four equal installments, on April 15, June 15, September 15, and January 15 of the following year. If the due date for any installment falls on a Saturday, Sunday, or legal holiday, the next business day is the due date.

Tips and Warnings for IRS Form 1040-ES Estimated Tax for Individuals

- You may be penal if you do not pay your estimated tax by the due date.

- If you do not pay enough tax through withholding and estimated tax payments, you may be penalized even if you are due a refund when you file your return.

- You may be able to avoid or lower the penalty if you can show that the underpayment was due to circumstances beyond your control.

- If you are subject to the penalty, you will be notified by the IRS.

- You can make estimated tax payments using the Electronic Federal Tax Payment System (EFTPS).

- Estimated tax payments are generally not required for taxpayers with no tax liability for the previous year. However, taxpayers with a tax liability for the previous year who do not pay enough tax through withholding or make estimated tax payments may be subject to the penalty.

- Additional information about estimated tax can be found in Publication 505, Tax Withholding and Estimated Tax.

IRS Form 1040ES Resources

- Download 1040-ES blank

- 1040-ES Instructions from IRS

- Getting Blank 1040-ES

- Filling out Document 1040-ES

- 1040 NR tax form

How to Fill Out 1040ES Form in 2025? Step-by-step Guide:

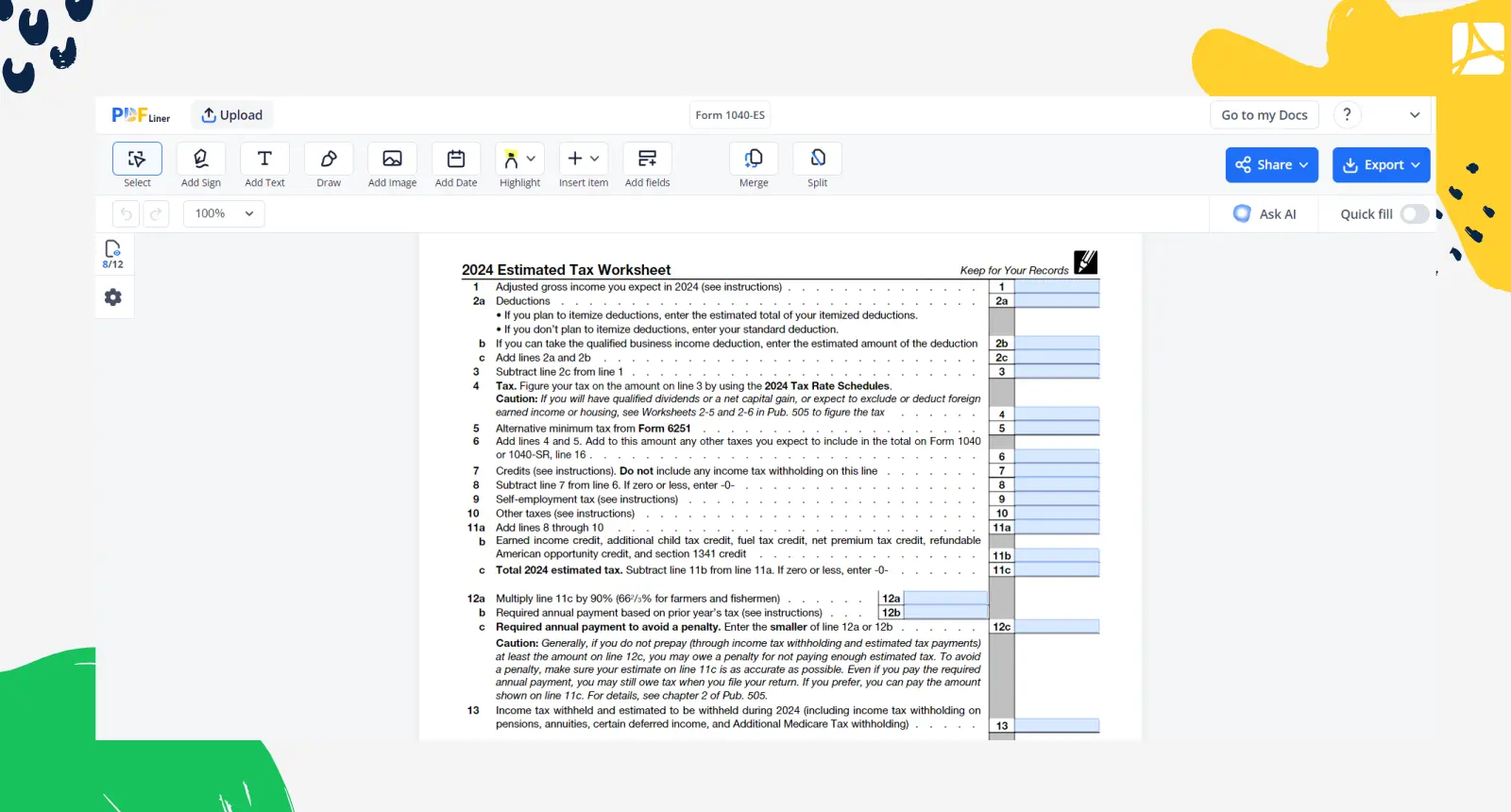

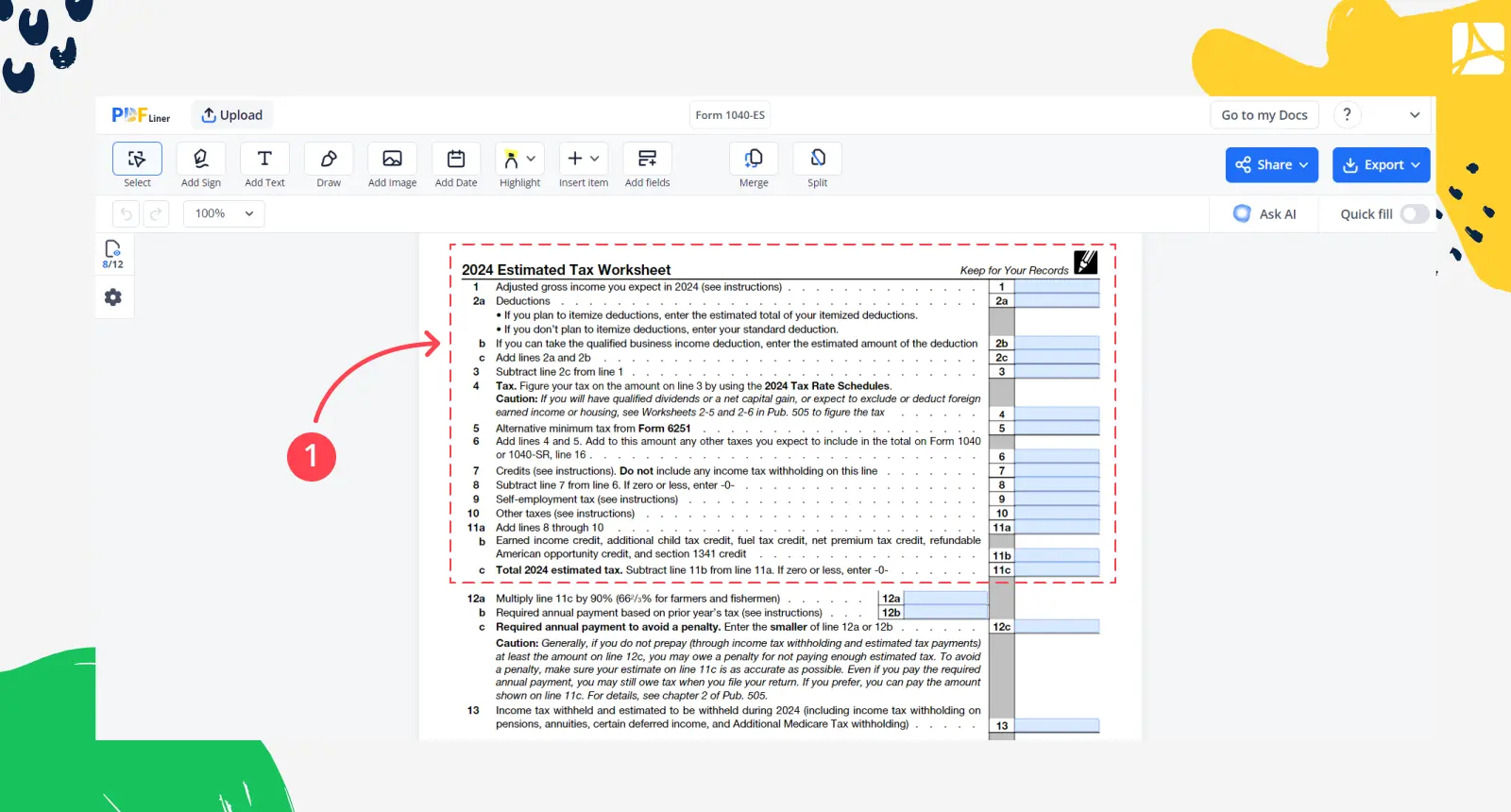

Step 1: Calculate your total estimated tax liability for the current year using the worksheet.

Step 2: Subtract any estimated tax payments you have already made from your total estimated tax liability.

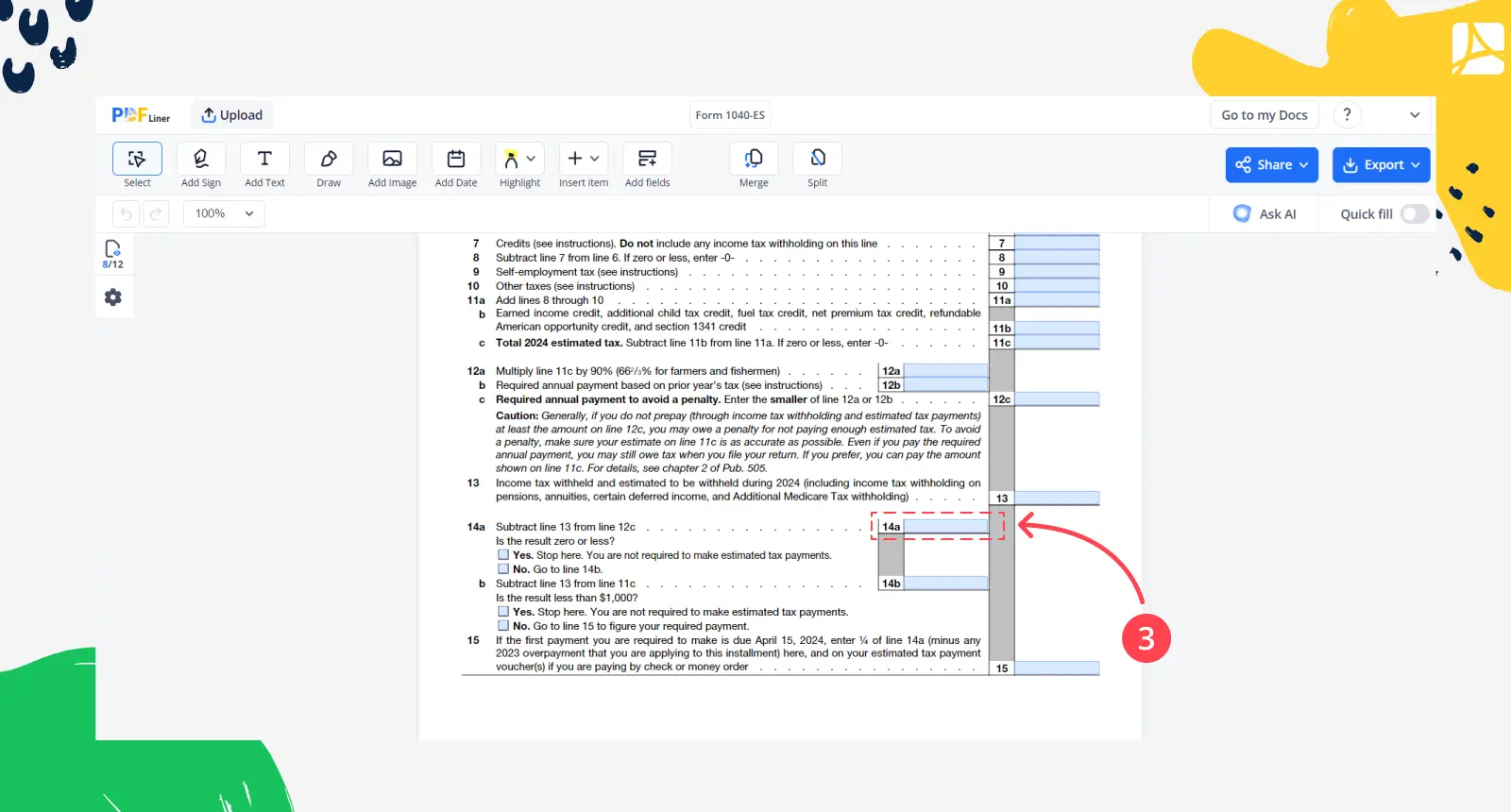

Step 3: Enter the amount of your remaining balance due on the line of line 14a of the form.

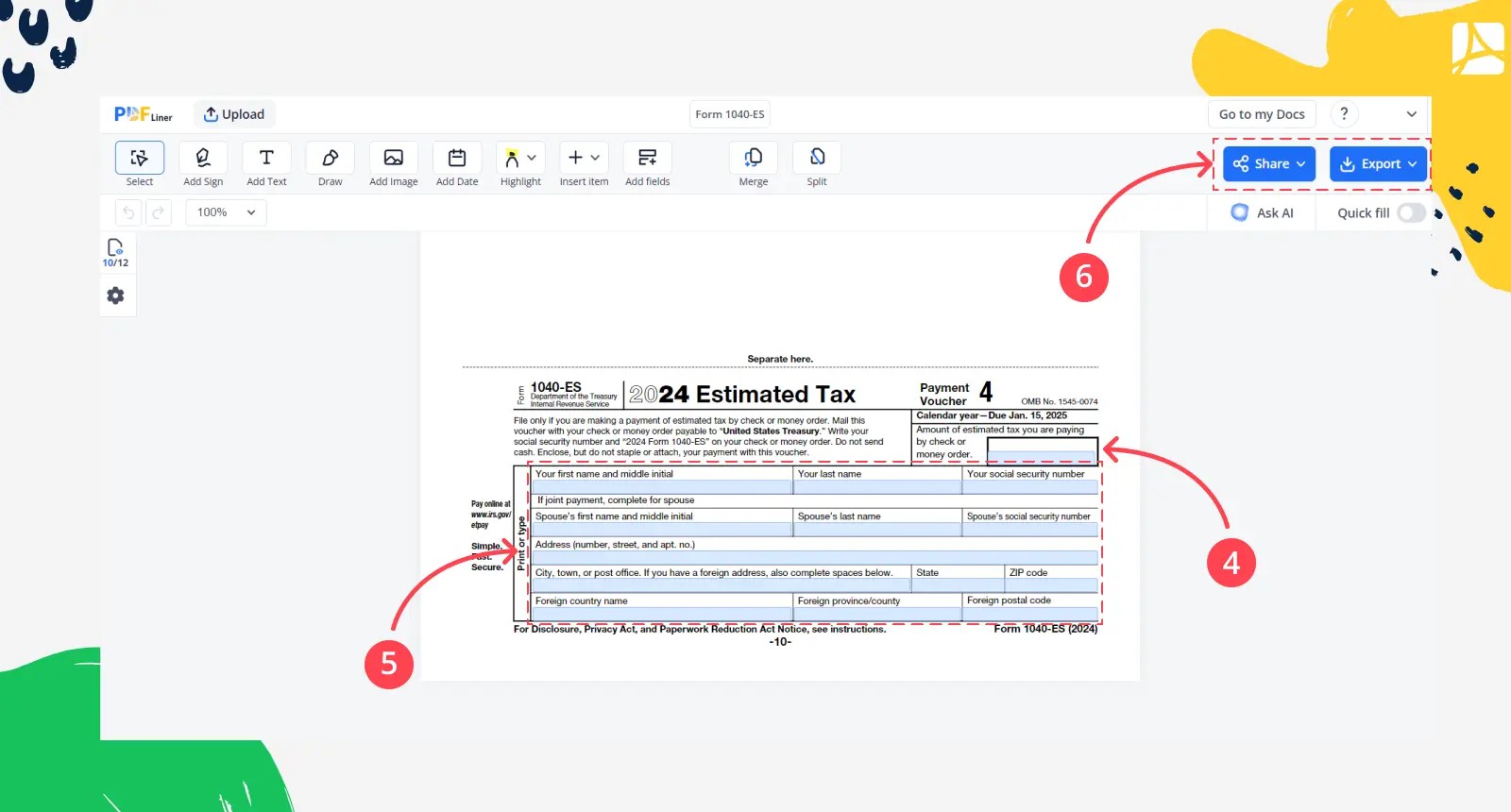

Step 4: You would need to pay ¼ of line 14a minus any 2025 overpayment, so calculate the amount and enter it into the relevant 1040-ES Payment Voucher.

Step 5: Write your personal information: name, address, and Social Security number.

Step 6: Click the Export button to save PDF and print the payment voucher if you are paying with a check or money order.

Step 7: Mail the completed voucher and any payment due to the IRS.

Step 8: Go to "My documents" and open the previously filled form.

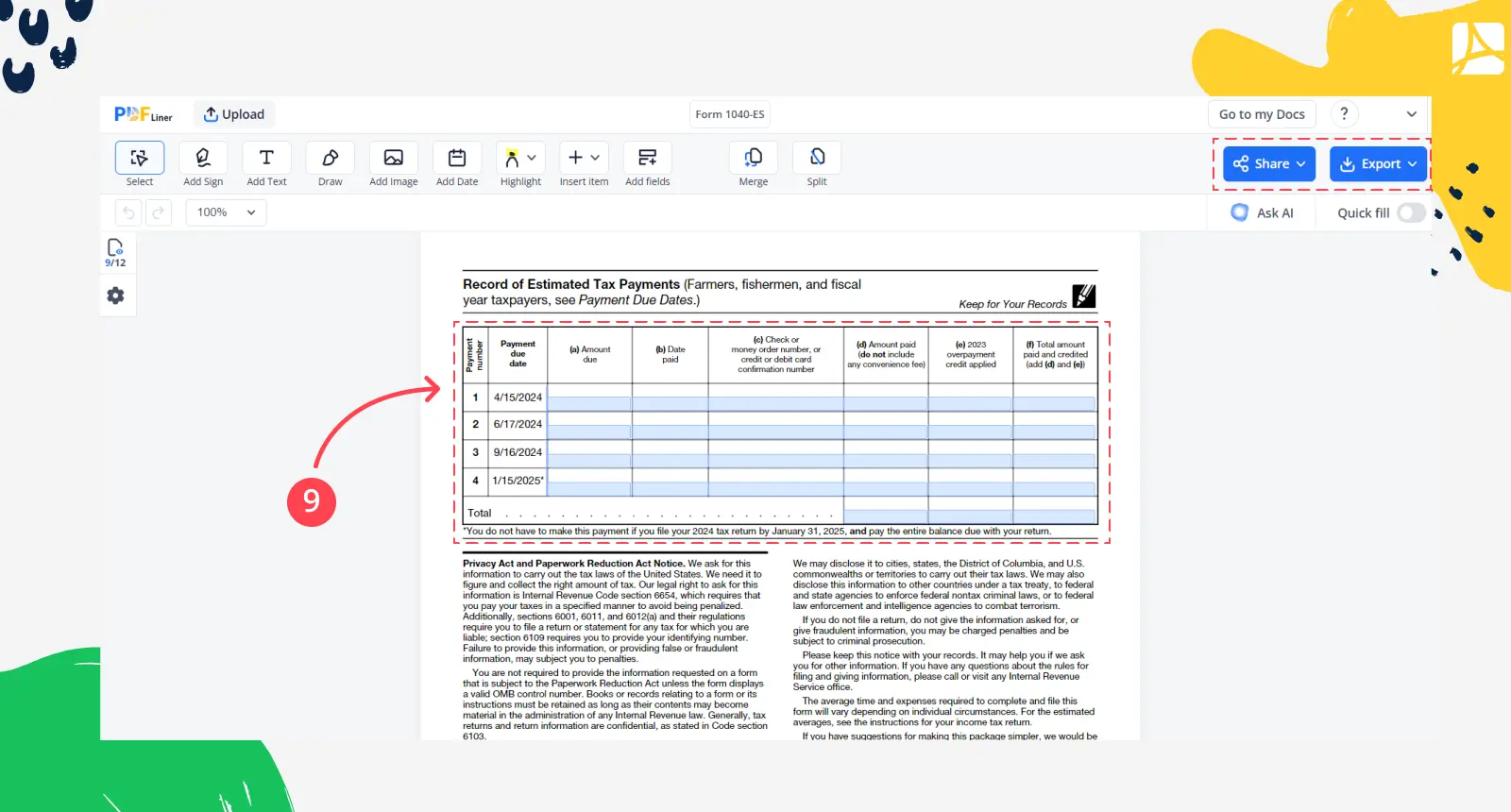

Step 9: Enter the amount, date of the payment, payment method number into the Record of Estimated Tax Payments spreadsheet.

Form Versions

FAQ: Fillable Form 1040-ES Popular Questions

-

When is a 1040-ES deadline?

You should file estimated tax payments four times during the taxation year. Usually, taxpayers who pay during a calendar year must file this form due on April 15, June 15, September 15, January 15 of the following annum. This is a widespread practice for most individuals. Yet, if you work according to a fiscal year calendar, dates might change.

-

How to get a printable Payment Voucher?

There is an opportunity to get Form 1040 ES in two ways. You may either search this document on IRS official website or open it on PDFLiner, which is easier. The document is already prepared to be filled online and does not require any downloading on your computer.

-

What is the 1040-ES form for?

1040-ES was created by IRS for taxpayers. It allows calculating taxes for the current year and making sure you neither overpay nor underpay anything. File 1040 relates to the last year as well, and estimated tax form allows calculating the current year’s taxes. You can use the blank for income and self-employment taxes.

-

Do I need to file 1040-ES?

You must file Form 1040 ES in case you expect having $1000 or more in taxes, and credits and deductions were calculated. You must also have withholding or credits less than the number calculated, which is $600 in this example, or anything under $1000.

-

Where to mail Form 1040-ES?

There is a list of addresses in the form for residents of the US or foreign countries. You should use the most appropriate one. Make sure you fill out this year’s form since addresses might change. For foreign countries, the address is IRS P.O. Box 1303 Charlotte, NC 28201-1303, for local ones, it depends on the state you live in.

-

What is line 13a c on form 1040-ES?

There is no line 13a or c. Line 13 in Form 1040 ES is for income tax withheld or estimated to be held during the year. You have to include the tax withholding on annuities, pensions, or deferred income. In line 14a, you should use the data from the 13th string, subtracting it from the 12c.

-

Who should file IRS 1040ES form?

Individual taxpayers who expect to owe $1,000 or more in taxes for the year should file IRS Form 1040-ES. This includes sole proprietors, single-member LLCs, and anyone who expects to owe self-employment tax.

-

When to use IRS Form 1040-ES?

Use IRS Form 1040ES fillable version to figure and pay your estimated tax for the current tax year if you expect to owe tax of $1,000 or more when you file your return.

-

Can IRS form for estimated tax payment be avoided?

Yes, estimated tax payments can be avoided if the taxpayer meets certain requirements. These requirements include having a valid Social Security number, filing a joint return, and having a certain amount of income.

Fillable online Form 1040-ES