-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

1099 Forms

-

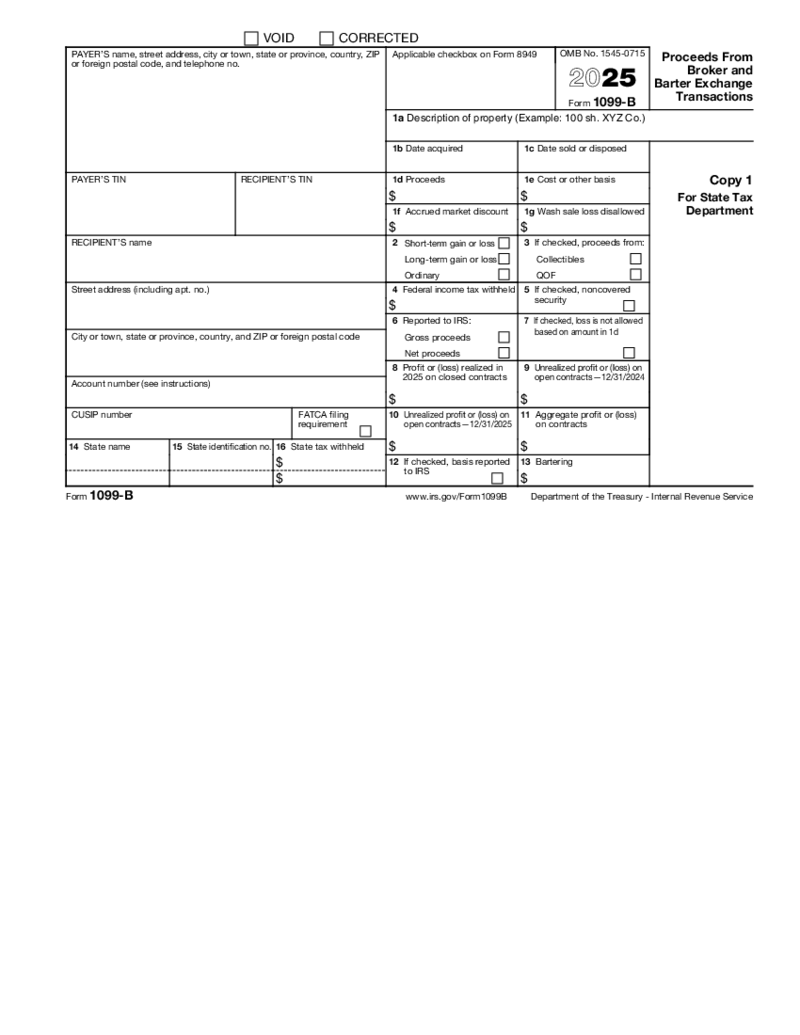

Form 1099-B (2025)

What Is Form 1099-B (2026)?

Form 1099-B, or Proceeds from Broker and Barter Exchange, is a document used by brokers or barter exchanges to record clients’ profits and losses throughout a tax year. Taxpayers use the data from IRS Form 1099-B to calcu

Form 1099-B (2025)

What Is Form 1099-B (2026)?

Form 1099-B, or Proceeds from Broker and Barter Exchange, is a document used by brokers or barter exchanges to record clients’ profits and losses throughout a tax year. Taxpayers use the data from IRS Form 1099-B to calcu

-

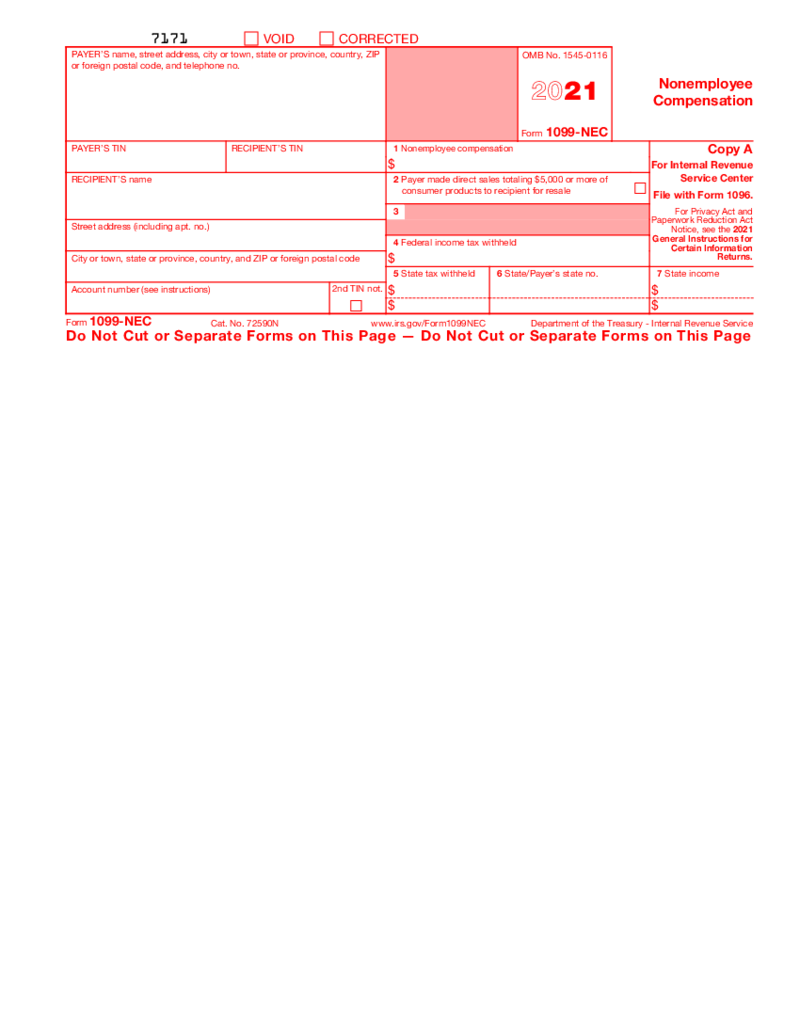

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

Form 1099-NEC (2021)

What is a 1099-NEC form 2021?

A 1099-NEC form 2021 is a tax document used to report nonemployee compensation. This form is used to report payments made to independent contractors and other nonemployees for services performed. The 1099-NEC form is used to

-

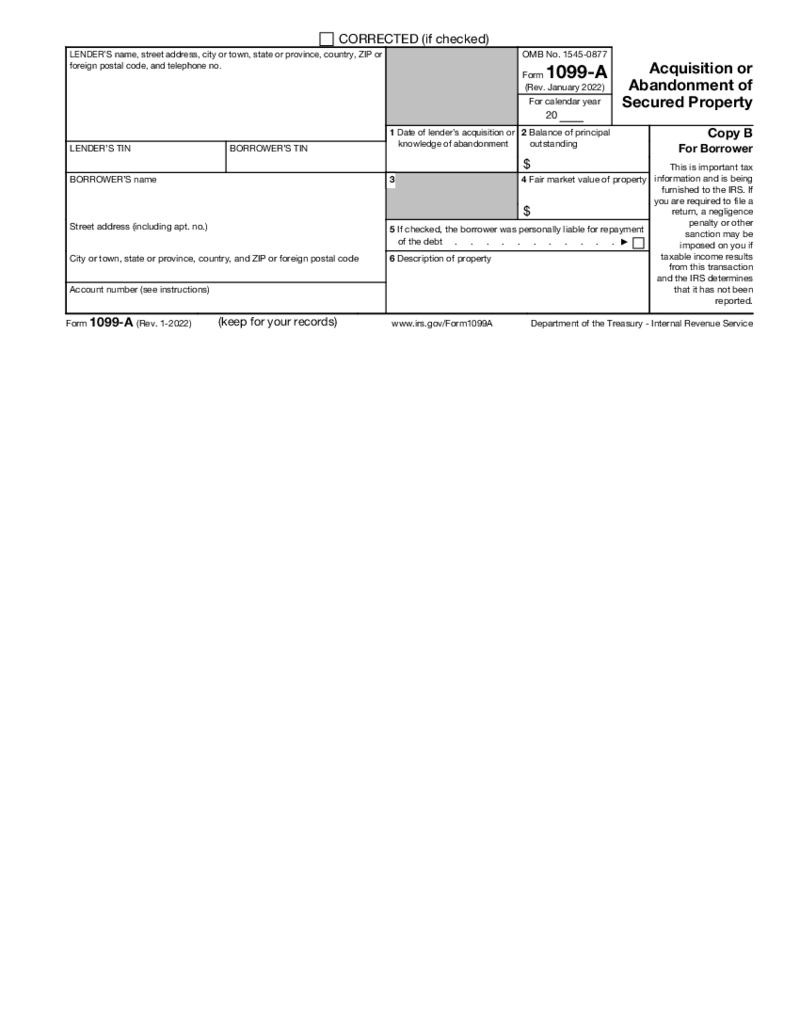

Form 1099-A (2022)

What Is Form 1099-A?

Form 1099-A is the acquisition or abandonment of secured property definition, which is needed to inform about various transactions not related to wages. Form 1099-A is commonly applied when an estate has been transferred because of fo

Form 1099-A (2022)

What Is Form 1099-A?

Form 1099-A is the acquisition or abandonment of secured property definition, which is needed to inform about various transactions not related to wages. Form 1099-A is commonly applied when an estate has been transferred because of fo

-

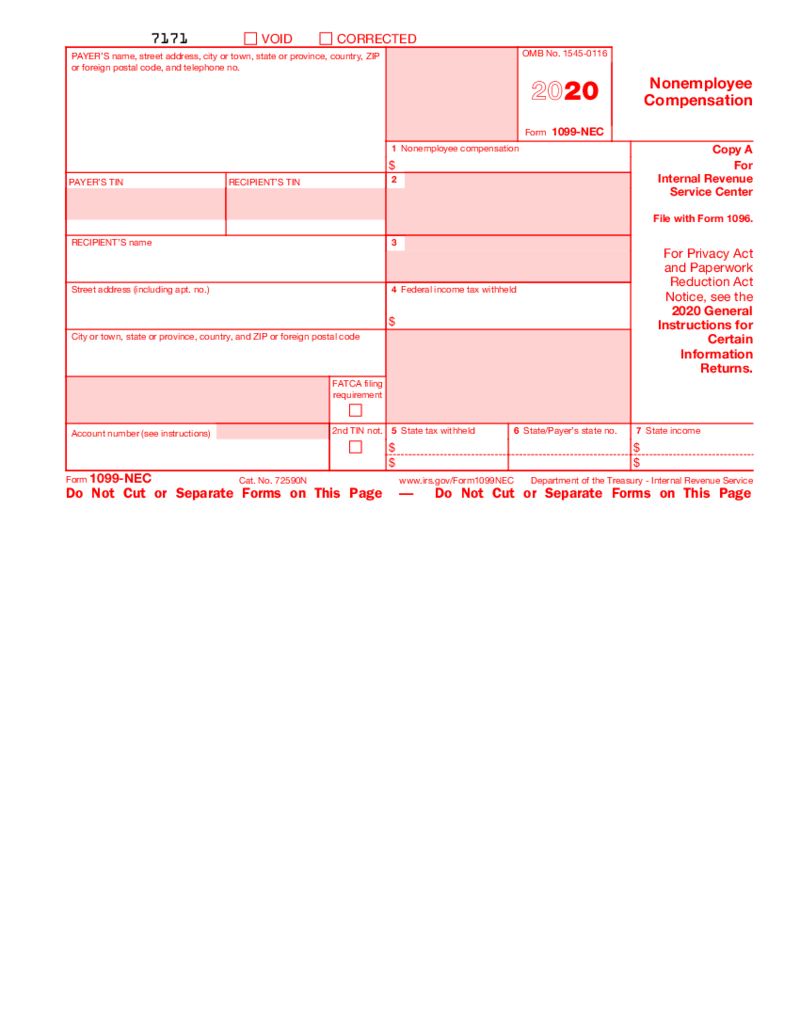

Form 1099-NEC (2020)

Overview of 2020 Form 1099 NEC

The Form 1099-NEC was brought back into use by the IRS for the tax year 2020 to separate non-employee compensation from the Form 1099-MISC. The blank 1099 NEC form 2020 printable is dedicated to reporting payments totaling $

Form 1099-NEC (2020)

Overview of 2020 Form 1099 NEC

The Form 1099-NEC was brought back into use by the IRS for the tax year 2020 to separate non-employee compensation from the Form 1099-MISC. The blank 1099 NEC form 2020 printable is dedicated to reporting payments totaling $

-

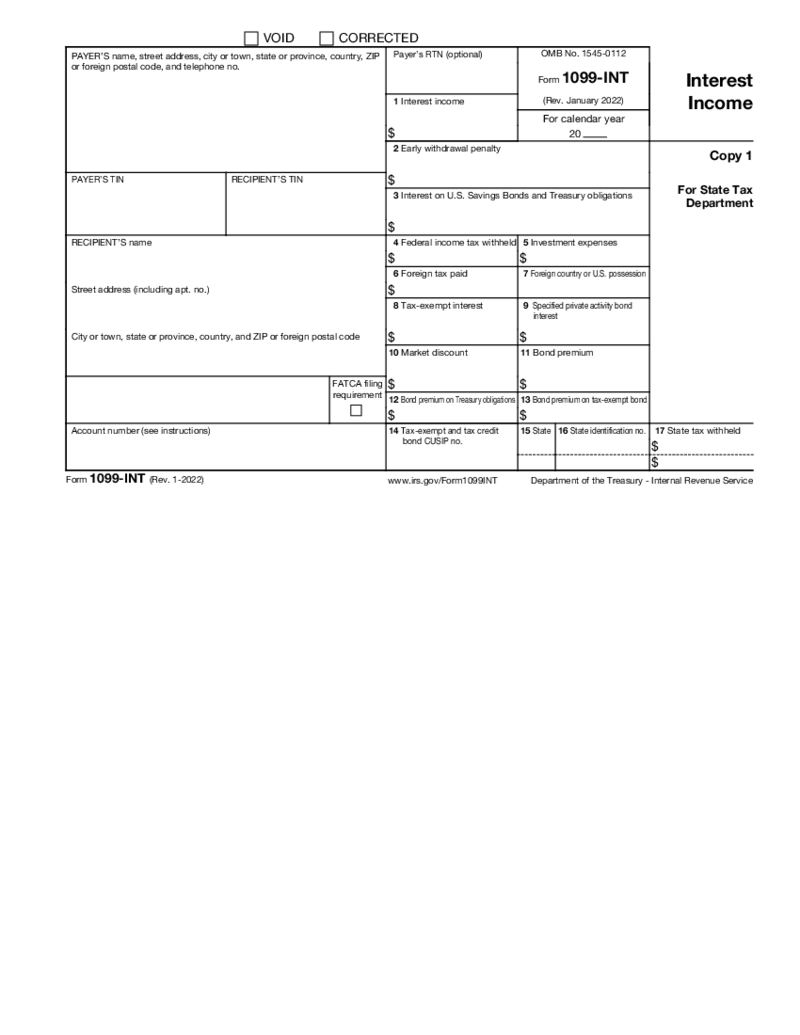

Form 1099-INT (2022 - 2023)

Introduction to Form 1099-INT 2022-2023

Form 1099-INT documents taxpayers receive from banks or other financial institutions that have paid them interest totaling $10 or more during the tax year. It encompasses various types of interest income, such as in

Form 1099-INT (2022 - 2023)

Introduction to Form 1099-INT 2022-2023

Form 1099-INT documents taxpayers receive from banks or other financial institutions that have paid them interest totaling $10 or more during the tax year. It encompasses various types of interest income, such as in

-

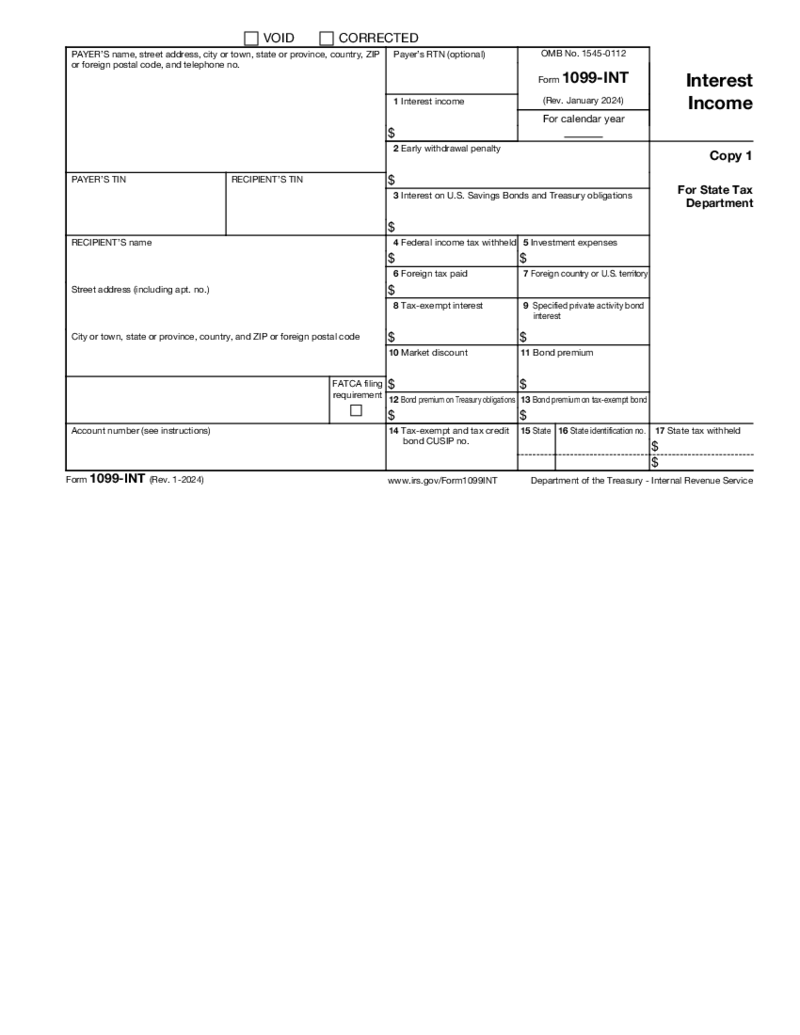

Form 1099-INT (2024)

What is form IRS 1099 INT 2026?

IRS 1099 INT is the form that needs to be filled by banks or other financial institutions and accredited investors to report interest income as well as the penalties on the investments. The fillable 1099-INT form is p

Form 1099-INT (2024)

What is form IRS 1099 INT 2026?

IRS 1099 INT is the form that needs to be filled by banks or other financial institutions and accredited investors to report interest income as well as the penalties on the investments. The fillable 1099-INT form is p

-

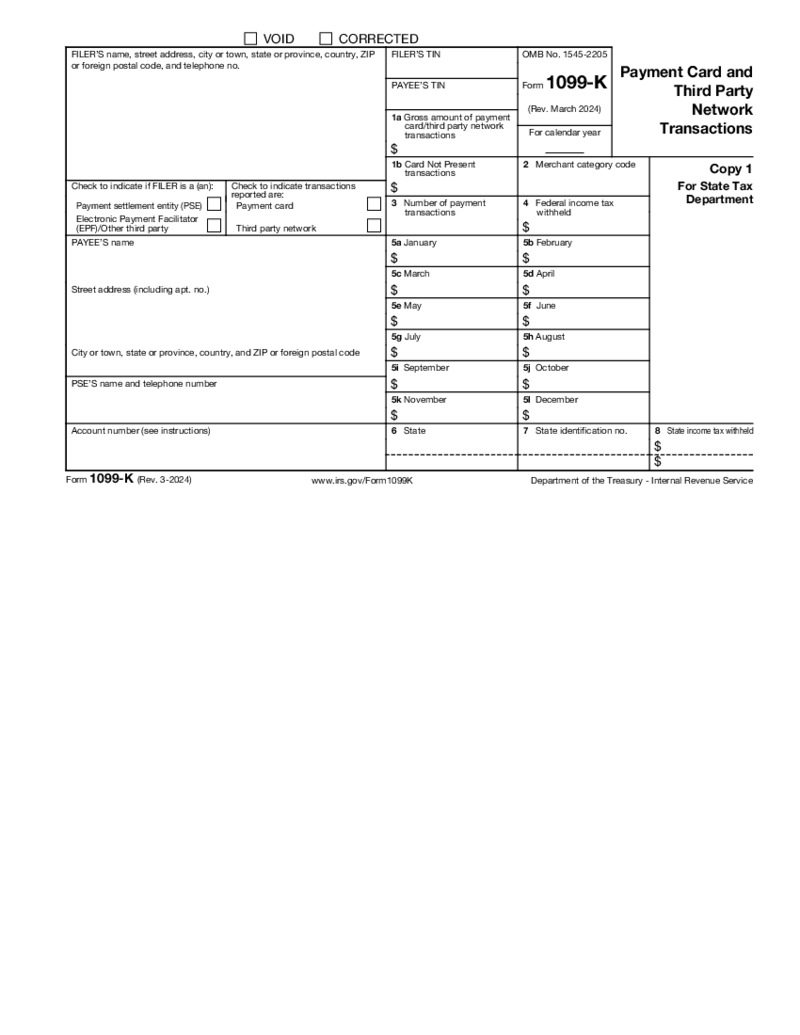

Form 1099-K (2024)

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment tra

Form 1099-K (2024)

What Is Form 1099-K (2024)?

The IRS Form 1099-K is also known as Payment Card and Third Party Network Transactions. The form has to be completed with the tax return from the private person. What is a 1099-K form? This is the information on the payment tra

-

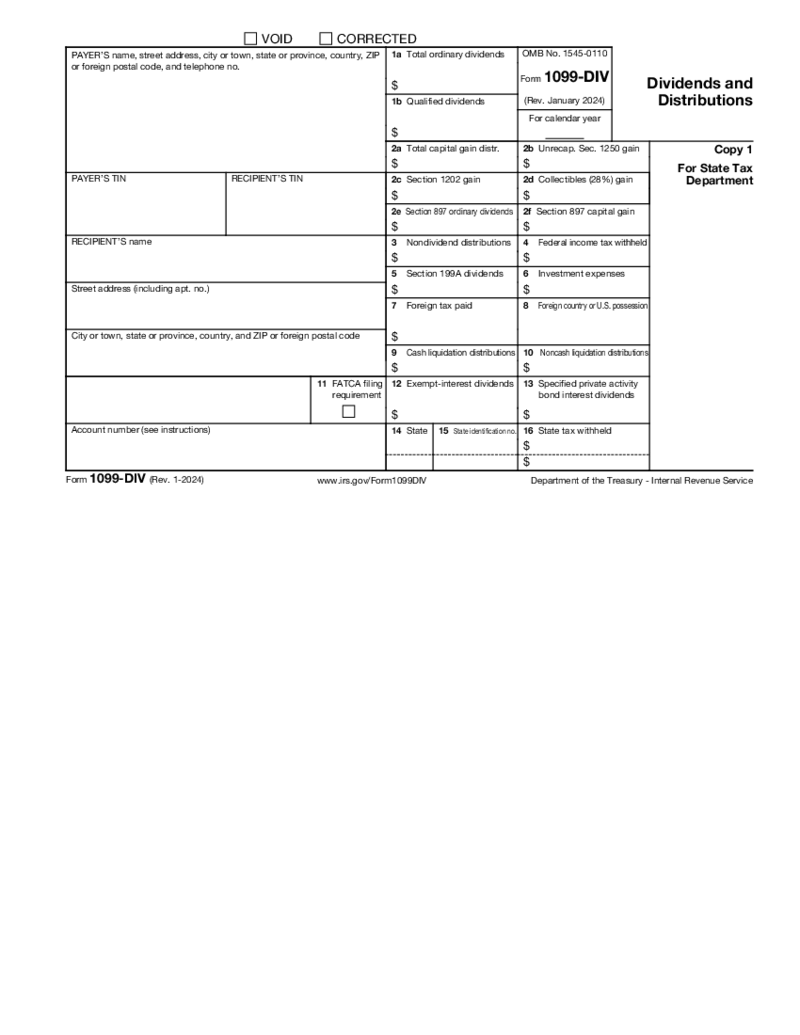

Form 1099-DIV (2024)

What Is 1099-DIV Form

This fillable and printable online PDF blank form is a document you may receive from banks and similar financial entities if you’re an investor who receives dividends and distributions from an equity plan or any kind of investm

Form 1099-DIV (2024)

What Is 1099-DIV Form

This fillable and printable online PDF blank form is a document you may receive from banks and similar financial entities if you’re an investor who receives dividends and distributions from an equity plan or any kind of investm

-

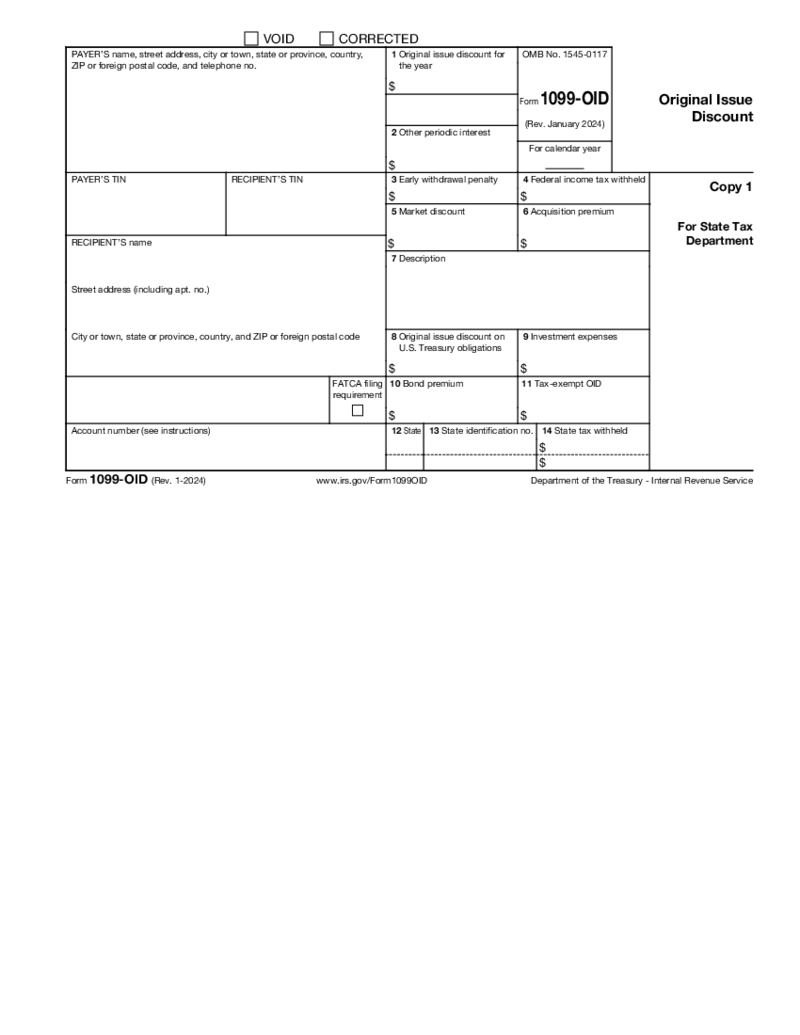

Form 1099-OID (2024)

What Is OID Form 1099?

It’s an IRS tax document utilized for reporting OID taxes on specific debt instruments. A debt instrument is an asset that people or entities use for raising money or generating investment income. The holder of bonds, ce

Form 1099-OID (2024)

What Is OID Form 1099?

It’s an IRS tax document utilized for reporting OID taxes on specific debt instruments. A debt instrument is an asset that people or entities use for raising money or generating investment income. The holder of bonds, ce

-

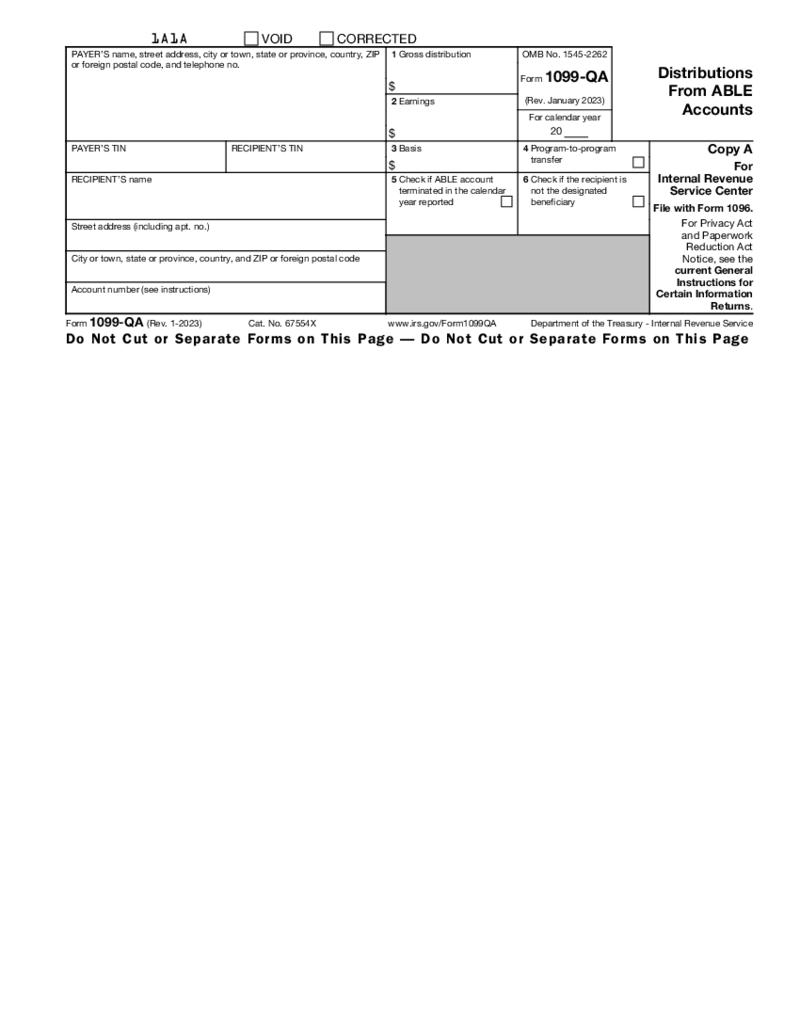

Form 1099-QA (2023)

The Ultimate Guide to Filling Out IRS Form 1099-QA for ABLE Account Distributions

The IRS Form 1099-QA is a critical tax document for those managing Achieving a Better Life Experience (ABLE) accounts. It details distributions from these accounts to assist

Form 1099-QA (2023)

The Ultimate Guide to Filling Out IRS Form 1099-QA for ABLE Account Distributions

The IRS Form 1099-QA is a critical tax document for those managing Achieving a Better Life Experience (ABLE) accounts. It details distributions from these accounts to assist

-

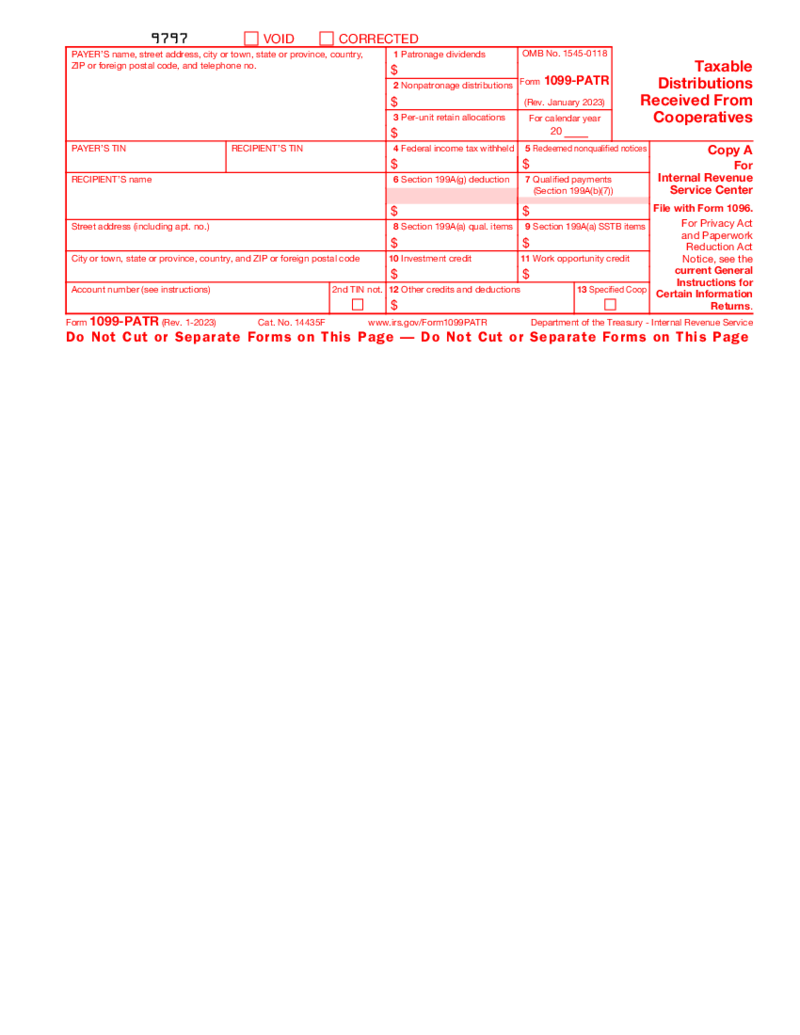

1099-PATR Form

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, t

1099-PATR Form

What Is a 1099 PATR Form?

As a start, the 1099-PATR form is a crucial document related to taxes that are specific to individuals, organizations, or agencies who, during the tax year, received a distribution from cooperatives of $10 or more. Essentially, t

-

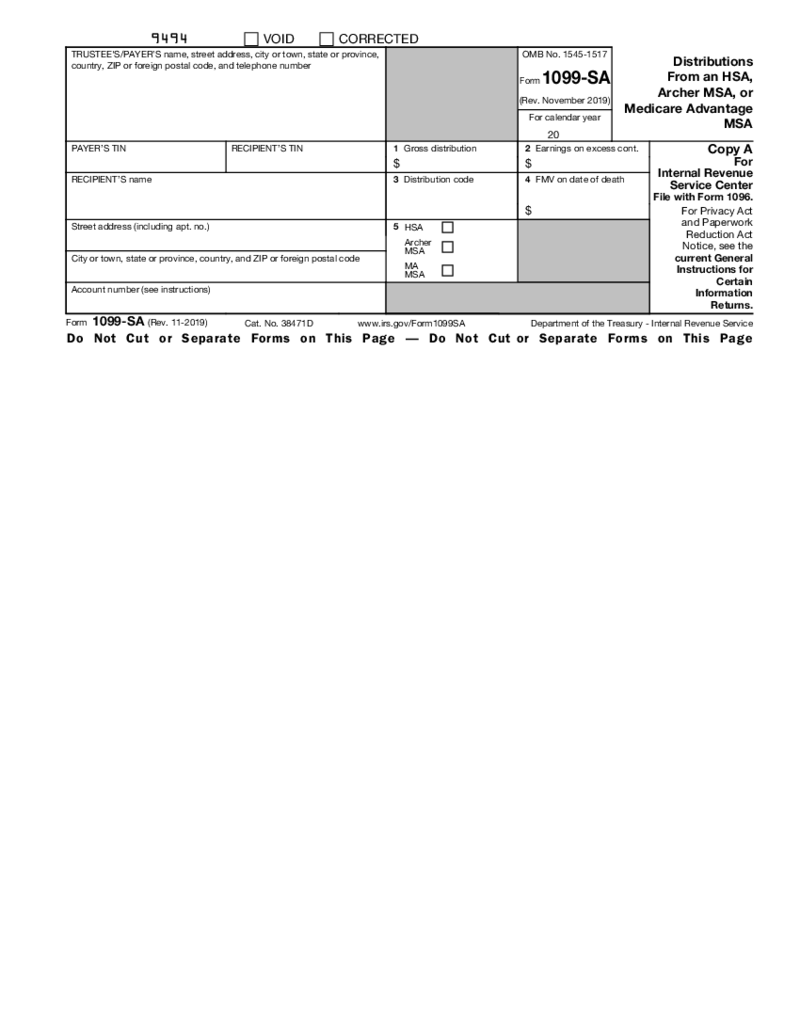

Form 1099-SA

What Is a Form 1099 SA?

It’s a document received from the IRS in case of needing to report distributions made from health savings account, archer medical saving account, and Medicare Advantage MSA on your federal taxes. Via PDFLiner, you can fill ou

Form 1099-SA

What Is a Form 1099 SA?

It’s a document received from the IRS in case of needing to report distributions made from health savings account, archer medical saving account, and Medicare Advantage MSA on your federal taxes. Via PDFLiner, you can fill ou

1099 Forms: Information Returns for Tax Reporting

Form 1099-MISC

This form is used to report various types of payments made in the course of trade or business. It's primarily used for payments of $600 or more, including:

✔️ Rents

✔️ Medical and health care payments

✔️ Prizes and awards

✔️ Attorney fees

Utilize PDFLiner to efficiently complete and e-sign this form.

Form 1099-NEC

Form 1099-NEC is specifically for reporting nonemployee compensation. It's required when:

✔️ Payments are made to independent contractors, freelancers, or sole proprietors

✔️ The total amount paid to a single recipient is $600 or more in a tax year

Form 1099-INT

This form is used to report interest income. Businesses that pay interest to investors must complete this form annually:

✔️ Banks reporting interest on savings accounts

✔️ Corporations paying interest on bonds

Form 1099-A

Lenders use Form 1099-A to report the acquisition or abandonment of secured property. It's required for:

✔️ Foreclosure proceedings

✔️ Property transferred in lieu of foreclosure

✔️ Abandoned property securing a loan

Form 1099-S

This form reports proceeds from real estate transactions. It's an essential part of many real estate closings and ensures proper reporting of capital gains:

✔️ Used for sales or exchanges of real estate

✔️ Helps track capital gains for tax purposes

✔️ Required for most real estate transactions, with some exceptions

FAQ

-

What is the deadline for 1099 forms to be mailed?

Send the document to the recipient by January 31st of the year following the tax year.

-

Where can I get tax 1099 forms for independent contractors?

1. IRS website: You can download and print 1099 forms directly from www.irs.gov. However, note that these forms often need to be ordered as special paper versions for official submission.

2. Order from the IRS: You can order official paper forms from the IRS by calling 1-800-TAX-FORM (1-800-829-3676) or through their online ordering system.

3. Office supply stores: Many stores like Staples, Office Depot, or OfficeMax sell IRS-approved 1099 forms.

4. Online retailers: Websites like Amazon or tax supply specialists often sell IRS-approved 1099 forms.

5. Accounting software: If you use accounting software like QuickBooks, TurboTax, or FreshBooks, they often have features to generate and file 1099 forms electronically.

6. Tax preparation services: Many professional tax preparers and payroll services can provide and file 1099 forms for you.

Remember, for official IRS filing, you typically need to use the official "red" Copy A of Form 1099 or an IRS-approved substitute. Photocopies are generally not accepted for official filing with the IRS.