-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

25 min

Schedule C (1040) 2024-2025

Calculate your profit or loss with a simple and secure form-filling tool. Fill it out, sign, print it, and mail it to the IRS with your 1040.

2024

2022

Show form versions

In Profit or Loss, Schedule C Is Here For You

1. Fill Out Schedule C

20 min

Input your personal details, income information, deductions, and credits easily with our user-friendly interface.

2. Print or Share

2 min

Click the “Export” button and choose “Print File” or choose the “Share” option to send to your tax advisor.

3. File to the IRS & Keep For Records

5 min

Mail Schedule C along with your 1040 Form to the IRS and store the electronic copy in your Dashboard for future reference.

What you need to know:

- 📎 Prepare all the information you have about your business's income and expenses (receipts, bills, invoices, 1099 Forms)

- 📎 Don't forget about online sales with all the returns or allowances.

- 📎 If you are a freelancer or contractor without an inventory and complicated deductions you can prepare the form by yourself.

- 📎 Schedule C should be filed along with all other tax return forms on April 15, 2024.

- 📎 You also need to complete Form 1040, Schedule 1 and Schedule SE.

- 📎 Double-check all the information and calculations before entering the result on other forms.

- 📎 For multiple business or professional activities, complete separate Schedule C for each.

- 📎 To deduct the use of your home for business fill out Form 8829 and don't add these expenses to Schedule C Part II.

When To Use Fillable Schedule C 2024 - 2025

Schedule C is an addition to Form 1040 for:

- 1. Small business owners;

- 2. Independent contractors;

- 3. Freelancers;

- 4. Statutory employees;

- 5. People who earn money from a hobby.

Businesses and professionals who work as sole proprietors use it to report income or loss for a year. It's also known as Profit or Loss From Business for Sole Proprietorship.

Per Internal Revenue Service, the profit or loss statement should be filed if your activity qualifies as a business:

- 1. The main purpose of the activity is meant for income or profit.

- 2. The activity is continuous and regular.

The most common examples of self-proprietors are financial consultants, freelance designers, writers, photographers, artists, local bakeries, small shops, etc.

Note:

You don't have to fill out Schedule C if you earned a one-time-only payment of less than $600 for your hobby and didn't receive a 1099 Form for this payment. In all other cases, you should use Schedule C if you received income shown on 1099-NEC or 1099-MISC.

Schedule C Due Dates

Schedule C is due on the same date as your tax return. If you file your tax return electronically, you have until the due date of the return (including extensions) to file Schedule C.

In 2024, the tax return is due on April 15 unless you file for an extension. If you file Form 4506-T, you can get a 6-month extension and submit your tax return on October 15.

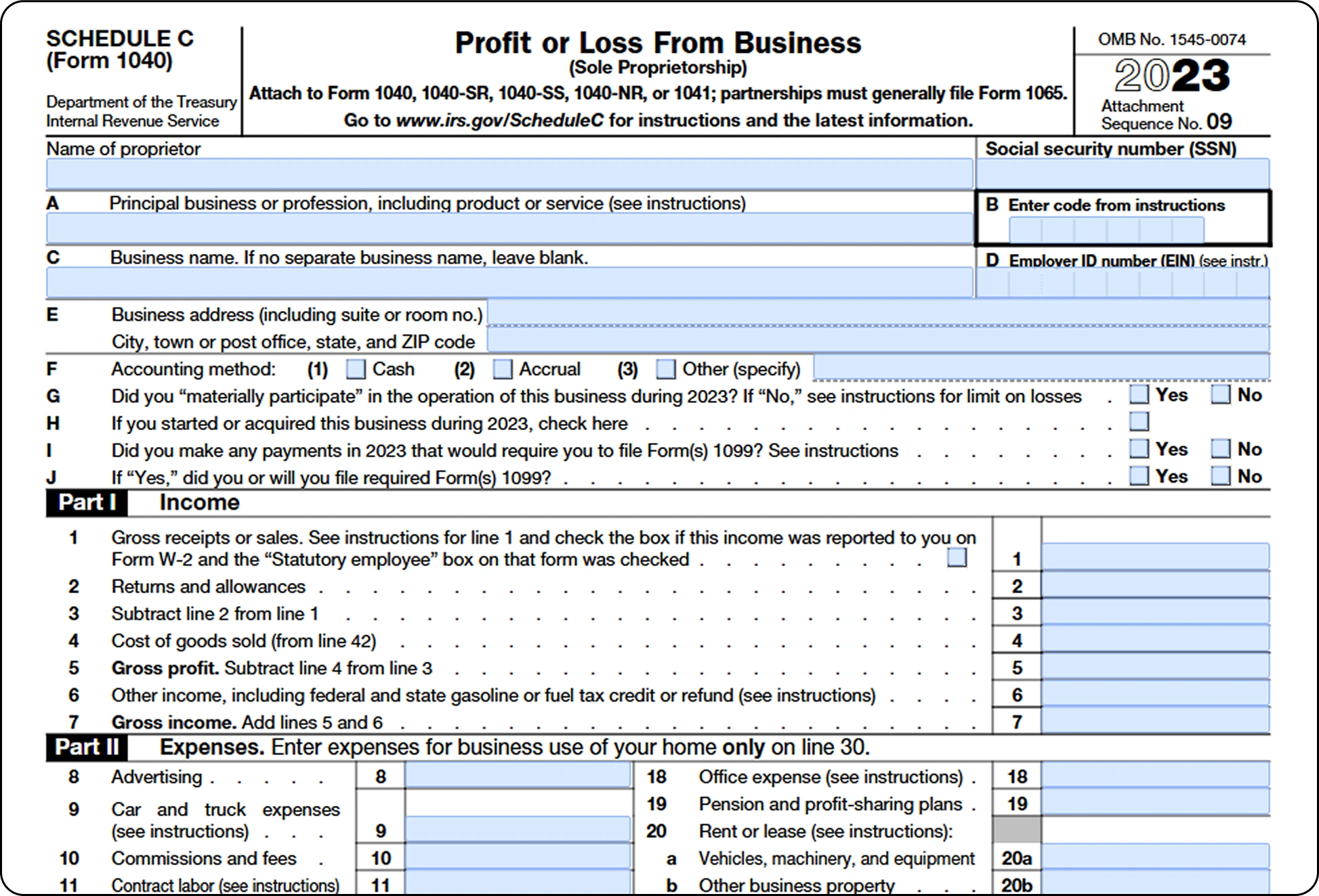

How To Fill Out a Schedule C Form 1040

Step 1: Prepare information

This step is crucial to accurately reporting your income and expenses, which affects your tax liability and potential deductions. Here's how to prepare:

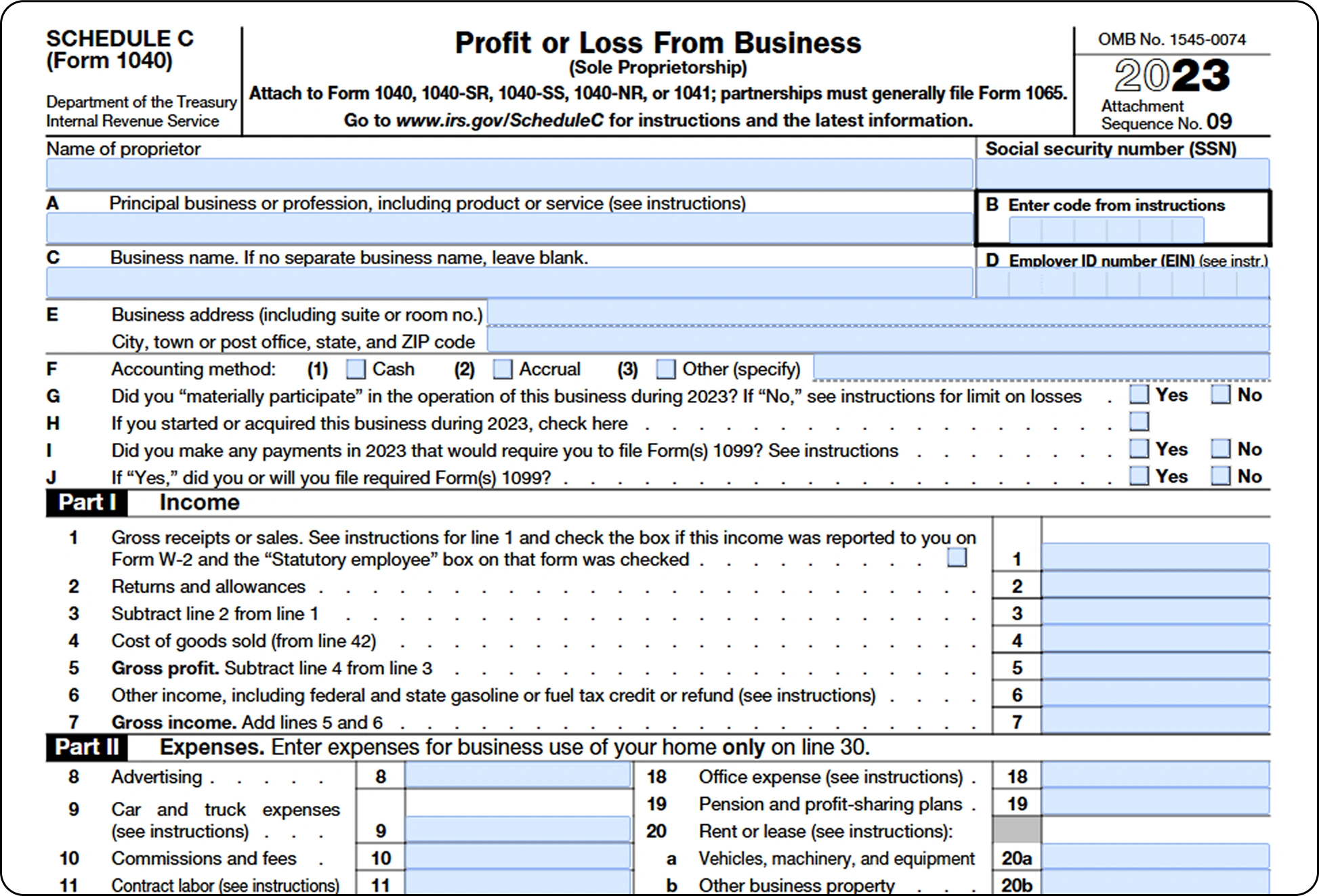

- 1. Gather Basic Information such as your SSN or EIN, business name, address, accounting method (usually cash or accrual), and IRS business code that accurately describes your type of business.

- 2. Collect records of all business income received during the year. This includes sales of goods, services rendered, and other income sources related to your business activity.

Note:

Make sure to include online sales with all the returns or allowances.

- 3. Gather all your expenses: receipts, invoices, bank and credit card statements, and records of all business-related expenses.

- 4. Categorize your expenses as accurately as possible (e.g., advertising, supplies, utilities, home office expenses).

- 5. If your business sells products, you must record inventory at the beginning and end of the year. This helps calculate the cost of goods sold (COGS), which is crucial for businesses with inventory.

- 6. If you use your vehicle for business, maintain a detailed log of business-related mileage, gas, repairs, insurance, and other associated costs.

- 7. If you use part of your home exclusively for business, measure the square footage of your workspace to calculate the deduction accurately.

- 8. If you filed a Schedule C for 2022, review it. It can serve as a helpful guide in organizing your records and ensuring consistency in reporting.

Having all your Schedule C information ready ahead of time will make the whole process a lot easier for you. You'll catch all the deductions you deserve and get your taxes right. Think of it as doing future-you a solid for a relaxed tax filing.

Step 2: Get Printable Form 1040 Schedule C

Click the “Fill out Schedule C” button and start the process right there in the user-friendly editor with the support of AI Assistant.

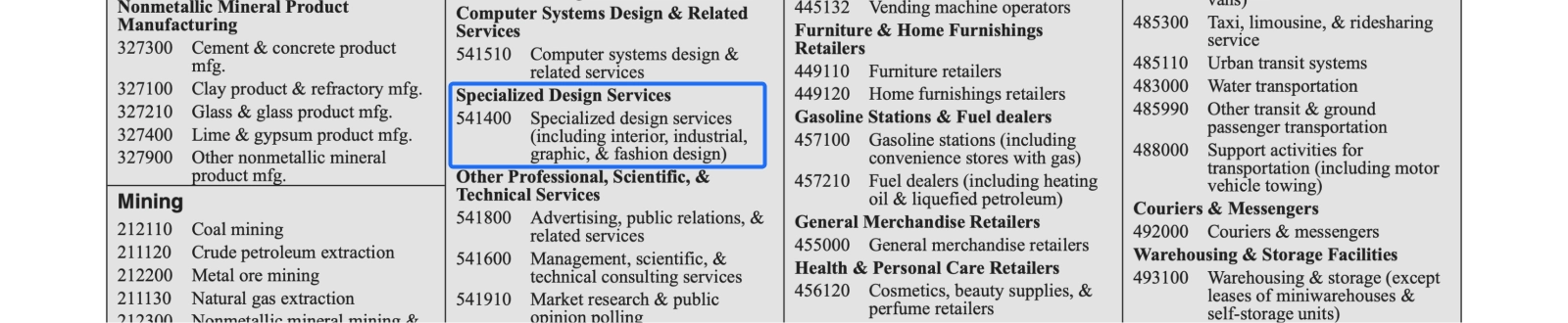

Step 3: Start with your business info

Provide your personal information and the data on business or profession:

- Name of proprietor: Write your full name here.

- SSN: Enter your Social Security Number.

- Line A: Describe your main business or professional activities and the product or service for which you receive income.

Note:

If you have multiple business or professional activities, complete separate Schedule C for each.

- Line B: Find an IRS code for your business activity and write it here.

- Line C: If your business's name differs from yours, add it here.

- Line D: Write your Employer ID Number, if you have one.

- Line E: Provide your business address. If you have a home office, then specify your home address here.

In this example, David Brown is a freelance graphic designer. He fills out his name, SSN, writes about his professional activity, and finds his business code in the IRS instructions.

He leaves lines C and D blank because he doesn't have EIN or a separate business name. Then writes his home office address on Line E.

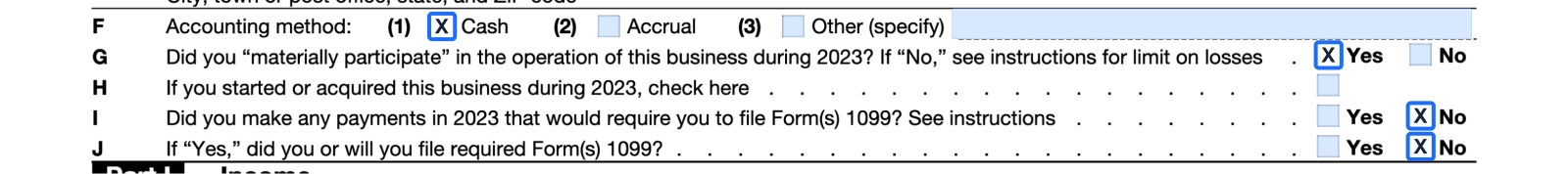

Step 4: Accounting method and questionnaire

First of all, choose the accounting method that applies to you. Here are the simple explanations:

- Cash Method: Imagine your business as a giant piggy bank. Every time someone puts money into it (pays you for your goods or services), you count that as income. And each time you take money out to pay for something (expenses), you count that as an expense. You only record the money when it moves in or out, like real cash changing hands.

- Accrual Method: Think of your business as keeping a diary this time. Every time you make a sale or provide a service, even if you have yet to be paid, you write it down as income. And whenever you receive a bill or owe money for expenses, even if you still need to pay it, you mark it as an expense. Here, it's all about when the income or expense happens, not when the cash is exchanged.

- Other Methods: This is like a mix-and-match approach. There are special rules for certain types of businesses or situations where both the cash and accrual methods partially capture what's going on. These could involve different ways of recording income or expenses based on the specifics of the business or industry.

Next, check the boxes answering the questions on Lines G - J.

David chooses a cash accounting method as he receives payment for his services as soon as he finishes the job and doesn't issue invoices for his work. And answers all the questions.

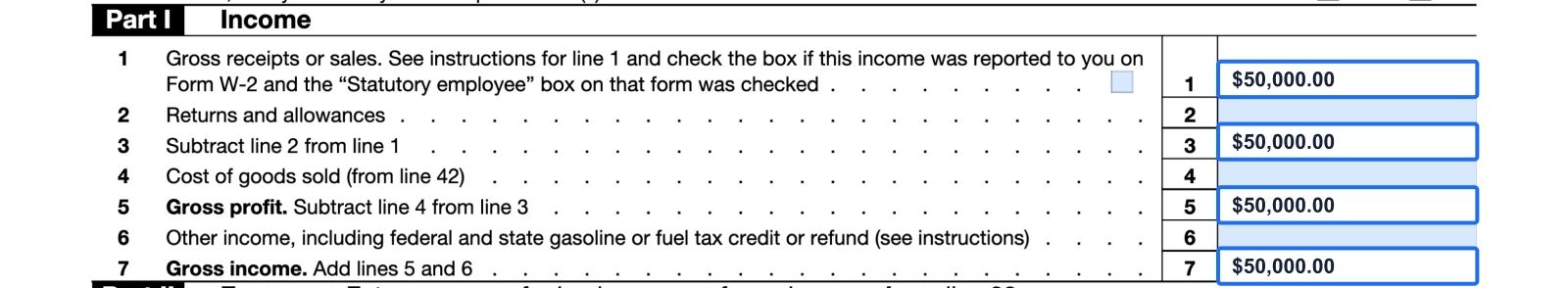

Step 5: Income section

In this section, we calculate our business's gross profit and gross income:

- Line 1: Calculate your gross receipts, 1099s, or sales during the year. In this example, David gathered all the 1099s that his clients sent him and got the amount of $50,000.

- Line 2: If you did any refunds to your customers during the year, calculate the amount and report them here.

- Line 3: Calculate your total income by subtracting line 2 from line 1. Since David had no returns, he copied the amount from line 1.

- Line 4: To complete this line, you would need to move to Part III of the form and calculate the cost of goods sold. This calculation is needed only if your business or profession requires inventory, materials and supplies, and labor expenses. David has none of this, so he skips Part III and Line 4.

- Line 5: Calculate a gross profit by subtracting line 4 from line 3 and write the amount here. In our case, it's still $50,000.00.

- Line 6: Report any other income, such as interest or rental. Since David had no other income this year, he left this blank.

- Line 7: Subtract line 5 from line 6 and enter the gross income. It's still $50,000.00 in our example.

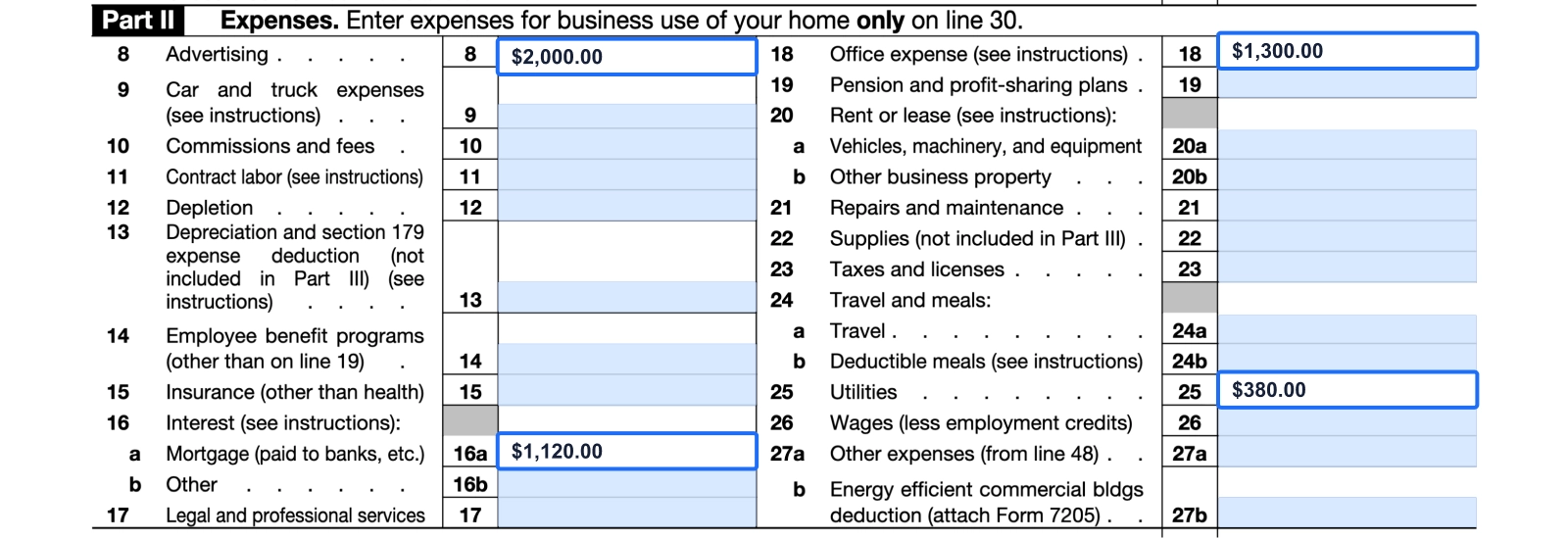

Step 6: Expenses section

In part II, you need to report and calculate all your expenses. This is where you list and add up all the costs of running your business throughout the year. Think anything from rent for your office space, utilities, advertising, supplies, travel expenses, and insurance premiums to payments for professional services. This section helps you detail the money you've spent to keep your business going and can significantly impact your taxable income by lowering it.

Note:

When you produce or acquire property for resale, certain costs must be capitalized. This means they should be reported in Part III instead of Part II and V. The only exceptions are small businesses and artists, as per Publication 538.

Here is an example of an expense list for our freelance graphic designer, David:

- 1. Line 8: $2,000.00 - for advertising on social media.

- 2. Line 16a: $1,120.00 - 7% of the home mortgage interest (the home office percentage of all home's square footage)

- 3. Line 18: $1,300.00 - for software subscriptions and laptop expenses.

- 4. Line 25: $380.00 - for 30% of utilities (phone and internet bills).

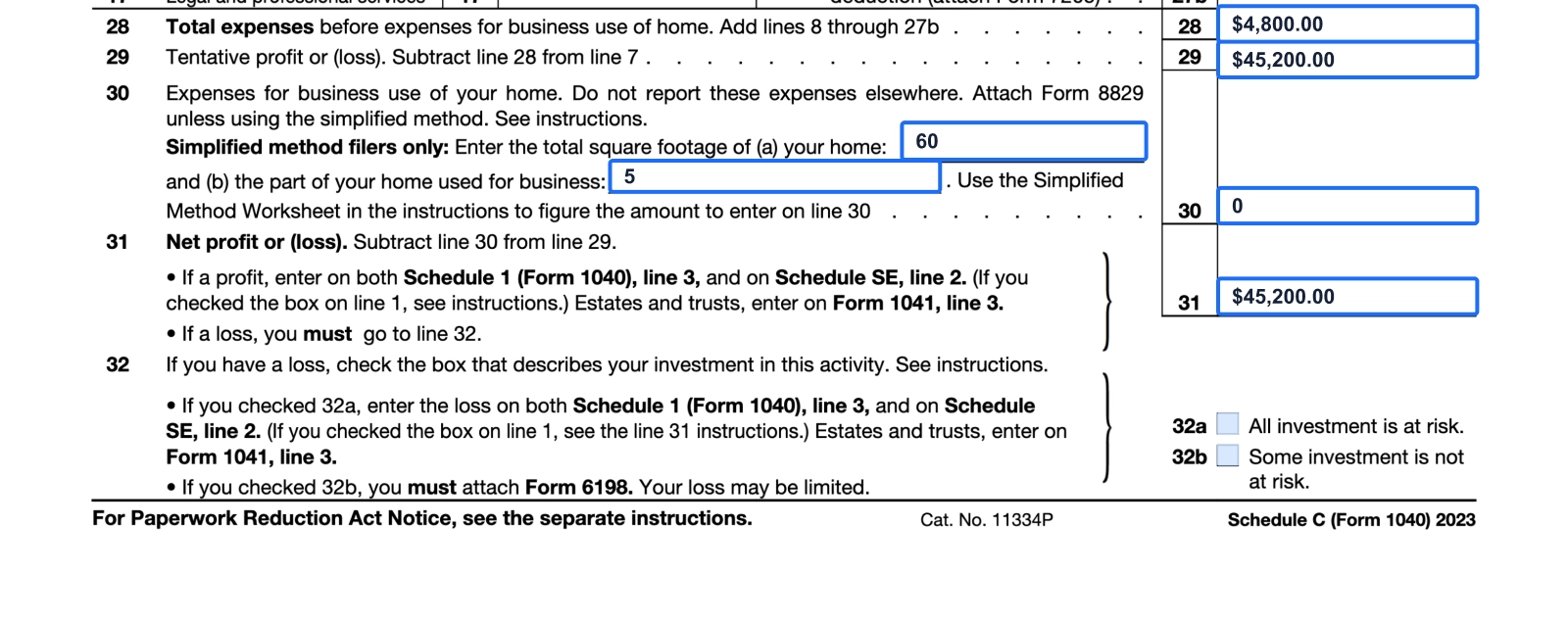

Step 7: Calculate net profit or loss and home office deductions

At the end of Part II you are supposed to figure out whether your business brought you profit or loss this year and calculate the amount you can deduct for business use of your home:

- Line 28: Add lines 8 - 27 to calculate total expenses and write the amount here. For David, it’s $4,800.

- Line 29: Subtract line 28 from line 7 to calculate your profit or loss. In our example, it's $45,200.

- Line 30: If you decide to use the simplified method worksheet for the business use of your home, you should write the total square footage of your home and the part you use for your home office. Finally, you should write the amount you got after completing the worksheet. Here, we use the simplified method and get 0 deduction.

- Line 31 or 32: Subtract line 30 from line 29, and if you get a positive amount, congratulations! Your business is profitable. Write the amount on line 31. If the amount is negative, you should choose whether this loss puts all your investments at risk or not and show the amount of loss on forms specified in Schedule C.

Note:

If you would like to deduct the use of your home for business, you should fill out Form 8829 and don't add these expenses to Schedule C Part II.

Step 8: Cost of goods sold, vehicle, and other expenses

Use Part III if your business or profession requires inventory, materials and supplies, and labor expenses to calculate the cost of goods sold.

Note:

If you need to use part III of the form, keep all the information in your records. It's also better to consult a tax advisor about filling out this part.

If you use your vehicle to conduct business (not to get from and to your business location), use Part IV to figure out the amount of expense that will go on Line 9 of Schedule C.

Use Part V and write the total amount on Line 27a for all other expenses not listed in the form.

In our example, David didn't have to fill out any of these parts, so he just left them blank.

Step 9: Double-check & Print or Share

Double-check all the information you entered, click the “Export” button, and then the “Print File” option to print your Schedule C Form 1040. You can also choose the “Share” option and send the form to your tax advisor to check if all is correct.

Step 10: Fill out additional forms

The amount of profit or loss you calculated on this form should go to other forms to calculate how much taxes you owe or will receive as a refund.

If you have profit copy the amount from Line 31 and enter it:

- 1. on Line 2 of Schedule SE (Form 1040) to calculate your self-employment tax.

- 2. on Line 3 of Schedule 1 (Form 1040) to calculate your additional income and adjustments;

- 3. if you filing for estate or trust the amount also goes to Line 3 of Form 1041.

If you have loss you should enter it on the same lines and forms but as negative amount. And if you checked that this loss doesn't put some of your investments at risk fill out and attach Form 6198.

How To File Form 1040 Schedule C

Congratulations on reaching the stage where you're ready to submit Schedule C with your 1040! Here's how you can submit your Schedule C alongside your Form 1040 by the April 15, 2024, deadline:

1. By Mail

Attach all Schedules and forms to your completed Form 1040. Double-check the IRS instructions for the correct mailing address, as it can vary based on your state and whether you're including a payment. Mistakes in addressing could delay processing or cause your return to be misplaced, so it's worth a few extra minutes to verify.

2. eFiling

Another filing option is small business owners is eFiling. If your adjusted gross income is $79,000 or less, the IRS offers the Free File program, a partnership with tax software companies providing free filing for eligible taxpayers. It's fast, secure, and you receive immediate confirmation upon the IRS receiving your return.

Table of contents

Make a Gift For The Future You

Say goodbye to delays with our user-friendly platform. Concentrate on your Schedule C now and get 1 step closer to ending tax season.

Cross Schedule C off your to-do list for tax season