-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

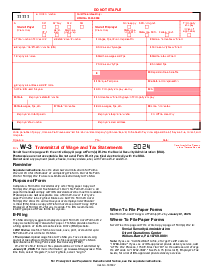

Form W-2AS

Get your Form W-2AS in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form W-2AS

Form W-2AS is essentially the American Samoa equivalent of the standard W-2 tax form used in the United States. The government mandates this IRS form for employers operating within American Samoa to provide to each of their employees and to the Social Security Administration (SSA). The purpose of Form W-2AS is to report the income earned by employees in American Samoa, as well as the taxes withheld by the employer over the fiscal year.

Who needs to file form W-2AS

The responsibility of filing Form W-2AS rests upon employers operating in American Samoa. It is a required form for every employee who has had taxes withheld or would have had taxes withheld if the employee's income were higher than the established threshold for taxation. Employees must receive their copy of W-2AS from their employer so that they can utilize the information when filing their individual income tax returns.

How to Fill Out Form W-2AS Guide

Filling out the W-2AS form can be daunting for employers, especially if they are managing multiple employees. The process is detail-oriented, requiring accurate information regarding each employee's wages and taxes withheld. Essential steps for completing this template include:

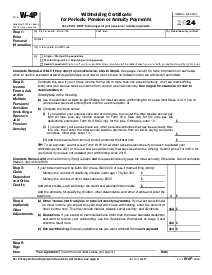

- Begin with the section designated for invalidation. If the information you're submitting is incorrect or the form is being reissued, mark 'VOID'.

- Input the employee's Social Security Number (SSN) without dashes or spaces, accurately ensuring its alignment in the designated boxes.

- In the space provided, enter your Employer Identification Number (EIN), also without spaces or dashes, ensuring it aligns with the correct boxes.

- Write your full legal business name, followed by the accurate business mailing address, including the city, state, and ZIP code.

- If there is an internal control number that your company uses to track this specific document, enter it in the 'Control number' area.

- Under the employee information section, write the worker's first name and middle initial, followed by their last name and suffix if applicable.

- Record the worker's complete address information, including the house or apartment number, street, city, state, and ZIP code.

- Move on to report the employee's total earnings for the year, including wages, tips, and other compensation.

- In the next line, you need to include the total amount of American Samoa income tax that has been withheld from the employee’s earnings.

- Next, you will record the total amount of earnings subject to social security tax.

- In the following space, specify the total social security tax amount that has been withheld from the employee’s earnings.

- Enter the total wages and tips that are subject to Medicare tax.

- After that, specify the total amount of Medicare tax that was withheld from those wages and tips.

- Record any reported tips subject to social security tax that have not been included in the wages, tips, and other compensation section.

- For any distributions made from nonqualified plans or deferred compensation, enter appropriate figures.

- Examine the box labeled with instructions for special situations and conditions, such as deferred compensation, or other codes as specified in the form instructions, and fill in the relevant details.

- Check the appropriate box if the employee is a statutory worker, if there is a retirement plan tied to them, or if they're receiving third-party sick pay.

- Finally, in the last section, provide any additional information, such as dependent care benefits, that doesn't fit into the prior entries.

Make sure to verify all the information for accuracy before submitting or saving your filled form.

Ensuring accuracy and timeliness

Accuracy is non-negotiable when it comes to completing and submitting Form W-2AS. Errors can lead to delays or issues for both the employer and employee. Moreover, the form must be sent out to employees by January 31st following the reporting year and filed with the SSA by the same date to avoid penalties. As such, employers need to start preparing these forms before the filing deadline.

Form Versions

2020

Fillable Form W-2AS (2020)

2021

Fillable Form W-2AS (2021)

2023

Form W-2AS (2023)

Fillable online Form W-2AS