-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 941 (March 2025)

Get your Form 941 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is 941 Form 2026?

941 fillable form is submitted by employers to report the taxes that were withheld from employees’ wages. It can be income taxes, Medicare tax, social security tax, etc.

What do I need a fillable 941 form for?

- You must fill out this form if you meet the following conditions:

- You are an employer;

- You need to report taxes withheld from employees’ wages: federal income tax, Medicare tax, social security tax, and income taxes.

Please note that the form also has a Payment Voucher. Complete it only if you make a payment with the 941 forms. If you are looking for a printable form 941 in PDF format, you found the right service. With PDFLiner you can easily fill out the form and click "Print" in the "Done" menu if you need a paper version.

Filing Considerations for 941 Tax Form 2026

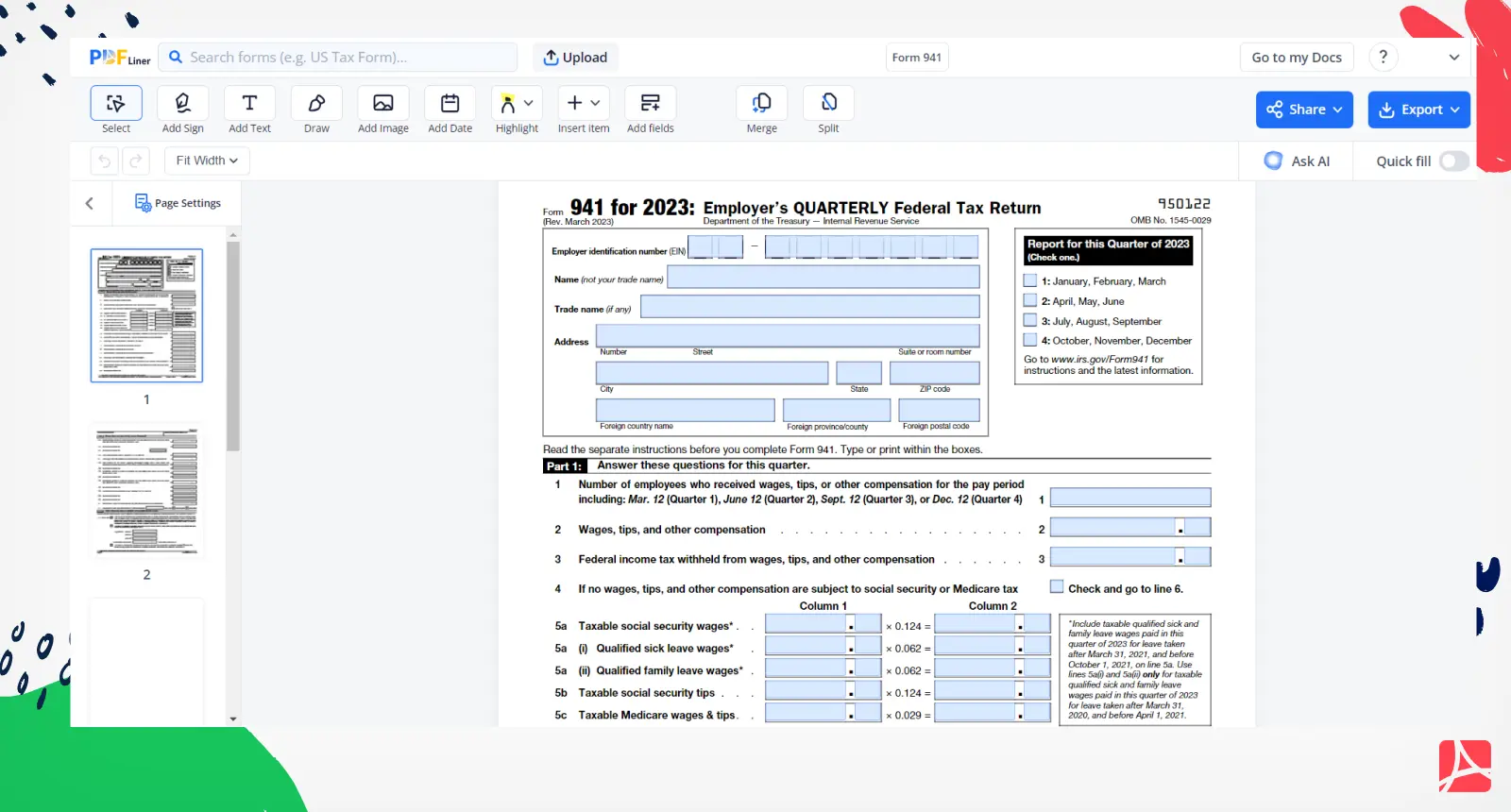

First of all, open a blank 941 form. At the top of the first page of the form, you need to enter the basic information about your company, such as EIN, name, trade name, and address. As the form is submitted each quarter, check the right quartal in the right box. The form has five parts:

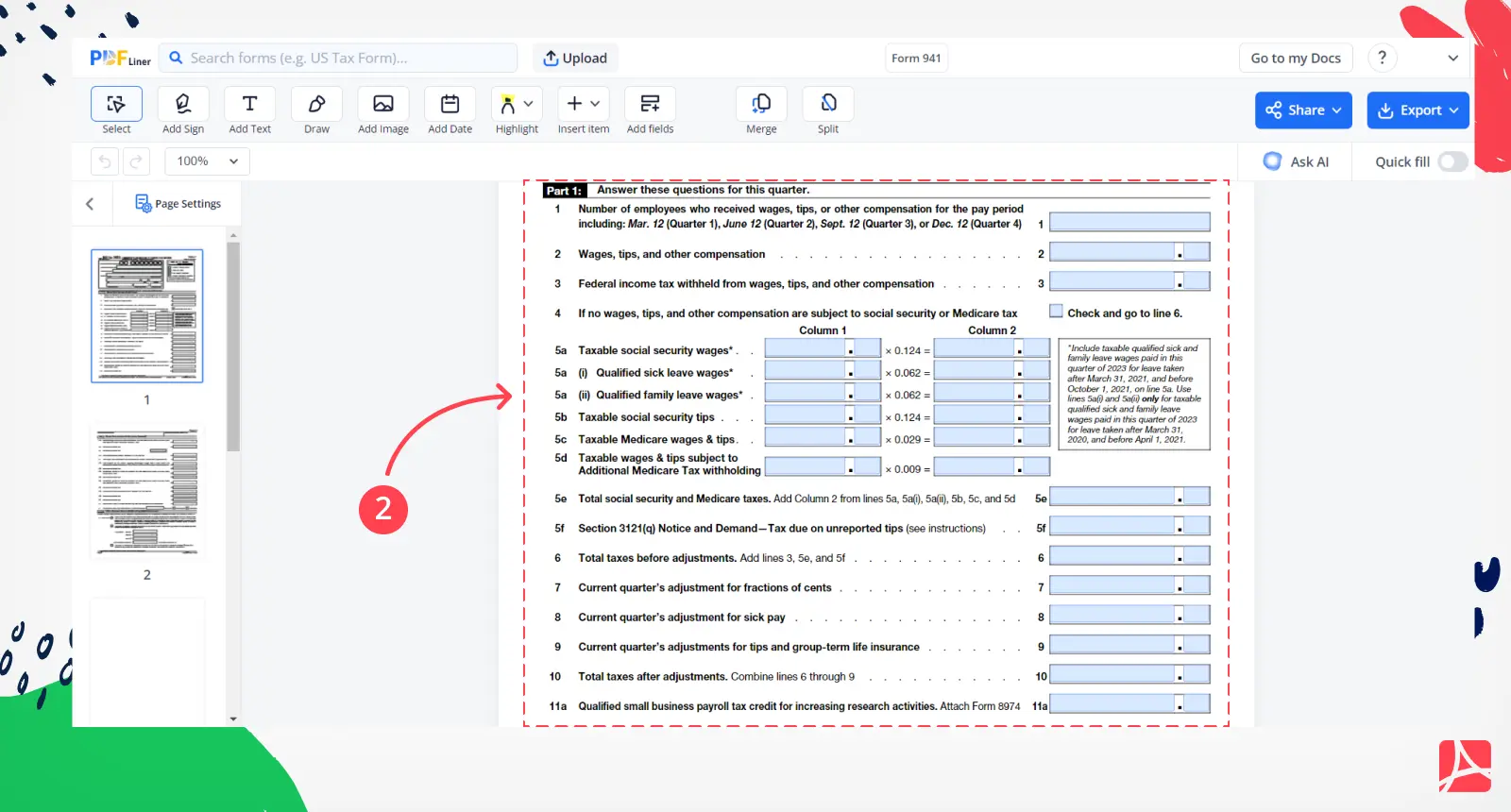

- Part 1 consists of the 15 questions related to your quartal activity;

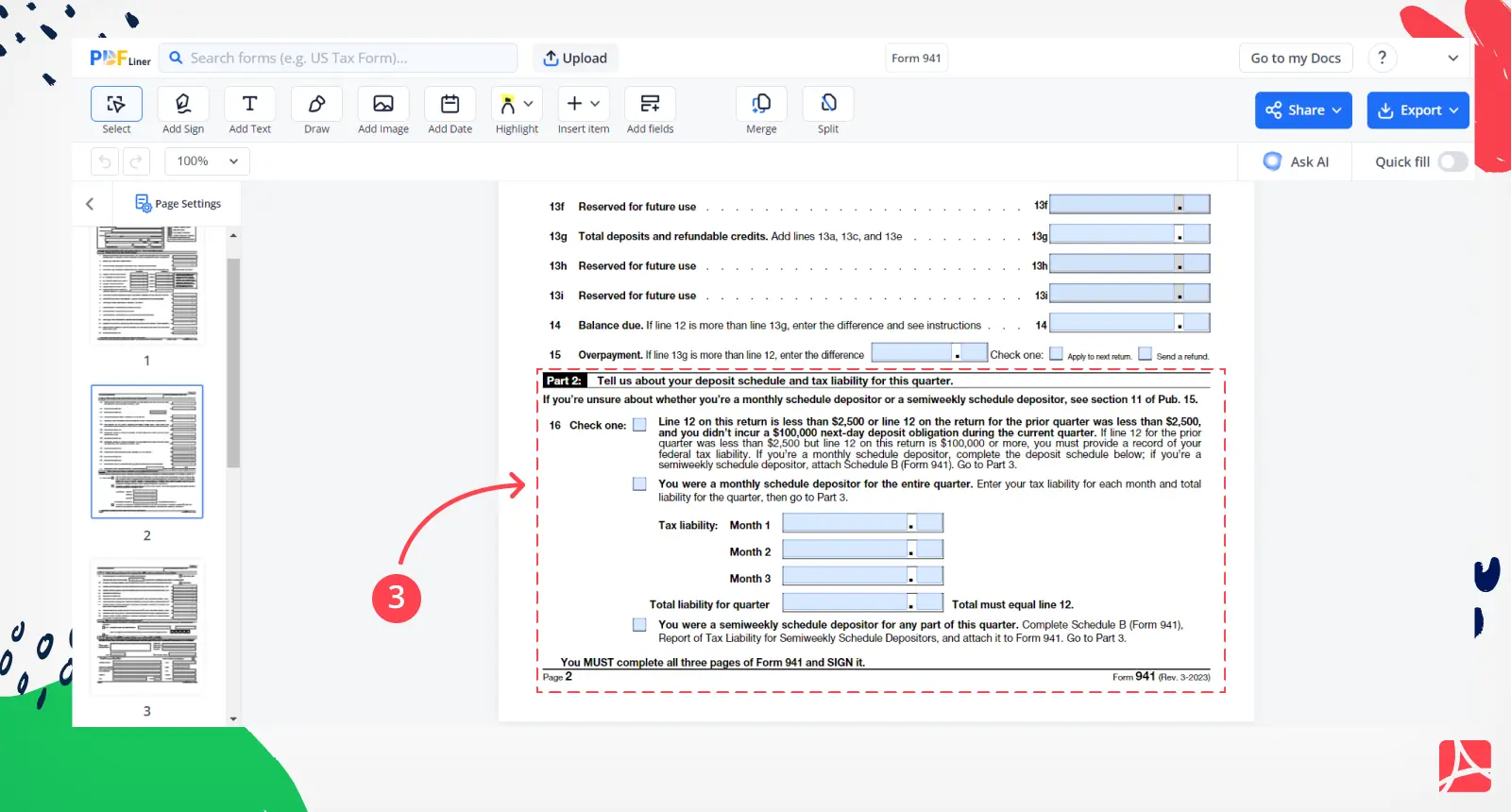

- In Part 2, you need to provide the information about your deposit schedule and tax liability;

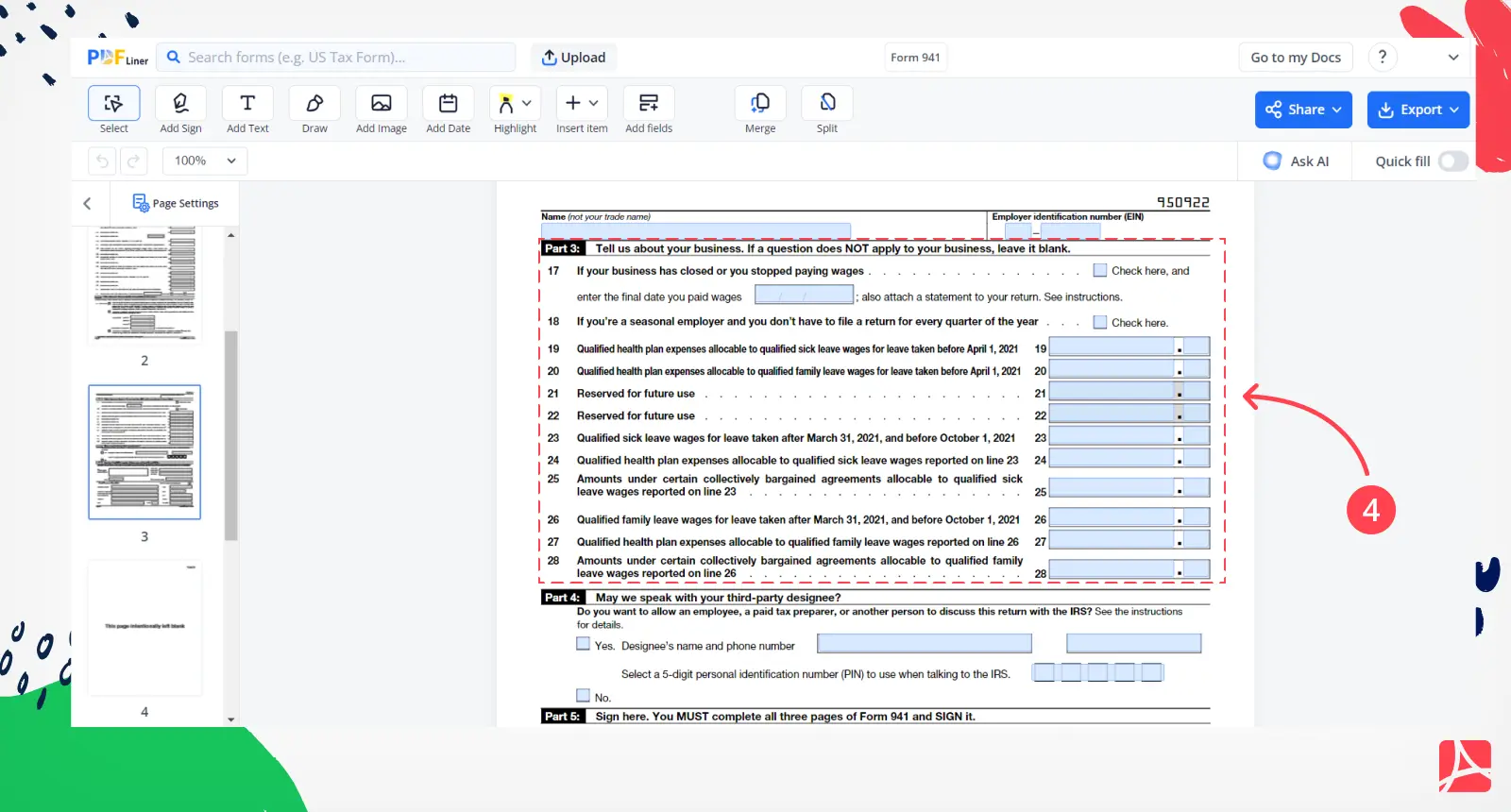

- Part 3 must be filled only if the questions contained in this section are related to your business;

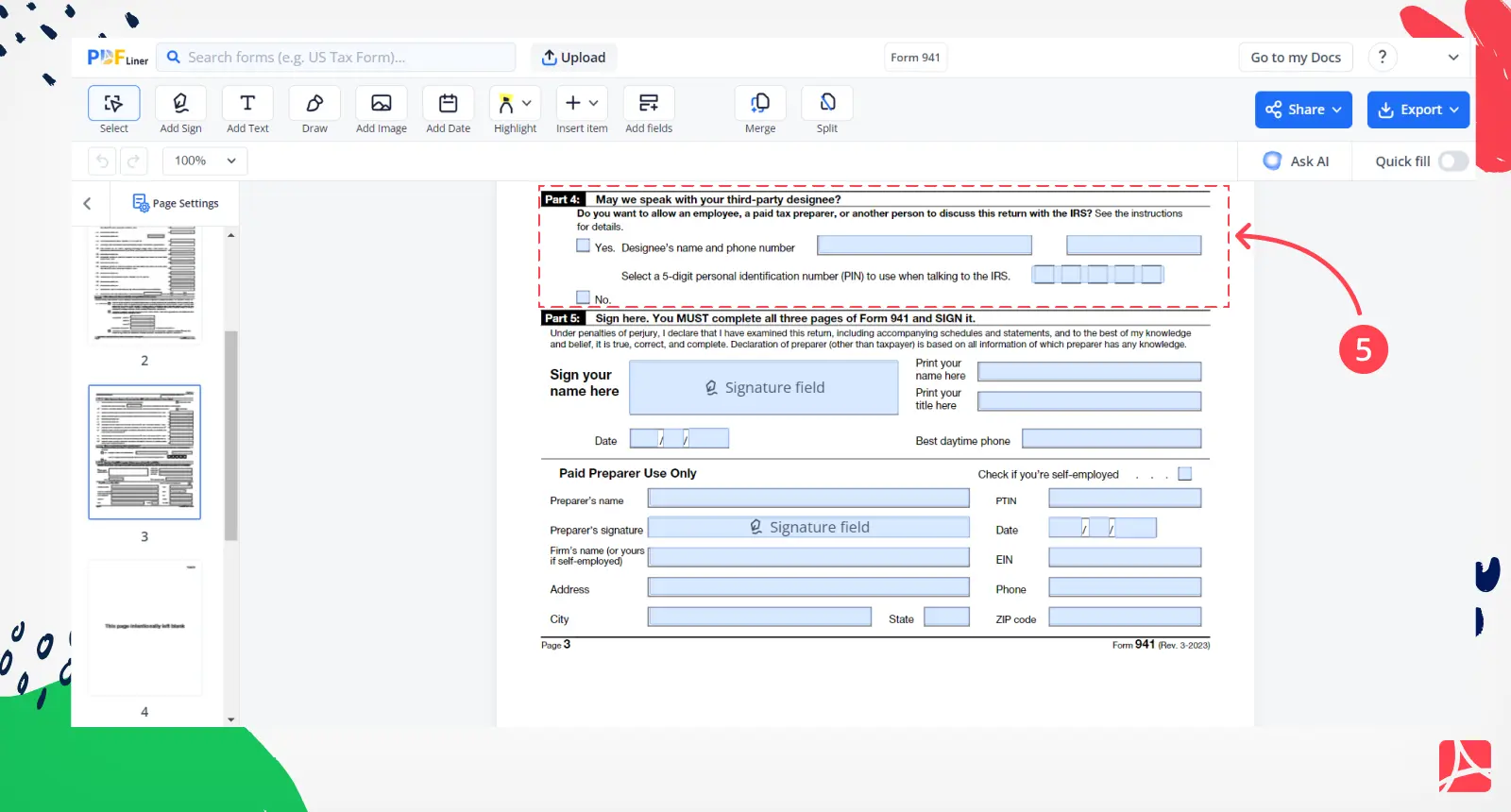

- Part 4 is about third-party designee;

- In Part 5, sign the form.

Also, there is a Payment Voucher. You need to complete it only if you pay with the IRS form 941.

Common Mistakes to Avoid While Filling out IRS Form 941

IRS Form 941 is used to report payroll taxes. The form includes information about the employer's tax liability, as well as the amount of taxes that have been withheld from employees' paychecks.

There are a few common mistakes that taxpayers make when filling out Form 941. These mistakes can lead to errors on the form, which can result in penalties and interest charges.

Here are four mistakes to avoid while filling out IRS Form 941:

1. Incorrect Employer Identification Number

The first mistake that taxpayers make is using the wrong Employer Identification Number (EIN) on the form. The EIN is a nine-digit number that is assigned to businesses by the IRS. The EIN can be found on the business's most recent tax return.

2. Incorrect Tax Period

Another mistake that taxpayers make is using the wrong tax period on Form 941. The tax period is the time frame that is covered by the form. The tax period can be found on the form itself.

3. Incorrect Filing Status

Another mistake that taxpayers make is using the wrong filing status on Form 941. The filing status is used to determine the amount of taxes that are owed. Taxpayers should make sure that they use the correct filing status when filing Form 941. The filing status can be found on the form itself.

4. Incorrect Payment Amount

The final mistake that taxpayers make is using the wrong payment amount on Form 941. The payment amount is the amount of taxes that are owed. Taxpayers should make sure that they use the correct payment amount when filing Form 941. The payment amount can be found on the form itself.

Organizations that work with form IRS 941

- US employers;

- IRS.

IRS Form 941 Resources

- Download 941 form blank

- Instructions for the Requester of Form 941

- How to fill out 941

- How to get Form 941

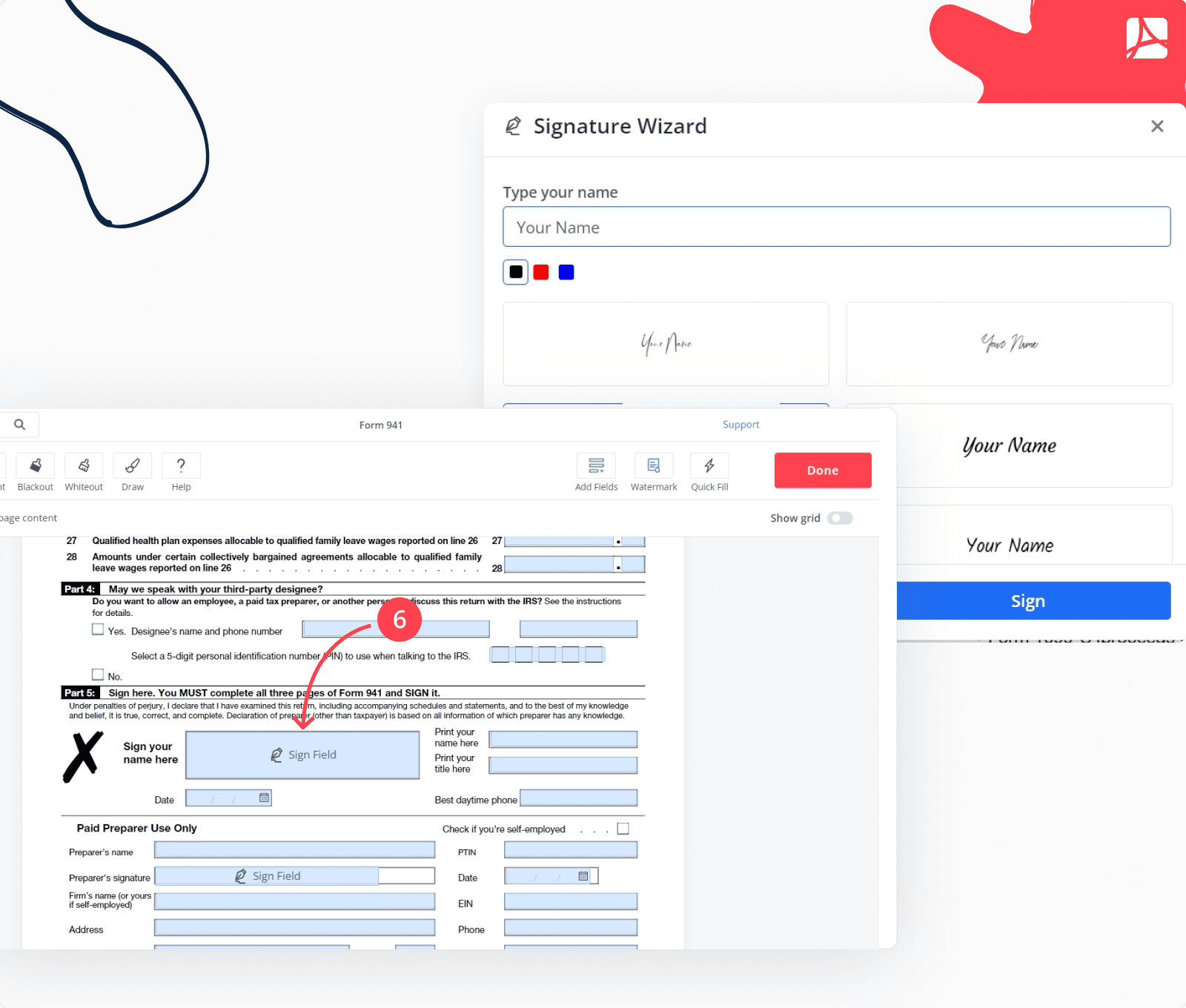

- How to sign Form 941

How to Fill Out Form 941? Quick Step-by-step Guide

Step 1: Fill in your personal information as an employer in the box at the beginning of the paper and indicate the reporting period.

Step 2: In Part 1, include data about your employees: their total number, tips received (as well as any other compensation), and the tax taken from them. Follow the directions to calculate the number of taxable wages and tips. To fill in lines 11-15, you need data from other tax forms.

Step 3: The 2nd Part is devoted to describing your financial situation during the reporting quarter. Check the box that suits you.

Step 4: In Part 3, mark the lines that best suit your business. If a statement does not fit the situation, leave it blank.

Step 5: If you wish, in Part 4, you can leave the contact details of your authorized person.

Step 6: Once you entered everything, carefully check all the information and sign the form by clicking the Sign Field.

Form Versions

2024

Fillable Form 941 (March 2024)

2022

Fillable Form 941 (June 2022)

FAQ: 941 Form Fillable Version Popular Questions

-

When to report Form 941?

The 941 PDF form filing schedule depends on the size of your business. If you have more than $1 million in annual payroll, you must file quarterly. If you have $50,000 or less in annual payroll, you may file annually.

-

When is Form 941 due?

Form 941 is one of those papers that is filled out every quarter rather than once a year. It should be sent at the end of each quarter, that is, on the last day of April, July, October, and January. In January, you submit documents for the previous year.

-

How to amend Form 941?

Especially for those who made a mistake in the sent papers, the IRS offers Form 941-X, with which you can make data corrections. Please note that you need to specify in detail and clarify what exactly needs to be fixed and why.

-

Who can sign Form 941?

It depends on who is authorized to complete this document on behalf of the company. It can be a personal owner, a corporation president or vice president, a partner or member of an LLC, etc. Also, the form should be signed by a paid preparer or authorized agent of a taxpayer.

-

How to get a fillable 941 Form?

You can download the latest version of the document along with the instructions from our library. The fillable form is also available on the official website of the tax office.

Fillable online Form 941