-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

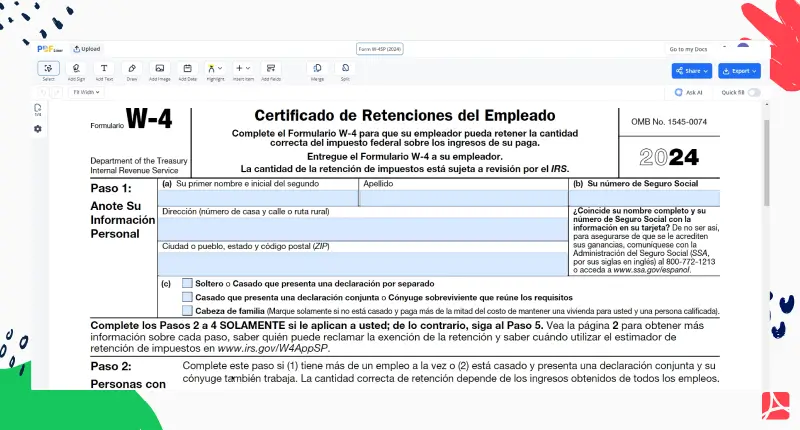

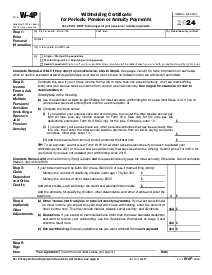

Form W-4SP (2024)

Get your Form W-4SP (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Spanish W-4 Form?

Also known as Certificado de Retenciones del Empleado, the form is a standard IRS document translation for Spanish-speaking individuals. The document is typically completed by an employee and forwarded to an employer for the purpose of withholding taxes from their paycheck. You can complete your W-4 Sp in Espanol. In case you need English translation, refer to the standard W-4.

What Do I Need the Form W-4 in Spanish For?

If you’re an employer with Spanish-speaking employees, this document is right up your street. The purpose of this particular Spanish-translated file is to make its completion effortless.

In a nutshell, you need the form to:

- prevent overpaid taxes;

- ward off tax debts;

- achieve peace of mind.

In many cases, the employer sends the template to their workers, but you can find it online, too. Now that you are here, make the most of the template presented “aquí” on PDFLiner. With our top-notch editing tools in your arsenal, you are guaranteed to sort out your administrative affairs fast and easily.

How to Fill Out the Spanish W-4 Form

Launch the template on PDFliner and get to its completion right away. When you’re through, you can download the file on your device, forward it to your employer digitally, or submit it to the Internal Revenue Service. Our versatile platform has it all when it comes to fast and effortless digital document management.

As you fill out the form, here’s what you need to indicate:

- your ID details;

- specifications in case you have several jobs;

- your income details;

- details about your dependents;

- your signature.

Last but not least, here’s a list of popular mistakes employers make when they deal with the Spanish W-4 form:

- Filling out the form on behalf of your staff members: Don’t do that.

- Completing the sections of the document that don’t reflect your current circumstances.

- Accepting the form with errors in the first place: Make them double-check before they send it to you.

- Instructing your staff members on what to indicate in the form.

When you’re through with the tax document, don’t forget to proofread it and ensure you haven’t made any mistakes. Upon adding your signature, leave the next field empty for your employer’s signature. Remember that if you don’t sort out this form on time, your employer will withdraw the highest tax rate from your salary. To sum up, if you want to manage your tax-related files fast and smartly, go digital and opt for PDFLiner.

Organizations That Work With the Spanish W-4 Form

- The IRS.

Form Versions

2022

Fillable Form W-4SP for 2022 tax year

2023

Fillable Form W-4SP for 2023 tax year

Fillable online Form W-4SP (2024)