-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 8829 Expenses for Business Use of Your Home (2023)

Get your Form 8829 (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Form 8829

Form 8829, Expenses for Business Use of Your Home, is an IRS document used by individuals who operate a business from home. This form allows taxpayers to calculate and claim deductions for expenses related to the business use of their home. Deductions may include a portion of rent or mortgage interest, utilities, insurance, repairs, and depreciation. Filling out Form 8829 is essential for entrepreneurs and freelancers looking to reduce their taxable income by leveraging the costs of maintaining a home office.

When to Use IRS Form 8829

IRS Form 8829 is intended for use under specific situations:

- Sole proprietors and single-member LLCs that have not elected to be taxed as S-corporations or C-corporations.

- Taxpayers who use a portion of their home exclusively and regularly for administrative or management activities of their business.

- Daycare providers use part of their homes for business purposes.

- Individuals storing inventory or product samples for their business at home.

How To Fill Out 8829 form instructions

Step 1: Gather Documentation

Before beginning, gather all necessary documentation, including:

- Total square footage of your home.

- Square footage of the area used exclusively for business.

- Total home expenses (utilities, mortgage interest, insurance, etc.).

- Any direct expenses exclusively for the business area of your home.

Step 2: Provide Basic Information

At the top of the form, fill in your name and, if applicable, your social security number as it appears on your tax return.

Step 3: Calculate the Percentage of Your Home Used for Business

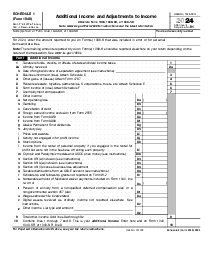

Part I of Form 8829: Calculate the percentage of your home used for business by dividing the square footage of the area used for business by the total square footage of your home.

Step 4: Enter Your Expenses

Part II: Here, you will list your actual expenses. This includes direct and indirect expenses. Direct expenses are those exclusively for the business part of your home (e.g., painting your home office). Indirect expenses are for keeping up and running your entire home, which are allocated based on the business use percentage calculated earlier. Common expenses include mortgage interest, property taxes, utilities, repairs, and depreciation.

Step 5: Calculate the Deduction

Follow the instructions within Part II to total your direct, indirect, and carryover losses from previous years. Then, calculate the allowable deduction based on the business-use percentage of your home.

Step 6: Depreciation Calculation

For those claiming depreciation, refer to Form 4562 to calculate depreciation amounts, then enter these totals in Part III of Form 8829. This section calculates the depreciation of your home office space, considering its business use percentage.

Step 7: Carryover to Schedule C

Part IV: Any non-deductible expenses due to the business income limit can be carried over to the next year. This section helps you calculate and document that carryover.

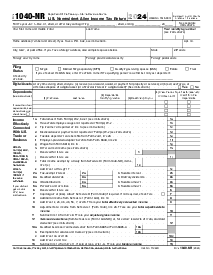

When to File Tax Form 8829

Tax Form 8829 should be filed alongside your annual income tax return. For most taxpayers operating their businesses as sole proprietors, this means attaching Form 8829 to Schedule C (Form 1040 or Form 1040-SR) and submitting it by the due date of your income tax return. Generally, this deadline falls on April 15th of each year unless an extension has been granted.

Incorporating Form 8829 into your tax filing process can substantially impact your taxable income, provided you meet the IRS guidelines for business use of your home. By understanding when and how to use this form, you can take full advantage of the deductions available, thereby reducing your overall tax liability.

Fillable online Form 8829 (2023)