-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

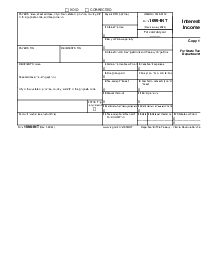

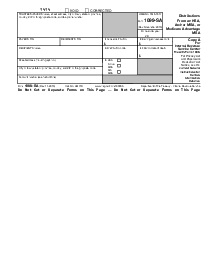

Fillable Form 1099-INT (2022 - 2023)

Get your Form 1099-INT (2022 - 2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Introduction to Form 1099-INT 2022-2023

Form 1099-INT documents taxpayers receive from banks or other financial institutions that have paid them interest totaling $10 or more during the tax year. It encompasses various types of interest income, such as interest from savings accounts, interest-bearing checking accounts, and U.S. Savings Bonds. Understanding and accurately reporting this income on your tax return is crucial for lawful tax compliance and optimizing your financial outcomes.

Who Receives Form 1099-INT

Typically, any individual who earns $10 or more in interest from a financial institution during the tax year will receive a Form 1099-INT. This form not only serves as a record for the taxpayer but also informs the IRS of the amount of taxable interest income the taxpayer has received, ensuring transparency and accountability in reporting.

Key Considerations for 2022-2023

For the tax years of 2022 and 2023, it's important to pay close attention to any updates in tax law or reporting requirements that may affect how you report interest income. While the core purpose of Form 1099-INT remains the same, minor adjustments to tax regulations can impact your tax obligations and potential deductions or credits related to interest income.

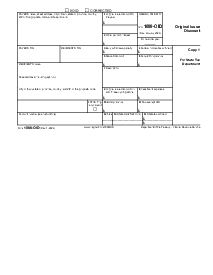

1099-INT Reporting and Compliance

Receiving a Form 1099-INT necessitates including this information on your federal tax return. Interest income is generally taxable at the federal level and, depending on your state, may also be taxable at the state level. Filing accurately is paramount to avoid potential discrepancies with the IRS, which could lead to audits or penalties.

Review Your Form: Double-check the information for accuracy as soon as you receive your Form 1099-INT. If you discover errors, contact the issuing institution promptly to correct them.

Understand Where It Goes: Report the interest income shown on your Form 1099-INT on your IRS Form 1040. The specific line to report this income may vary, so referencing the latest tax instructions or consulting with a tax professional is advisable.

Consider the Impact on Your Tax Return: The addition of interest income can affect your overall tax situation. It may increase your taxable income and, consequently, your tax liability. However, certain types of interest, like that from some U.S. bonds or savings bonds used for education, may be exempt from taxation under specific conditions.

Filing Deadlines

Be mindful of the annual tax filing deadline, typically April 15, to avoid incurring any late filing penalties. Ensure that all documents, including Form 1099-INT, are organized and ready for submission to streamline the filing process.

Fillable online Form 1099-INT (2022 - 2023)