-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

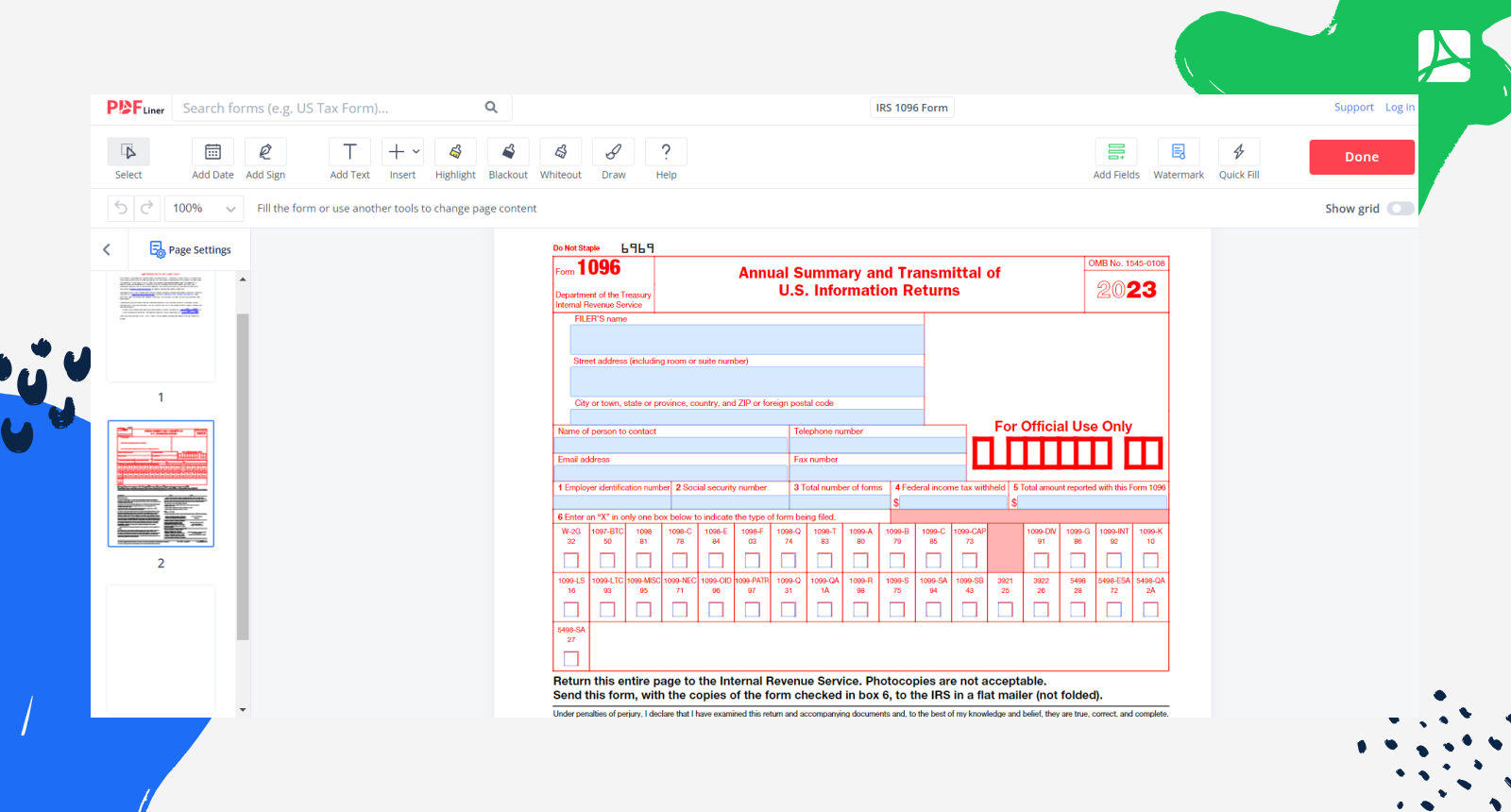

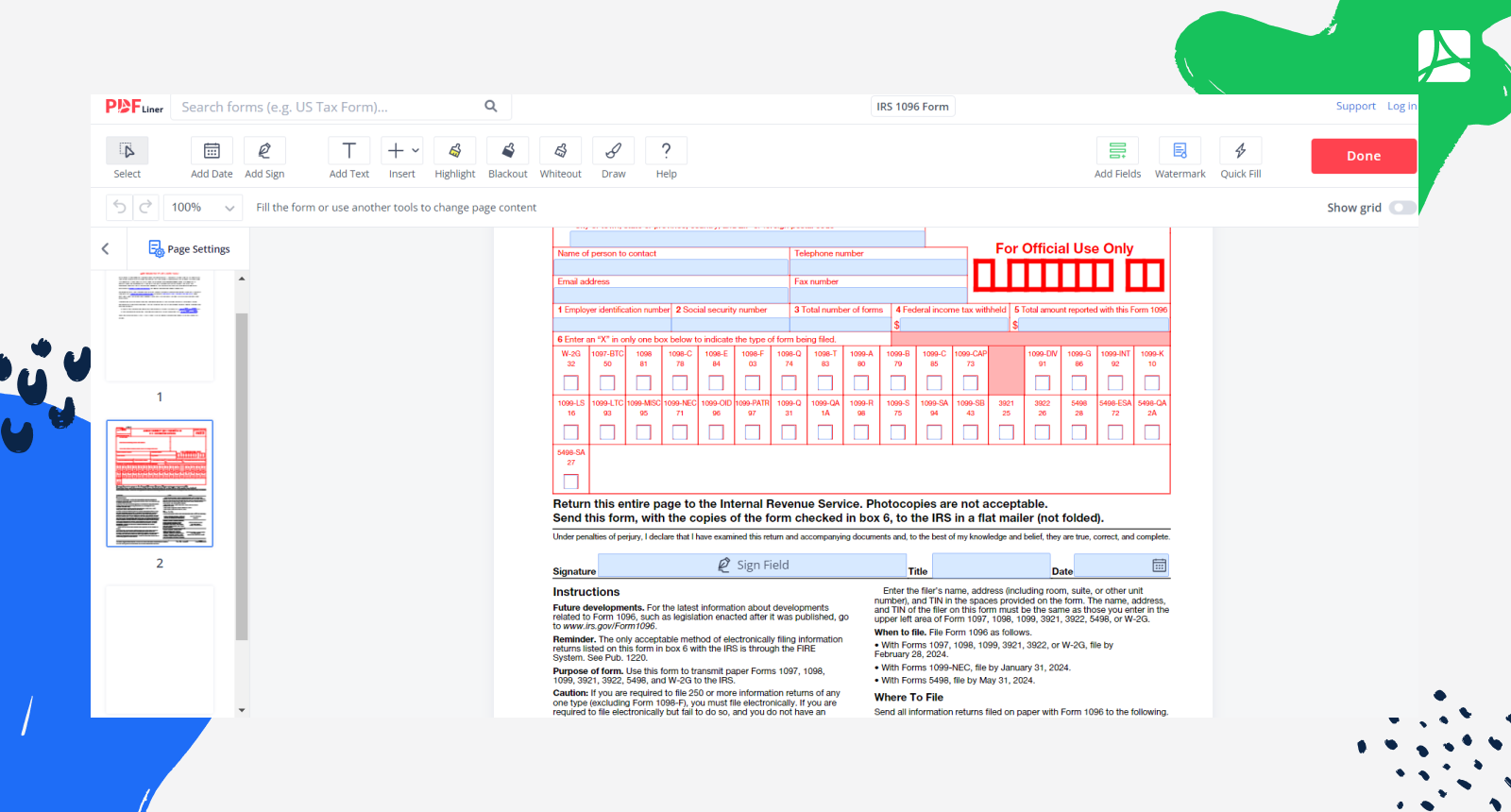

IRS 1096 Form (2024)

Get your IRS 1096 Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is IRS 1096 2026?

Form 1096 is a file that provides results with all information documents you may already have submitted to recipients and Internal Revenue Service. If you provided information to recipients, no matter which docs you use, you must submit IRS 1096 later. However, different forms require various approaches. This document must be accompanied by forms that have been submitted before.

What I need the IRS 1096 2026 for?

Depending on the file you filled out before, there’re different goals to provide 1096 to authorities. For example:

- Government, educational and financial institutions require this form to keep finances in order;

- Small or corporate businesses, brokers, insurance companies require 1096 to show the communication between them and recipients;

- Mortgage lenders, homeowners, real estate agents, loan holders, creditors have to show the form to clients;

- Lottery, casinos, other gambling institutions require for tax reports.

There is a penalty if you don’t fill out IRS 1096 on time. If you file late, the penalty starts at $30 per one form. It depends on form submission and how late it was submitted. Take care to check all deadlines on the official website. It is recommended to check each tax document deadline separately.

Organizations that work with 1096 file

Department of the Treasury, Internal Revenue Service.

Relevant to IRS 1096 Documents:

- Fillable 1096 2021;

- Fillable 1099-MISC;

- Fillable 1099-NEC;

- Fillable 1099-INT;

- IRS 1040 NR form;

- IRS 3520 Form.

Related to blank 1096 Resources

How to Fill Out a 1096 Form IRS?

Step 1:Open the fillable 1096 by clicking "Fill Out Form" button.

Step 2: Provide the following information:

- Company: name, address, phone, the person who can be contacted;

- SSN or EIN number must be included;

- Complete Box 3 by listing all forms you want to send to Internal Revenue Service;

- Box 4 contains the total number of tax withheld on all forms you submit;

- Box 5 consists of all payments on forms;

- You may put X mark in Box 6, for the document type you are submitting.

Step 3: Once you completed the file, click "Done" button to save the document.

Form Versions

2022

Fillable Form 1096 for 2022 tax year

FAQ: Let’s Go Through Form 1096 Popular Questions

-

Where to get Form 1096?

Get the printable 1096 blank at PDFLiner by choosing "Fill Out Form" button and completing it online. If you would like to get simply a blank, go to the official website and download 1096 there. In case you need a scannable 1096 blank to fill it with Internal Revenue Service, you would have to order it.

-

When is 1096 due?

The due date for Form 1096 is usually February 28, it wasn't changed this year. However, please remember you have to provide all copies of the blank to non-IRS recipients by January 31 of the year after the tax annum.

-

How to file a corrected 1096?

To file a corrected 1096, you would have to fill it out, print a paper Copy A of the document, and then mail it to the local Internal Revenue Service office. You can find the mailing address on the 2nd and 3rd pages of the form.

-

What are the components of Form 1096?

File 1096 contains sections for:

- Filer’s Information;

- Forms to be filled out.

-

How do I print a 1096?

To print tax form 1096 you should fill it out and then click the Done button and choose the Print option.

Fillable online IRS 1096 Form