-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Employment (payroll) taxes Forms

-

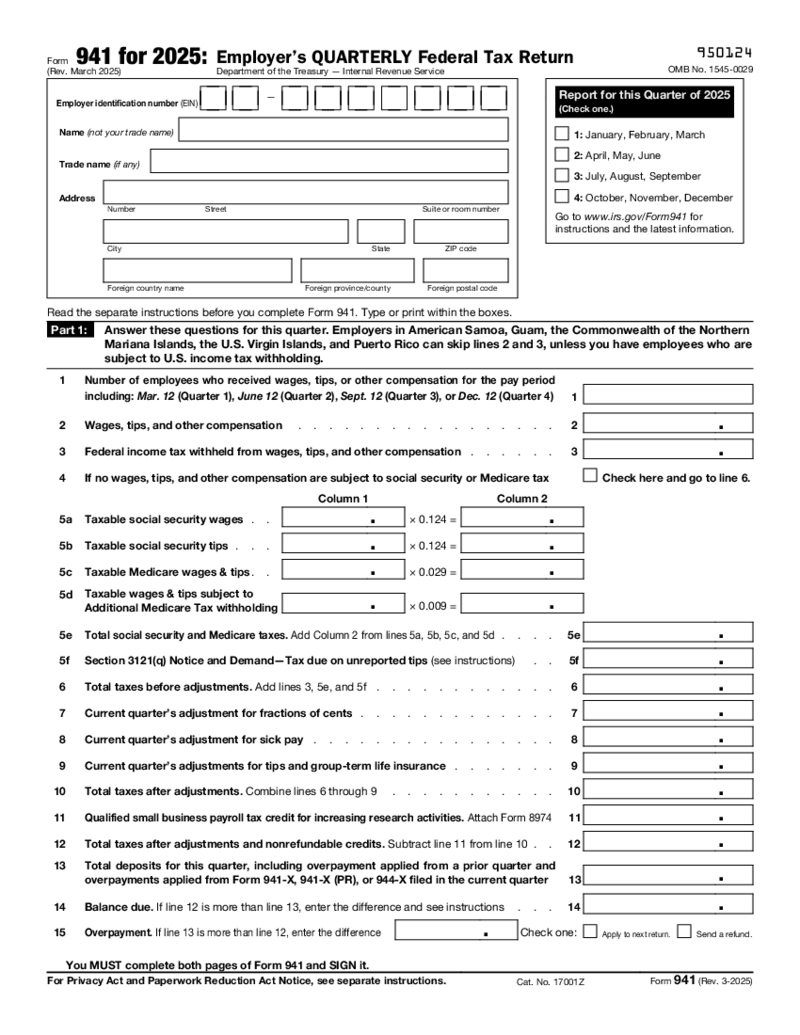

Form 941

What Is 941 Form 2026?

941 fillable form is submitted by employers to report the taxes that were withheld from employees’ wages. It can be income taxes, Medicare tax, social security tax, etc.

What do I need a fillable 941 form for?

Form 941

What Is 941 Form 2026?

941 fillable form is submitted by employers to report the taxes that were withheld from employees’ wages. It can be income taxes, Medicare tax, social security tax, etc.

What do I need a fillable 941 form for?

-

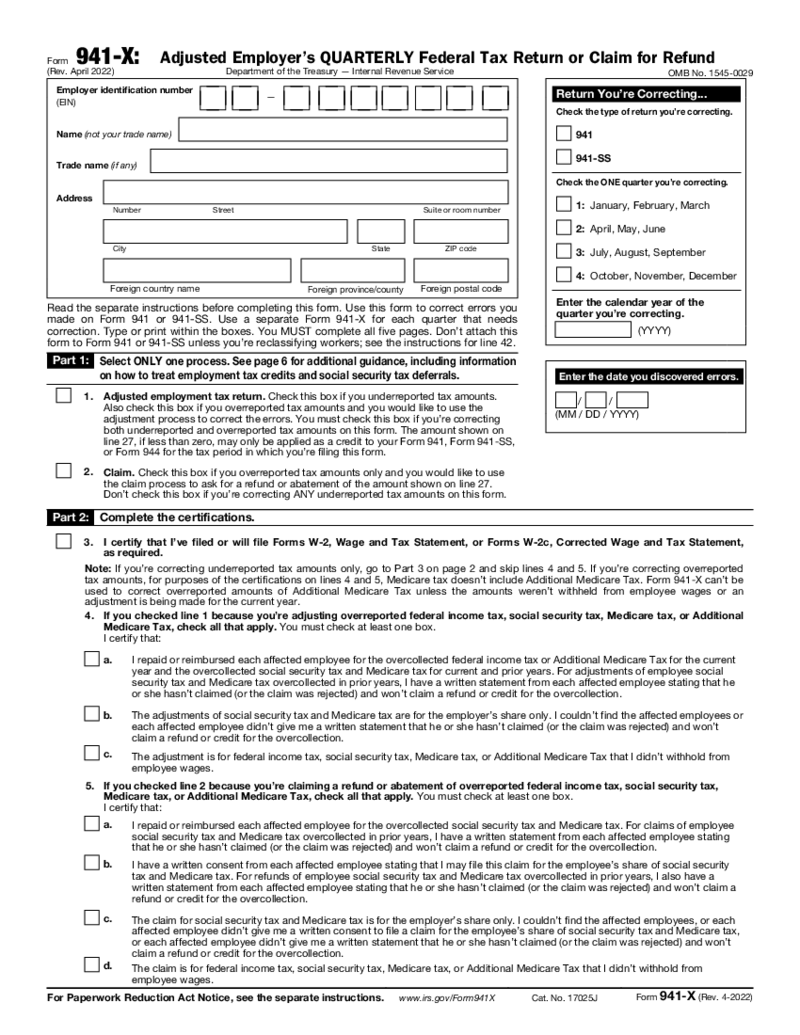

Form 941-X

What Is Form 941 X 2020?

Want to know the basics about this form? We’ve got you covered. Let’s start with the definition. It’s a document utilized for correcting errors you’ve made on your 941 tax return. Keep reading for mor

Form 941-X

What Is Form 941 X 2020?

Want to know the basics about this form? We’ve got you covered. Let’s start with the definition. It’s a document utilized for correcting errors you’ve made on your 941 tax return. Keep reading for mor

-

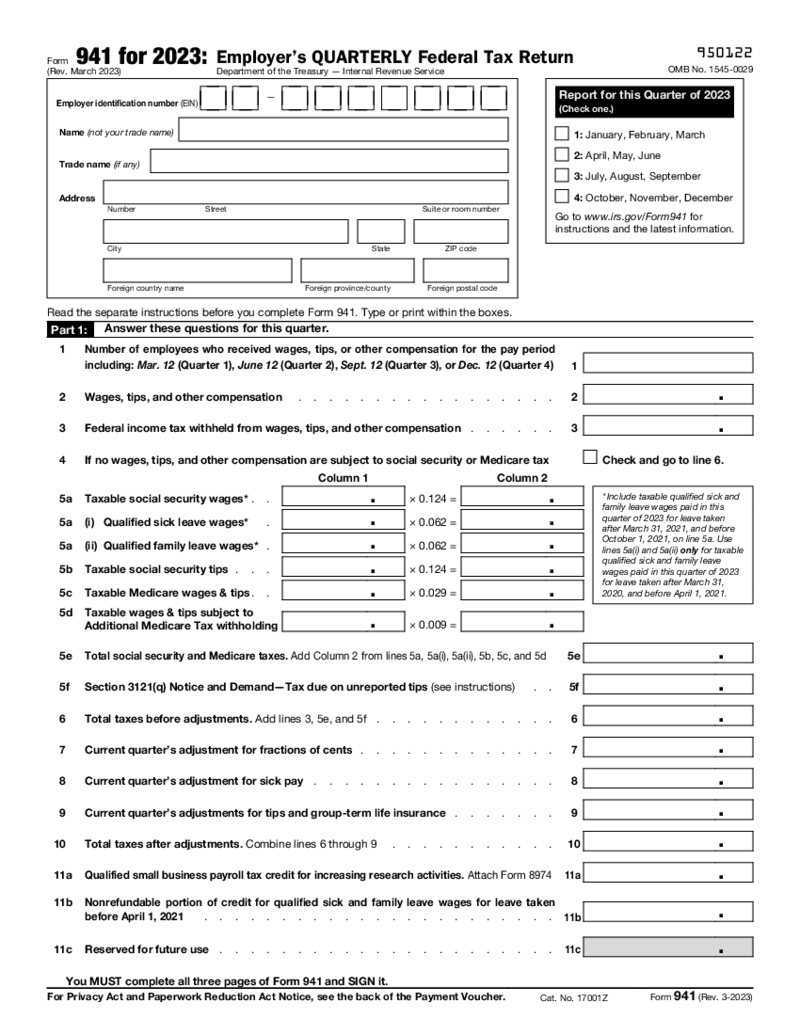

Form 941 (March 2023)

How To Fill Out Form 941 (March 2023)

With revisions as of March 2023, employers must be familiar with the form's requirements to ensure accurate and timely filings. This guide aims to simplify the process of filling out Form 941 for the first quarter

Form 941 (March 2023)

How To Fill Out Form 941 (March 2023)

With revisions as of March 2023, employers must be familiar with the form's requirements to ensure accurate and timely filings. This guide aims to simplify the process of filling out Form 941 for the first quarter

-

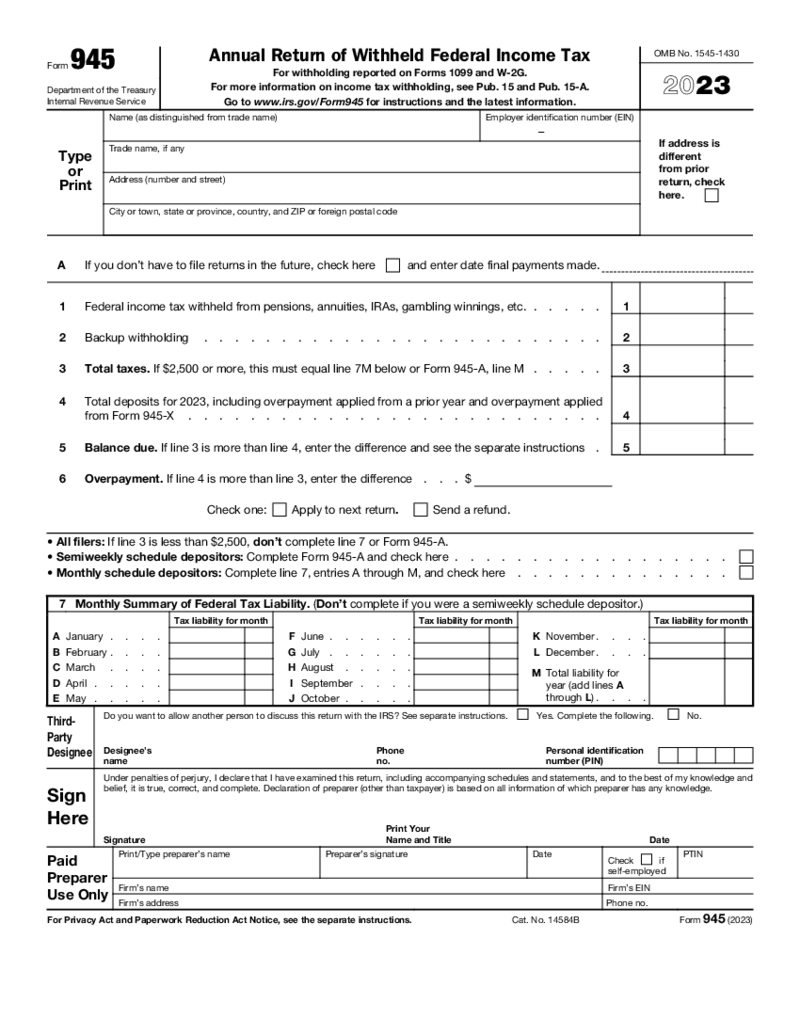

Form 945

What Is a 945 Form?

The 945 Form is a simple one-page document that employers can use to report to the IRS their withholdings of federal prodit taxes from non-employees working for their company. Such deductions from non-payroll compensations can be very

Form 945

What Is a 945 Form?

The 945 Form is a simple one-page document that employers can use to report to the IRS their withholdings of federal prodit taxes from non-employees working for their company. Such deductions from non-payroll compensations can be very

-

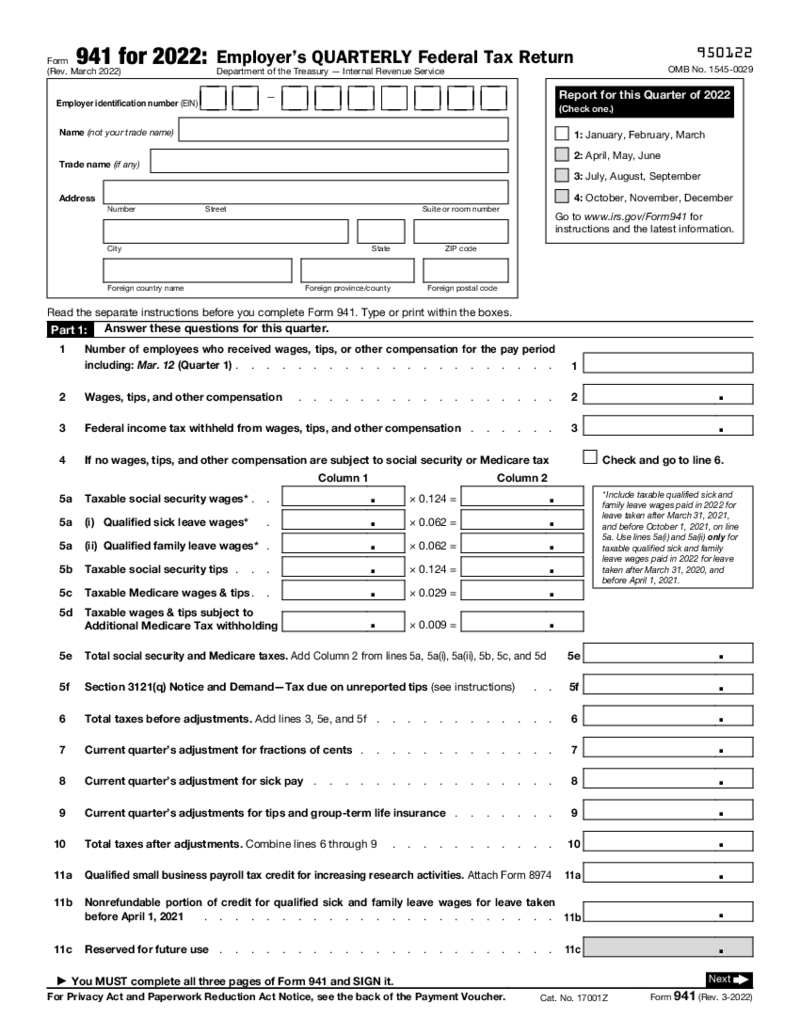

Form 941 (March 2022)

How Do I Acquire Fillable Form 941 (March 2022)?

There is a huge forms library at PDFLiner, so you can easily find here the needed blank form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to f

Form 941 (March 2022)

How Do I Acquire Fillable Form 941 (March 2022)?

There is a huge forms library at PDFLiner, so you can easily find here the needed blank form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to f

-

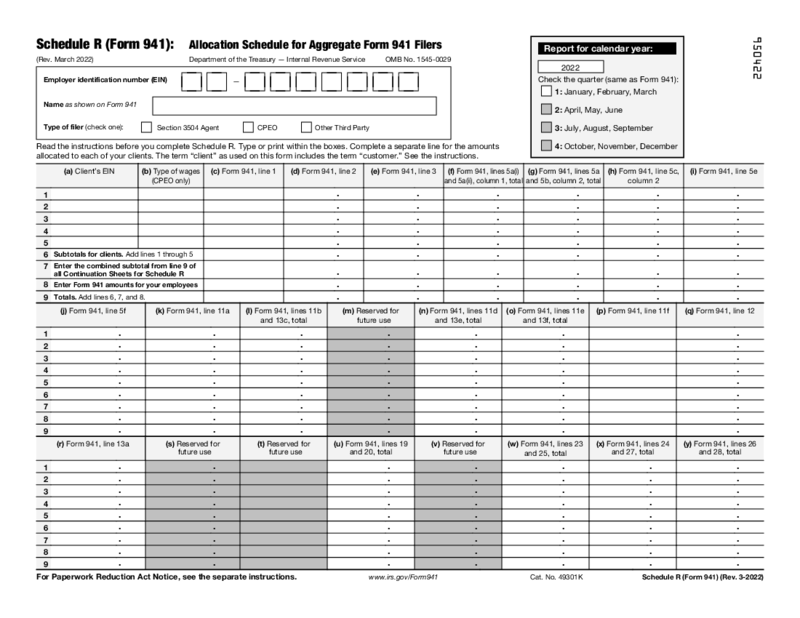

Form 941 (Schedule R)

How to Redact and Fill Out 941(Schedule R) Online

To redact and e-file form 941 Schedule R online, you should follow these steps:

Obtain a digital copy of the IRS form 941 Schedule R.

Open the Schedule R form 941 in a PDFLiner

Form 941 (Schedule R)

How to Redact and Fill Out 941(Schedule R) Online

To redact and e-file form 941 Schedule R online, you should follow these steps:

Obtain a digital copy of the IRS form 941 Schedule R.

Open the Schedule R form 941 in a PDFLiner

-

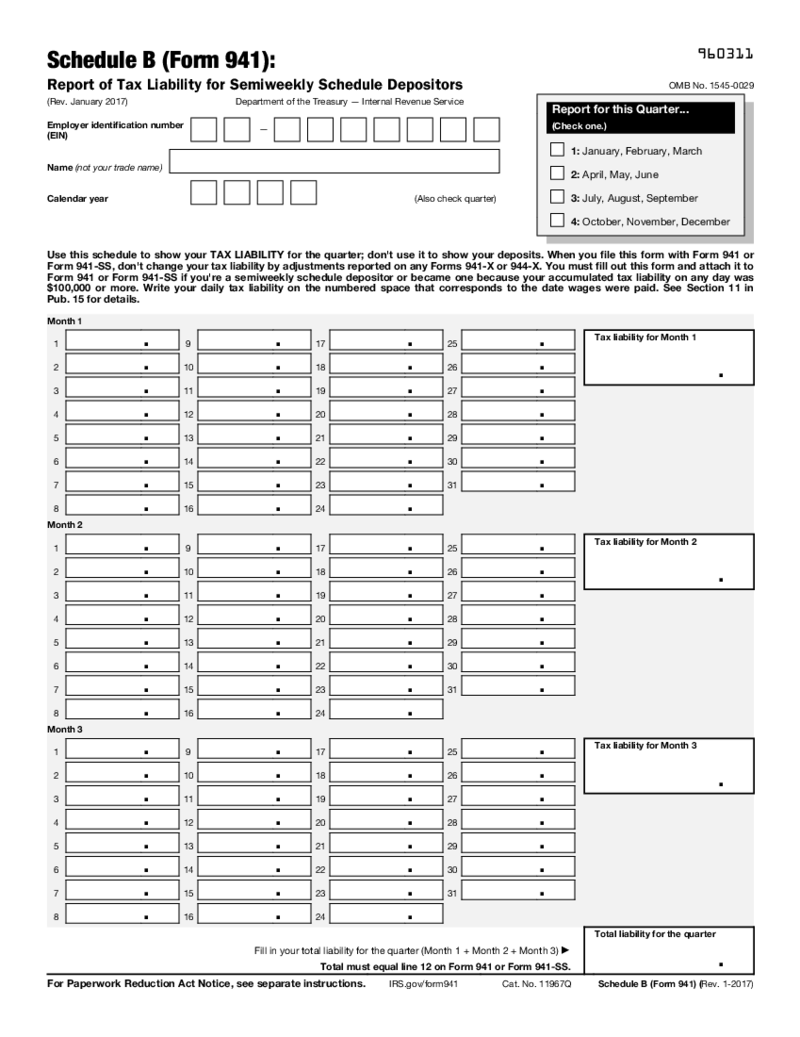

Form 941 Schedule B

What Is Form 941 Schedule B?

It’s a tax document that formalizes tax reports for semi

Form 941 Schedule B

What Is Form 941 Schedule B?

It’s a tax document that formalizes tax reports for semi

-

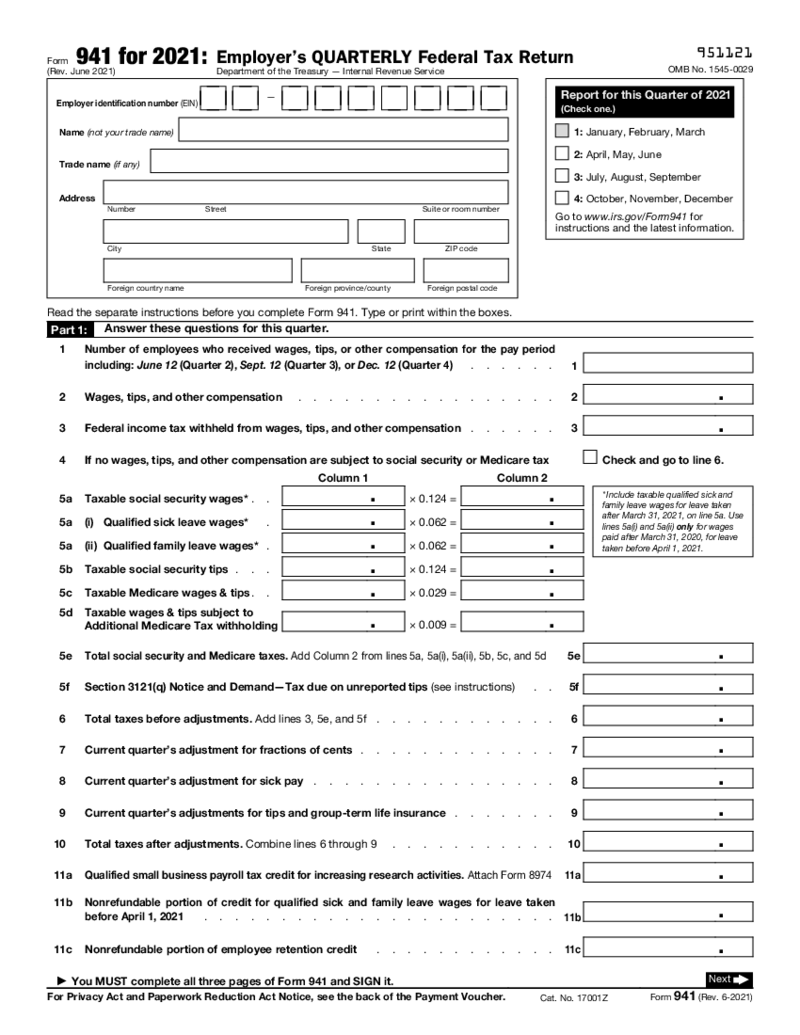

Form 941 (June 2021)

How to Find a Fillable Form 941 for 2021?

You can get the form online at here at PDFliner. To get the form Either hit the "Fill this form" button or do the steps below:

Enter your account.

Look for the “Form 94

Form 941 (June 2021)

How to Find a Fillable Form 941 for 2021?

You can get the form online at here at PDFliner. To get the form Either hit the "Fill this form" button or do the steps below:

Enter your account.

Look for the “Form 94

-

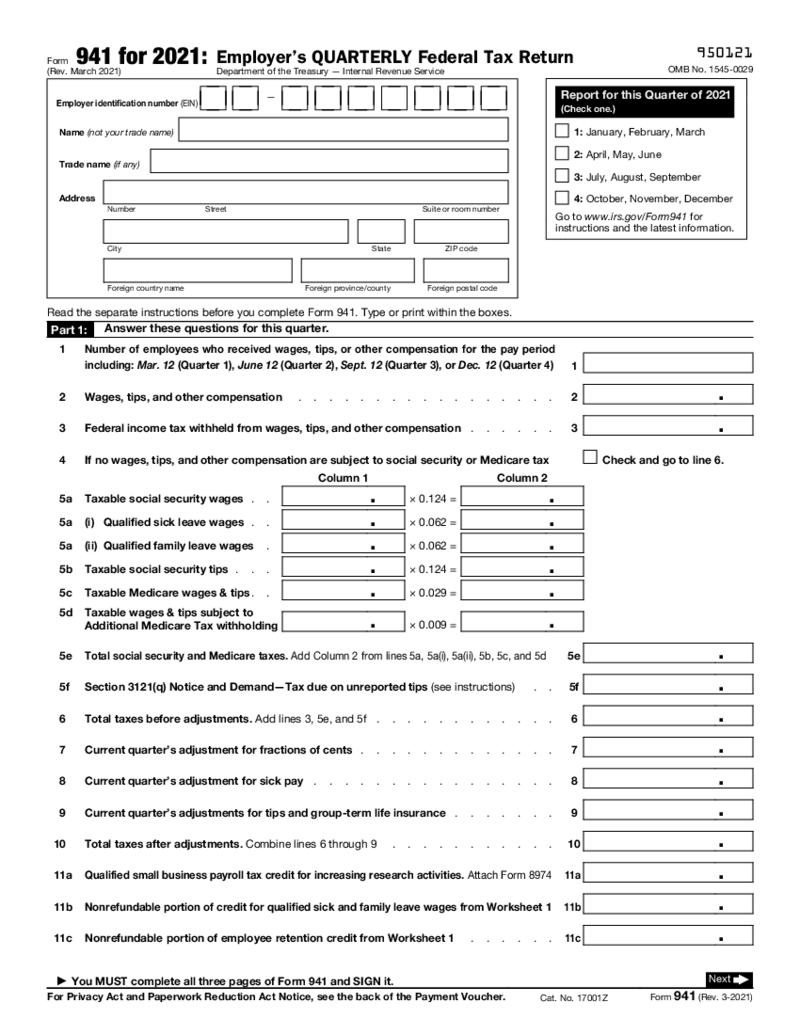

Form 941 (March 2021)

Can I still fill out Form 941 for 2021?

A Form 941 is a tax form used by employers to report their quarterly federal tax liability. You can still fill out Form 941 for tax year 2021. However, you will need to file a separate Form 941 for each qu

Form 941 (March 2021)

Can I still fill out Form 941 for 2021?

A Form 941 is a tax form used by employers to report their quarterly federal tax liability. You can still fill out Form 941 for tax year 2021. However, you will need to file a separate Form 941 for each qu

-

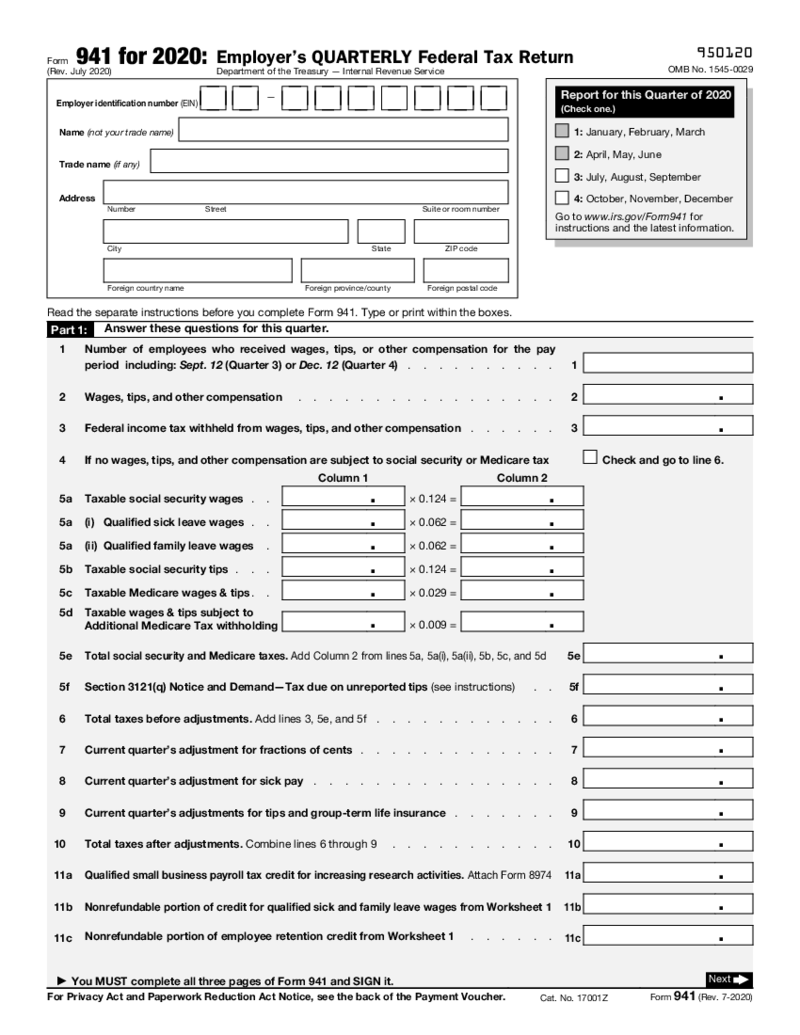

Form 941 (2020)

Where to Find a Blank Form 941 for 2020?

You'll be able to obtain the blank form from the PDFLiner catalog. To start filling out the form, click the “Fill this form” button, or if you would like to know how to find it here letter, follow t

Form 941 (2020)

Where to Find a Blank Form 941 for 2020?

You'll be able to obtain the blank form from the PDFLiner catalog. To start filling out the form, click the “Fill this form” button, or if you would like to know how to find it here letter, follow t

-

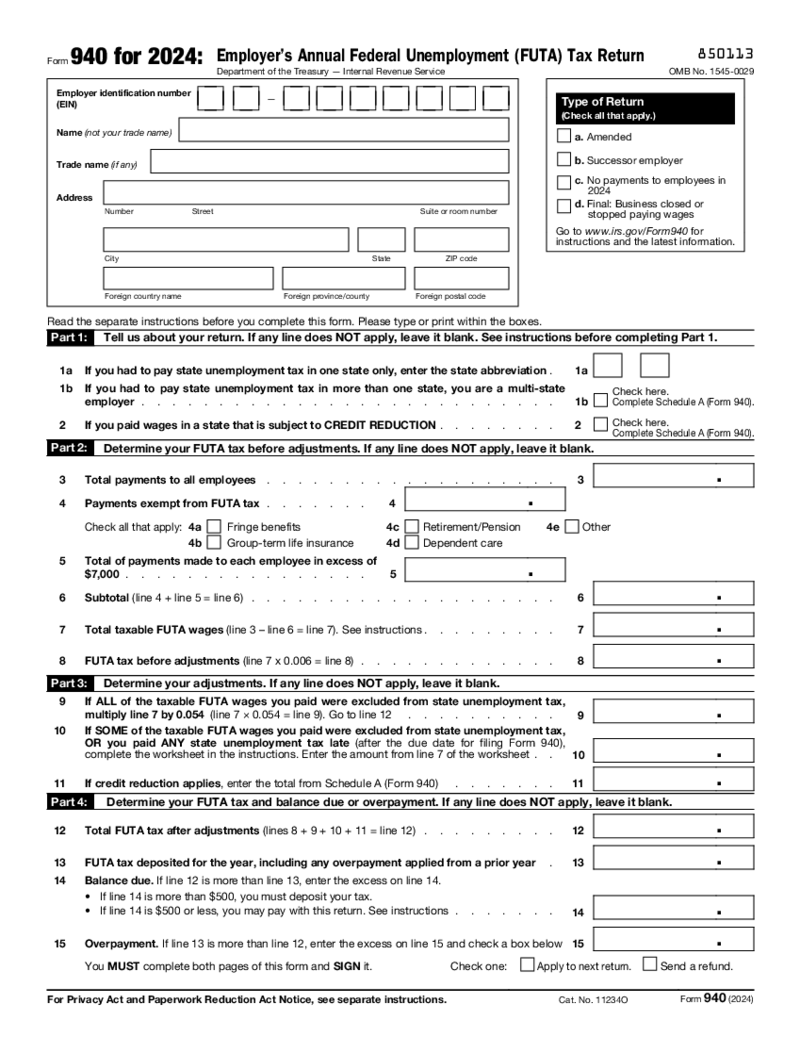

Form 940

What Is IRS 940 Form 2024?

IRS 940 Form is a federal non-fillable form by the Internal Revenue Service of the US. It is designed to provide comprehensive information about the IRS 940 fillable form. It allows you to get acquainted with the process of fili

Form 940

What Is IRS 940 Form 2024?

IRS 940 Form is a federal non-fillable form by the Internal Revenue Service of the US. It is designed to provide comprehensive information about the IRS 940 fillable form. It allows you to get acquainted with the process of fili

-

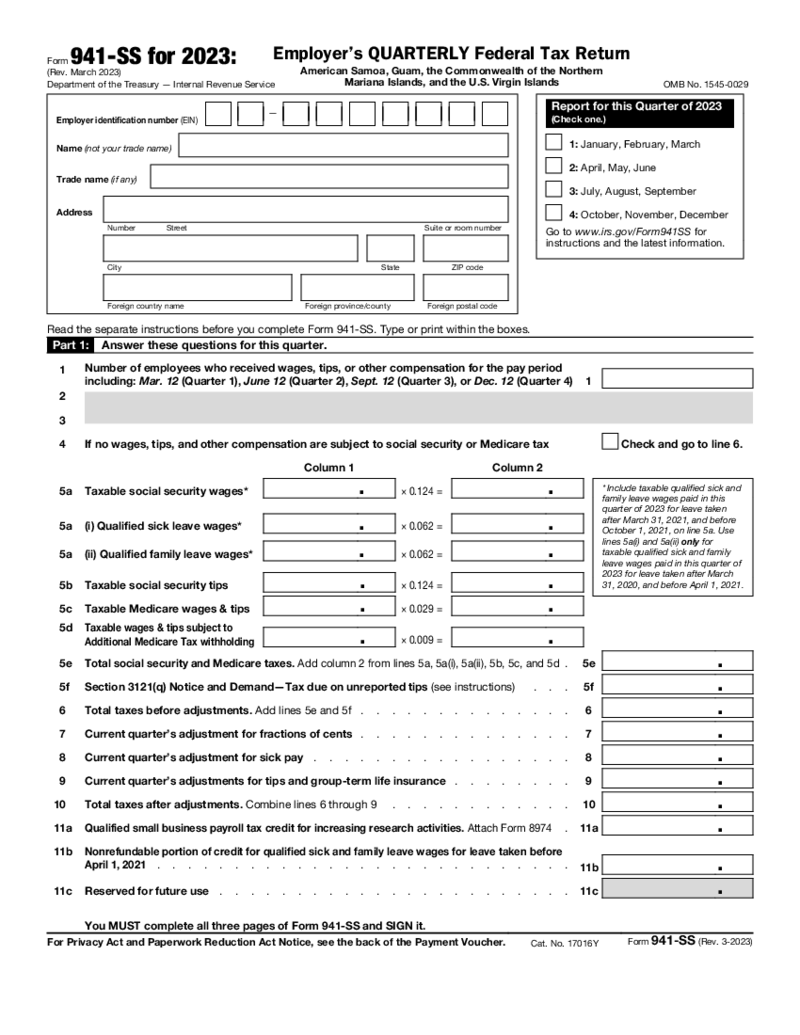

Form 941-SS

What Is 941 SS?

Also known as Employer’s Quarterly Federal Tax Return, it’s a form used for reporting social security and Medicare taxes for employees in American Samoa, US Virgin Islands, Guam, and the Commonwealth of the Northern Mariana Isl

Form 941-SS

What Is 941 SS?

Also known as Employer’s Quarterly Federal Tax Return, it’s a form used for reporting social security and Medicare taxes for employees in American Samoa, US Virgin Islands, Guam, and the Commonwealth of the Northern Mariana Isl

What Are Employment Payroll Taxes?

Upon hiring your first employee, you become obliged to deal with payroll tax. Despite the occasional singular form, payroll tax comes down to an array of taxes paid on employee’s wages. So, if you have staff members working for you, you’re going to need to deduct a part of their wages to pay taxes on their behalf, as well as pay payroll taxes on each of them out of your earnings. In this category, you’ll find employment tax form templates, along with brief outlines of some of the most widely used employment payroll tax forms.

Most Popular Employment Payroll Tax Forms

If you operate a small business without employees, paying payroll taxes for yourself is still a must. In this sense, it’s referred to as the IRS self employment tax. It’s relatively easy to deal with. But when you have employees, things with payroll taxes get a little bit trickier. Absolutely, withholding, submitting, and remitting payroll taxes can be complicated, but it’s definitely what you should delve into as a business owner. Below, you’ll find the most widely used forms in this context.

- Form 941. Known as Employer’s Quarterly Tax Return, this form is a must-submit four times per year if you’re a small business owner and have people working for you. When filling out the form, you’re going to need to indicate general details about your company, such as EIN, business name, and contact information. As you progress through the form, ensure you are most accurate when indicating employer identification number, tax period, filing status, and payment amount. Accuracy is paramount when it’s about all tax forms, be it self employment payroll taxes or property tax returns.

- Form 941-X. When describing the previous form, we’ve mentioned some of its most error-sensitive elements. So, in case you did make mistakes when specifying your employee’s identification number or, say, payment amount, Form 941-X is what you need. The template is used for correcting errors you’ve made on your 941 tax return.

- Form 4070-A. Also referred to as Employee’s Report of Tips to Employer, this document is used for reporting any tips your staff members receive while working for you. Irrespective of the form in which these compensation payments are received, employees need to report them when their monthly amount exceeds $20. This form is voluntary, but it ultimately helps keep your books in order.

- Form 941 Schedule B. It’s a file that documents tax reports for semi-weekly pay periods. A semi-weekly period is when wages are distributed two times a week, usually on initially agreed upon dates. Whether you’re planning to fill out a self employment tax form or an employer payroll tax form, PDFLiner is the best platform for your fastest and most effective digital file processing.

Do you know that time is money? You sure do. With that said, do your best to equip yourself with the highest-quality services for online document management. This approach is sure to boost your productivity, as well as your revenue.

Where to Get Employment Payroll Tax Forms

Are you rummaging the World Wide Web in search of these forms? Consider you’ve already found them. In our vast library of free online templates, you’ll lay your fingertips on top-notch pre-made fillable forms that cater to an array of industries and user needs. Launch the needed form in the blink of an eye and get the completion going right here and right now. Our editing tools are exceptionally useful and a cakewalk to master. On PDFLiner, you can also easily find federal self employment tax forms and fill them out online.

FAQ

-

Are payroll taxes and employment taxes the same?

More or less. Employment taxes include federal income tax, SS and Medicare taxes, as well as FUTA taxes. With regard to payroll taxes, the term is a bit broader, but in a nutshell, it covers a group of employment taxes that show up on your paycheck i.e., SS and Medicare.

-

Does the employer pay employment taxes at time of payroll?

Employer companies pay their share of payroll taxes on a monthly or semi-weekly basis. Whether it’s about employer payroll taxes or self employment payroll taxes, they should be withheld in a timely manner.