-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Information returns

-

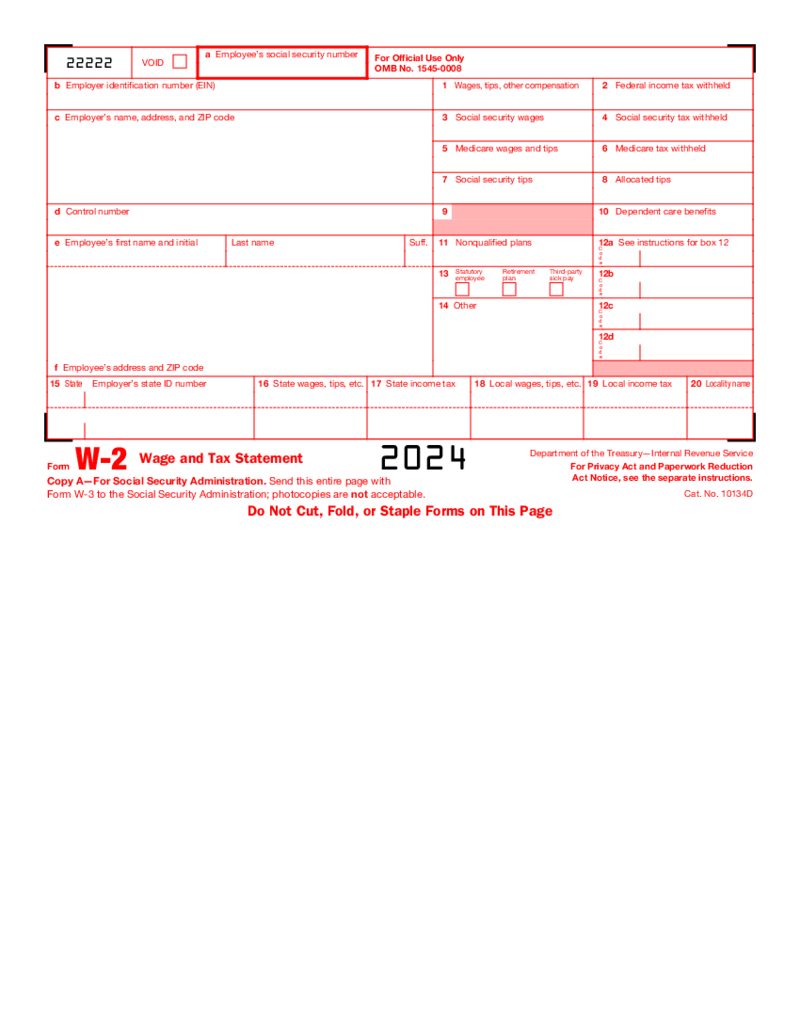

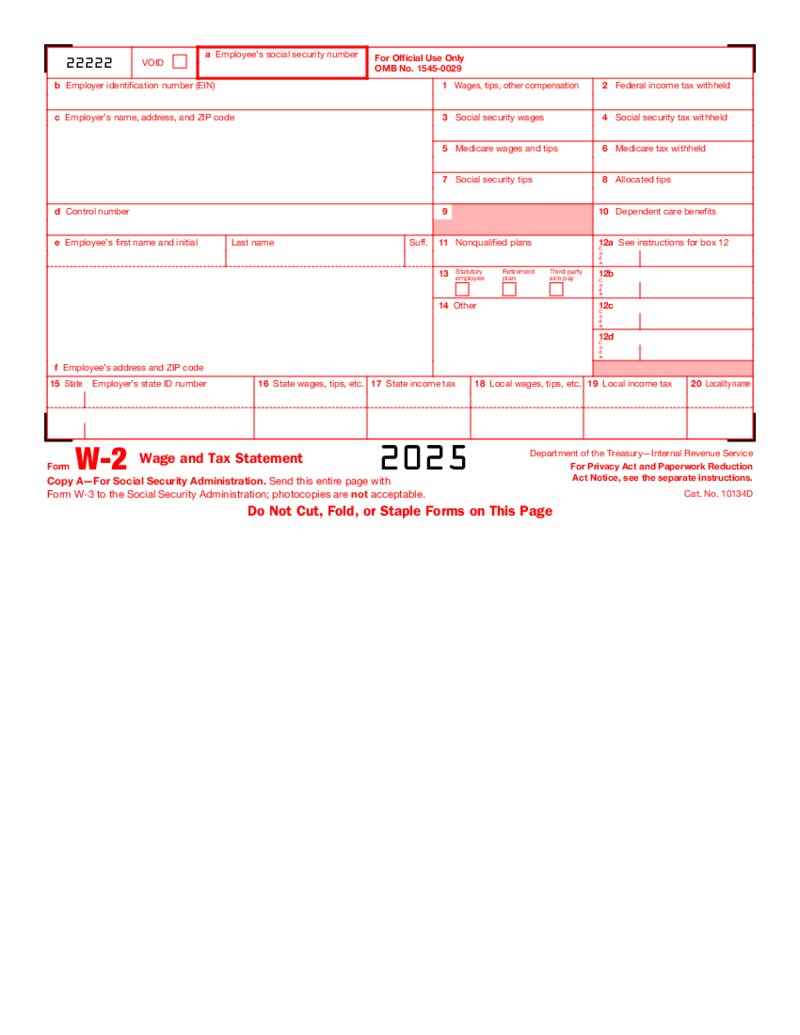

W-2 Form 2025

How to Fill Out a W-2 Form PDF

The printable W2 form (also known as Wage and Tax Statement) provides the correct sum paid to the employee and the taxes withheld from their paychecks during the year. Every employer should fill out this form by the end of t

W-2 Form 2025

How to Fill Out a W-2 Form PDF

The printable W2 form (also known as Wage and Tax Statement) provides the correct sum paid to the employee and the taxes withheld from their paychecks during the year. Every employer should fill out this form by the end of t

-

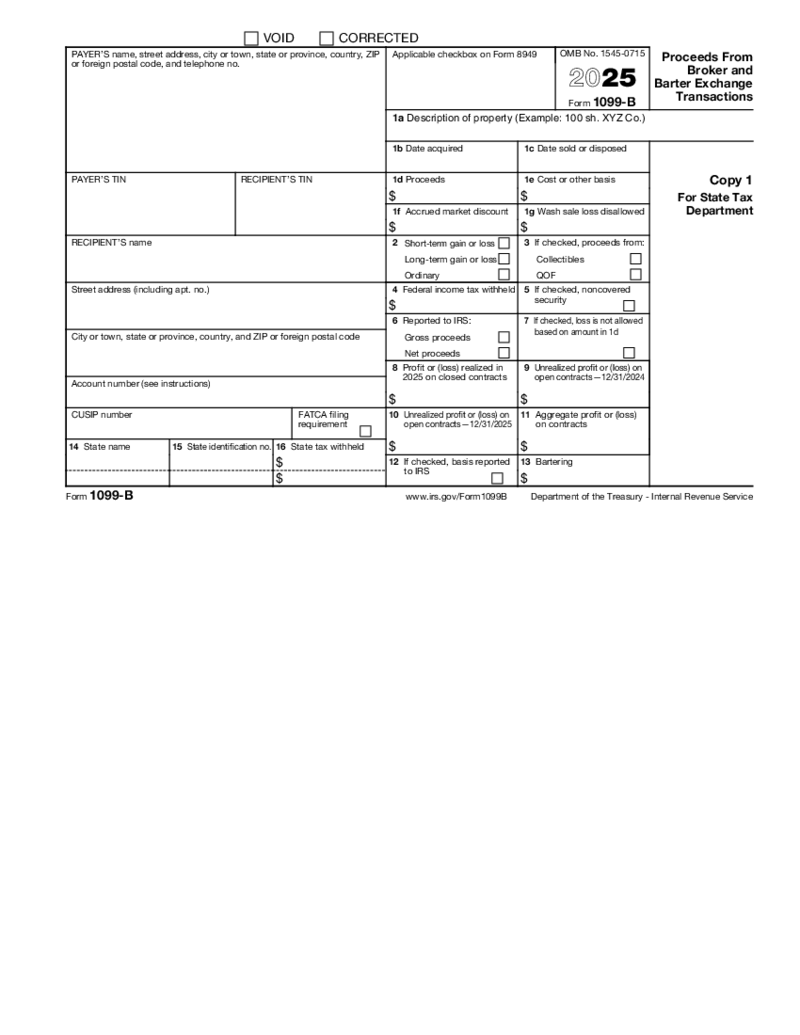

Form 1099-B (2025)

What Is Form 1099-B (2026)?

Form 1099-B, or Proceeds from Broker and Barter Exchange, is a document used by brokers or barter exchanges to record clients’ profits and losses throughout a tax year. Taxpayers use the data from IRS Form 1099-B to calcu

Form 1099-B (2025)

What Is Form 1099-B (2026)?

Form 1099-B, or Proceeds from Broker and Barter Exchange, is a document used by brokers or barter exchanges to record clients’ profits and losses throughout a tax year. Taxpayers use the data from IRS Form 1099-B to calcu

-

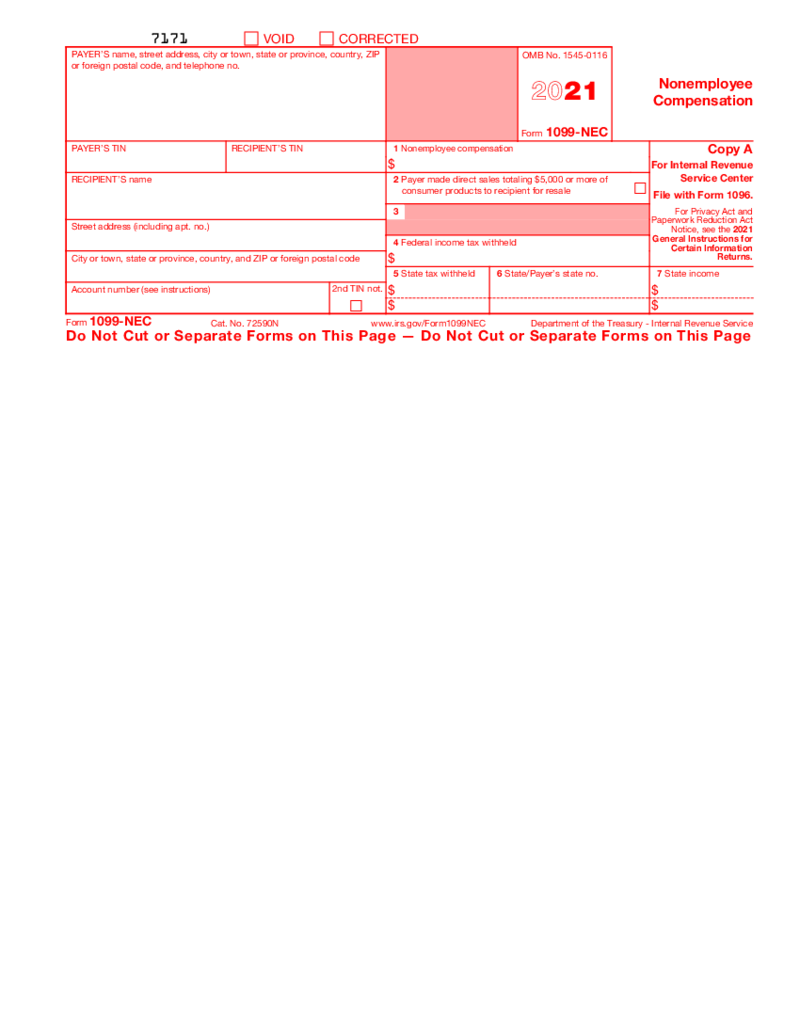

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

-

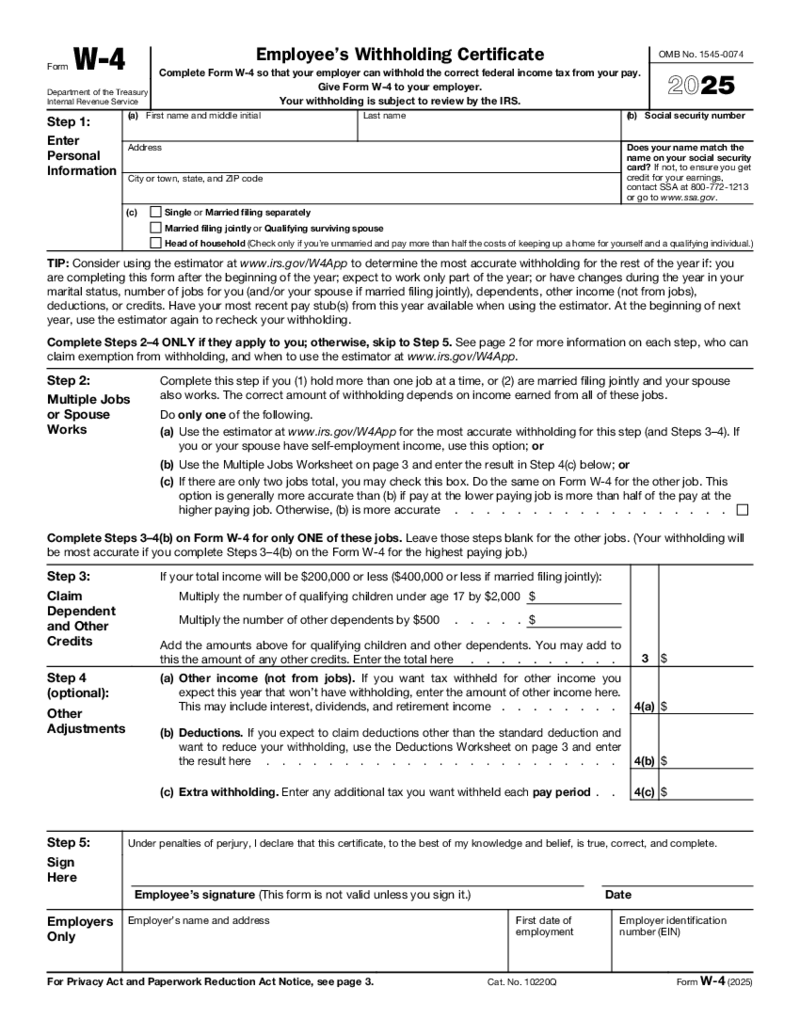

Form W-4 (2025)

What Is a W-4 Form 2025

The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxe

Form W-4 (2025)

What Is a W-4 Form 2025

The fillable W4 form, formally known as Employee's Withholding Allowance Certificate, is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal income taxe

-

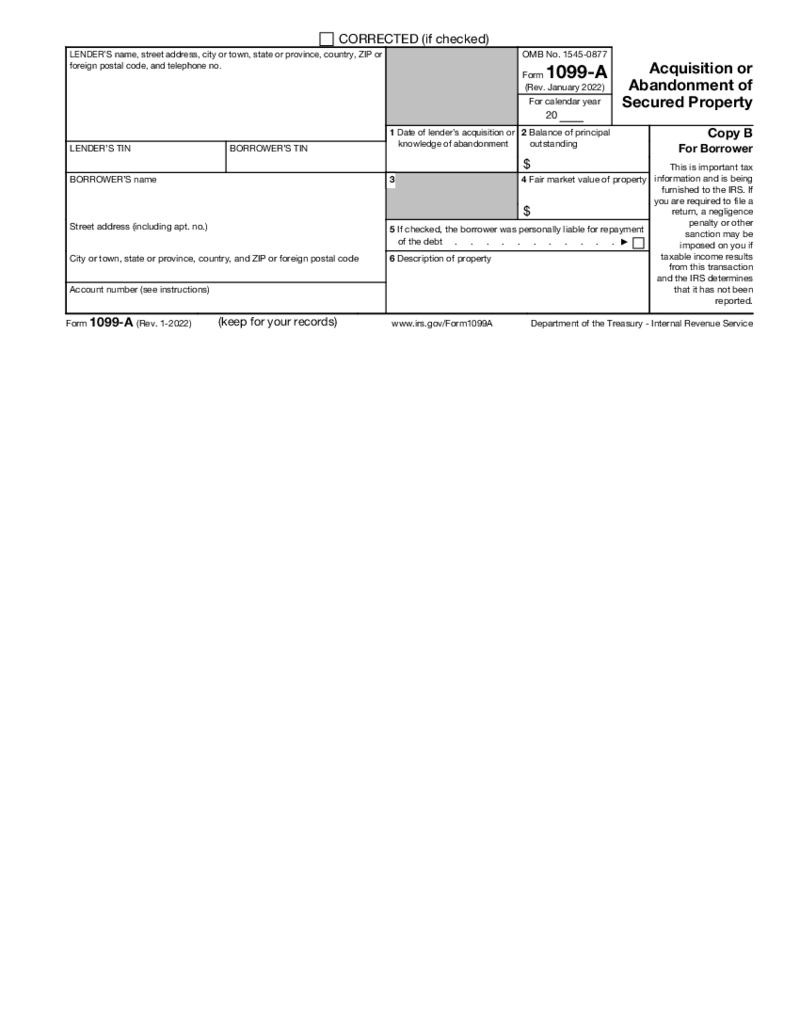

Form 1099-A (2022)

What Is Form 1099-A?

Form 1099-A is the acquisition or abandonment of secured property definition, which is needed to inform about various transactions not related to wages. Form 1099-A is commonly applied when an estate has been transferred because of fo

Form 1099-A (2022)

What Is Form 1099-A?

Form 1099-A is the acquisition or abandonment of secured property definition, which is needed to inform about various transactions not related to wages. Form 1099-A is commonly applied when an estate has been transferred because of fo

-

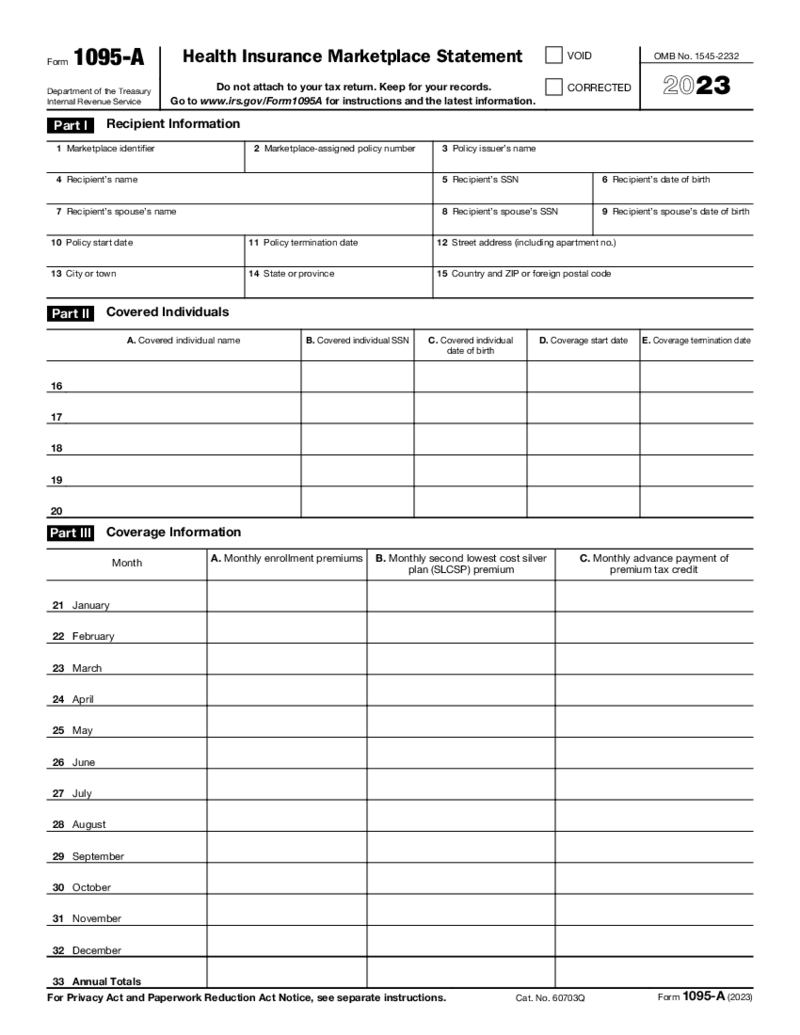

Form 1095-A

What is Form 1095-A 2023 - 2024?

Form 1095-A is the form for declaring the cost of health insurance and federal subsidy you receive. This subsidy or Premium Tax Credit (PTC) is necessary to make the cost of healthcare cheaper.

Form 1095-A

What is Form 1095-A 2023 - 2024?

Form 1095-A is the form for declaring the cost of health insurance and federal subsidy you receive. This subsidy or Premium Tax Credit (PTC) is necessary to make the cost of healthcare cheaper.

-

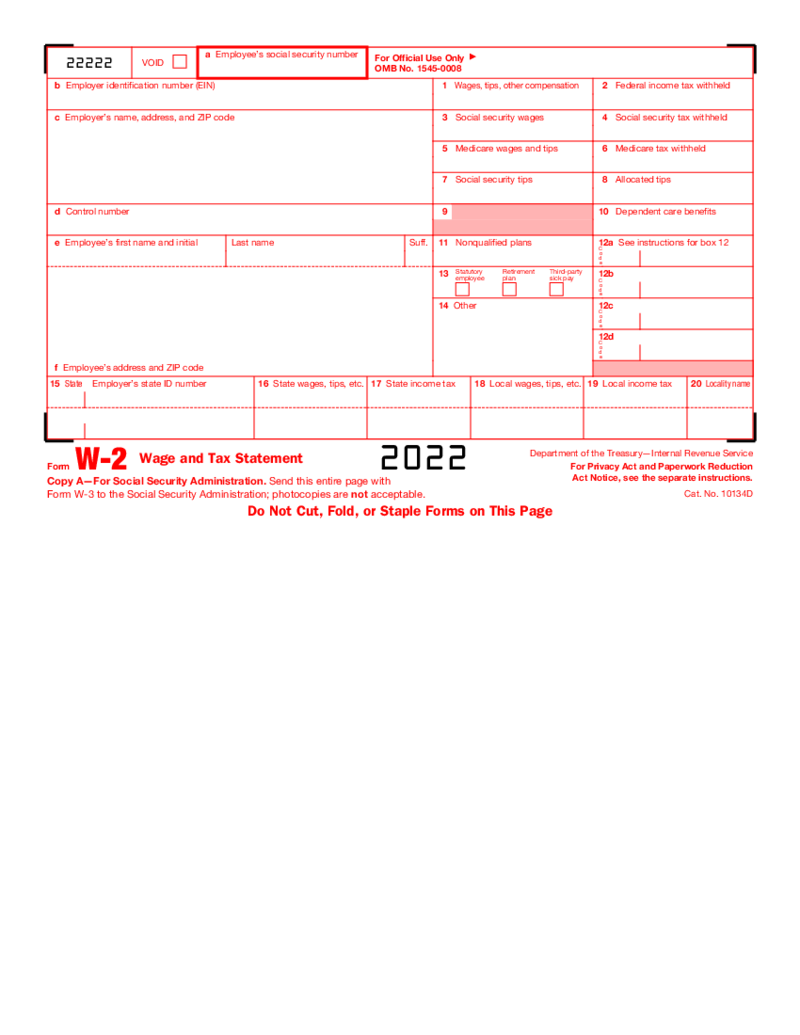

Form W-2 (2022)

Introduction to W2 form 2022

A W-2 form 2022, also known as a Wage and Tax Statement, is a form used by employers to report the wages and taxes withheld from an employee's pay to the Internal Revenue Service (IRS) and the Social Security Administratio

Form W-2 (2022)

Introduction to W2 form 2022

A W-2 form 2022, also known as a Wage and Tax Statement, is a form used by employers to report the wages and taxes withheld from an employee's pay to the Internal Revenue Service (IRS) and the Social Security Administratio

-

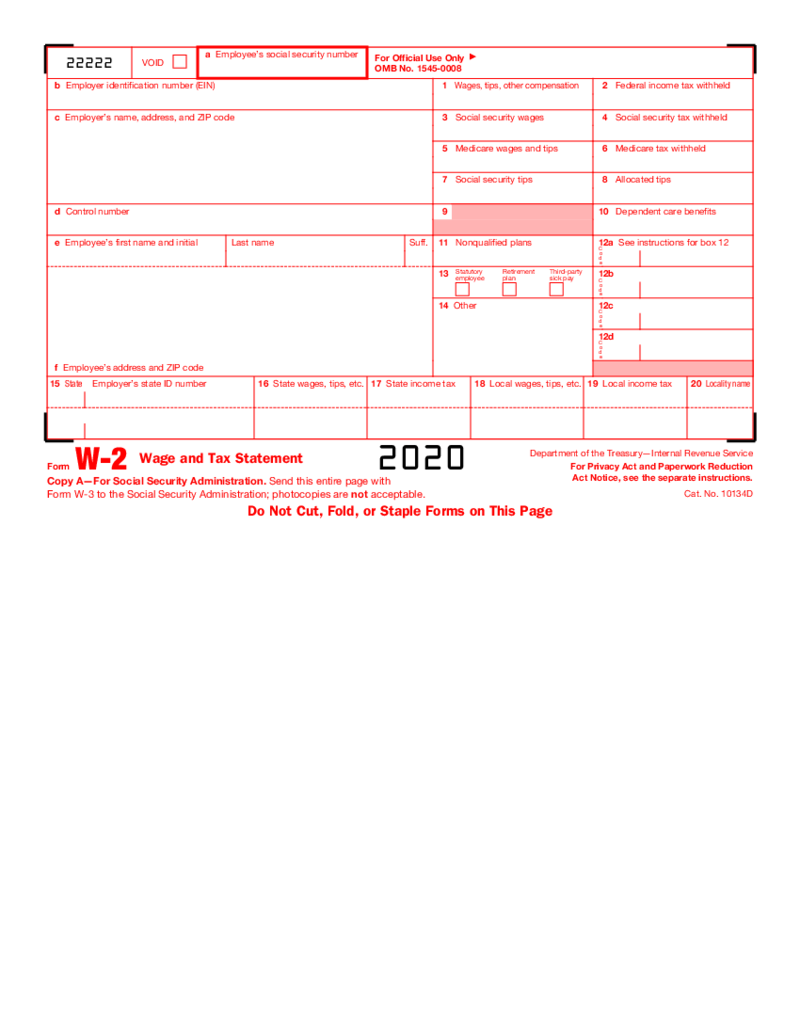

W-2 Form (2020)

How to Find a Fillable W-2 Form (2020)?

The document is ready for you to acquire at the PDFLiner library. Click the "Fill this form" button to open it in the editor, or follow the instructions below:

Log In to your PDFLiner acc

W-2 Form (2020)

How to Find a Fillable W-2 Form (2020)?

The document is ready for you to acquire at the PDFLiner library. Click the "Fill this form" button to open it in the editor, or follow the instructions below:

Log In to your PDFLiner acc

-

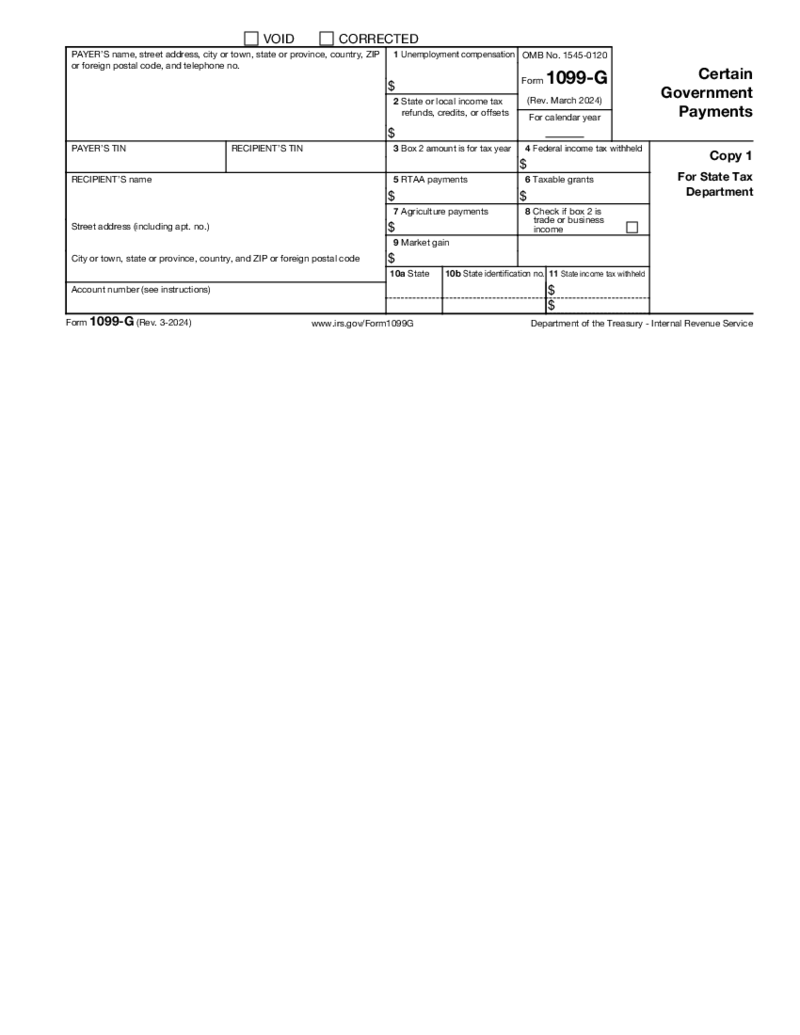

Form 1099-G (2025)

What Is a 1099 G Form (2025)?

If you are looking for what is a 1099-G form, you might need it for unemployment compensation. Yet, this form is used for certain government payments. It includes tax refunds, offsets, credits, unemployment compensation, and

Form 1099-G (2025)

What Is a 1099 G Form (2025)?

If you are looking for what is a 1099-G form, you might need it for unemployment compensation. Yet, this form is used for certain government payments. It includes tax refunds, offsets, credits, unemployment compensation, and

-

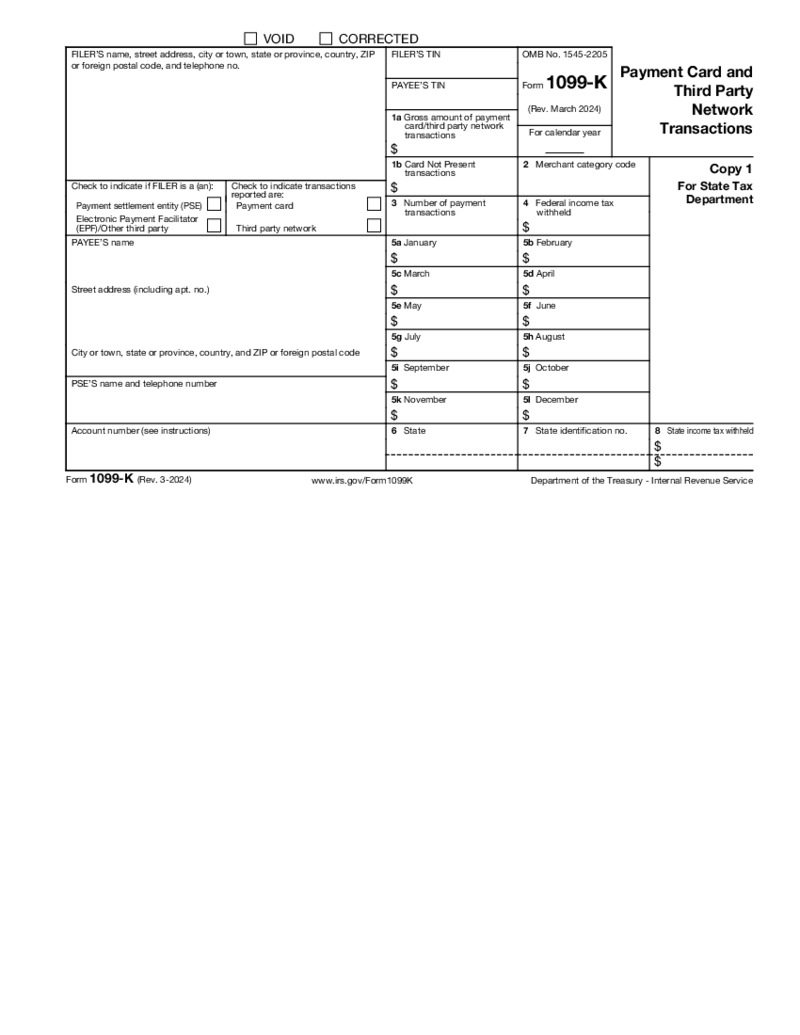

Form 1099-K (2024)

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment tra

Form 1099-K (2024)

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment tra

What Are Information Return Forms

Because transactions are made within all businesses, tax authorities require companies with employees to report these payments. That’s where information return forms come into play. These forms are utilized for reporting taxable transactions to the corresponding authorities. As a result, your tax liability can be easily calculated. In this category, you can lay your hands on these particular templates and edit them the way you see fit while infusing them with tax returns, sales and credit information. Take a browse through the forms, pick the one you currently need, and make the most of the outstanding PDFLiner tools to adjust the pre-made template to your requirements.

Most Popular Information Returns

When adding all the required IRS information on tax returns, be as accurate and up-to-date as possible. That way, you’ll avoid any possible typos or mistakes in your crucial documents.

Here are the most frequently used tax returns information docs.

- W-9 Form. This document is widely used between self-employed individuals and companies they work with, in order to provide the required taxpayer data and thus, report it to the IRS. For example, if you’ve just started working on a project as a freelancer for a company, this company may require you to fill out this document. As a taxpayer, in this form, you need to indicate your ID data and tax classification. Don’t forget to add your signature when you’re through filling out the main body of the form. Bear in mind that because the information on tax returns of this kind is sensitive, both parties should work on its maximum protection.

- Form 1099-MISC. Has your business paid someone who’s not a freelancer? Then this form is most likely a must-file for you. It’s used for reporting a variety of transactions over $600, such as healthcare payments, rents, awards, legal investments, and the like. You’re welcome to complete this form digitally via PDFLiner, just like the rest of the information return templates presented in our vast catalog.

- Form W-2. Also referred to as the Wage and Tax Statement, this doc an employer must forward to each staff member and then submit to tax authorities as the year resumes. This form is used for reporting a staff member’s yearly earnings and the amount of taxes withheld from their paycheck.

- Form 1099-NEC. This doc is utilized by companies for the purpose of reporting compensations sent to non-employees: freelancers, sole proprietors etc. You’re going to need to deal with this template if you received over $600 in nonemployee payments throughout a year.

- Form W-4. If you’ve just found a new job, be ready that your boss will soon ask you to fill out this particular doc. Employees complete this form for their bosses to get an idea of how much tax to withhold from their paycheck. If you make mistakes in this form, you may wind up owing taxes upon submitting your return.

With all that said, when it comes to the nonprofit tax returns public information, your approach should focus on maximum accuracy and straightforwardness. Before getting the completion process going, prepare all the necessary docs and data in advance, in order to ward off any possible confusion. Alternatively, turn to professional help or ask a reliable bookkeeper to review your tax docs as you’re through with them.

Where to Get Information Returns Forms

You can find the premade templates of these forms here, in the PDFLiner vast library of blank fillable forms. If you’re on the prowl for one of the most frequently used templates, feel free to open it straight from this category. Just find the template you need, click Fill Online, and begin completing the form the way it’s required by the government and the way you see fit. Make the most of our digital signature feature to easily add a signature to your file. Send the doc for signature to your colleague or partner via PDFLiner and receive it back in a matter of minutes. Yes, it’s that fast and convenient.

FAQ

-

Where do you enter the information for daycare on tax returns?

If you’re eligible for the Child and Dependent Care Credit, fill out Form 2441 and attach it to your 1040. For more details and nuances, please consult your tax advisor.

-

What should I do if I entered wrong information on tax returns?

Made a mistake on your return? Don’t panic. There’s a form for that. Opt for Form 1040-X to add corrections to the information you previously failed to accurately provide.

-

Where to find property tax information for tax returns?

That depends on the state you live in, so make sure you look up these details in your local tax office.

-

What information can you receive from a person’s tax returns?

In a nutshell, a tax return contains details on a person’s earnings, spendings, and other tax information. These forms grant taxpayers the possibility to calculate their tax liability, pinpoint tax payments, or request refunds for overpaid taxes.