-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

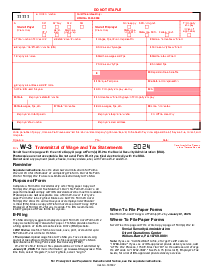

Form W-4P (2021)

Get your Form W-4P (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding Form W 4P 2021 for Withholding on Pensions

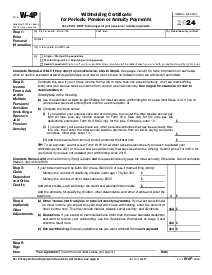

Form W-4P for 2021 is crucial for anyone receiving pension or annuity payments. This form serves as a guide for payers to determine the correct amount of federal income tax to withhold from these payments. Given its impact on monthly income and annual tax liability, it's essential to comprehend the details of this form.

Importance of the form W-4P for retirees and beneficiaries

Retirees and beneficiaries must pay attention to their tax withholding to avoid facing unexpected taxes or penalties at the end of the financial year. The IRS Form W-4P 2021 allows individuals to specify their withholding preferences, avoid underpaying taxes, and manage their cash flows effectively. By accurately completing this form, pensioners ensure they're not surprised by a large tax bill or a smaller refund than anticipated.

How to Fill Out the W 4P Form 2021

Filling out this IRS template might seem daunting, but it's a straightforward process when broken down correctly. Here's a simplified approach:

- Begin by entering your first name, middle initial, and last name in the designated areas at the top of the form.

- Provide your Social Security Number (SSN) in the space provided.

- Write your residential address, including the number and street or rural route you reside at.

- Add your city or town, followed by the state you live in and your ZIP code.

- If you have a claim or identification number related to your pension or annuity contract, enter it.

- If you wish to opt out of federal income tax withholding from your pension or annuity, check the box that corresponds to this preference. Skip lines 2 and 3 if you do this.

- Specify the total number of allowances you are claiming for tax withholding from each periodic pension or annuity payment if you want taxes withheld. This requires you to enter a number.

- Indicate your marital status by selecting one of the three options: Single, Married, or Married but withhold at the higher single rate.

- Decide if you want an additional amount withheld from each pension or annuity payment. If so, enter this dollar amount; remember that you must have entered a number of allowances (even if zero) on line 2 to fill out this section.

- Finally, sign your name at the bottom to authenticate the form and date it to record when you completed the document.

Staying compliant with the IRS form W 4P 2021

Compliance with tax regulations is non-negotiable. When you submit Form W-4P, you're ensuring that the correct amount of tax is being withheld from your payments. Non-compliance can result in underpayment of taxes and potential penalties at the end of the tax year. Be proactive and make sure your withholding reflects your current obligations.

Utilize PDFliner for easy completion and submission

For a hassle-free experience in handling IRS Form W 4P 2021, look no further than PDFliner. This online platform lets you fill out your form digitally, ensuring accuracy and security. PDFliner offers an intuitive interface that guides you through the completion process step by step, making it simple to update your information as needed and submit the form directly to your payer or the IRS. A PDFliner online service can save you time, reduce errors, and provide you with digital records of all your submissions.

Form Versions

2020

Fillable Form W-4P (2020)

2023

Fillable Form W-4P (2023)

Fillable online Form W-4P (2021)