-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

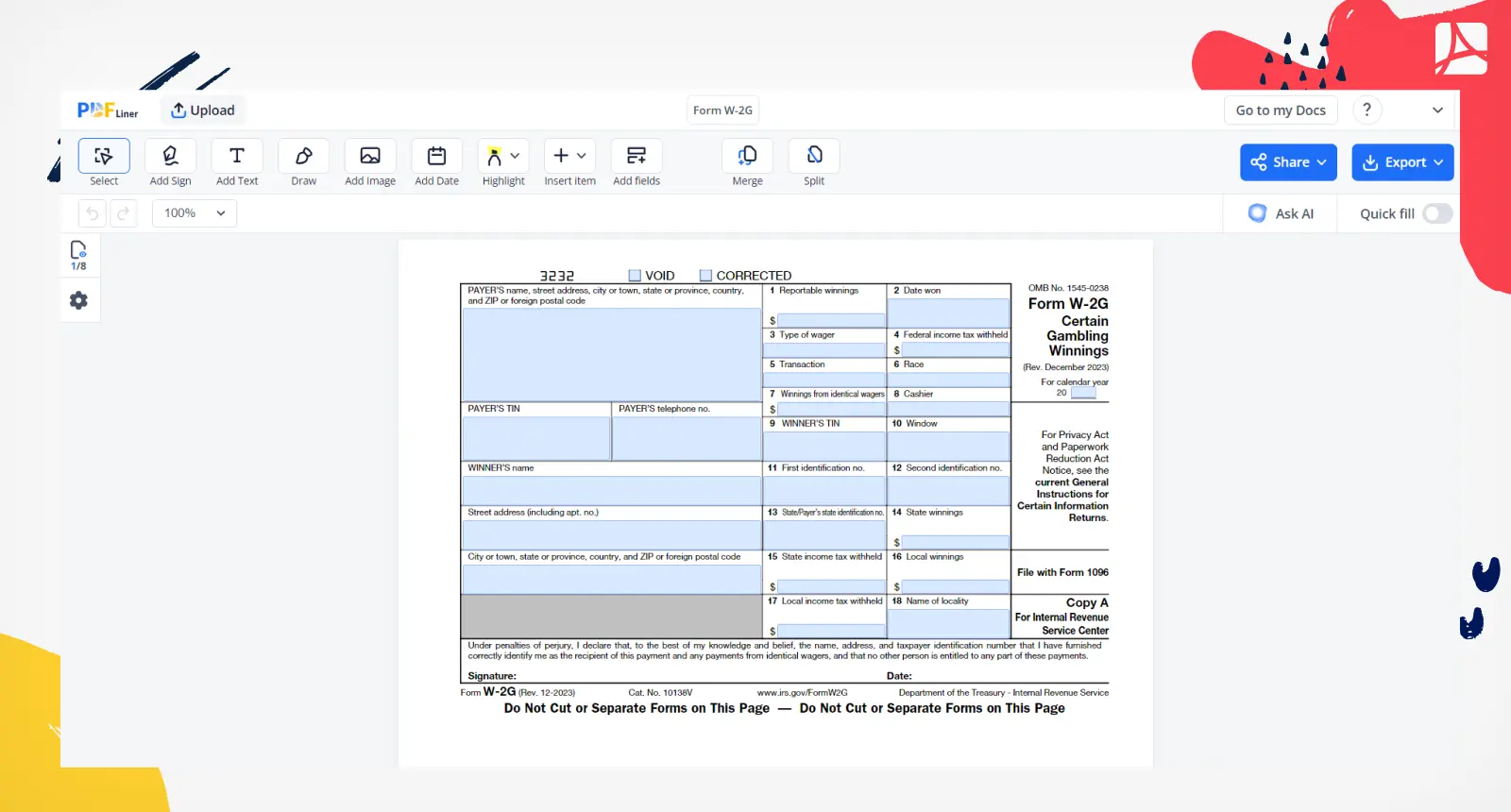

Form W-2G

Get your Form W-2G in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Fillable Form W 2G?

Also known as Certain Gambling Winnings, it’s a tax document utilized for reporting gambling winnings and any federal income tax withheld for those winnings. A casino or other gambling facility forwards this doc to customers who had must-report winnings throughout the previous year. In this piece, we’ll cover its purpose and provide instructions on how to fill it out. Stay tuned.

What Do I Need the W-2G Form For?

Here’s what you need this document for:

- documenting gambling winnings and any federal income tax withheld for those winnings;

- reporting this vital information to the Internal Revenue Service.

Based on the IRS guidelines, reporting winnings from any gambling activity, such as bingo, (foreign) lottery, card games, sports, or slot machines is a must. Even if your winnings are insignificant, you still must report them. Don’t forget that aside from the W 2G form, our catalog of templates contains a multitude of other industry-focused templates to make the most of.

How to Fill Out Tax Form W-2G

The document is an eight-pager that’s not exactly a cakewalk to fill out. No worries. With PDFLiner, your chances of completing any form fast and correctly get a powerful boost. Here are the steps to follow to complete the IRS form W-2G via our platform.

Step 1: Sign up and log in to PDFLiner.

Step 2: Find the form in our template catalog.

Step 3: Launch it and wait until it loads.

Step 4: Begin completing it. Specify your personal data, such as:

- your name;

- address;

- telephone number;

- federal identification number.

Step 5: Indicate your total amount of winnings, the date they were won, the type of wager, as well as how much tax has already been withheld.

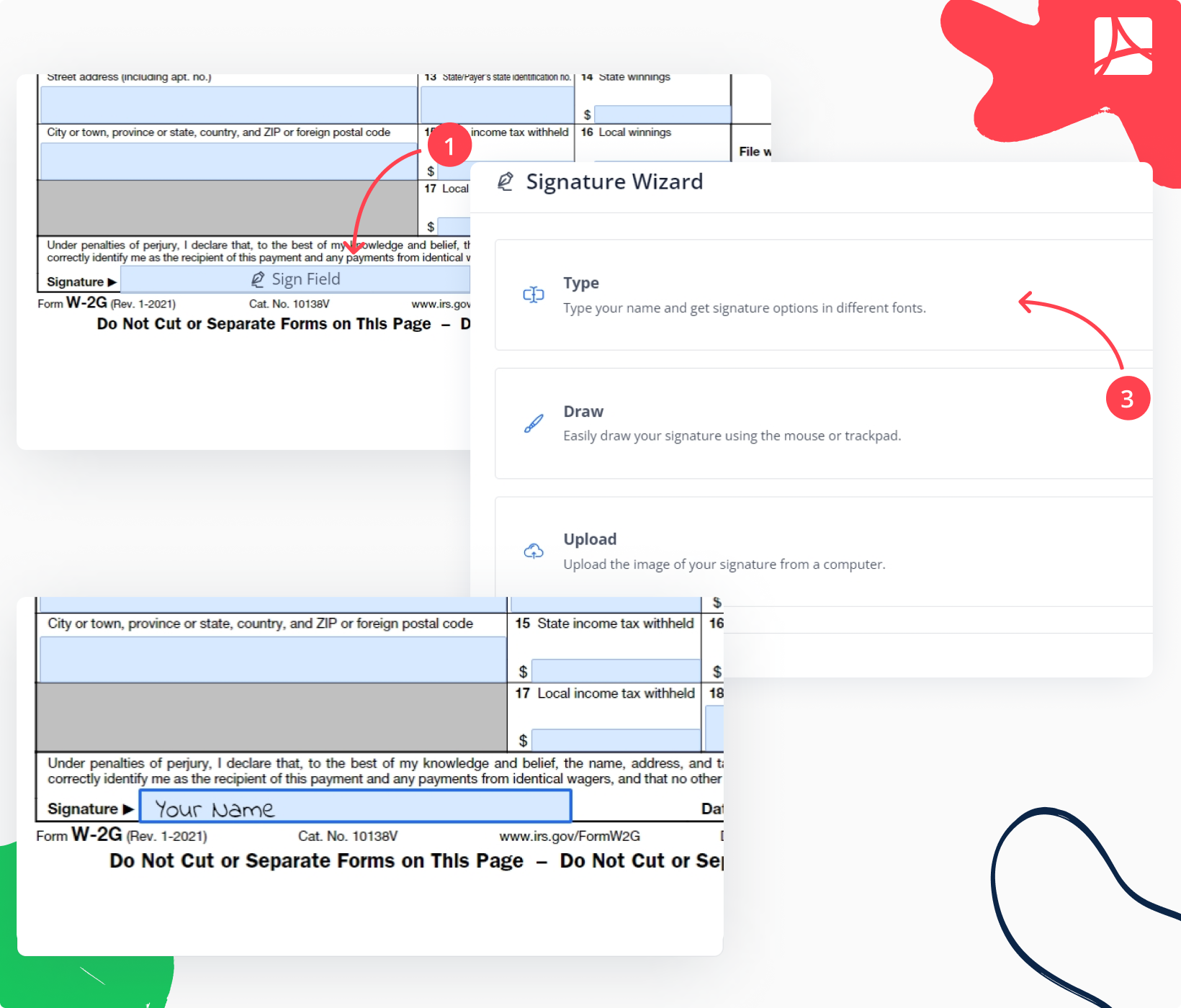

Step 6: Don’t forget to add your signature.

If you want to speed up the process of signing your docs or sending them to your partners or colleagues for signature, feel free to make the most of the PDFLiner digital file signature tool. The benefits of switching to e-signatures are obvious: it’s fast, easy, convenient, and exceptionally secure.

At the end of the day, no wonder that many companies have switched to digital document management these days. It’s the best and speediest way to complete files, irrespective of their purpose and your needs. And it’s cost-effective, too, so give it a try without hesitation.

Organizations That Work With Forms W 2G

- Department of Treasury Internal Revenue Service;

- Casinos and other gambling facilities.

Form Versions

2021

Form W-2G 2021

Fillable online Form W-2G