-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

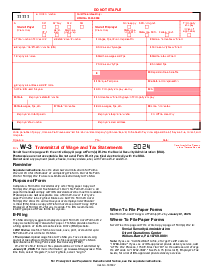

Form W-2C (2023)

Get your Form W-2C in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form W-2C

Also referred to as the Corrected Wage and Tax Statement, it’s a form utilized to correct formerly issued wage/tax information from present or prior years. Like the W-2 Form, it’s a multi-purpose doc for reporting corrected earnings to the IRS, FTB, and SSA.

The template of the W 2C fillable form is offered here in the PDFLiner gallery of pre-designed niche-specific files. Find it and fill it out right here and right now without even leaving our platform. This post will briefly cover the form's purpose and provide instructions on its completion.

Where to Buy W 2C Forms

You can find Forms W 2C here in our library of tax templates. All our templates are also fully customizable. It means that upon registering with our service, you can make use of its multiple editing tools to adjust the document to your current situation, which will:

- ensure maximum file accuracy;

- help you incorporate a secure and legitimate e-signature;

- speed up your document processing time;

- allow you to automate your file management processes.

However, if you need a copy A of the form, you should order a scalable version directly from the IRS.

What Do I Need the IRS Form W-2C For

Here’s what you need this document for:

- making corrections on formerly issued wage/tax information (W-2S);

- reporting corrected earnings to the IRS, FTB, and SSA.

Aside from the fillable W 2C form, in our catalog of templates, you’ll find a multitude of other pre-designed forms that require a lot less adjustment compared to the file created from scratch. We’re constantly working on improving our library of templates, ensuring they stay up-to-date and fully compliant. The team behind PDFLiner refines the service nonstop in order to provide you with the highest-quality digital document management platform.

How to Fill Out Form W 2C Online

The W 2C form fillable contains fillable pages, as well as the ones for informational purposes only. The latter contain instructions on how to fill out the form, along with similar general information about the document. Start by looking through the form, finding these passages with instructions, and studying them prior to getting the completion started. When you’re through, follow these steps to complete the form W 2C fillable via our handy digital service:

- Register with PDFLiner and log in to the platform.

- Find the template via our search feature.

- Open it and wait until the page loads.

- Start filling it out.

- Indicate your name, address, and ZIP code.

- Specify tax year/form corrected.

- Type your SSN.

- Provide details on the previously reported vs corrected information.

Don’t forget to proofread everything when you’re through completing the form. Don’t neglect this step, for mistakes and inconsistencies are highly undesirable. If you feel that the W-2C form fillable is too challenging to sort through on your own, find a professional to do it for you.

Organizations That Work With the IRS W 2C Form

- IRS (Internal Revenue Service);

- FTB (Franchise Tax Board);

- SSA (Social Security Administration).

Form Versions

2014

Fillable W-2C Form 2014

FAQ:

-

Why would I get a W-2C?

You might receive a Form W-2C if your employer made an error on your original Form W-2, which is used to report wages and other compensation paid to you during a tax year.

-

What is the w-2c deadline for filing?

The deadline for filing a W-2c form, which is used to correct errors on a previously filed W-2 form, is the same as the deadline for filing W-2 forms, which is typically the end of February.

-

What is Form W-2C used for?

Form W-2C is usually used when the original Form W-2 has errors that you need to correct.

Fillable online Form W-2C