-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1040-ES (2021)

Get your Form 1040-ES (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1040 ES 2021?

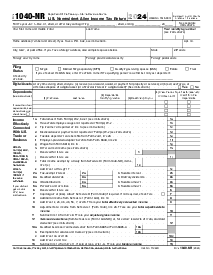

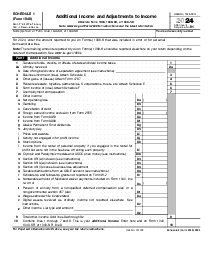

Form 1040-ES, also known as the Estimated Tax for Individuals, is a form taxpayers use to pay estimated taxes to the IRS on income that is not subject to withholding. This could include income from self-employment, dividends, rent, or other sources. The form helps you calculate and pay estimated taxes every quarter to avoid underpayment penalties.

Importance of estimated tax payments

The 2021 Form 1040 ES is an important document for anyone who earns income that does not have taxes automatically withheld. This may apply to self-employed individuals, investors, or those with significant income from sources like rental properties. The Internal Revenue Service (IRS) requires that taxes on income be paid as you earn or receive it throughout the year, and estimated taxes serve to meet this requirement.

How to Fill Out 1040 ES Form 2021

Filling out the 2021 IRS 1040 ES form accurately is vital to prevent underpaying or overpaying. Properly completed, this form can help to distribute your tax payments evenly throughout the year and avoid a large tax bill when filing your annual return:

- Begin by providing your name and Social Security Number (SSN) in the appropriate fields at the top of the form.

- If you have a joint filing, include your spouse's name and SSN in the designated areas next to your information.

- Enter your address details, including street, city, state, and zip code in the respective fields following your name and SSN.

- Move to the estimated tax worksheet associated with the 1040-ES form, starting with your expected adjusted gross income for the year 2021, and record this in the first line of the worksheet.

- Subsequently input your deductions, detailing each figure where required, to calculate the taxable income estimate, which you will document later in the worksheet.

- Calculate your estimated total tax liability for 2021, including income tax, self-employment tax, and any other taxes, and transcribe this sum into the corresponding line.

- If you expect credits, such as the child tax credit or the earned income credit, subtract these from your estimated tax liability and record the result.

- Determine the smaller of 90% of your current year's expected tax liability or 100% of your prior year's tax liability, and note this on the appropriate line to establish your required annual payment to avoid penalties.

- Enter the total of any estimated federal income tax payments you've already made for the tax year, including any overpayments from the previous year that you've applied to this year's taxes.

- Subtract the total payments made from your required annual payment calculated earlier to ascertain the balance due or the refund expected.

- Decide how you would like to pay or receive payments, whether it's through check, money order, or direct debit or deposit, and provide your bank routing and account numbers if necessary in the designated areas.

Digital convenience with PDFliner

In our digitized age, managing tax forms electronically provides unmatched convenience and efficiency. With PDFliner, accessing and completing the IRS form 1040 ES 2021 is a streamlined process. This platform allows users to fill, edit, e-sign, and print IRS tax templates directly from their devices, eliminating the need for paper copies and manual submissions. This digital tool is especially useful for taxpayers who prefer to manage their tax submissions online or looking for a more eco-friendly solution.

Fillable online Form 1040-ES (2021)