-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

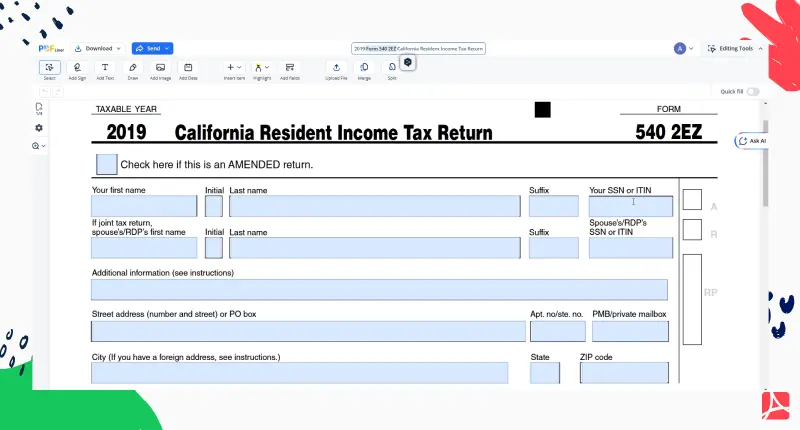

Complete Guide to the 2019 Form 540 2EZ California Resident Income Tax Return

Get your 2019 Form 540 2EZ California Resident Income Tax Return in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Introduction to Form 540 2EZ

Form 540 2EZ is a simplified version of California's standard state income tax form, aimed at making tax filing easier for eligible residents. This form is generally used by individuals with relatively uncomplicated financial situations.

When and Who Should Use Form 540 2EZ?

Form 540 2EZ is ideal for California residents who fulfill specific conditions, such as having wage income under a certain threshold, being under the age of 65, and not itemizing deductions. It's designed to simplify tax filing for those with straightforward financial circumstances.

Step-by-Step Instructions to Filling Out Form 540 2EZ

- Start by filling in your personal information, including your name, address, and social security number.

- Report your income, including wages, salaries, and tips.

- Calculate your tax by using the provided tax table.

- Subtract your tax credits, if any, to arrive at your total tax.

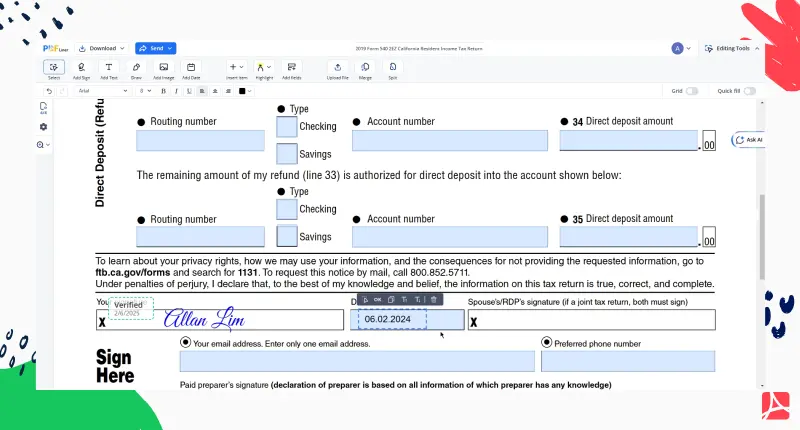

- Calculate the amount you owe or your refund by subtracting your payments from your total tax.

Common Mistakes to Avoid While Filling Out Form 540 2EZ

- Not checking the eligibility criteria before selecting Form 540 2EZ.

- Mistyping personal information or financial details.

- Overlooking tax credits or deductions you may be eligible for.

- Forgetting to sign and date the form.

Tips and Tools for Easy Tax Filing with Form 540 2EZ

Effective tax filing involves keeping track of deadlines, maintaining accurate records, and using appropriate tools for calculation. Online calculators, tax software, and professional tax advisors can all make the process smoother.

|

Tool |

Use |

|---|---|

| Online Tax Calculator | Estimate your tax liability or refund |

| Tax Software | Automate calculations and form filling |

Conclusion and Additional Resources

Form 540 2EZ can be a helpful tool for eligible California residents to simplify their tax filing process. However, it's crucial to understand the form's requirements, how to fill it out correctly, and the common mistakes to avoid. For more guidance, consult the official instructions provided by the California Franchise Tax Board or seek help from a tax professional.

Fillable online 2019 Form 540 2EZ California Resident Income Tax Return