-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Information returns - page 3

-

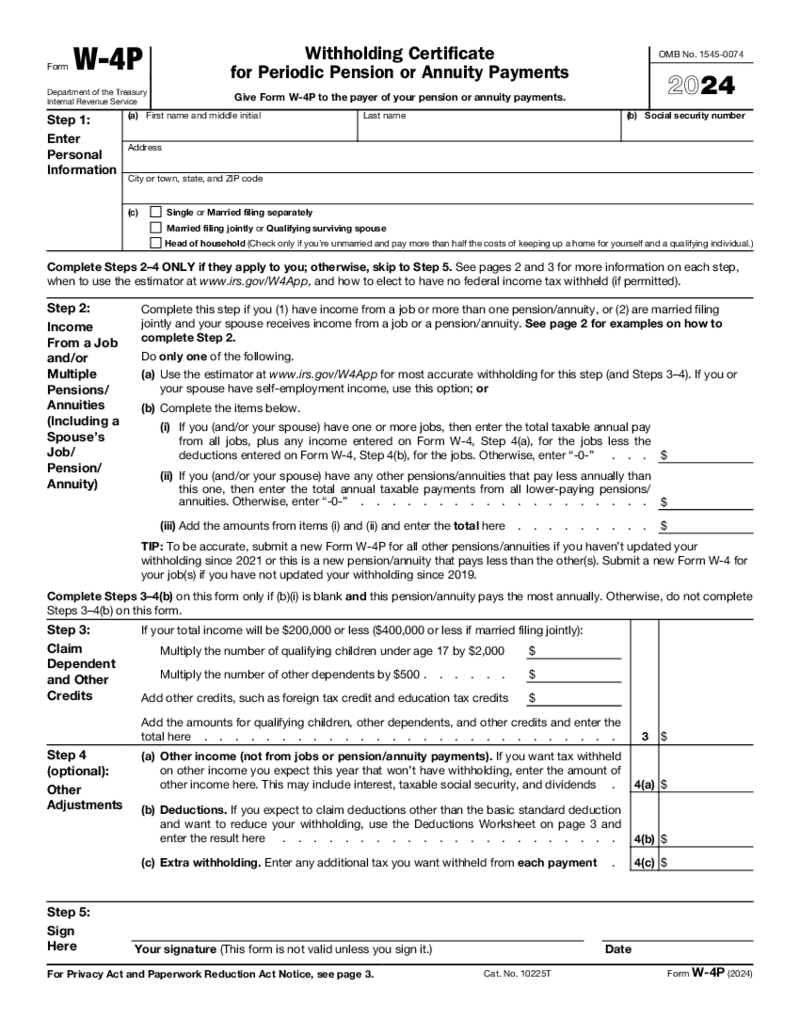

Form W-4P (2024)

What Is a W-4P Form?

Also known as Withholding Certificate for Periodic Pension or Annuity Payments, it’s an official document for US citizens and resident aliens who receive pensions, annuities, and other deferred compensation. The printable W 4P f

Form W-4P (2024)

What Is a W-4P Form?

Also known as Withholding Certificate for Periodic Pension or Annuity Payments, it’s an official document for US citizens and resident aliens who receive pensions, annuities, and other deferred compensation. The printable W 4P f

-

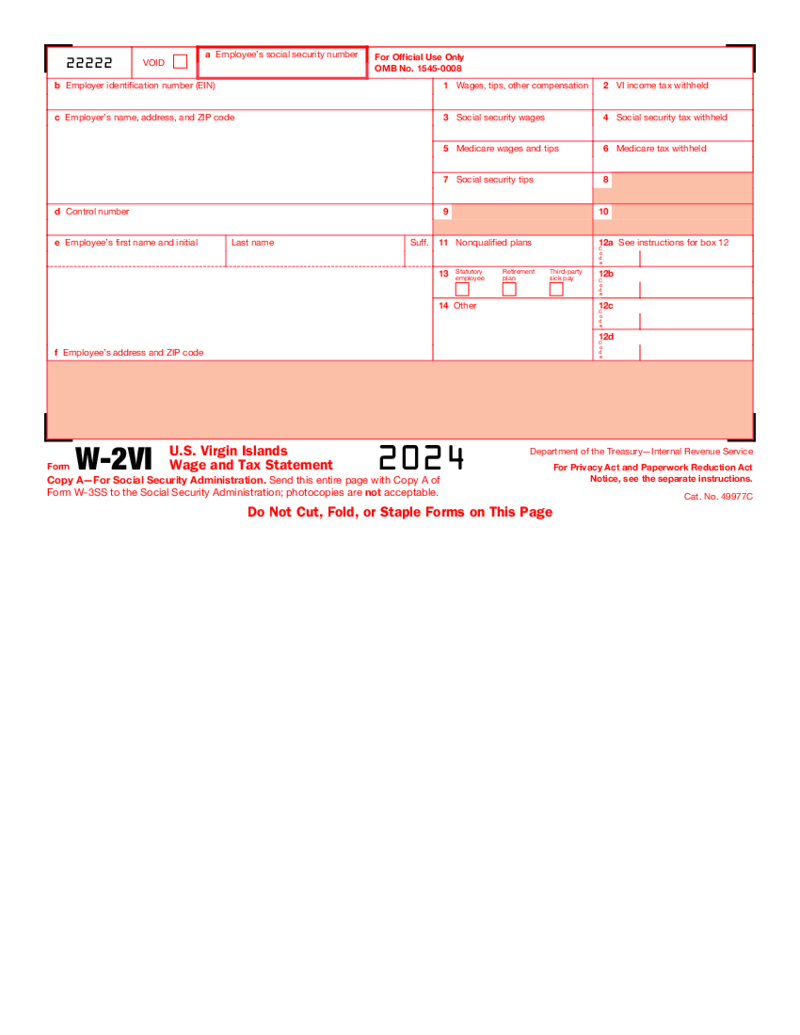

Form W-2VI (2024)

What Is W-2VI Form

The W-2VI form, also known as the Virgin Islands Wage and Tax Statement, is a crucial document for employers operating in the U.S. Virgin Islands. This form is analogous to the W-2

Form W-2VI (2024)

What Is W-2VI Form

The W-2VI form, also known as the Virgin Islands Wage and Tax Statement, is a crucial document for employers operating in the U.S. Virgin Islands. This form is analogous to the W-2

-

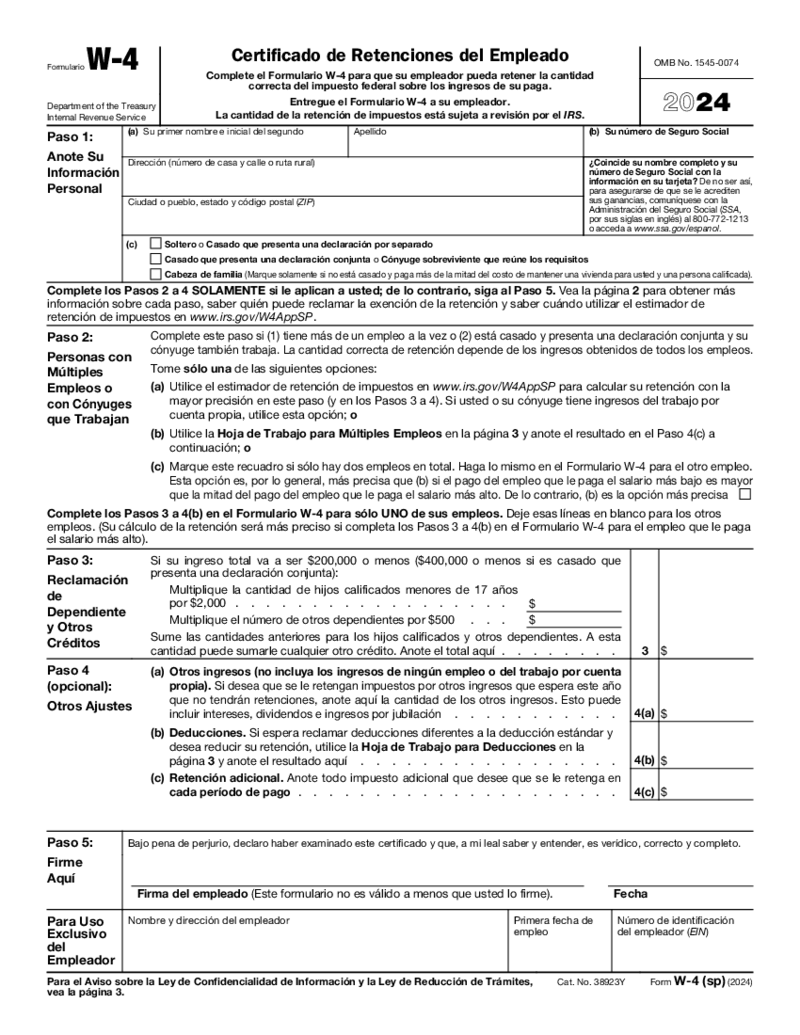

Form W-4SP (2024)

What Is a Spanish W-4 Form?

Also known as Certificado de Retenciones del Empleado, the form is a standard IRS document translation for Spanish-speaking individuals. The document is typically completed by an employee and forwarded to an employer for the pu

Form W-4SP (2024)

What Is a Spanish W-4 Form?

Also known as Certificado de Retenciones del Empleado, the form is a standard IRS document translation for Spanish-speaking individuals. The document is typically completed by an employee and forwarded to an employer for the pu

-

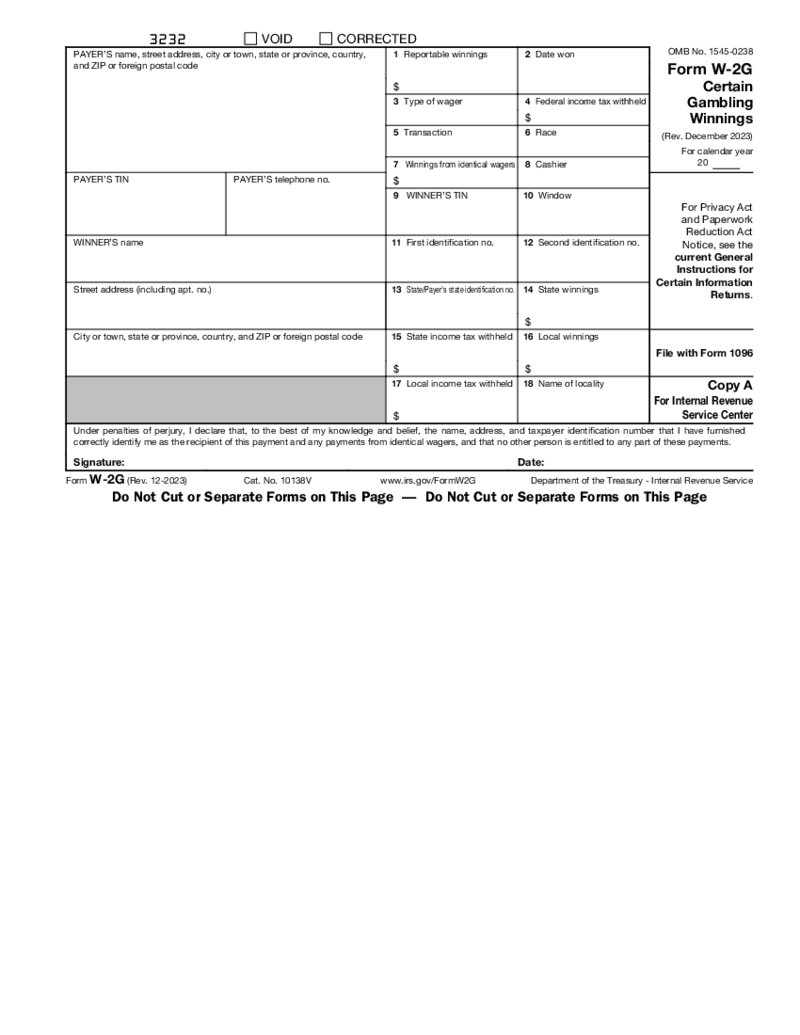

Form W-2G

What Is a Fillable Form W 2G?

Also known as Certain Gambling Winnings, it’s a tax document utilized for reporting gambling winnings and any federal income tax withheld for those winnings. A casino or other gambling facility forwards this doc to cust

Form W-2G

What Is a Fillable Form W 2G?

Also known as Certain Gambling Winnings, it’s a tax document utilized for reporting gambling winnings and any federal income tax withheld for those winnings. A casino or other gambling facility forwards this doc to cust

-

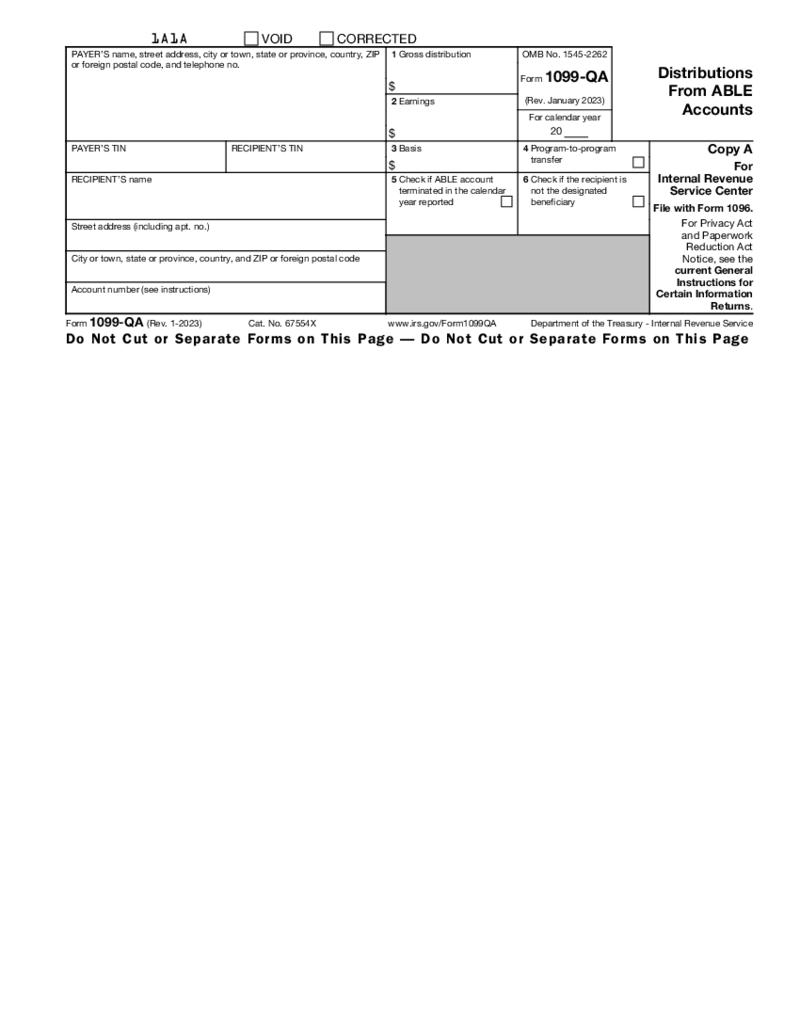

Form 1099-QA (2023)

The Ultimate Guide to Filling Out IRS Form 1099-QA for ABLE Account Distributions

The IRS Form 1099-QA is a critical tax document for those managing Achieving a Better Life Experience (ABLE) accounts. It details distributions from these accounts to assist

Form 1099-QA (2023)

The Ultimate Guide to Filling Out IRS Form 1099-QA for ABLE Account Distributions

The IRS Form 1099-QA is a critical tax document for those managing Achieving a Better Life Experience (ABLE) accounts. It details distributions from these accounts to assist

-

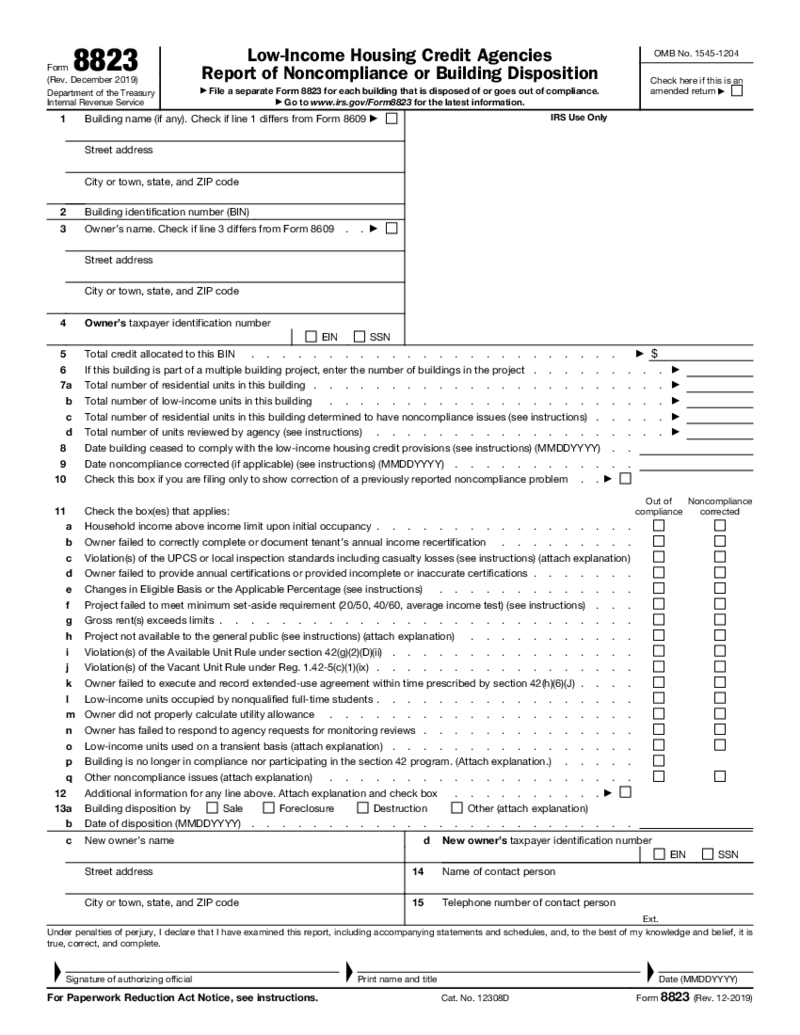

IRS Form 8823

What Is Form 8823

IRS 8823 Form, also known as the Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition, serves as a vital document used by state or local housing credit agencies. It aims to report noncompliance or building d

IRS Form 8823

What Is Form 8823

IRS 8823 Form, also known as the Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition, serves as a vital document used by state or local housing credit agencies. It aims to report noncompliance or building d

-

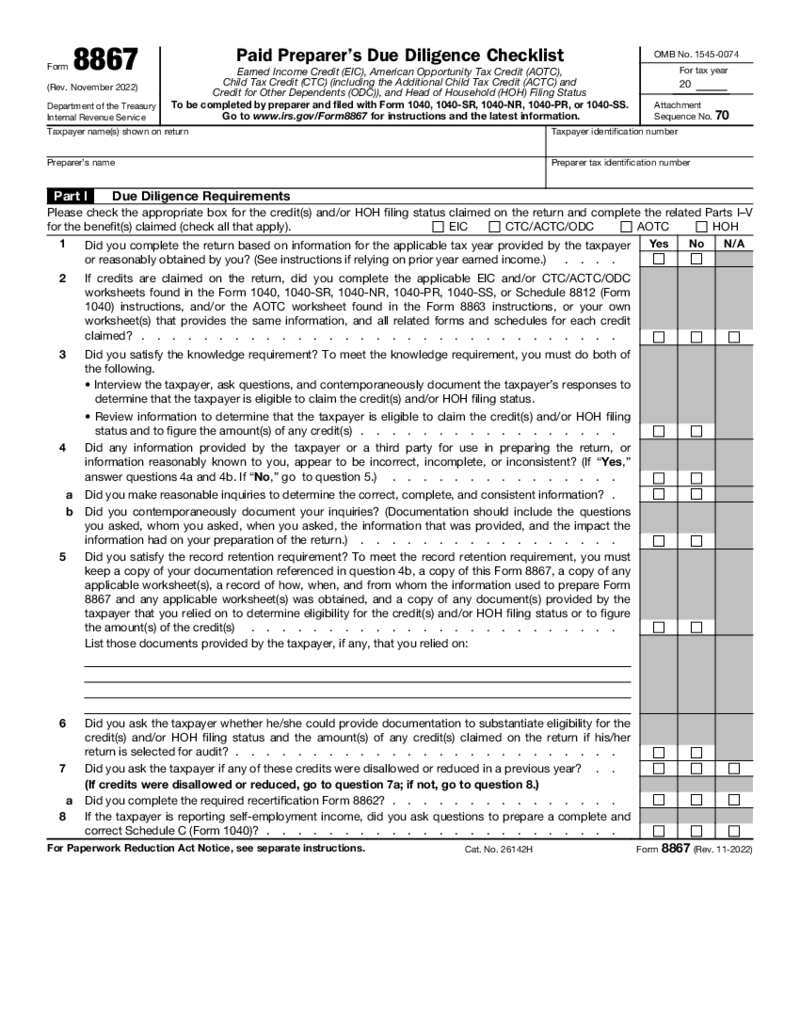

Due Diligence Form 8867

What is IRS Form 8867

IRS Form 8867, or the 8867 tax form, is a due diligence checklist designed to promote transparency and accountability in the process of claiming certain tax benefits. These benefits include Earned Income Credit (EIC), Child Tax Credi

Due Diligence Form 8867

What is IRS Form 8867

IRS Form 8867, or the 8867 tax form, is a due diligence checklist designed to promote transparency and accountability in the process of claiming certain tax benefits. These benefits include Earned Income Credit (EIC), Child Tax Credi

-

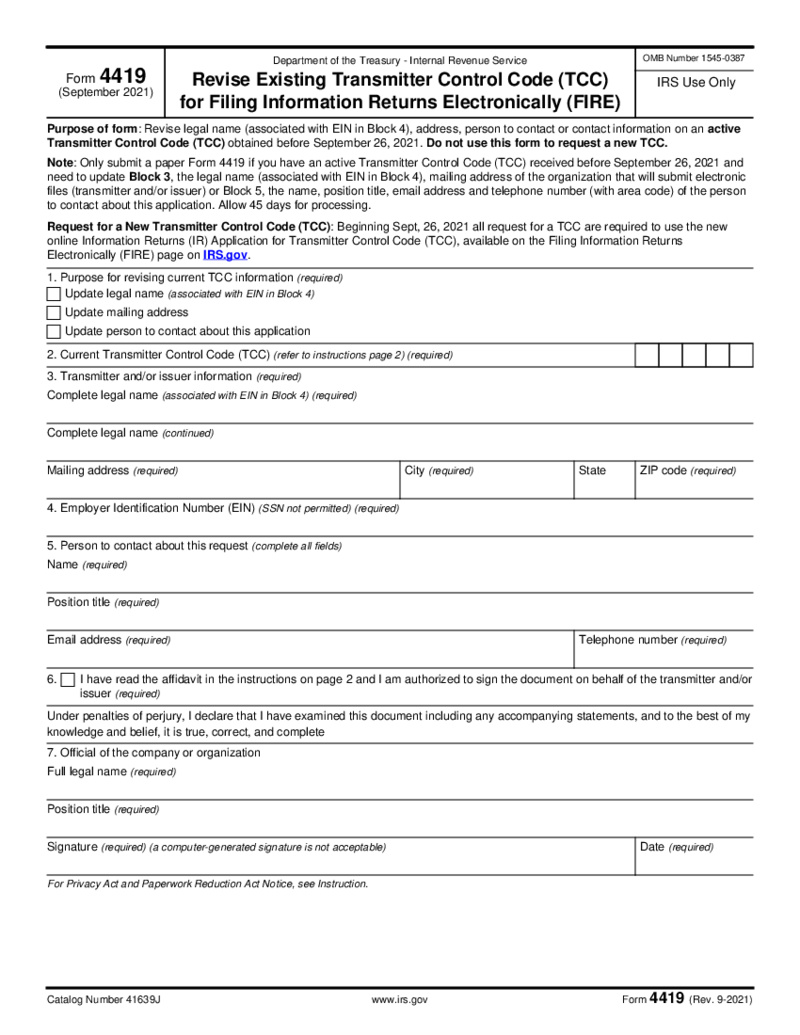

Form 4419

1. What is the 4419 form?

The fillable 4419 form is intended for the revision of the information on the current Transmitter Control Code. You can download the 4419 form to request the extra TCC for all the types of the form you may find in Box 8 in the do

Form 4419

1. What is the 4419 form?

The fillable 4419 form is intended for the revision of the information on the current Transmitter Control Code. You can download the 4419 form to request the extra TCC for all the types of the form you may find in Box 8 in the do

-

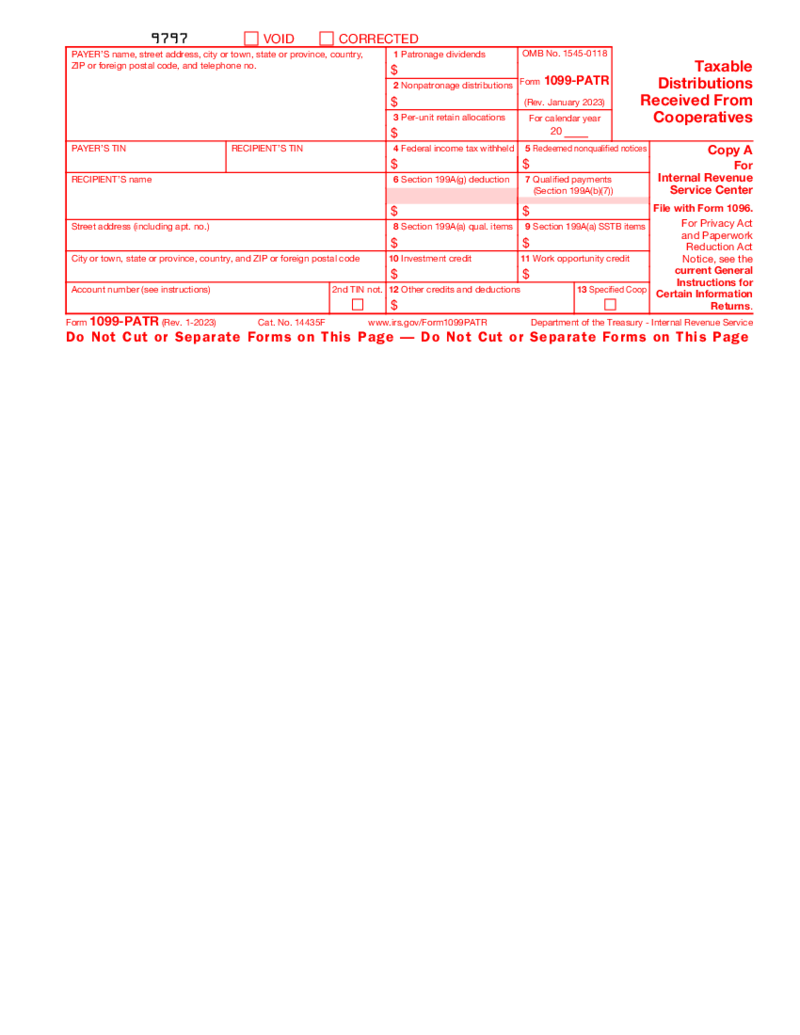

1099-PATR Form

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, t

1099-PATR Form

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, t

-

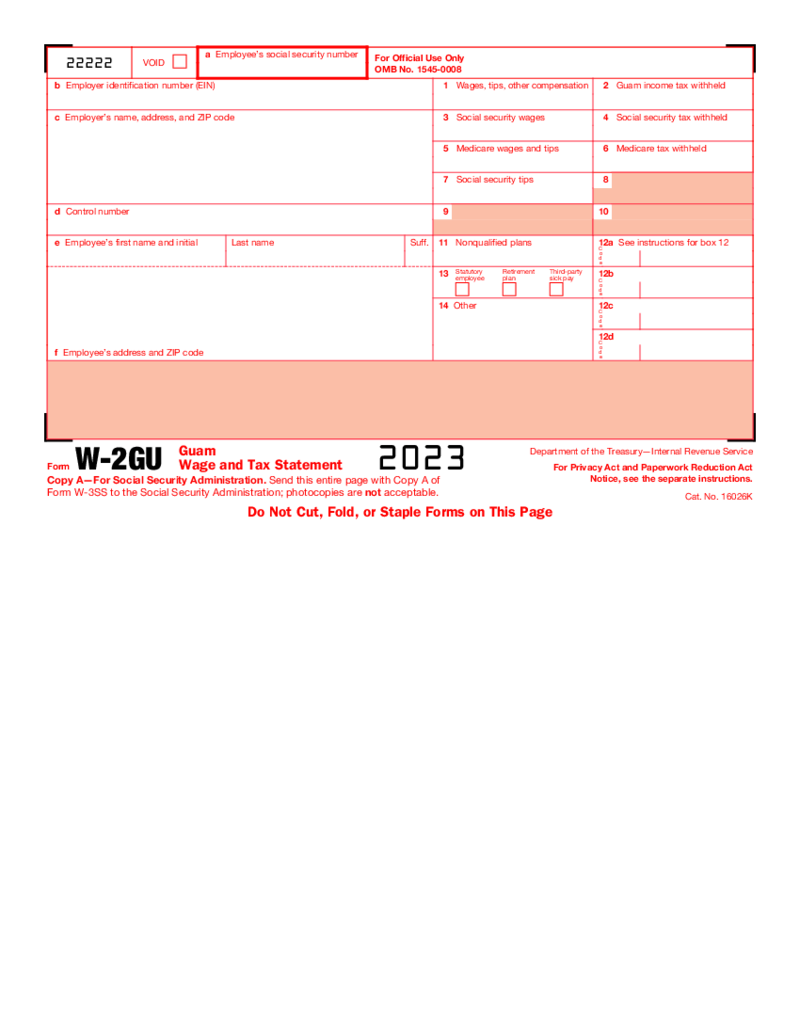

Form W-2GU

What is Form W-2GU?

The W 2GU template is also known as the Guam Wage and Tax Statement. Each employer has to send a report on the Guam wages to the IRS. If you pay the US income tax withholding wages you don’t have to use the form. You can use the

Form W-2GU

What is Form W-2GU?

The W 2GU template is also known as the Guam Wage and Tax Statement. Each employer has to send a report on the Guam wages to the IRS. If you pay the US income tax withholding wages you don’t have to use the form. You can use the

-

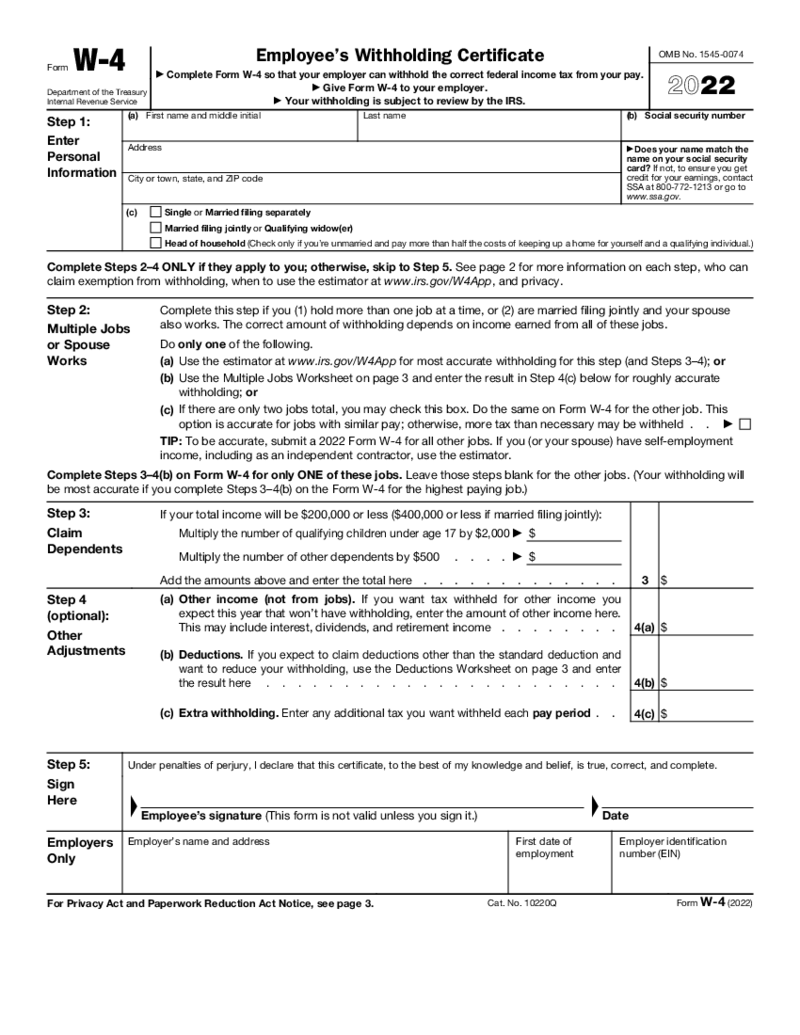

Form W-4 (2022)

What is the Difference Between Form W-4 2022 and 2023

Form W-4 is used by employees to specify their

Form W-4 (2022)

What is the Difference Between Form W-4 2022 and 2023

Form W-4 is used by employees to specify their

-

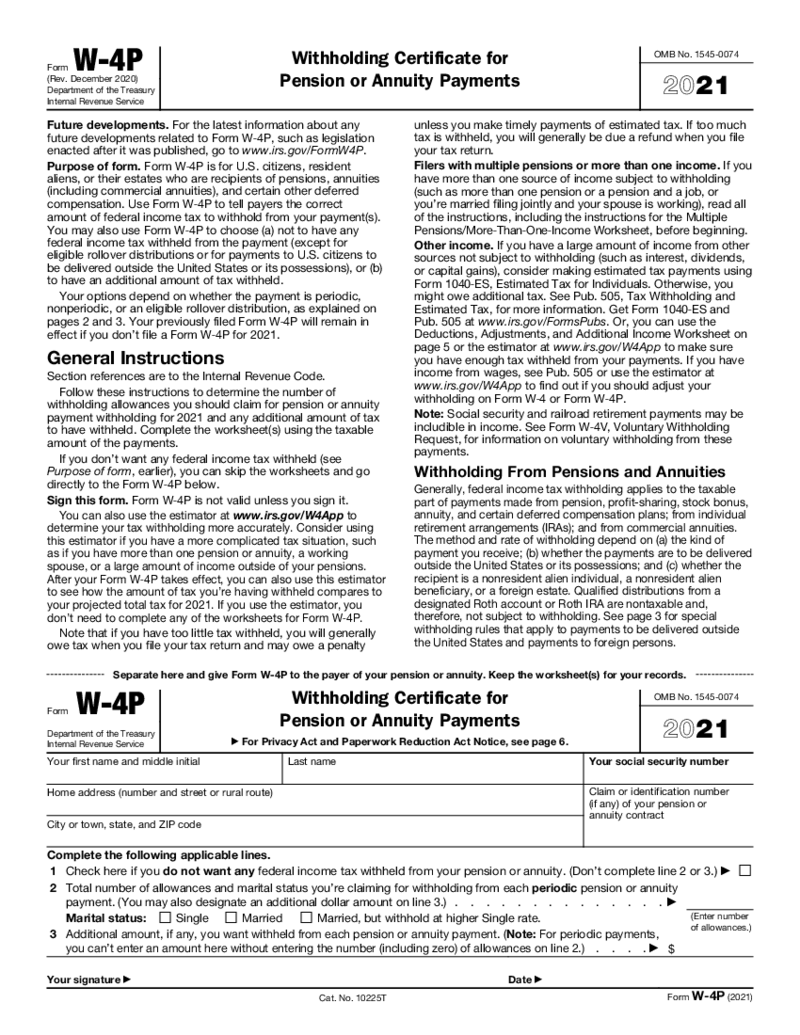

Form W-4P (2021)

Understanding Form W 4P 2021 for Withholding on Pensions

Form W-4P for 2021 is crucial for anyone receiving pension or annuity payments. This form serves as a guide for payers to determine the correct amount of federal income tax to withhold from these pa

Form W-4P (2021)

Understanding Form W 4P 2021 for Withholding on Pensions

Form W-4P for 2021 is crucial for anyone receiving pension or annuity payments. This form serves as a guide for payers to determine the correct amount of federal income tax to withhold from these pa

FAQ

-

Where do you enter the information for daycare on tax returns?

If you’re eligible for the Child and Dependent Care Credit, fill out Form 2441 and attach it to your 1040. For more details and nuances, please consult your tax advisor.

-

What should I do if I entered wrong information on tax returns?

Made a mistake on your return? Don’t panic. There’s a form for that. Opt for Form 1040-X to add corrections to the information you previously failed to accurately provide.

-

Where to find property tax information for tax returns?

That depends on the state you live in, so make sure you look up these details in your local tax office.

-

What information can you receive from a person’s tax returns?

In a nutshell, a tax return contains details on a person’s earnings, spendings, and other tax information. These forms grant taxpayers the possibility to calculate their tax liability, pinpoint tax payments, or request refunds for overpaid taxes.