-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 941-X

Get your Form 941-X in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

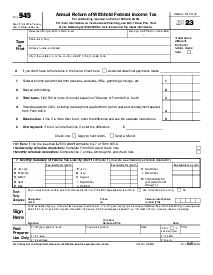

What Is Form 941 X 2020?

Want to know the basics about this form? We’ve got you covered. Let’s start with the definition. It’s a document utilized for correcting errors you’ve made on your 941 tax return. Keep reading for more information about the purpose of Form 941 X, as well as instructions on how to fill it out, and where to file it.

What I Need 941-X Form For?

The purpose of this specific form is straightforward: it serves for correcting mistakes made on form 941. Whether you’re here to make the most of this particular document or you’re on the prowl for other tax templates, our extensive catalog of online forms is available for free on the around the clock basis. Use PDFLiner to adjust, share, and digitally sign your documents without having to scan or print them out. Say good-bye to paper-based document workflow. Go digital and save heaps of your time.

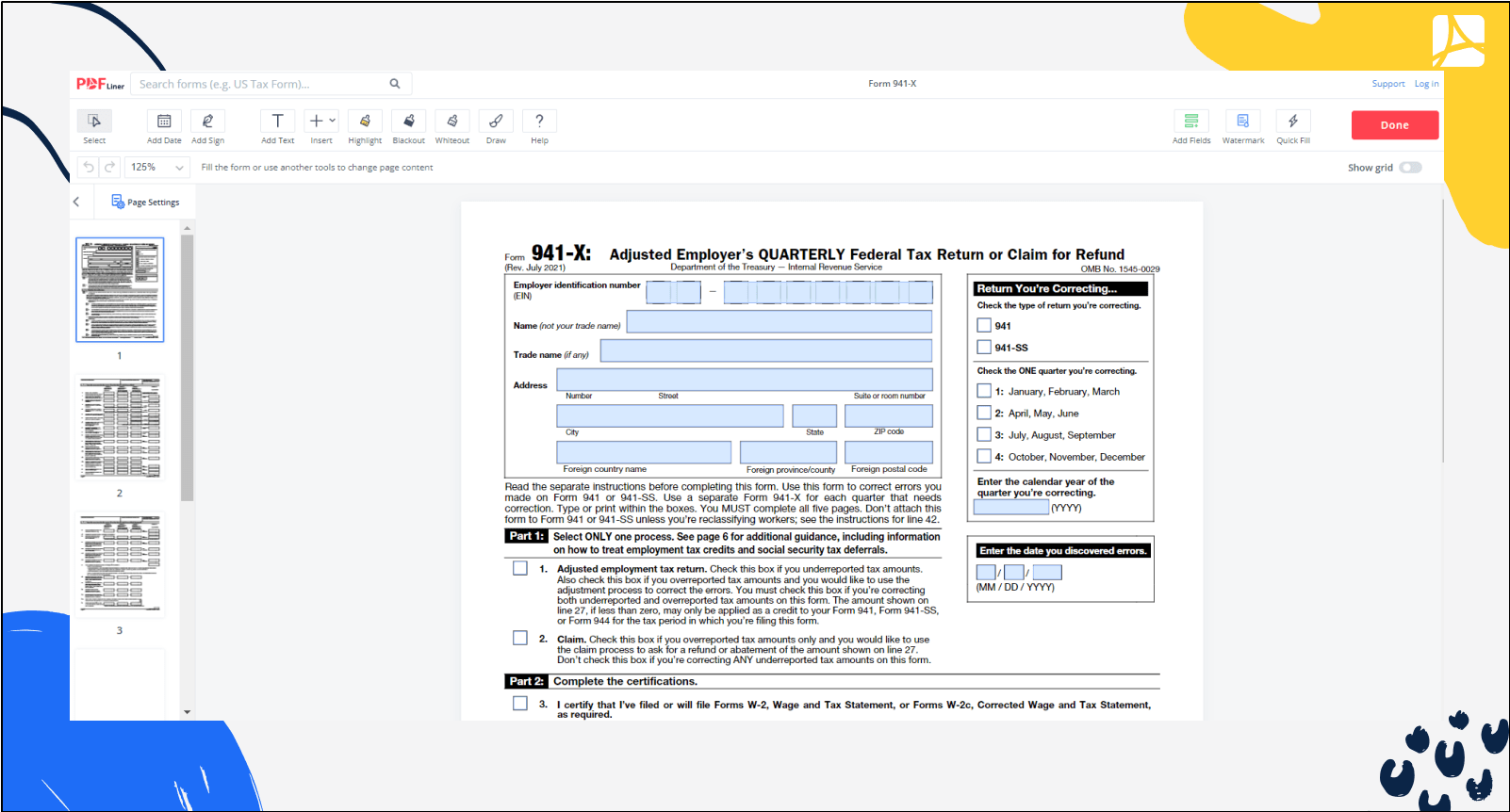

How to Fill Out Form 941 X PDF?

In case you come across any difficulties completing this six-pager, you can always turn to professional bookkeeper help. Here’s what should be indicated in this document:

-

Employer identification number.

-

Name, trade name, address.

-

The type of return you’re correcting.

-

The date when you discovered errors.

-

Certifications.

-

The corrections for the current quarter.

-

Correction explanations.

-

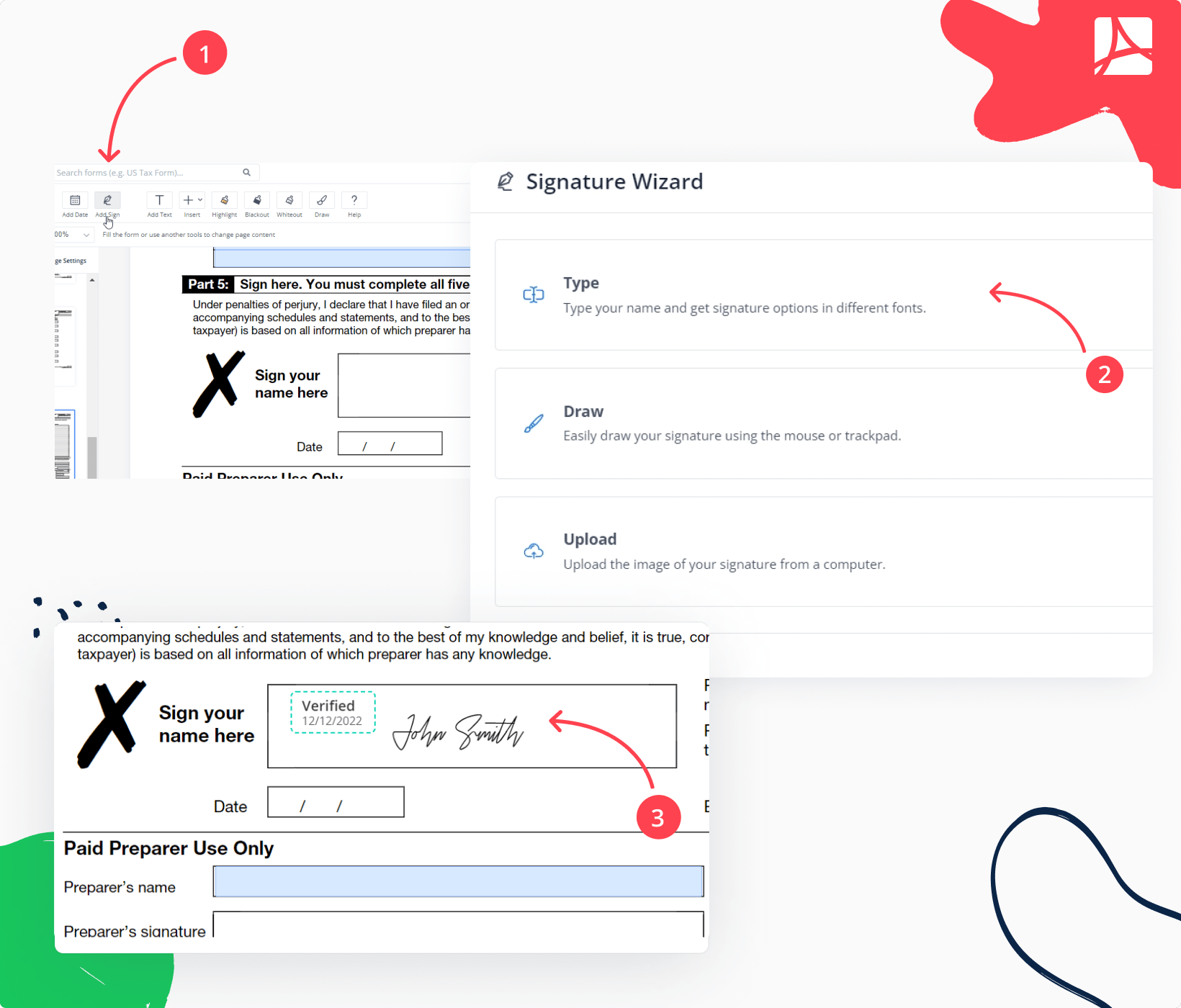

Your signature.

So, have you finally decided to switch to managing your administrative affairs online? That’s doubtlessly the right choice. Fill out any industry-specific form you need via PDFLiner. That way, you’ll speed up your document workflow tremendously and free up your time to focus on other vital tasks like effective leadership and making money. With our online PDF management system, you get to skyrocket your document management to stardom.

Organizations That Work With the Printable 941-X Form

-

IRS.

Fillable online Form 941-X