-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

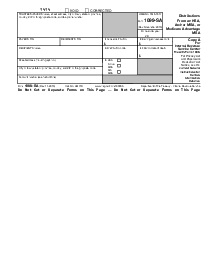

Form 1099-H

Get your Form 1099-H in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1099 H?

Form 1099-H is an important tax form that reports any advance payments of qualified health insurance payments for eligible individuals, reporting the Health Coverage Tax Credit payments. These payments are made to qualifying taxpayers who have lost jobs due to foreign competition and other specified circumstances. Knowing the nuances of Form 1099-H is crucial for those who are entitled to receive this benefit and ensures they can accurately report their taxes.

Eligibility criteria for IRS form 1099 H

To be eligible for the HCTC and subsequently receive a 1099-H form, individuals must meet specific criteria set by the IRS. These criteria are associated with unemployment due to trade adjustments, and the IRS usually informs recipients if they qualify for the credit. Understanding eligibility is a stepping stone in assuring that benefits are received and forms are filed correctly.

How to Fill Out Form 1099-H

Filling out tax forms accurately is key to avoiding complications with the IRS. Here is a step-by-step guide on filling form 1099 H with ease:

- Check the "VOID" box at the top of the form if you are nullifying a previously completed form. If you're correcting an already submitted form, mark the "CORRECTED" box instead.

- Indicate the calendar year that the form covers.

- Enter the name of the insurance provider or the policy issuer in the space labeled for the issuer's or provider's name.

- Fill in the address fields for the issuer or provider, including the street address, city or town, state or province, and, if applicable, the country and ZIP or foreign postal code.

- Include the issuer's or provider's telephone number in the designated space.

- Input the issuer's or provider's Taxpayer Identification Number (TIN) in the space provided.

- In the recipient section, fill in the recipient's Taxpayer Identification Number.

- Enter the recipient's full name as it would appear on tax documents.

- Provide the recipient's address, which should include the street address, apartment number, city or town, state or province, country, and ZIP or foreign postal code, if applicable.

- Specify the total amount of Health Coverage Tax Credit (HCTC) advance payments received by the individual during the year.

- Enter the number of months for which HCTC payments were received.

- In the monthly breakdown section, input the amount of HCTC received for each month, ensuring that every month from January through December is accounted for with either the specific amount of HCTC payments or a zero if no payment was received for that month.

Leveraging pdfliner for your tax forms

PDFLiner is a robust platform where you can find, manage, and edit a wide array of fillable Information returns templates and IRS tax PDF forms, including the 1099 H form. Maneuvering through tax documentation digitally simplifies the process, making it easier to handle and submit forms swiftly and securely. For individuals looking to obtain a copy of this 1099 form or seeking a convenient way to manage their tax forms, PDFLiner provides an intuitive and user-friendly service with secure storage of your documents.

Fillable online Form 1099-H