-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1099 K (2024)

Get your Form 1099-K (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment transaction you have to provide to the IRS to make your voluntary tax compliance advanced.

What do I need the Form 1099-K 2026 for?

The fillable 1099-K form is provided by officials in case you:

- Received the payments from the payment cards, including debit, stored-value cards, or credit cards;

- Third-party transactions to your cards that are above the minimum threshold, which is $20 000 and more for the gross payments;

- You have to file the form if you have more than 200 transactions from third parties that exceed $20 000. Pay attention that there is no such threshold for transactions from payment cards.

This form is not that complicated; however, it requires total accuracy with the numbers. You might want to read 1099-K instructions in advance. The printable form is available on PDFLiner. You don’t have to download it and can complete it online. Follow the next steps:

How to File a 1099 K Form in 2024?

The 1099 k form contains 5 copies that should be filed with the different recipients:

File Copy A with the IRS using Form 1096. You can fill out this form at PDFLiner, print it and mail to the IRS.

1. For states Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, and Virginia send the form to the following address:

Internal Revenue Service

Austin Submission Processing Center

P.O. Box 149213

Austin, TX 78714

2. If your business is registered in Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, or Wyoming mail it to:

Department of the Treasury

Internal Revenue Service Center

P.O. Box 219256

Kansas City, MO 64121-9256

3. For California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, or West Virginia the form should be sent to:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201

Copy 1 is usually used in cases when your state tax department requires from you to send them a paper copy of this form. In this case, mail this copy to your state tax department office.

Send Copy B of the Form 1099 K to the payee, so they can use it to file a tax return.

Copy 2 is also for recipients. They will use it to file a state tax return.

Copy C should stay with you for a record.

Where to Report Form 1099 K on Tax Return?

1. For self-employed or an independent contractors:

Report the 1099-K income on Schedule C of form 1040. Just enter your form 1099 K IRS gross income on Line 1 of Schedule C. If you have more 1099s, you need to sum them up and report the total amount of money you earned from all sources of income, including checks and cash.

2. For partnerships, corporations or an S corporations:

Report the 1099 K form income on line 1a of your form 1065, 1120 or 1120-S. And again if you have more than one form 1099 add all the income that's reported on them and show this amount on line 1a.

Organizations That Work with Form 1099-K

- The IRS;

- State Tax Department.

IRS Form 1099-K 2026 Resources

- Download blank 1099-K

- Instructions for the Requester of Form 1099-K

- What is a 1099-K

- How to file 1099-K form

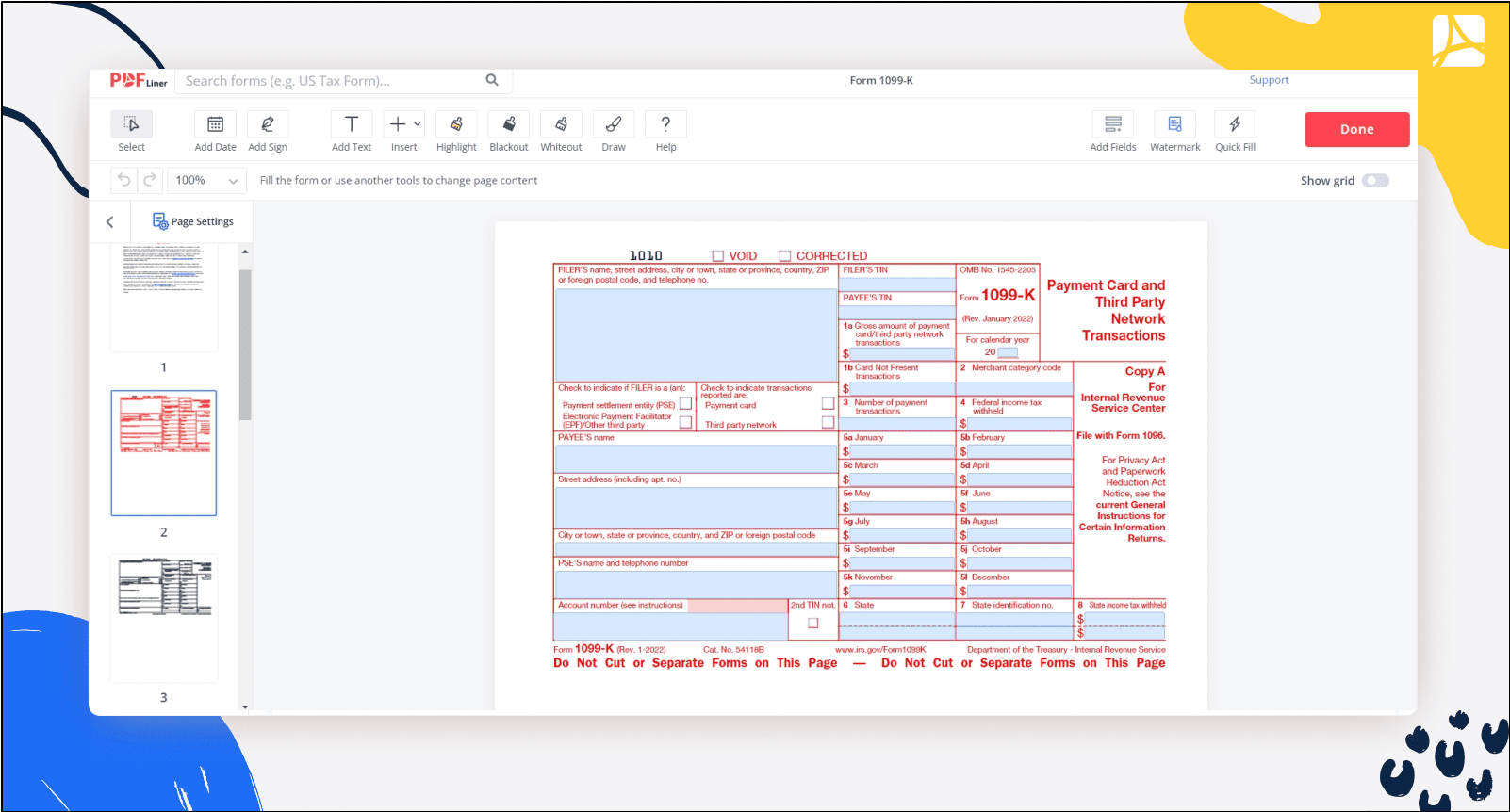

How to Fill Out Form 1099-K in 2024?

Step 1: Click the "Fill Out Form" button above.

Step 2: Provide the information on the filer, including their name, address, and TIN.

Step 3: Provide the payee’s TIN.

Step 4: Write the gross amount of the payment card, card that is not present in the transaction, and category code of the merchant.

Step 5: Put the number of the payment transaction and federal income tax amount withheld;

Step 6: Pick the right statement and put the tick in the appropriate box.

Step 7: Write down the name and address of the payee.

Step 8: Provide information on the tax withheld by each month.

Step 9: Write down the account number and PSE’s name.

Step 10: Click the "Done" button in the right upper corner to save your document.

FAQ: Form 1099-K (2024) Popular Questions

-

How to get a 1099-K form?

You can get a printable 1099-K form here, at PDFLiner, or you can search for it on the official IRS website.

-

Where to report a 1099-K?

You should report the total amount of all your 1099 forms on line 1 of Schedule C (Form 1040). The 1099-K is also should be reported on forms 1065, 1120 and 1120-S.

-

How to file a 1099-K?

You don't have to file a 1099-K form to the IRS. You would need to report your gross income on line 1 of Schedule C.

-

How to print a 1099-K?

In order to print 1099-K, follow these simple steps:

- Open the fillable 1099-K at PDFLiner.

- Fill out the form.

- Click the "Done" button.

- Pick the "Print" option.

- Choose a printer that you would like to use.

- Click the "Print" button.

Fillable online Form 1099-K (2024)