-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1099-OID (2024)

Get your Form 1099-OID (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

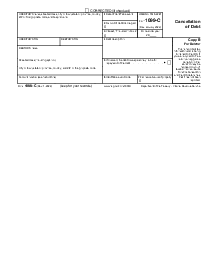

What Is OID Form 1099?

It’s an IRS tax document utilized for reporting OID taxes on specific debt instruments. A debt instrument is an asset that people or entities use for raising money or generating investment income. The holder of bonds, certificates of deposits, and similar debt instruments issued at a less value compared to their actual redemption price at maturity submits this form to the Internal Revenue Service. Keep reading for details about the purpose of the 1099 OID form PDF, the entities that use the document, as well as its completion instructions.

What I Need 1099 OID Form For?

Interested in pinpointing the purpose of this form? It’s pretty simple: as a holder of certain debt instruments, you need the form 1099-OID to report OID taxes. Now, that’s where a solid digital document editing service like PDFLiner may come in handy. With the help of an online file management platform, you are sure to boost your overall productivity at work and get the chance to focus on what really matters: bringing the income in.

How to Fill Out Form 1099 OID?

The document features two pages, with the second being fillable. Here are the must-indicate points of the file:

-

Payer’s name and contacts.

-

Original discount for the year.

-

Payer’s TIN and recipient’s TIN.

-

Recipient ID info.

-

Early withdrawal penalty.

-

Federal income tax withheld.

-

Market discount.

-

Acquisition premium.

-

Investment expenses.

-

Bond premium.

Now that you’ve discovered our platform, you’re probably on your way to digitizing your administrative affairs. That’s great. You’re welcome to fill out the IRS 1099 OID form online via PDFLiner. It’s fast, easy, and effective. Furthermore, it saves you from errors and allows you to adjust the document the way you prefer.

Organizations That Work With the 1099 OID Forms

-

IRS.

Form Versions

2019

Form 1099-OID (2019)

Fillable online Form 1099-OID (2024)