-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

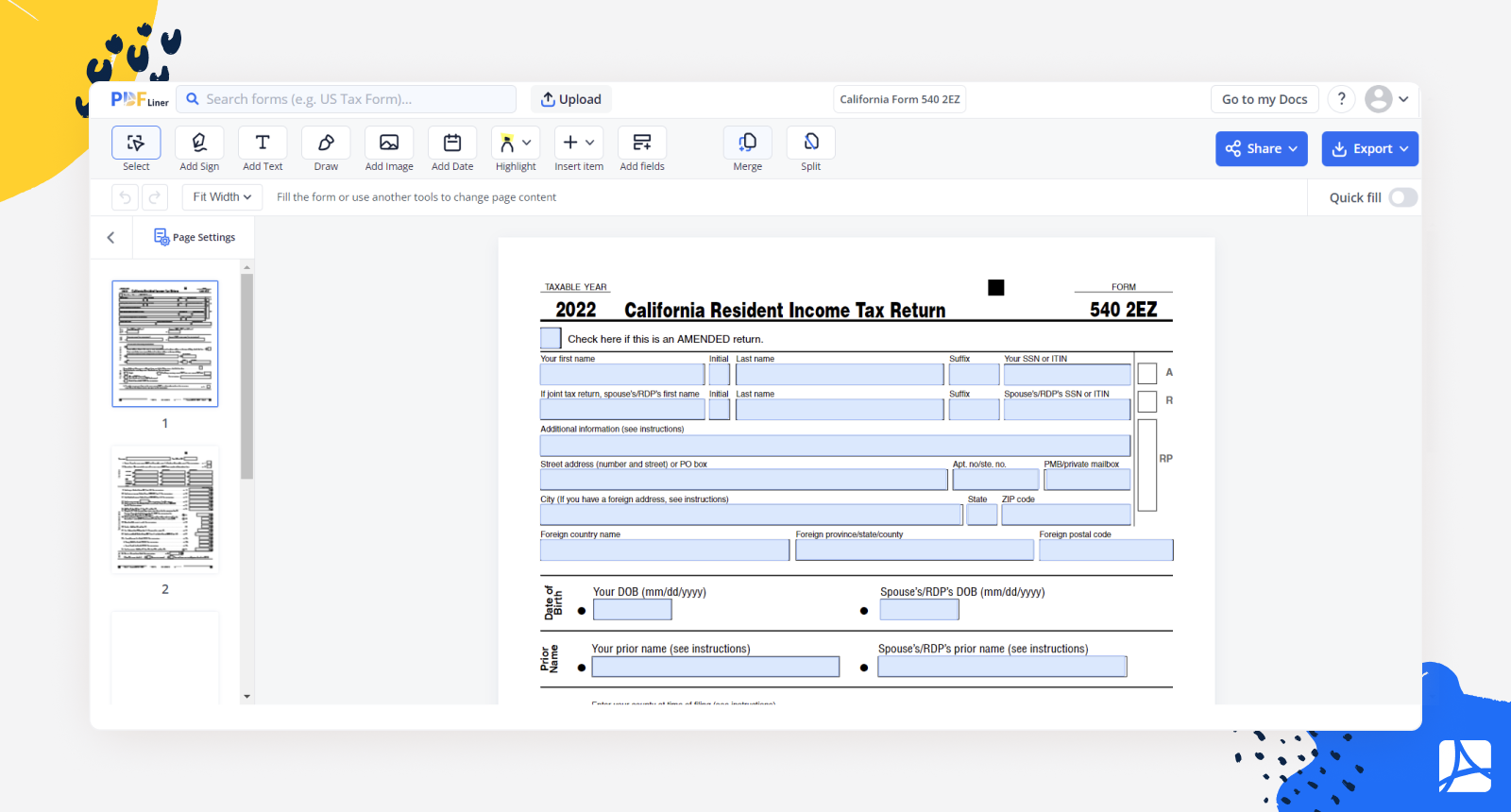

California Form 540 2EZ

Get your California Form 540 2EZ in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 540 2EZ

In California taxes, the tax form 540 2EZ is a shorter and simplified version of the standard 540 form. It's an opportunity for qualifying individuals to file their California resident income tax straightforwardly and efficiently.

Form 540 2EZ is intended for single or joint filers with no dependents who have earned income from wages, salaries, or tips and have only a handful of specific deductions, like mortgage interest or medical expenses. Moreover, their taxable income should not exceed a certain amount, which is annually adjusted for inflation.

Navigating the California Form 540 2EZ

Despite being a simplified form, the California 540 2EZ tax form is loaded with pertinent information crucial for accurate tax filing. The form is divided into sections, each designed to provide the state's tax agency with a clear picture of your income and the tax you owe.

The first section seeks basic information such as your name, address, and Social Security Number. Next, you provide your income details, including wages, taxable interest, and adjustments to income. The subsequent sections help calculate the tax, with areas dedicated to nonrefundable credits, payments, and refundable credits. Lastly, you'll find the section for the amount you owe or your refund.

How to Fill Out CA Form 540 2EZ

Completing the California resident income tax form 540 2EZ might seem daunting, but the process becomes more manageable with a step-by-step approach. Here is a straightforward guide on how to fill out this form. As always, consult a tax professional if unsure about any step in this process.

Step 1: Insert your personal information

The top part of the form requires your name, address, and Social Security Number. If you are married or in a registered domestic partnership and filing jointly, enter your spouse's or partner's name and Social Security Number.

Step 2: Income

In this section, you will input your income. The lines correspond to:

- Line 1: Wages, salaries, tips, etc. Use your W-2 form to fill in this section.

- Line 2: Taxable interest. This should be reported on your 1099-INT form.

- Line 3: Total income. Add lines 1 and 2 together.

Step 3: Adjustments to Income

Here, you can make adjustments to your income.

- Line 4: Enter the amount here if you contributed to the California Seniors Special Fund.

- Line 5: Subtotal. Subtract line 4 from line 3.

- Line 6: California standard deduction. This is a predetermined amount based on your filing status.

- Line 7: Taxable income. Subtract line 6 from line 5. If the result is less than zero, enter 0.

Step 4: Tax

Here, you determine the amount of tax you owe:

- Line 8: Tax. Use the tax table provided with the form instructions to find your tax.

- Line 9: Nonrefundable renter's credit if you qualify for it.

- Line 10: Subtract line 9 from line 8. This is your total tax.

Step 5: Payments

Here, you account for payments already made:

- Line 11: California income tax withheld, as reported on your W-2.

- Line 12: 2022 estimated tax payments and amount applied from 2021 return.

- Line 13: Add lines 11 and 12. This is your total payment.

Step 6: Calculate Your Refund or Amount You Owe

Line 14: If the amount on line 10 is bigger than on line 13, subtract line 13 from line 10. This is the amount you owe.

Line 15: If the amount on line 13 is bigger than on line 10, subtract line 10 from line 13. This is the amount of your refund.

Step 7: Sign and Date the Form

Finally, sign and date the form at the bottom, confirming that all your information is accurate to the best of your knowledge. If filing jointly, both parties must sign.

Once you have completed the form, mail it to the California Franchise Tax Board or file it electronically through the state's tax portal.

Remember, everyone's tax situation is unique. Always consult with a tax professional if you're unsure about anything. With a step-by-step approach and careful attention to detail, you can successfully complete your California Form 540 2EZ.

Form Versions

2022

Fillable California Form 540 2EZ for 2022

Fillable online California Form 540 2EZ