-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

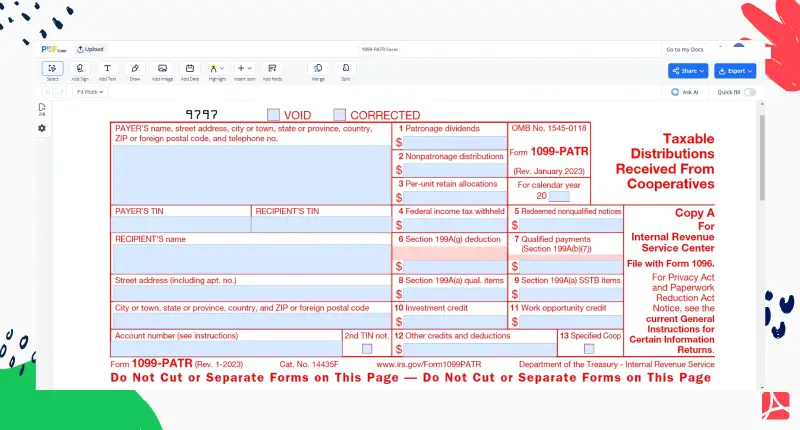

1099-PATR Form

Get your 1099-PATR Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, these distributions are paid out to patrons from cooperatives, which exist for mutual benefits. The IRS (Internal Revenue Service) created the form 1099-PATR to report these transactions, as they may be taxable, depending on certain conditions.

What do I need the 1099-PATR for?

Like all forms in the IRS’s 1099 series, the 1099-PATR is used for reporting less-familiar income types. Business cooperatives file a 1099-PATR form for each individual:

- to whom they have paid 10 USD or more in patronage dividends and other distributions under section 6044(b) of the IRC;

- from whom federal tax is withheld under the backup withholding rules.

This does not apply to payments to tax-exempt organizations.

Where do I enter form 1099 PATR?

If you're wondering about this question, the answer is relatively simple. The data from 1099 PATR form doesn't go directly into your personal tax return. Instead, the data guides you to other forms before calculating the tax amount and eventually reporting on form 1040.

To clarify, some information would eventually be reported on Schedule C (Profit or Loss from Business), while other information could go on Schedule E (Supplemental Income and Loss) or even Schedule F (Profit or Loss from Farming).

How to Fill Out IRS Form 1099 PATR

When pondering how to fill out this IRS form, it's crucial to understand the reporting process. Following the form 1099-PATR instructions is critical for accurate filing:

- Start in the top left corner where “PAYER’S name” is labeled. Here, you will input the name of the Payer.

- Below “PAYER’S name,” fill in the “street address," "city or town," "state or province," "country," "ZIP or foreign postal code.” If you have the Payer’s telephone number, you can enter it in the labeled box.

- Further, on the left, provide the Payer's Taxpayer Identification Number (TIN) in the "PAYER’S TIN" field.

- On the right side of the form, in the “RECIPIENT’S TIN," fill in the recipient's Taxpayer Identification Number.

- Beneath RECIPIENT’S TIN, enter the "RECIPIENT’S name."

- Under the recipient's name field, provide the recipient's street address, city/town, state/province, country, and zip/foreign postal code in the respective fields.

- In the "Account number" field, you'll need to enter the recipient's specified account number. Below this, if there is a 2nd TIN involved, fill in the respective number.

- In the section labeled "Patronage dividends," enter the total amount of dividends paid on a patronage basis.

- Venture into the "Nonpatronage distributions" section, providing the total amount of all nonpatronage distributions made during the tax year to patrons.

- In the "Per-unit retain allocations" section, report the per-unit retained allocations distributed.

- If Federal income taxes were withheld from the dividends or distributions, specify this total within the "Federal income tax withheld" field.

- Fill out "Redeemed nonqualified notices" if you redeemed nonqualified written notices.

- If you qualify for the Section 199A(g) deduction, input the appropriate figure into the "Section 199A(g) deduction" field.

- For the "Qualified payments (Section 199A(b)(7))" field, log how much of the payments were from qualified business income.

- The next section, "Section 199A(a) qual. items," refers to your qualified business income. Enter the amount from this income without losses or deductions applied.

- The field "Section 199A(a) SSTB items" requires you to document any SSTB items.

- In the section labeled “Investment credit,” list any qualified expenditures for the purpose of figuring the investment credit.

- If there were any opportunities for the "Work opportunity credit", disclose the amount in the respective field.

- Any applicable credits and deductions which do not fit in the above categories can be input into 'Other credits and deductions'.

- For the final box of reporting form 1099 PATR, put a tick in 'Specified Coop' only if the entity is a Specified Coop.

Where to report 1099 PATR on form 1040

Speaking specifically on reporting a 1099-PATR on your form 1040, the majority of the information from the 1099-PATR goes on Schedule 1 under Additional Income. If there's a checkbox next to Box 3, for instance, details will go on Schedule F or E, depending on the specifics.

Organizations that work with 1099-PATR

- The Internal Revenue Service (IRS)

Fillable online 1099-PATR Form