-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

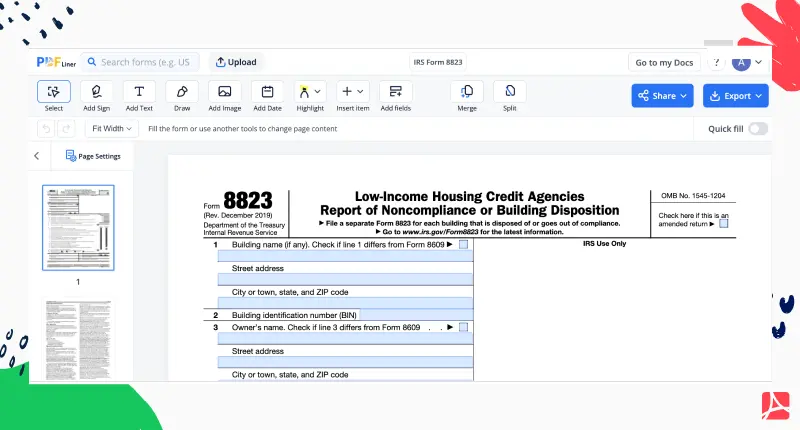

IRS Form 8823

Get your IRS Form 8823 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 8823

IRS 8823 Form, also known as the Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition, serves as a vital document used by state or local housing credit agencies. It aims to report noncompliance or building disposition regarding low-income housing projects.

By utilizing this form, housing credit agencies can notify the IRS about any violations or changes that may impact the eligibility for low-income housing tax credits. Form 8823 is crucial in ensuring compliance with regulations and facilitating the proper administration of the Low-Income Housing Tax Credit program.

What Is IRS Form 8823 Used For

The document is utilized for the following purposes:

- reporting noncompliance or building disposition regarding low-income housing projects.

- notifying the IRS about violations or changes that may affect eligibility for low-income housing tax credits.

- identifying issues that could impact the eligibility for tax credits and ensuring compliance with program regulations.

- facilitating communication between housing credit agencies and the IRS.

- promoting proper administration and oversight of low-income housing projects.

- assisting in the monitoring and enforcement of regulatory requirements.

- maintaining the integrity and effectiveness of low-income housing initiatives.

How to Fill Out Tax Form 8823

Completing the file using the PDFLiner online document management platform is a seamless process with the following 11 steps:

- Sign in to your PDFLiner account or create one if you don't have an existing profile.

- Find the needed template in the extensive catalog provided.

- Open the file and explore it thoroughly. Note that it consists of four pages.

- Begin with the first fillable page and carefully read the instructions on the subsequent pages.

- Enter your personal and agency information in the appropriate sections on the first page.

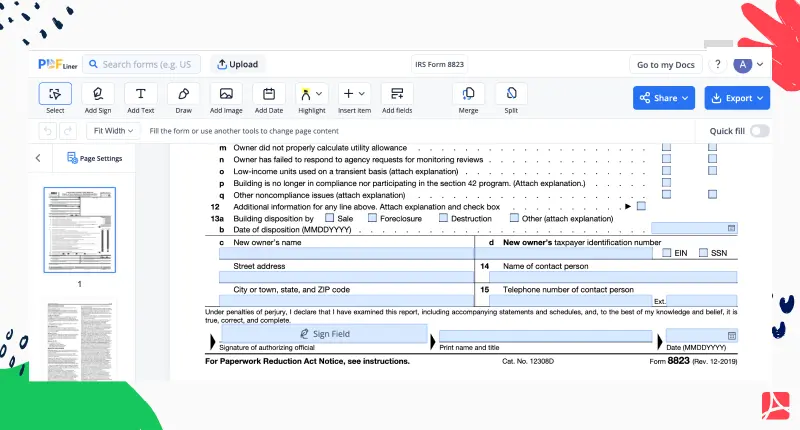

- Proceed to the subsequent pages and provide details of noncompliance or building disposition, following instructions.

- Include specific information such as project numbers, building identification, type of noncompliance, and actions taken.

- Attach any required supporting documentation.

- Proofread all the entered information for maximum accuracy.

- Save the completed file as a PDF for proper record-keeping.

- If necessary, print the form and follow the instructions provided by the IRS for submission.

Utilize the PDFLiner platform to streamline the process of filling out the 8823 form. It offers a feature-packed interface, access to essential instructions and ensures compliance with IRS guidelines.

How to File IRS Tax Form 8823

After completing the file, visit the IRS website to determine the appropriate submission method, whether electronic filing or mailing. If electronic filing is chosen, follow the IRS procedures and use the preferred platform for submission. In the case of mailing, securely package the form and any supporting documentation, adhering to the IRS instructions for the designated mailing address. Submit the form within the specified timeframe to comply with the existing requirements.

Fillable online IRS Form 8823