-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Information returns - page 4

-

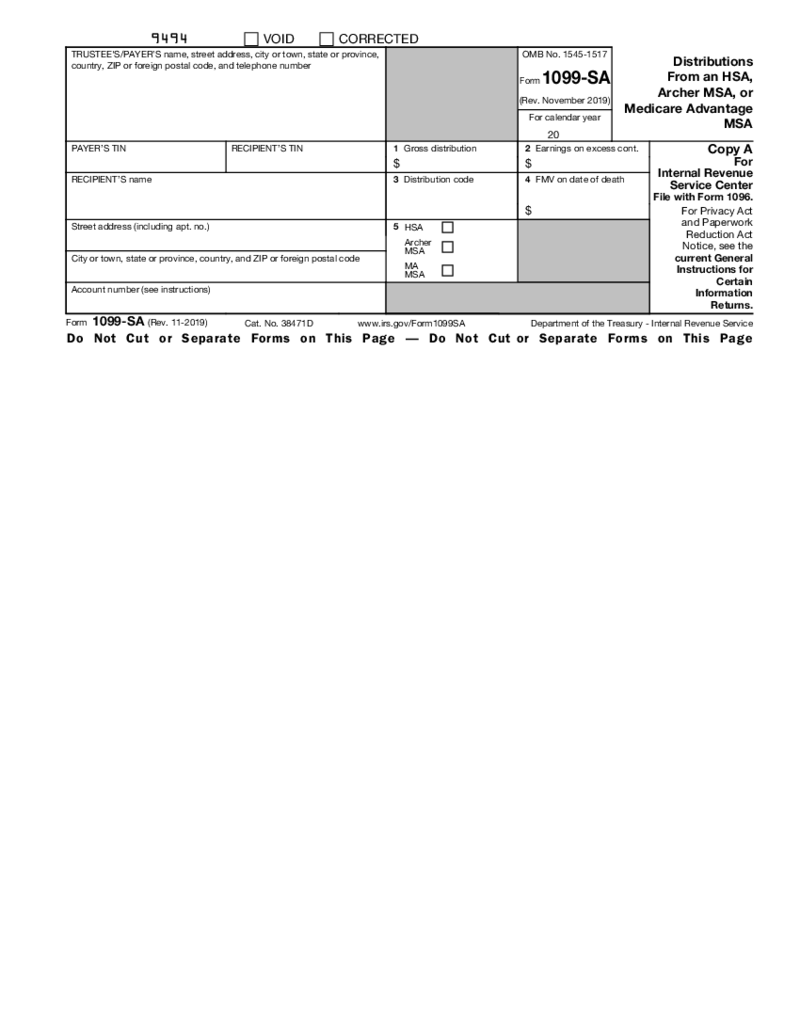

Form 1099-SA

What Is a Form 1099 SA?

It’s a document received from the IRS in case of needing to report distributions made from health savings account, archer medical saving account, and Medicare Advantage MSA on your federal taxes. Via PDFLiner, you can fill ou

Form 1099-SA

What Is a Form 1099 SA?

It’s a document received from the IRS in case of needing to report distributions made from health savings account, archer medical saving account, and Medicare Advantage MSA on your federal taxes. Via PDFLiner, you can fill ou

-

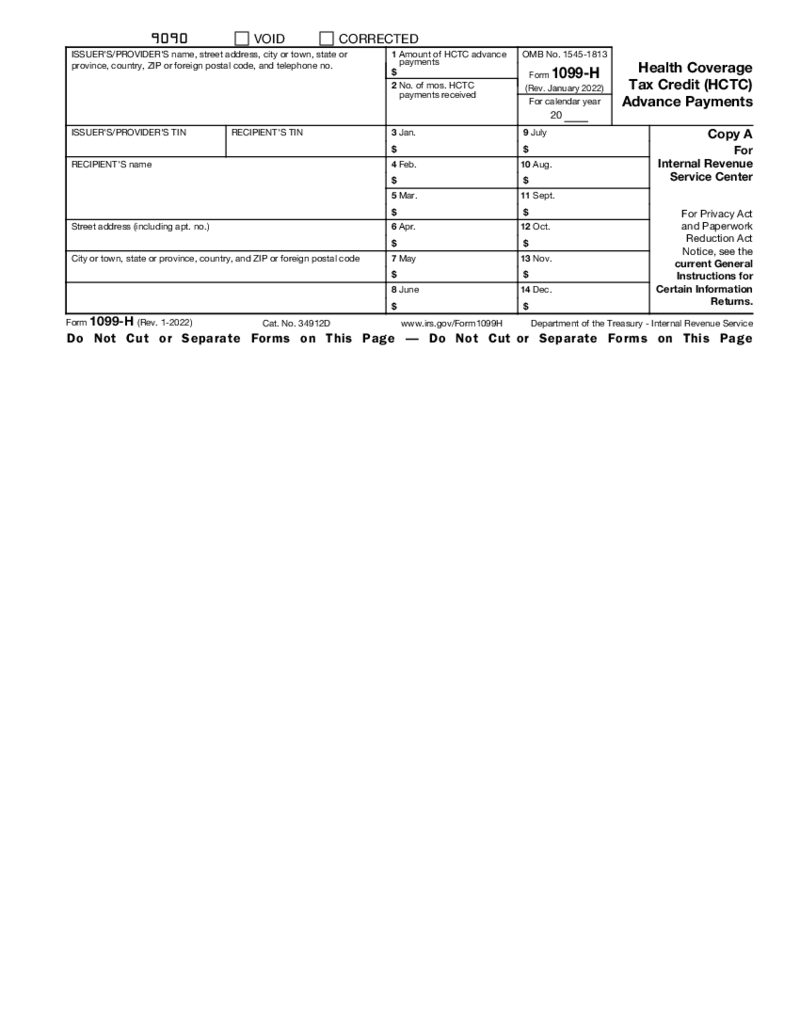

Form 1099-H

What Is Form 1099 H?

Form 1099-H is an important tax form that reports any advance payments of qualified health insurance payments for eligible individuals, reporting the Health Cov

Form 1099-H

What Is Form 1099 H?

Form 1099-H is an important tax form that reports any advance payments of qualified health insurance payments for eligible individuals, reporting the Health Cov

-

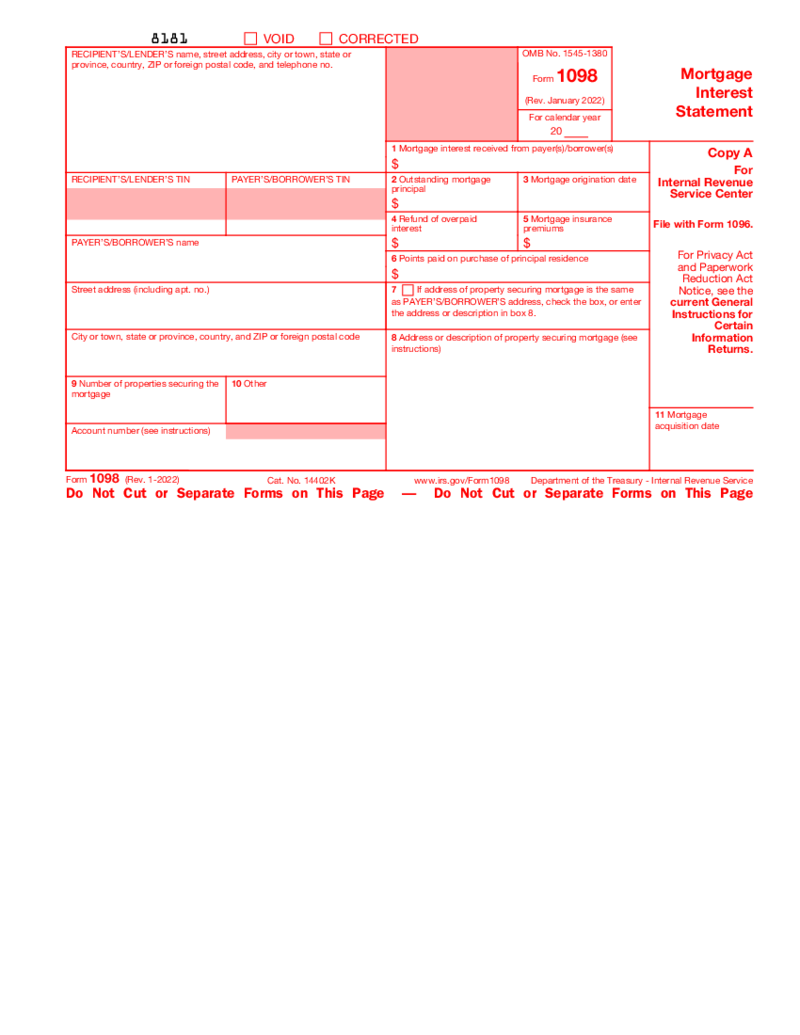

Form 1098 (2023)

What is IRS Form 1098 Mortgage Interest 2024?

IRS Form 1098 is a necessary tax document for filling for those who are preparing to take a mortgage. This document is filled out by lenders and issued to borrowers.

What I need IRS 1098 2023-2024&n

Form 1098 (2023)

What is IRS Form 1098 Mortgage Interest 2024?

IRS Form 1098 is a necessary tax document for filling for those who are preparing to take a mortgage. This document is filled out by lenders and issued to borrowers.

What I need IRS 1098 2023-2024&n

-

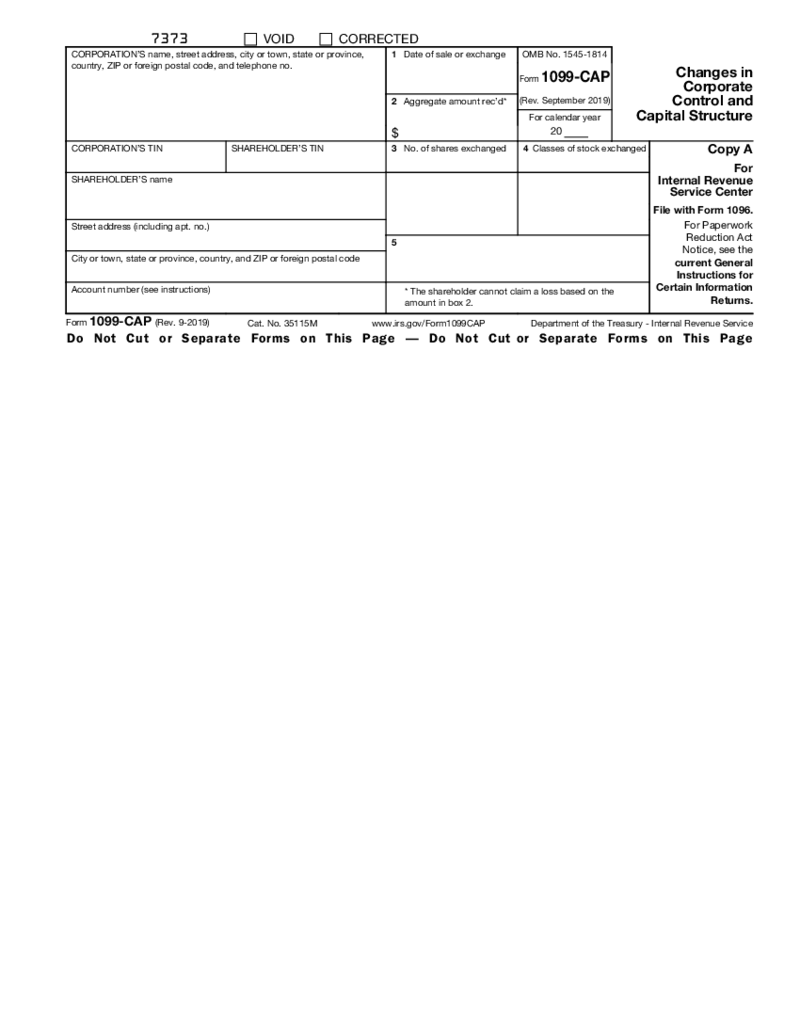

Form 1099-CAP

What Is Form 1099-CAP?

The IRS Form 1099-CAP is a document released by the Internal Revenue Service to indicate the income shareholders receive via the corporation. The form consists of 5 fillable pages. Each page includes duplicated fields for each party

Form 1099-CAP

What Is Form 1099-CAP?

The IRS Form 1099-CAP is a document released by the Internal Revenue Service to indicate the income shareholders receive via the corporation. The form consists of 5 fillable pages. Each page includes duplicated fields for each party

-

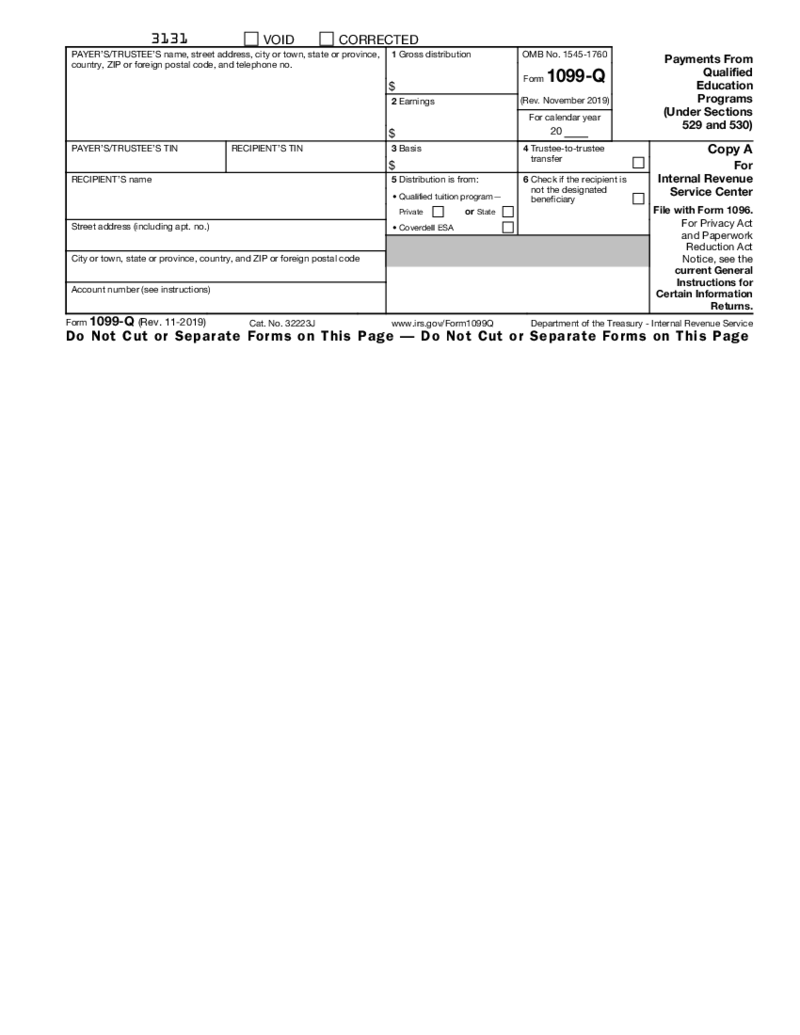

Form 1099-Q

What Is Form 1099-Q?

If you are wondering what is a 1099 Q tax form, you are not the only one. This form was created by the US Department of the Treasury, Internal Revenue Service. It is called Payments From Qualified Education Programs. This form is sent

Form 1099-Q

What Is Form 1099-Q?

If you are wondering what is a 1099 Q tax form, you are not the only one. This form was created by the US Department of the Treasury, Internal Revenue Service. It is called Payments From Qualified Education Programs. This form is sent

-

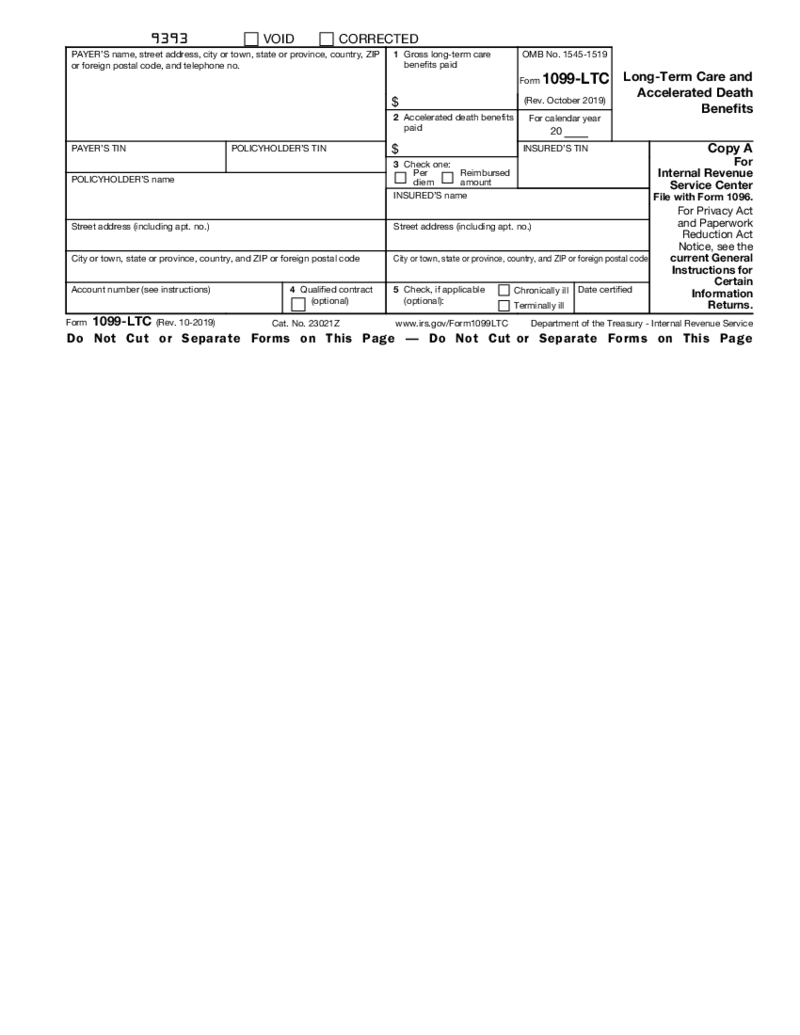

Form 1099-LTC

What is Form 1099-LTC?

The form 1099-LTC is also known as the Long-Term Care and Accelerated Death Benefits. This form is sent to the taxpayer who received the LTC benefits. It does not matter whether you received it by yourself or in your name. The form

Form 1099-LTC

What is Form 1099-LTC?

The form 1099-LTC is also known as the Long-Term Care and Accelerated Death Benefits. This form is sent to the taxpayer who received the LTC benefits. It does not matter whether you received it by yourself or in your name. The form

-

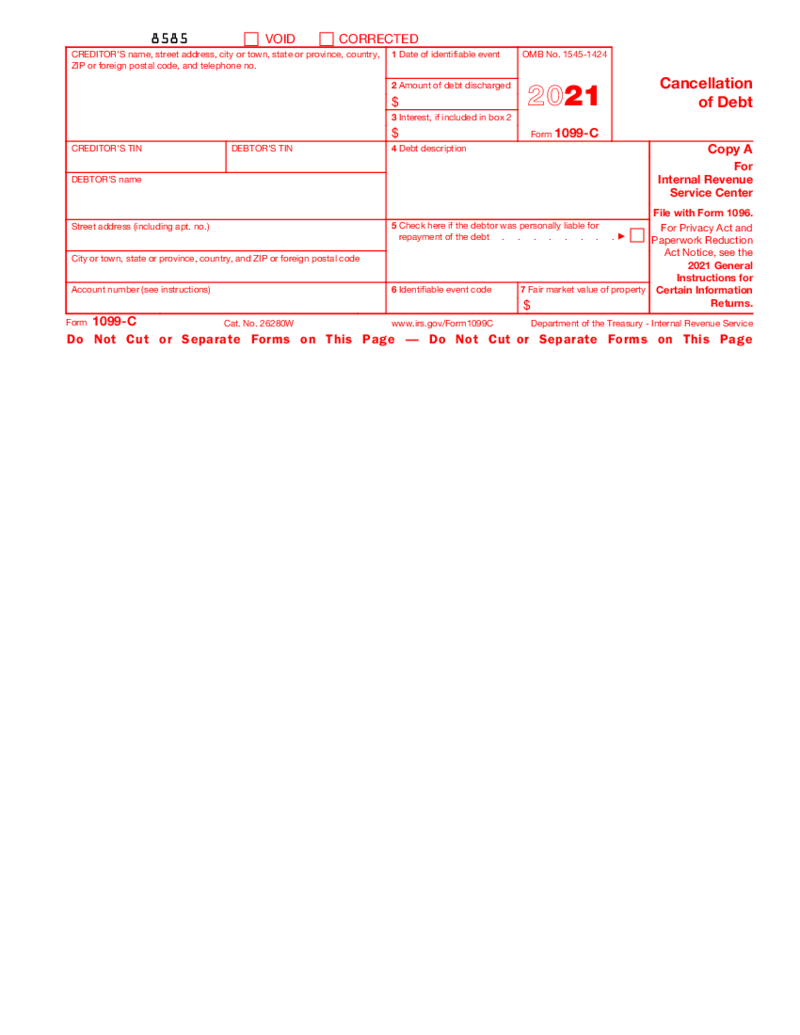

Form 1099-C (2021)

What Is A 1099 C Form 2021

The 1099 C form for the tax year 2021 is a tax document that financial institutions use to report the cancellation of a $600 or more debt to the Internal Revenue Service (IRS). Known formally as Form 1099-C Cancellation of

Form 1099-C (2021)

What Is A 1099 C Form 2021

The 1099 C form for the tax year 2021 is a tax document that financial institutions use to report the cancellation of a $600 or more debt to the Internal Revenue Service (IRS). Known formally as Form 1099-C Cancellation of

-

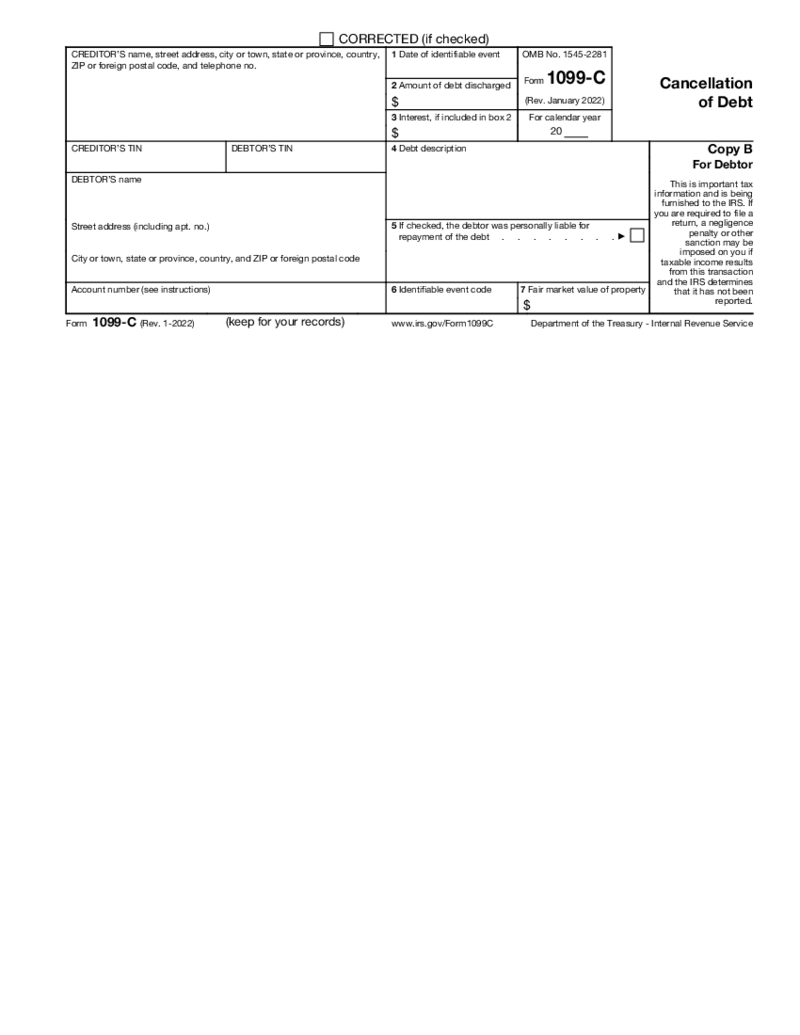

Form 1099-C (2022-2023)

What Is a Form 1099-C (2022-2023)?

Form 1099-C, known as Cancellation of Debt, serves to report various payments and transactions not related to wages. This form is required for cases when lenders and creditors have repaid $ 600 debt or more. After that,

Form 1099-C (2022-2023)

What Is a Form 1099-C (2022-2023)?

Form 1099-C, known as Cancellation of Debt, serves to report various payments and transactions not related to wages. This form is required for cases when lenders and creditors have repaid $ 600 debt or more. After that,

-

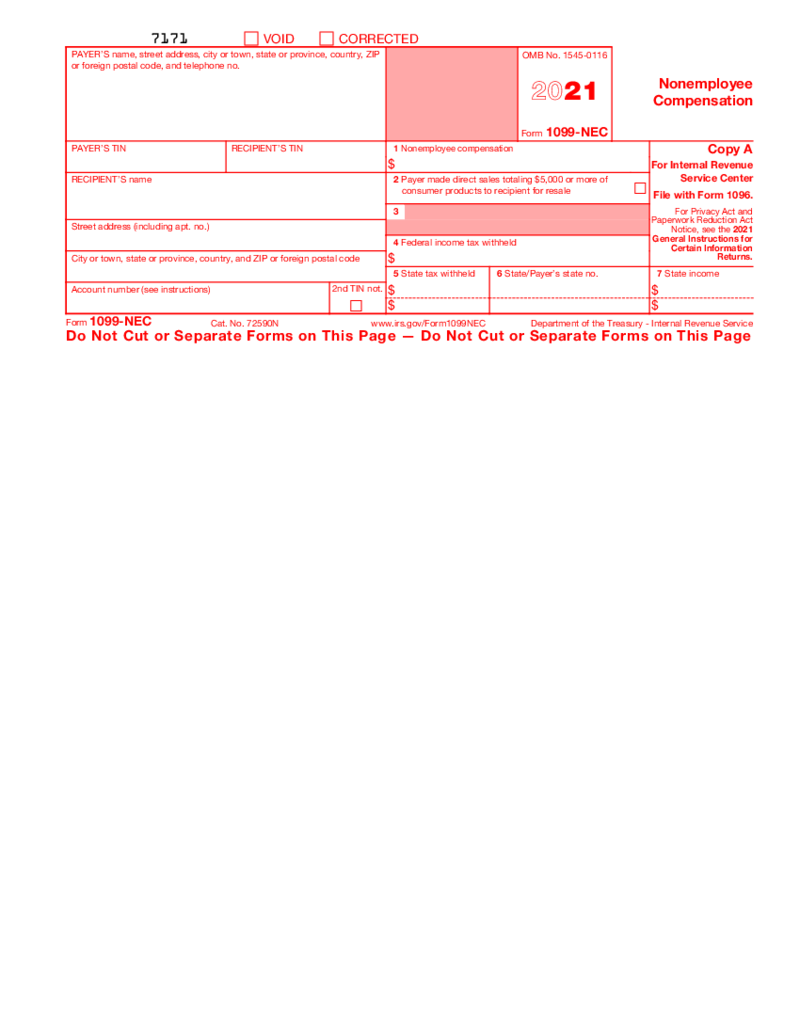

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

-

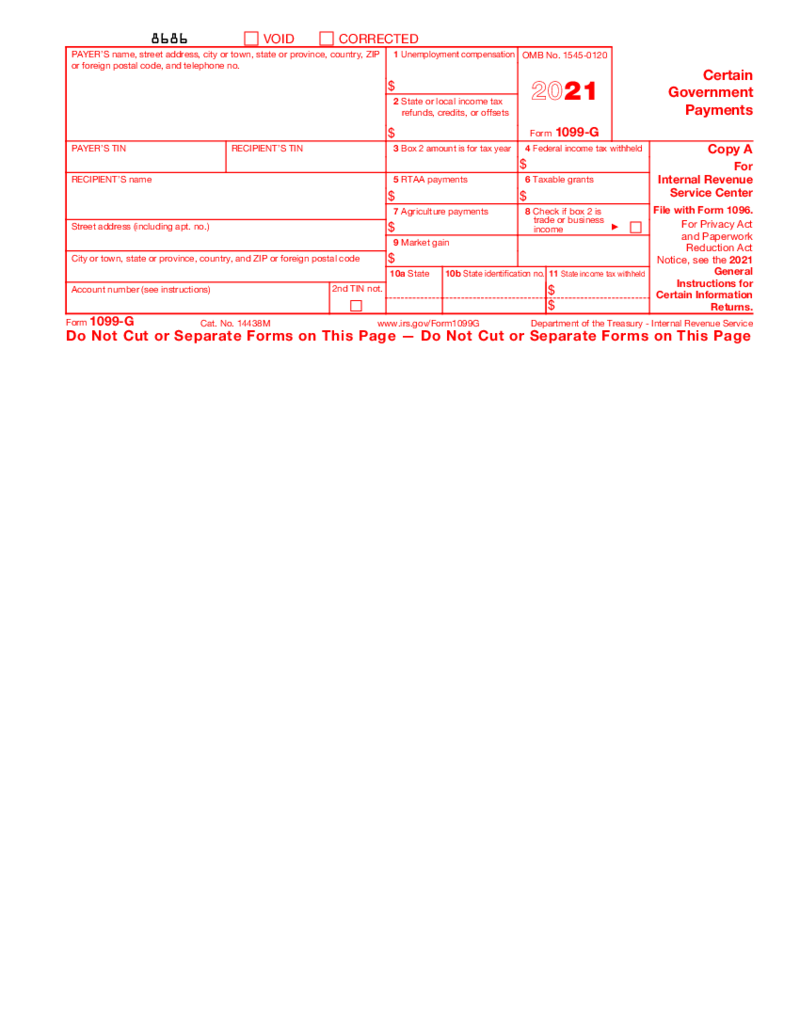

Form 1099-G (2021)

What is Form 1099 G 2021

Form 1099 G 2021 is a tax document that the government uses to report certain types of payments. It covers a range of payments, including unemployment compensation, state or local income tax refunds, credits or offsets, agricultur

Form 1099-G (2021)

What is Form 1099 G 2021

Form 1099 G 2021 is a tax document that the government uses to report certain types of payments. It covers a range of payments, including unemployment compensation, state or local income tax refunds, credits or offsets, agricultur

-

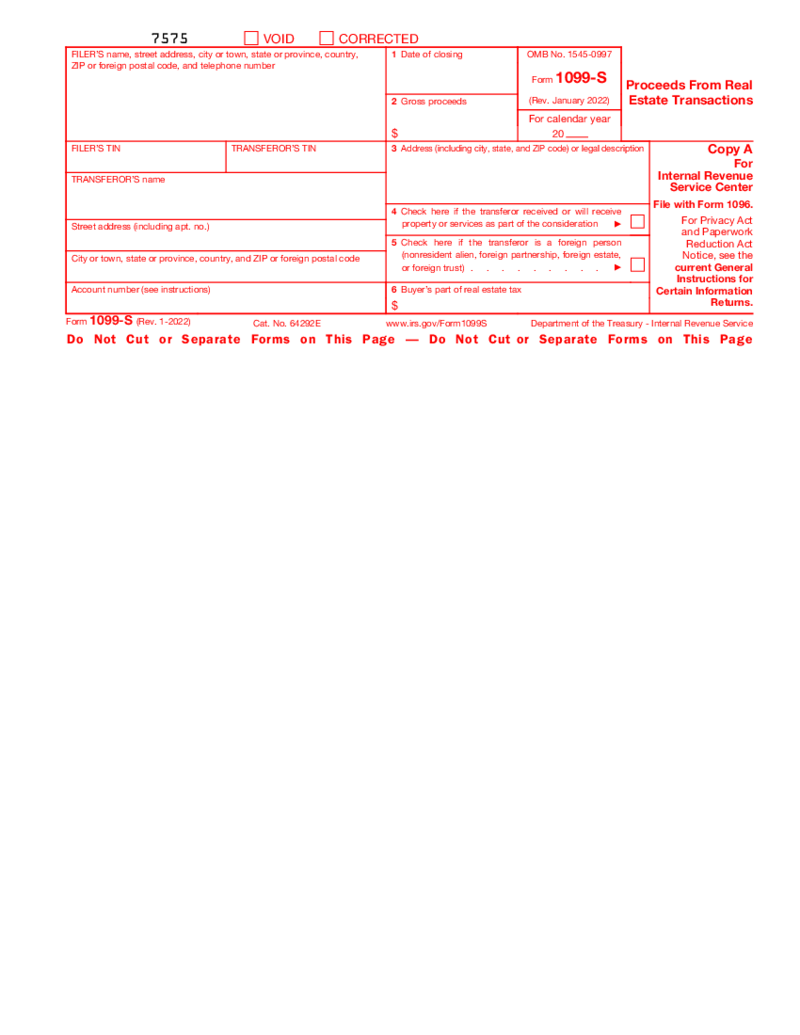

Form 1099-S (2023)

What Is Form 1099-S 2026?

The 1099-S is filed for reporting proceeds from a sale or exchange of real estate. It allows reporting total income from any residential real estate business, including sales, exchanges, interest, as well as timber. People who ar

Form 1099-S (2023)

What Is Form 1099-S 2026?

The 1099-S is filed for reporting proceeds from a sale or exchange of real estate. It allows reporting total income from any residential real estate business, including sales, exchanges, interest, as well as timber. People who ar

-

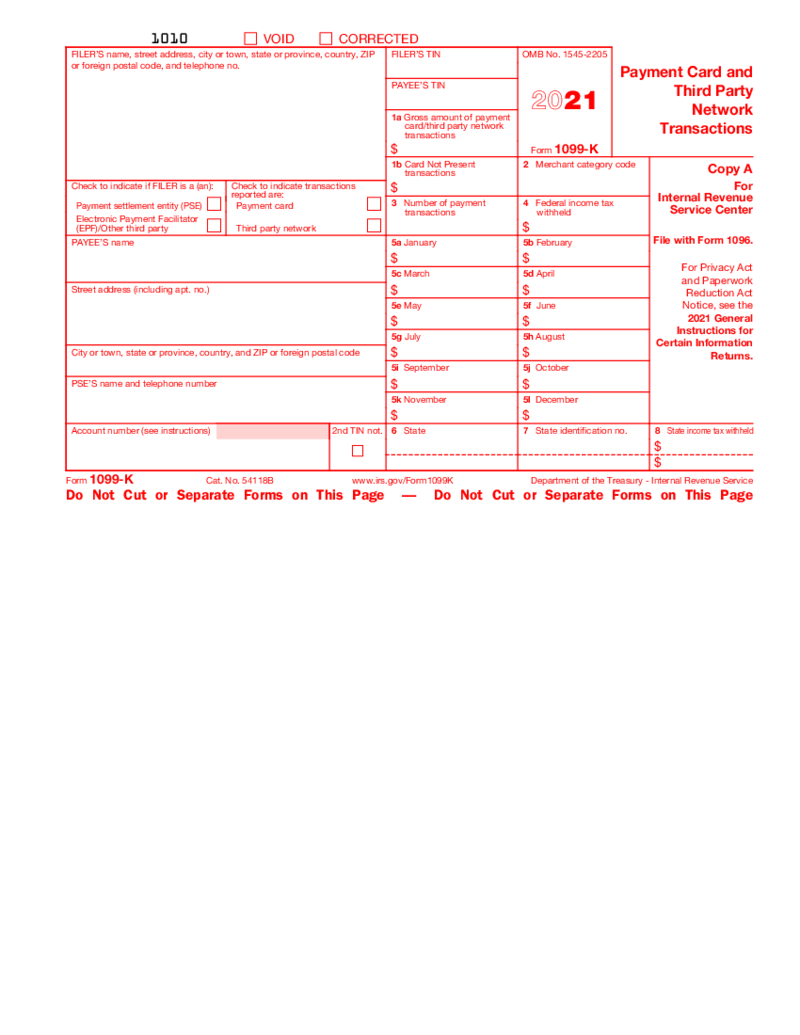

Form 1099-K (2021)

What is Form 1099-K?

A 1099-k IRS form is a way for the IRS to track income that comes through credit card and third-party network transactions. The form is used to report certain payment transactions to improve voluntary tax compliance.

Form 1099-K (2021)

What is Form 1099-K?

A 1099-k IRS form is a way for the IRS to track income that comes through credit card and third-party network transactions. The form is used to report certain payment transactions to improve voluntary tax compliance.

FAQ

-

Where do you enter the information for daycare on tax returns?

If you’re eligible for the Child and Dependent Care Credit, fill out Form 2441 and attach it to your 1040. For more details and nuances, please consult your tax advisor.

-

What should I do if I entered wrong information on tax returns?

Made a mistake on your return? Don’t panic. There’s a form for that. Opt for Form 1040-X to add corrections to the information you previously failed to accurately provide.

-

Where to find property tax information for tax returns?

That depends on the state you live in, so make sure you look up these details in your local tax office.

-

What information can you receive from a person’s tax returns?

In a nutshell, a tax return contains details on a person’s earnings, spendings, and other tax information. These forms grant taxpayers the possibility to calculate their tax liability, pinpoint tax payments, or request refunds for overpaid taxes.