-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

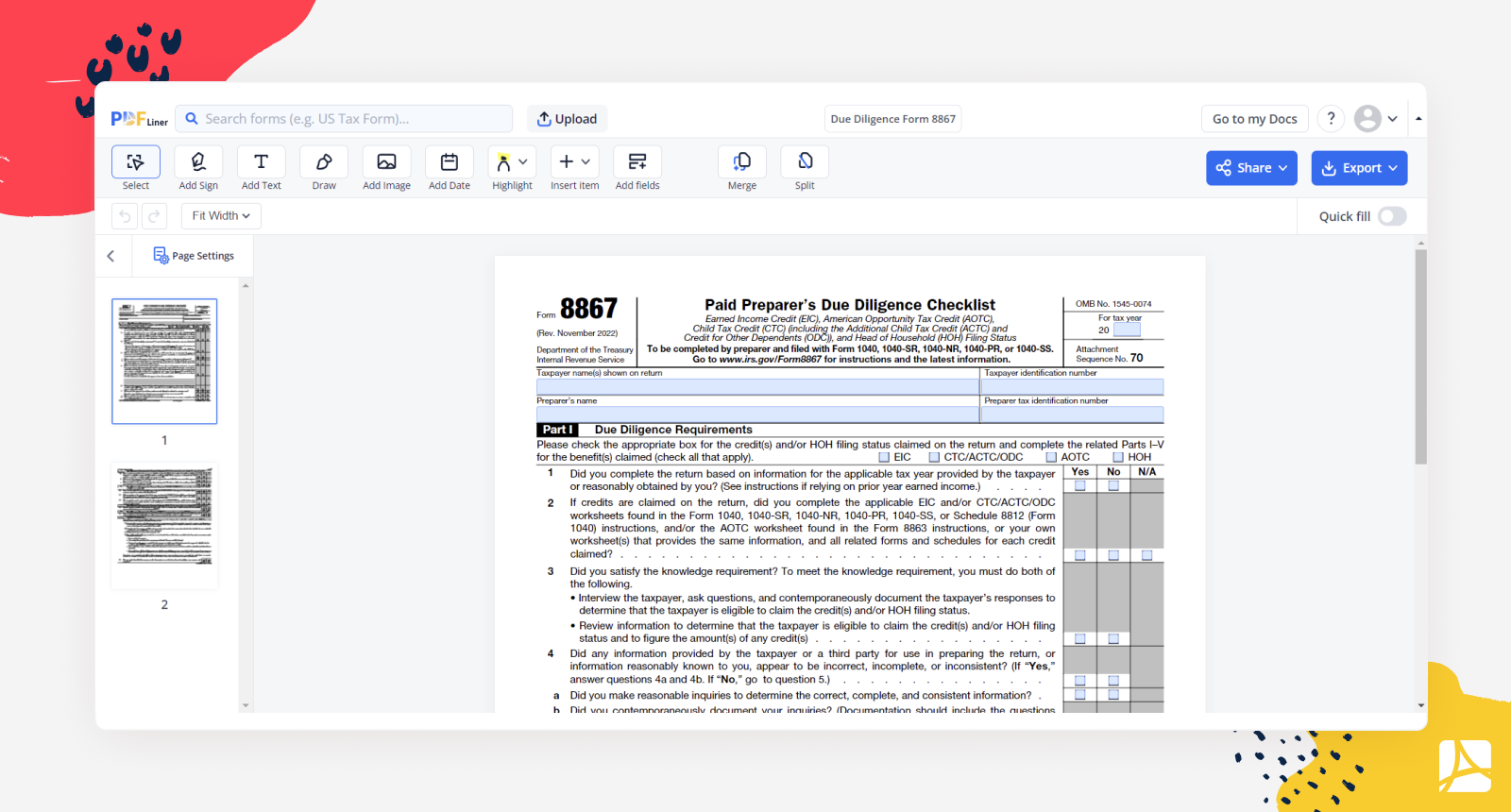

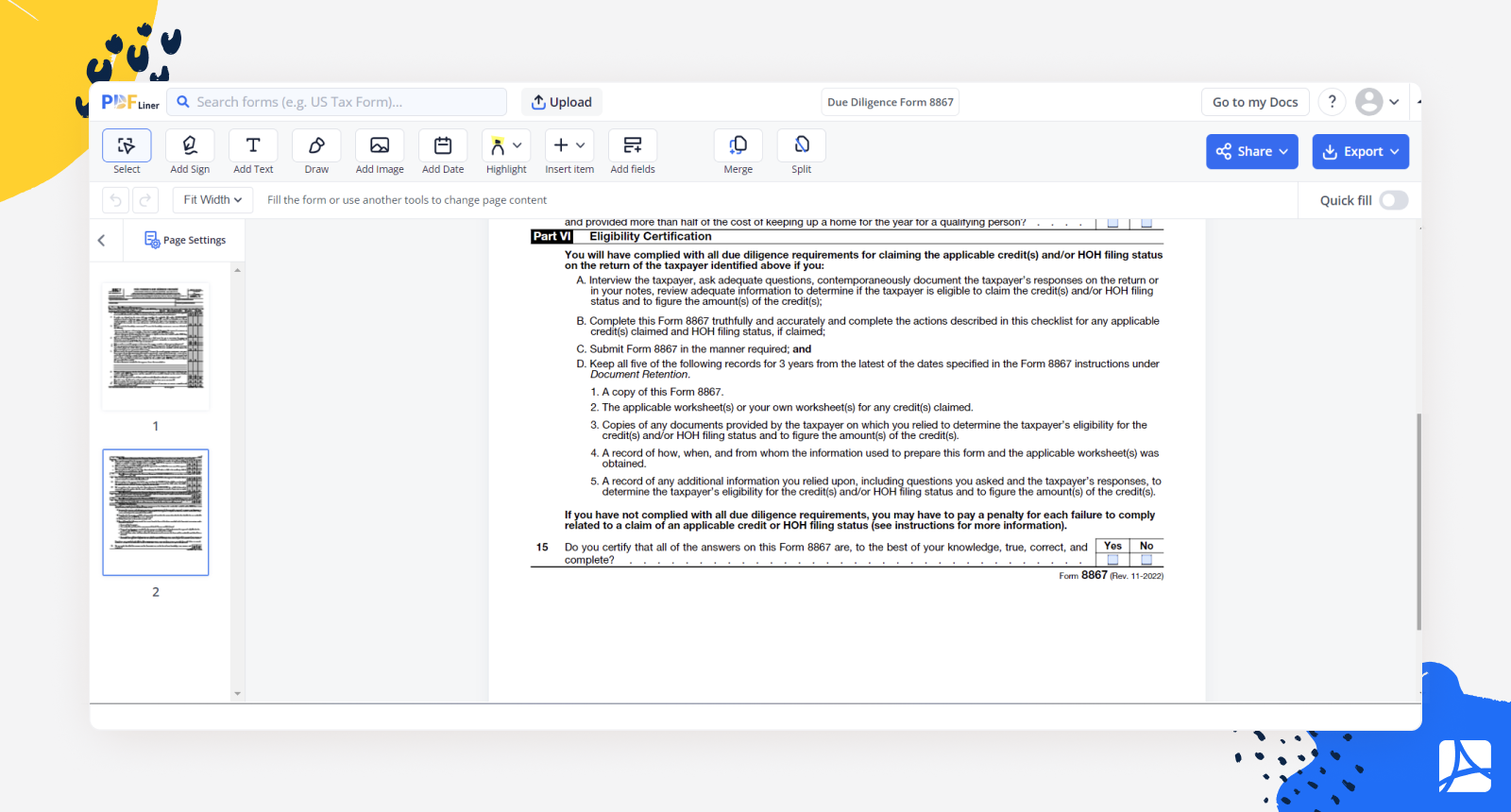

Due Diligence Form 8867

Get your Due Diligence Form 8867 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is IRS Form 8867

IRS Form 8867, or the 8867 tax form, is a due diligence checklist designed to promote transparency and accountability in the process of claiming certain tax benefits. These benefits include Earned Income Credit (EIC), Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), American Opportunity Credit (AOC), and Head of Household (HoH) filing status.

The completion and filing of Form 8867 is mandatory for paid tax preparers, ensuring they have performed due diligence in assessing a taxpayer's eligibility for these credits or filing status.

Why is Due Diligence Form 8867 Necessary

The due diligence form 8867 plays a critical role in the accurate and lawful administration of tax benefits. This federal form 8867 helps the IRS ensure that tax benefits are provided only to eligible taxpayers, thereby minimizing fraudulent claims and potential mistakes. Filing the form 8867 tax form is also a crucial step for tax preparers in avoiding any associated penalties, which can be as high as $530 per return, as of my knowledge cutoff in 2021.

When is Form 8867 Required

So, when is Form 8867 required? As mentioned earlier, any paid tax preparer who prepares a federal tax return or claim for refund that includes any of the aforementioned credits or filing status must submit IRS Form 8867. The tax preparer must do this for each tax return or claim that carries these benefits.

How to Comply with the 8867 Tax Form Requirement

Fulfilling the requirements of tax form 8867 requires more than just completing and submitting the form. It also involves meeting the four elements of due diligence outlined by the IRS, including:

- Completion and submission of Form 8867 based on the information provided by the taxpayer.

- Computing the credits based on the current tax law.

- Asking the taxpayer additional questions when the information provided seems incorrect, inconsistent, or incomplete.

- Keeping records of all inquiries made and responses received for each tax benefit claimed.

Conclusion

Navigating tax laws can be a daunting task, but with the right understanding of the tools at your disposal, such as the IRS Form 8867, it becomes more manageable. Remember, due diligence is key in tax preparation, and fulfilling your obligations, like the submission of the federal form 8867, can prevent potential complications or penalties down the line.

As the tax year unfolds, remember the value of IRS Form 8867, the due diligence form 8867. Complying with this requirement not only helps in upholding the integrity of the tax system but also safeguards your professional standing as a tax preparer.

Fillable online Due Diligence Form 8867