-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

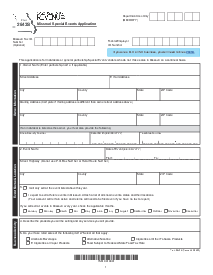

Arkansas Form AR1000F

Get your Arkansas Form AR1000F in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the AR1000F Form

The AR1000F form, officially known as the Full Year Resident Individual Income Tax Return, is a key component of fiscal obligations for Arkansas taxpayers. It's a document by which residents report their annual income details to the state's tax authority. The AR1000F form acts as the state-level counterpart of general federal tax forms such as the 1040.

Who should use the Arkansas income tax form AR1000F?

The Arkansas income tax Form AR1000F is intended to be used by full-year residents of Arkansas. If you lived in the state for the entire tax year, regardless of where you earned your income, you should use this form. It allows you to report your worldwide income for tax purposes as per the state of Arkansas's tax regulations.

However, if you are a part-year resident or non-resident, there are other specific forms assigned. Always remember, when unsure, consult with a tax professional or IRS guidelines for definitive advice.

How to Fill Out the Form AR1000F

When you decide to start tackling your Arkansas tax form AR1000F, you'd need to gather the necessary information in advance. Next, follow these instructions:

- Start with the 'Identification Section’. Input your Social Security Number, your full Name, and your Spouse’s Social Security Number and Full Name (if applicable).

- Next, fill in the demographic details, including your Present Home Address, City or Town, State, and Zip Code.

- In the 'Filing Status section', choose the applicable status from the provided options, such as Single, Married Filing Joint Return, Married Filing Separate Return, Head of Household, or Qualifying Widower. Choose the appropriate ones by clicking the checkboxes.

- For the 'Paid Preparer' section, write the name and contact details of your paid preparer if you hired one.

- Move onto the 'Income' section. Make sure to fill in all applicable fields based on your income sources. This includes wages, salaries, tips, taxable interest, dividend income, etc.

- Next, you will encounter the 'Tax Computation' section. Tally your total income from all the sources, apply for the necessary deductions, exemptions, and calculate your Total Tax as per the indicated tax rates.

- In the 'Tax Credits' section, specify any credits that are applicable to you, such as business tax credits, school choice tax credits, etc. These credits will reduce your overall Tax Liability.

- Fill out the 'Payments' section by including the total amount of estimated tax payments you have made throughout the tax year. This includes both State and Federal withholdings.

- Lastly, based on the total tax calculated and the total payments made, determine whether you are eligible for a 'Refund' or if there's 'Tax Due'. If you overpaid, write this amount under 'Refund'. Meanwhile, if you underpaid, write how much you owe in 'Tax Due'.

- After completing all sections, double-check your details, and sign the document.

- Once done, you can download, print, or directly submit the filled-out form online as per your convenience.

Importance of the Arkansas state tax form AR1000F

The Arkansas tax form AR1000F is crucial for residents as it not only allows taxpayers to summarize their income details over a tax year but also to calculate the amount they owe in state taxes. Falling short on this obligation can incur penalties, ranging from fines to legal actions. Therefore, understanding how to correctly complete and remit this form is paramount to fulfilling your tax obligations.

Fillable online Arkansas Form AR1000F