-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Information returns - page 2

-

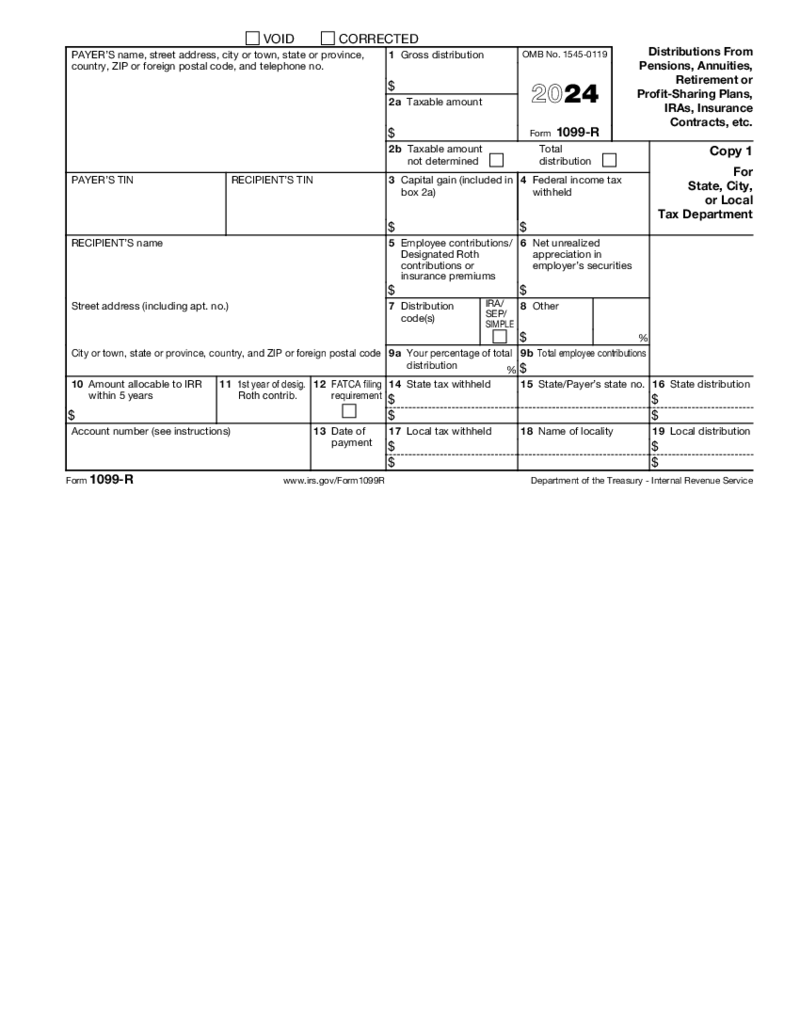

Form 1099-R (2024)

What Is Form 1099-R 2026?

Form 1099-R is used to report the distributions a person gets from pensions, annuities, etc. You should fill out this form if the amount of designated distribution is more than $10. The 1099-R form is filed with other fillable IR

Form 1099-R (2024)

What Is Form 1099-R 2026?

Form 1099-R is used to report the distributions a person gets from pensions, annuities, etc. You should fill out this form if the amount of designated distribution is more than $10. The 1099-R form is filed with other fillable IR

-

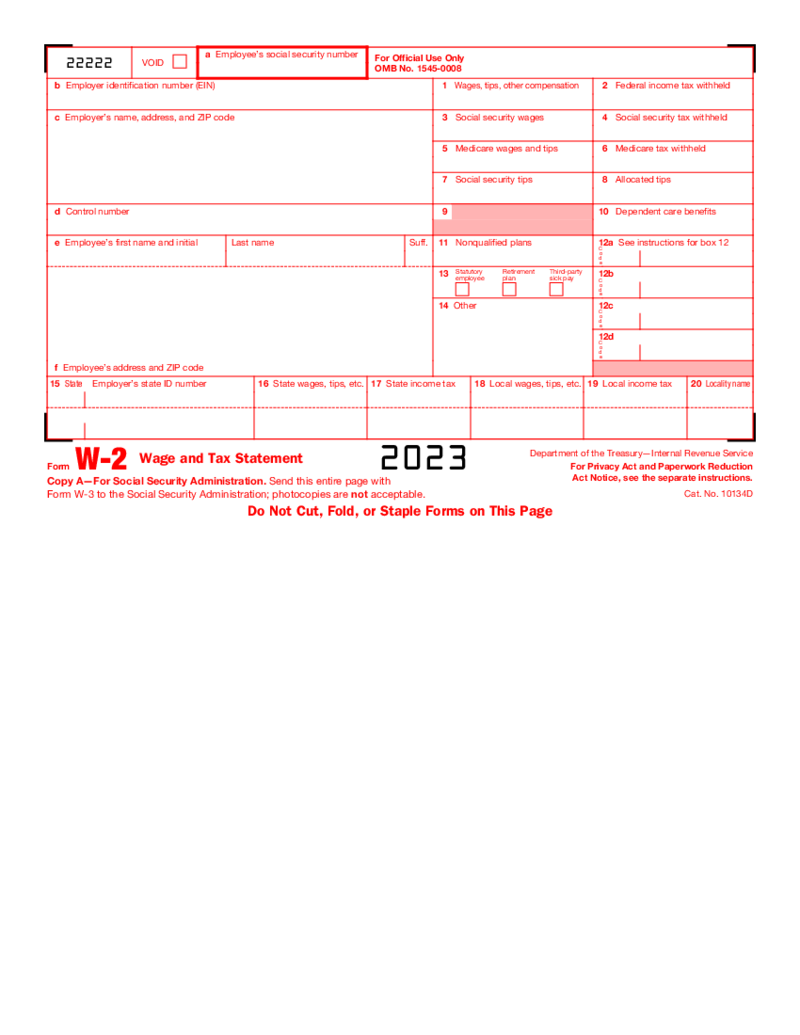

Form W-2 (2023)

How to Properly Fill Out the W-2 Form 2023

Tax season can be a daunting time for employers and employees alike. With the IRS requiring detailed reporting of wages and taxes withheld, the W-2 form is a critical document in the tax filing process. The W-2 F

Form W-2 (2023)

How to Properly Fill Out the W-2 Form 2023

Tax season can be a daunting time for employers and employees alike. With the IRS requiring detailed reporting of wages and taxes withheld, the W-2 form is a critical document in the tax filing process. The W-2 F

-

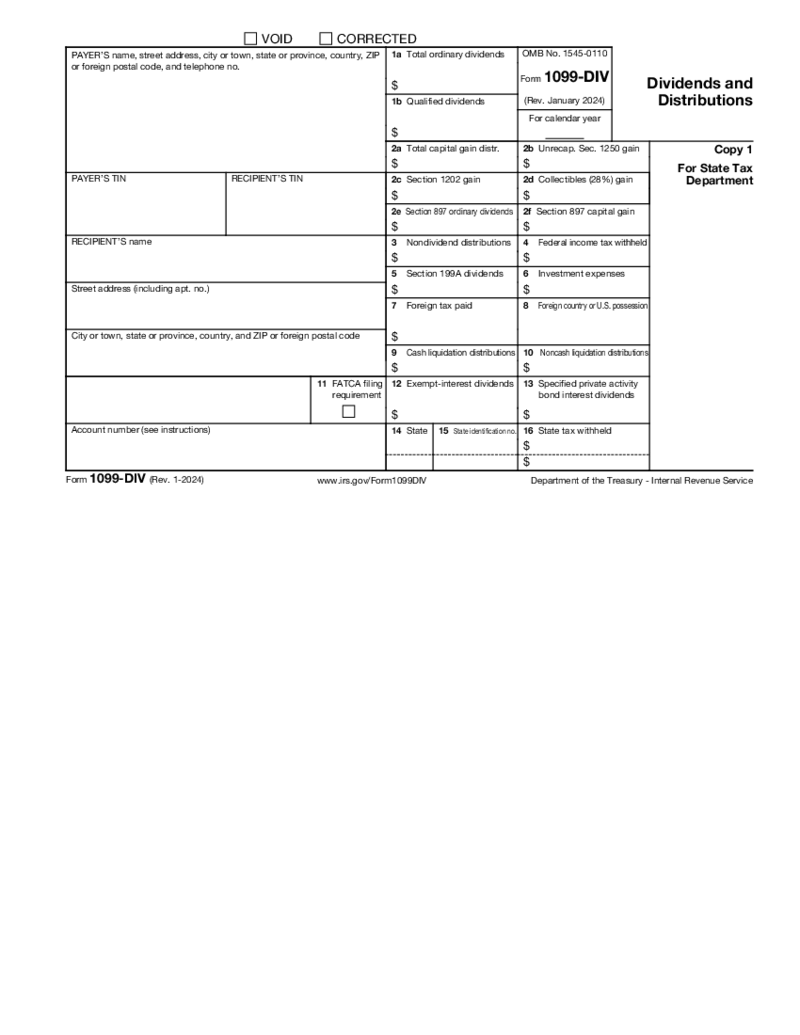

Form 1099-DIV (2024)

What Is 1099-DIV Form

This fillable and printable online PDF blank form is a document you may receive from banks and similar financial entities if you’re an investor who receives dividends and distributions from an equity plan or any kind of investm

Form 1099-DIV (2024)

What Is 1099-DIV Form

This fillable and printable online PDF blank form is a document you may receive from banks and similar financial entities if you’re an investor who receives dividends and distributions from an equity plan or any kind of investm

-

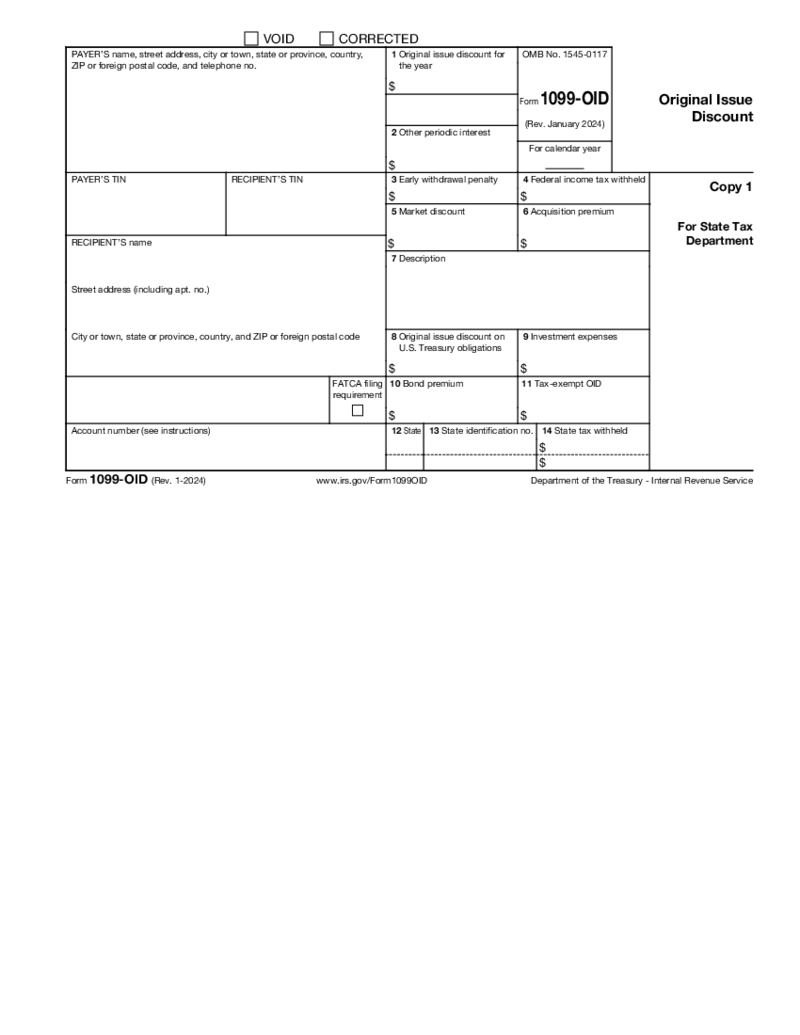

Form 1099-OID (2024)

What Is OID Form 1099?

It’s an IRS tax document utilized for reporting OID taxes on specific debt instruments. A debt instrument is an asset that people or entities use for raising money or generating investment income. The holder of bonds, ce

Form 1099-OID (2024)

What Is OID Form 1099?

It’s an IRS tax document utilized for reporting OID taxes on specific debt instruments. A debt instrument is an asset that people or entities use for raising money or generating investment income. The holder of bonds, ce

-

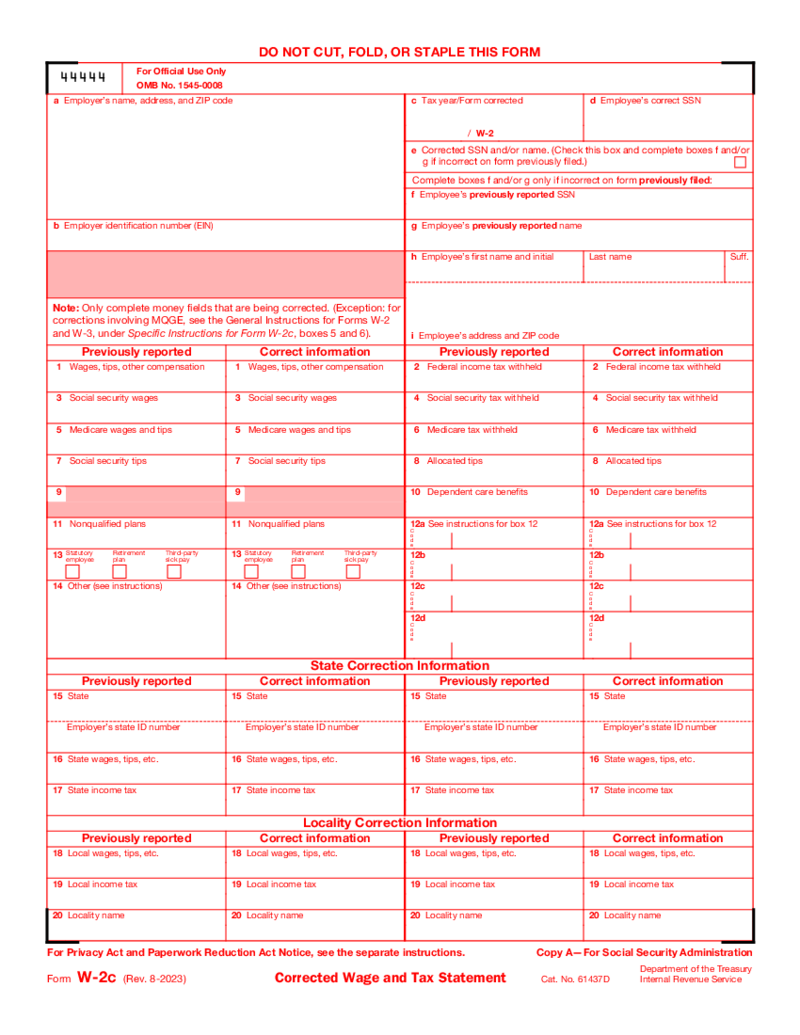

Form W-2C

What Is Form W-2C

Also referred to as the Corrected Wage and Tax Statement, it’s a form utilized to correct formerly issued wage/tax information from present or prior years. Like the W-2 Form, it&rsquo

Form W-2C

What Is Form W-2C

Also referred to as the Corrected Wage and Tax Statement, it’s a form utilized to correct formerly issued wage/tax information from present or prior years. Like the W-2 Form, it&rsquo

-

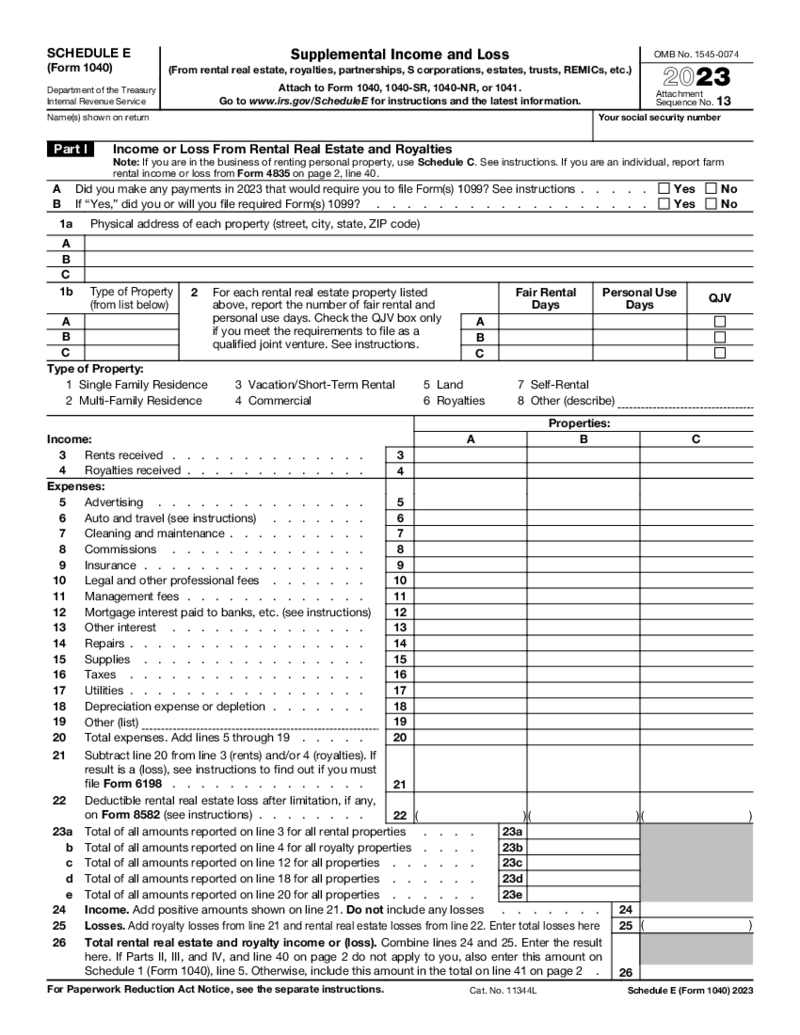

Form 1040 (Schedule E)

What Is 1040 Schedule E 2023 - 2024

Schedule E is part of Form 1040 supplements, all used for the purpose of annual tax reporting for US citizens. Its primary focus is supplemental income and loss as opposed to core ones.

Form 1040 (Schedule E)

What Is 1040 Schedule E 2023 - 2024

Schedule E is part of Form 1040 supplements, all used for the purpose of annual tax reporting for US citizens. Its primary focus is supplemental income and loss as opposed to core ones.

-

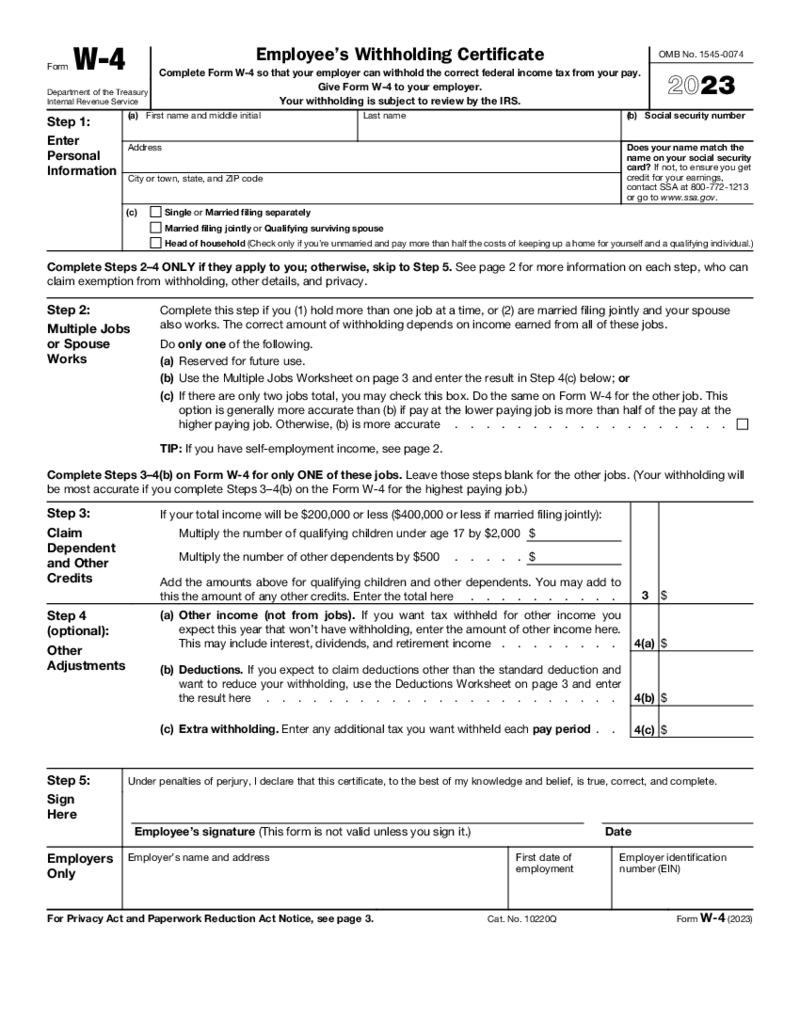

Form W-4 (2023)

Ultimate Guide to the W-4 Form 2023: Ensuring Accurate Withholdings

The W-4 Form is a crucial document for both employees and employers as it determines the amount of federal income tax to be withheld from an employee's paycheck. With the 2023 W-4 tax

Form W-4 (2023)

Ultimate Guide to the W-4 Form 2023: Ensuring Accurate Withholdings

The W-4 Form is a crucial document for both employees and employers as it determines the amount of federal income tax to be withheld from an employee's paycheck. With the 2023 W-4 tax

-

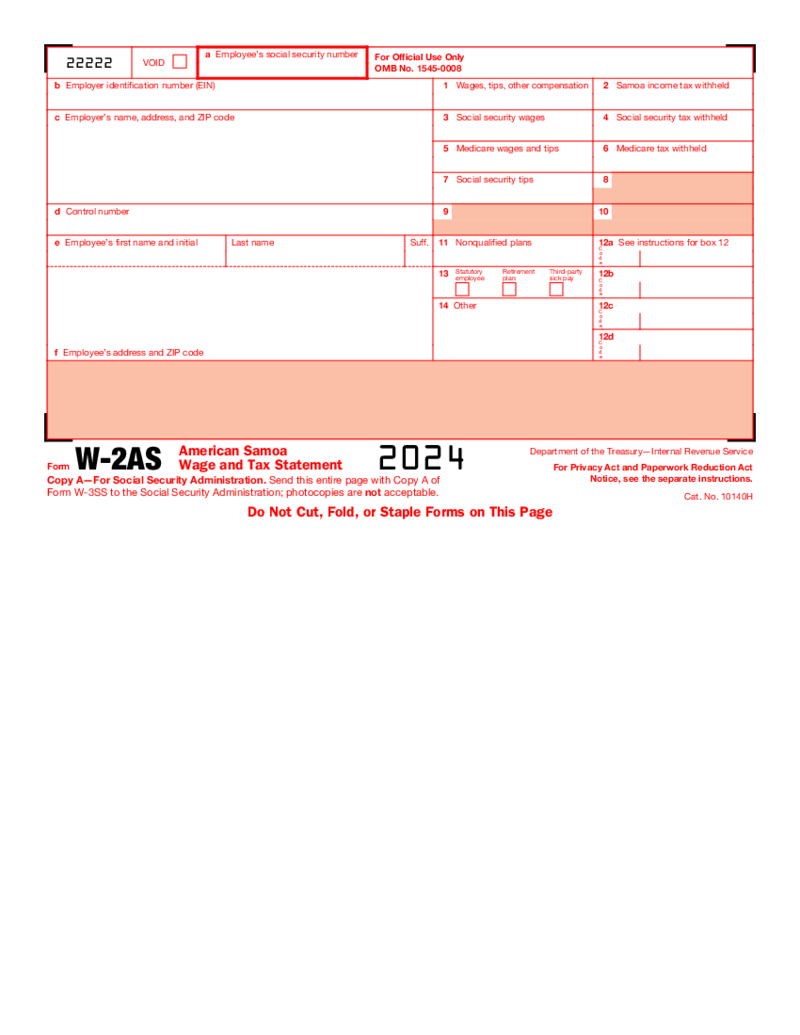

Form W-2AS

What Is Form W-2AS

Form W-2AS is essentially the American Samoa equivalent of the standard W-2 tax form used in the United States. The government mandates this IRS form for employers operating within American Samoa to provide to each of their employees an

Form W-2AS

What Is Form W-2AS

Form W-2AS is essentially the American Samoa equivalent of the standard W-2 tax form used in the United States. The government mandates this IRS form for employers operating within American Samoa to provide to each of their employees an

-

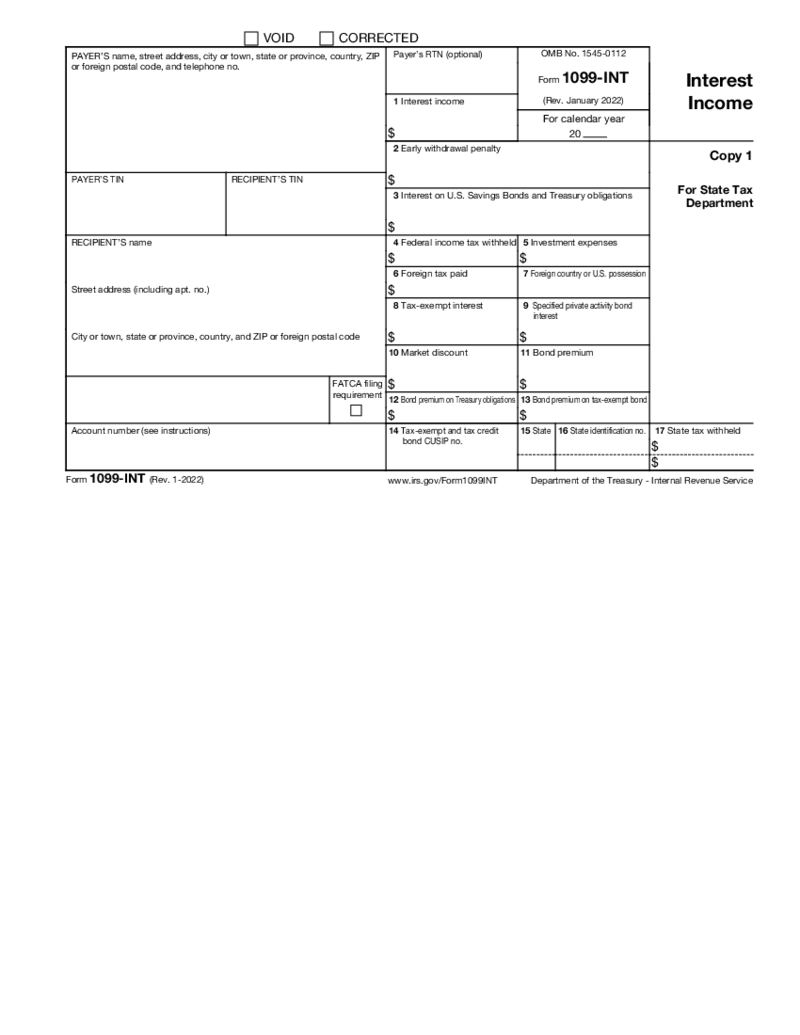

Form 1099-INT (2022 - 2023)

Introduction to Form 1099-INT 2022-2023

Form 1099-INT documents taxpayers receive from banks or other financial institutions that have paid them interest totaling $10 or more during the tax year. It encompasses various types of interest income, such as in

Form 1099-INT (2022 - 2023)

Introduction to Form 1099-INT 2022-2023

Form 1099-INT documents taxpayers receive from banks or other financial institutions that have paid them interest totaling $10 or more during the tax year. It encompasses various types of interest income, such as in

-

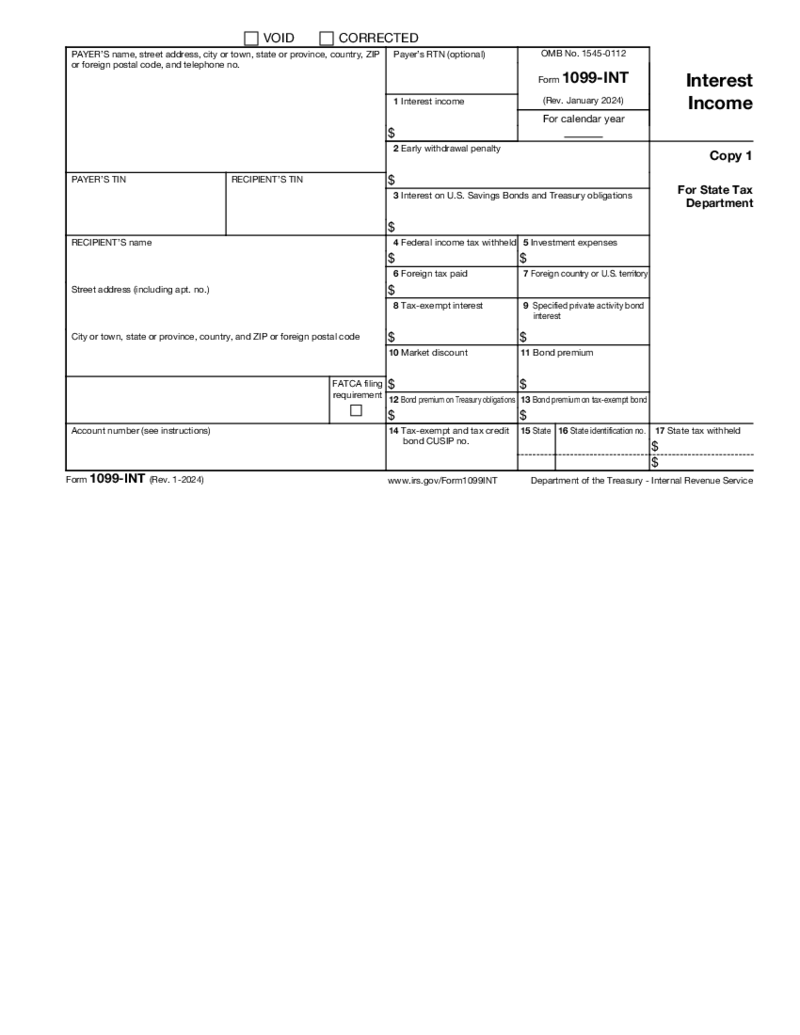

Form 1099-INT (2024)

What is form IRS 1099 INT 2026?

IRS 1099 INT is the form that needs to be filled by banks or other financial institutions and accredited investors to report interest income as well as the penalties on the investments. The fillable 1099-INT form is p

Form 1099-INT (2024)

What is form IRS 1099 INT 2026?

IRS 1099 INT is the form that needs to be filled by banks or other financial institutions and accredited investors to report interest income as well as the penalties on the investments. The fillable 1099-INT form is p

-

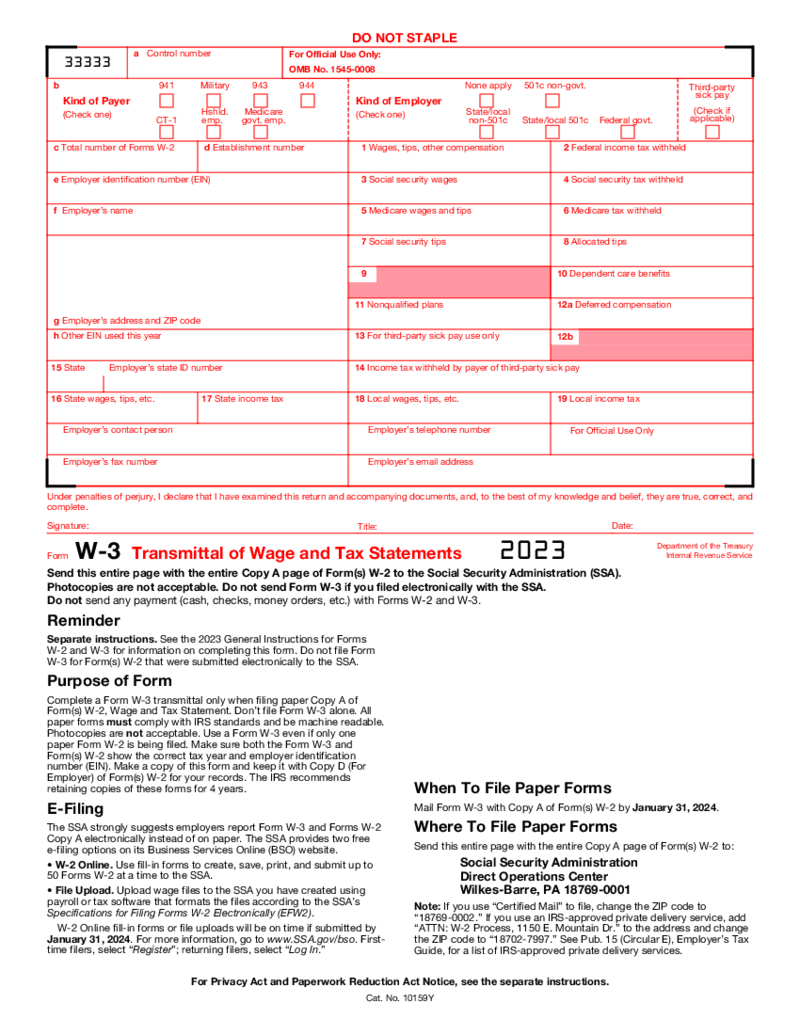

Form W-3 (2023)

The W-3 form, also known as the Transmittal of Wages and Tax Statements, is an essential document that employers use to provide information about their employees' total wages, social security wages, and more. It's a crucial part of the tax preparation process

Form W-3 (2023)

The W-3 form, also known as the Transmittal of Wages and Tax Statements, is an essential document that employers use to provide information about their employees' total wages, social security wages, and more. It's a crucial part of the tax preparation process

-

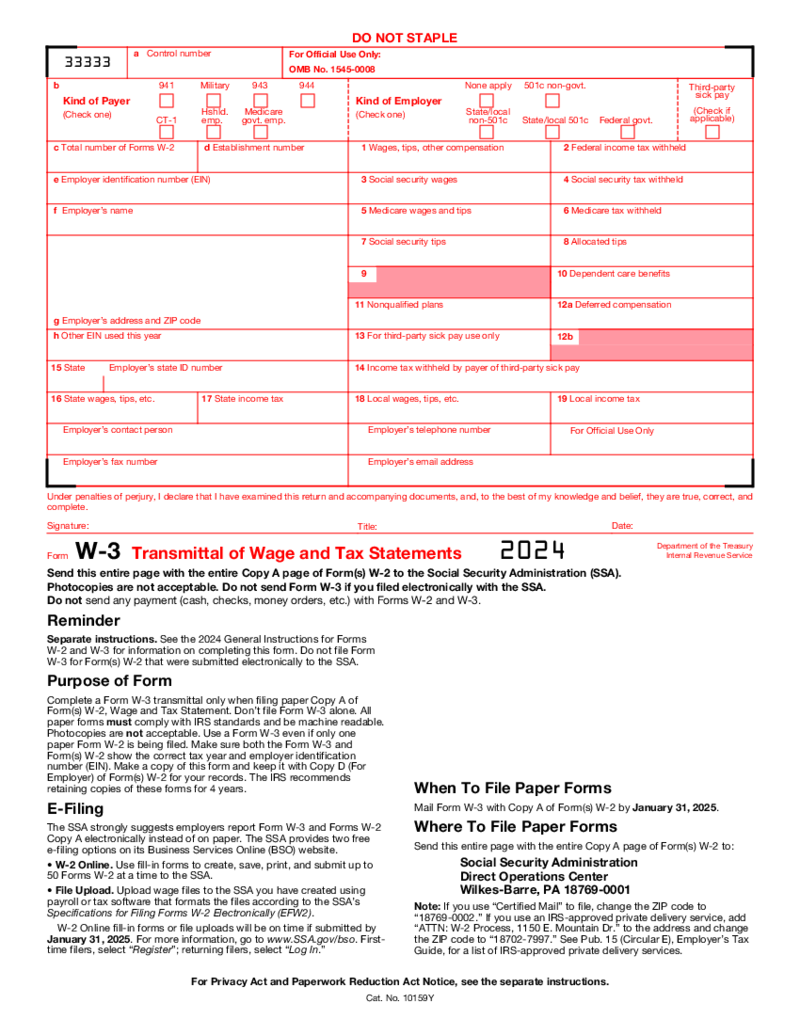

Form W-3 - Transmittal of Wage and Tax Statements

What is a W-3 Tax Form (2026)?

You’ve most likely heard of the W-2 form. If your business has at least one employee, the transmittal W-3 form should also be in your focus zone. Form W-3, also referred to as Transmittal of Wage and Tax Statements, is

Form W-3 - Transmittal of Wage and Tax Statements

What is a W-3 Tax Form (2026)?

You’ve most likely heard of the W-2 form. If your business has at least one employee, the transmittal W-3 form should also be in your focus zone. Form W-3, also referred to as Transmittal of Wage and Tax Statements, is

FAQ

-

Where do you enter the information for daycare on tax returns?

If you’re eligible for the Child and Dependent Care Credit, fill out Form 2441 and attach it to your 1040. For more details and nuances, please consult your tax advisor.

-

What should I do if I entered wrong information on tax returns?

Made a mistake on your return? Don’t panic. There’s a form for that. Opt for Form 1040-X to add corrections to the information you previously failed to accurately provide.

-

Where to find property tax information for tax returns?

That depends on the state you live in, so make sure you look up these details in your local tax office.

-

What information can you receive from a person’s tax returns?

In a nutshell, a tax return contains details on a person’s earnings, spendings, and other tax information. These forms grant taxpayers the possibility to calculate their tax liability, pinpoint tax payments, or request refunds for overpaid taxes.