-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Information returns - page 6

-

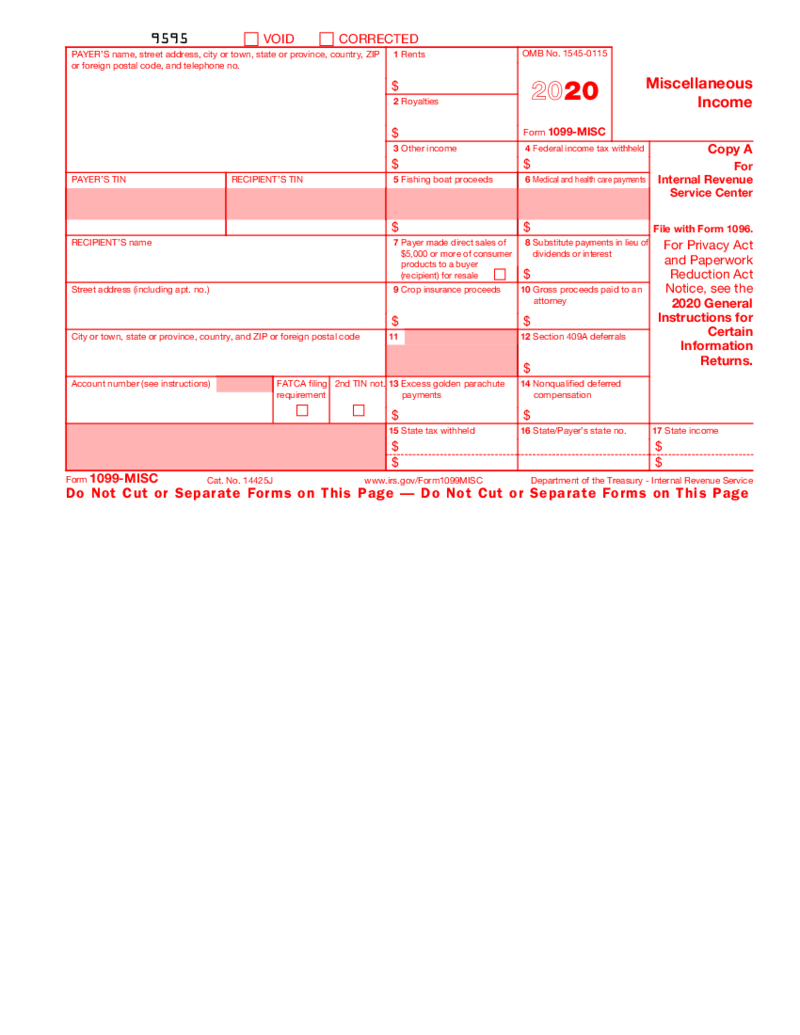

1099-MISC Form (2020)

What is 1099-MISC 2020 form?

The 1099-MISC form for 2020 is one of the types of forms that were created for US citizens to report about the incomes and expenses. It is necessary to define the level of taxes the individuals have to pay.

Wh

1099-MISC Form (2020)

What is 1099-MISC 2020 form?

The 1099-MISC form for 2020 is one of the types of forms that were created for US citizens to report about the incomes and expenses. It is necessary to define the level of taxes the individuals have to pay.

Wh

-

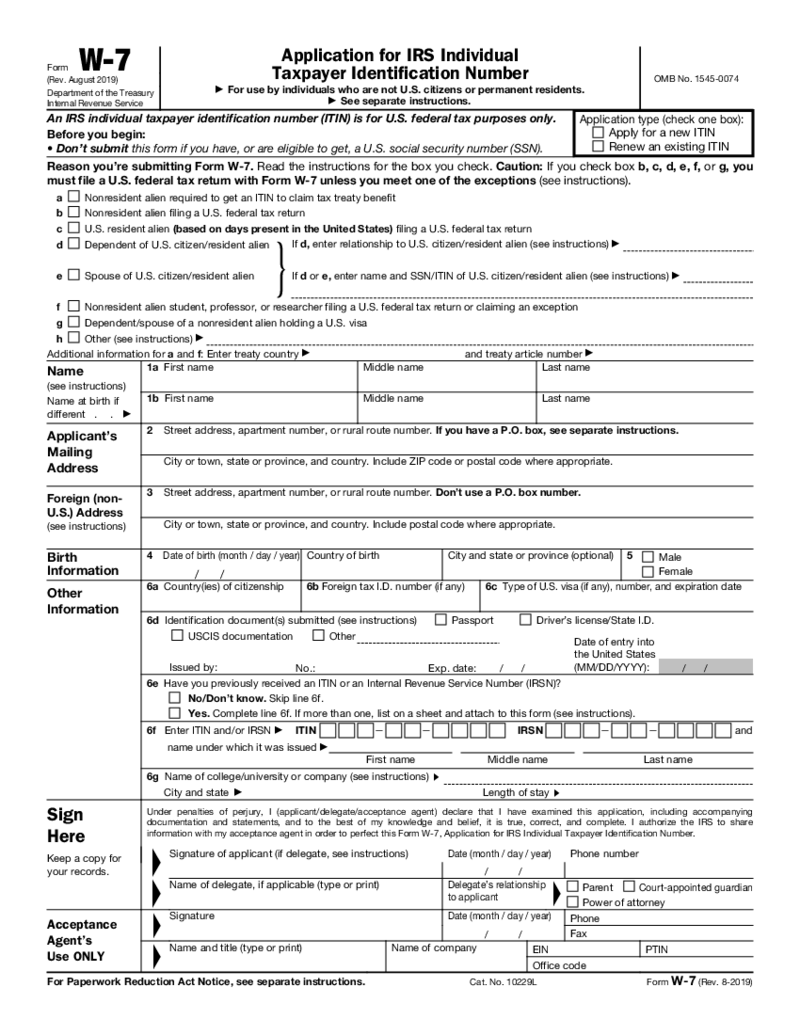

Form W-7

What is a W7 Form?

Form W-7 is an application for IRS individual taxpayer identification number or simply ITIN. ITIN is an 9-digits number that IRS grants to people who can't receive an SSN for some reason and uses is to identify a tax payer.&nbs

Form W-7

What is a W7 Form?

Form W-7 is an application for IRS individual taxpayer identification number or simply ITIN. ITIN is an 9-digits number that IRS grants to people who can't receive an SSN for some reason and uses is to identify a tax payer.&nbs

FAQ

-

Where do you enter the information for daycare on tax returns?

If you’re eligible for the Child and Dependent Care Credit, fill out Form 2441 and attach it to your 1040. For more details and nuances, please consult your tax advisor.

-

What should I do if I entered wrong information on tax returns?

Made a mistake on your return? Don’t panic. There’s a form for that. Opt for Form 1040-X to add corrections to the information you previously failed to accurately provide.

-

Where to find property tax information for tax returns?

That depends on the state you live in, so make sure you look up these details in your local tax office.

-

What information can you receive from a person’s tax returns?

In a nutshell, a tax return contains details on a person’s earnings, spendings, and other tax information. These forms grant taxpayers the possibility to calculate their tax liability, pinpoint tax payments, or request refunds for overpaid taxes.