-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1096 (2020)

Get your Form 1096 (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is 1096 Form 2020?

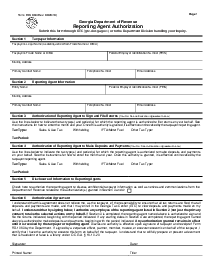

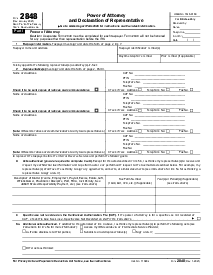

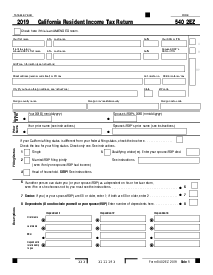

The 1096 form 2020 serves as a cover sheet to report the totals from information returns, which may include forms such as 1099, 1098, and other tax documents. It is important to note that Form 1096 is utilized when submitting paper forms to the IRS. The primary purpose of Form 1096 is to summarize the information from forms such as 1099, 1098, 3921, 3922, 5498, and W-2G.

Importance of IRS form 1096 for 2020 PDF

As tax season approaches, a proper template is indispensable when preparing your IRS documents. The 2020 Form 1096 template acts as a guideline, ensuring that all your information is correctly and consistently presented. With it, you can effectively capture and organize the information for each form you're submitting to the IRS, ensuring the summary aligns accurately with the individual transmittals. So, access to a reliable and correctly formatted form 1096 template can be particularly helpful.

How to Fill Out the IRS Form 1096 for 2020

When you embark on the task of completing the 2020 form 1096 fillable, it's essential to be meticulous:

Begin by typing your company or personal name as it appears on tax documents in the designated section at the top of the form template.

- Follow by entering your address details, including the street, room or suite number if applicable.

- Input the city, state, or province, along with the country and postal code in the next section.

- Provide the contact information of the individual the IRS can reach out to with any inquiries regarding the form. This includes the full name of the contact person.

- Enter a reachable phone number and an alternative fax number, if available.

- Include an email address for correspondence related to the form.

- Specify your Employer Identification Number (EIN) if you’re filing for a business entity. For individual filers, provide your Social Security Number (SSN).

- Indicate the total count of forms you are submitting with this summary Form 1096.

- Report the accumulated federal income tax withheld across all forms you are summarizing.

- State the collective dollar amount reported on all the forms that you are including with this Form 1096.

- Select the appropriate type of form you are filing from the list provided by marking an “X” in the corresponding box. Remember to mark only one box.

- Conclude by entering your signature, your title within the company (if applicable), and the date you completed form 1096. This verifies that all the information you've provided is accurate to the best of your knowledge.

Why using PDFliner for your 1096 form 2020 needs is a smart decision

Opting to use PDFliner to manage your form 1096 for tax year 2020 provides various benefits. It not only offers a user-friendly platform for accessing and completing your form but also secures your information with advanced encryption. Additionally, with features like online storage and the ability to share documents directly, PDFliner simplifies the submission process as well.

Fillable online Form 1096 (2020)