-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

W-9S Form

Provide your TIN for your student loan in a few minutes using this simple and secure tool.

Get your IRS Form W-9S in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

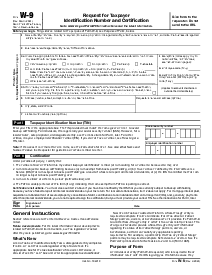

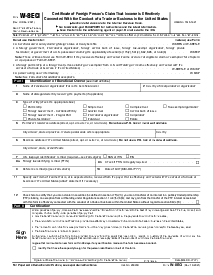

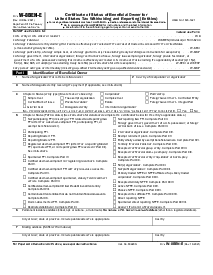

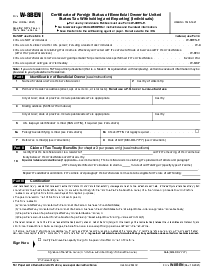

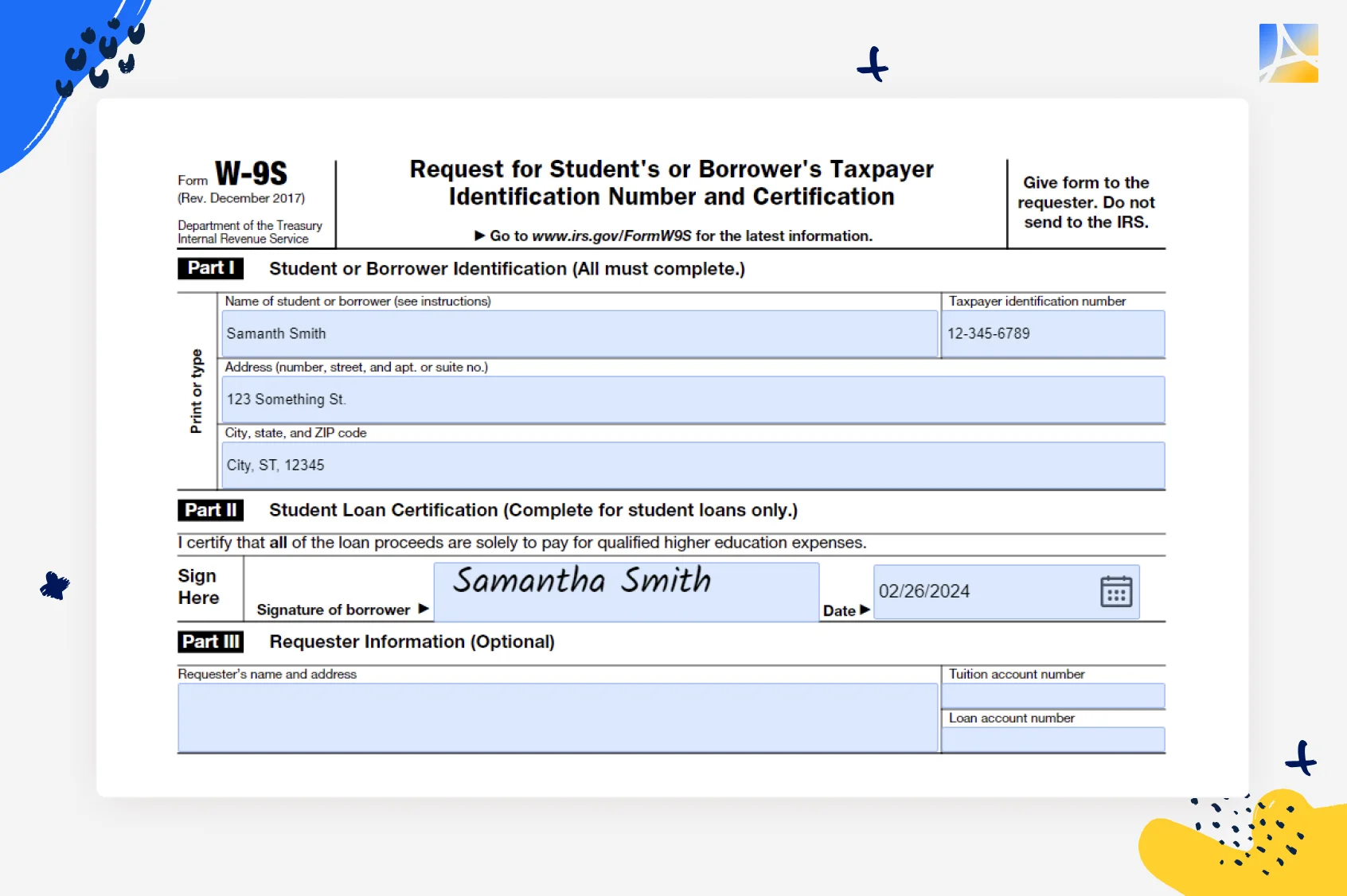

What is a W-9S Form

W-9S form purpose is similar to a standard W9 Form specifically designed for students or borrowers to provide their TIN and certification. Educational institutions or lenders use this form to obtain the correct TIN of the student or borrower to report information to the IRS related to tuition and related expenses and student loan interest. It includes sections for the student or borrower's identification, student loan certification (if applicable), and optional requester information. The form helps determine eligibility for tax benefits related to education expenses and student loan interest deductions.

How To Fill Out IRS W-9S Form

Here are the step-by-step instructions for filling out the IRS W-9S Form:

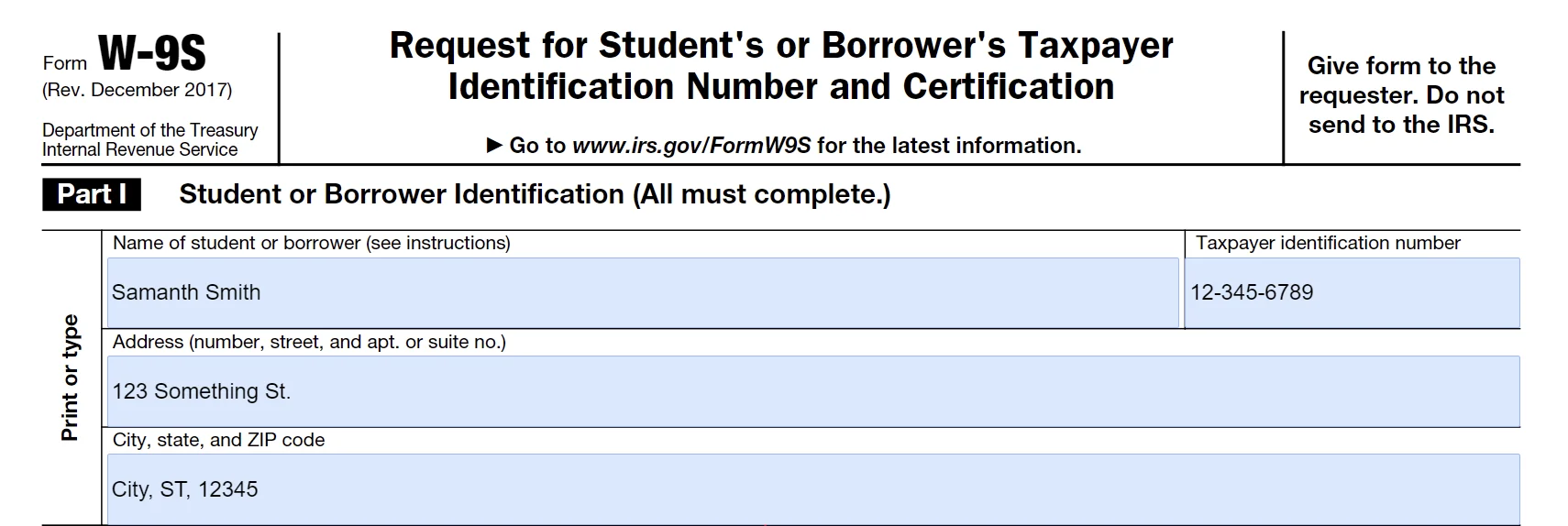

Step 1: Name and address

Enter the name and mailing address of the student or borrower. If the form is being filled out in relation to tuition payments, enter the student's information.

Note: If it's for a student loan, enter the borrower's information. If both a student loan and tuition payments are involved and the student is not the borrower (e.g., the borrower is the parent), complete two Forms W-9S – one for the student and one for the loan borrower.

Step 2: Taxpayer’s Identifying Number

Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you do not have an SSN or ITIN but plan to apply for one, write "Applied For" in the space provided. If your ITIN has been deactivated, you can still use it on Form W-9S but must renew it when filing a tax return.

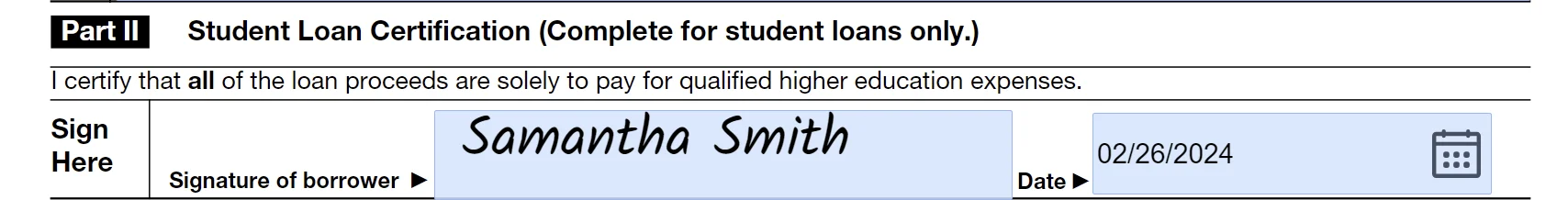

Step 3: Sign and date (for student loans only)

This part should be completed only if your student loan is incurred solely to pay for qualified higher education expenses. Sign the certification to confirm that all loan proceeds will be used solely for these expenses. Do not sign if the loan is for mixed-use. You may sign for a revolving line of credit or similar loan if it's used solely for qualified higher education expenses.

To eSign the form using PDFLiner:

- Click the Sign Field in Part II of the PDF;

- Choose the "My Signature" option;

- Create a signature using one of the 3 methods.

Step 4: Requester information (optional)

This section is optional and provided for the requester's convenience (e.g., educational institution or lender). It may include the requester's name, address, and tuition or loan account number.

Additional Form W-9S Instructions

How to get an SSN or ITIN

- For an SSN, use Form SS-5 from the Social Security Administration.

- For an ITIN, because you are not eligible for an SSN, use Form W-7.

Electronic submissions

The educational institution or lender may request your SSN or ITIN and certification on paper or electronically.

Remember to sign and date the form where applicable and provide it to the requester, not to the IRS. This form helps report information about tuition and related expenses (Form 1098-T) and student loan interest (Form 1098-E), which can affect tax deductions and credits related to education.

Fillable online IRS Form W-9S