-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

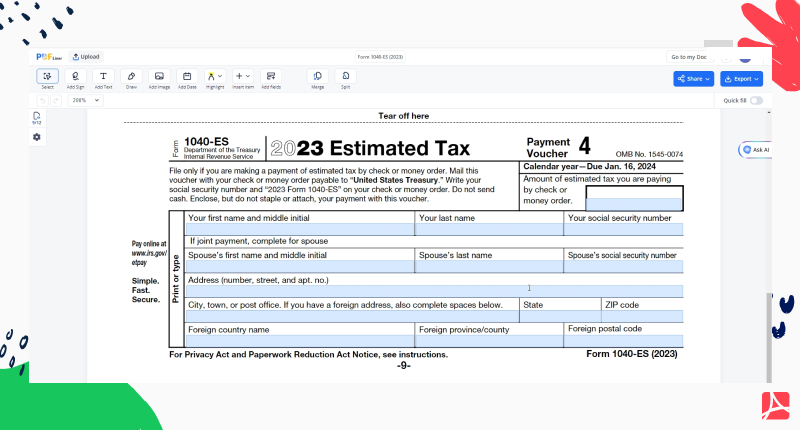

Fillable Form 1040-ES (2023)

Get your Form 1040-ES (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

The Ultimate Guide on How to Fill Out IRS Form 1040-ES 2023

The IRS Form 1040-ES 2023, also known as "Estimated Tax for Individuals," is a crucial document for individuals who are required to pay estimated taxes throughout the year. This includes income not subject to withholding, such as self-employment earnings, dividends, and rental income. By accurately filling out this form, taxpayers can avoid underpayment penalties and manage their cash flows efficiently throughout the fiscal year.

Who Needs to File IRS Form 1040-ES 2023

If you expect to owe $1,000 or more in taxes for the current year after subtracting withholdings and credits, you likely need to file the 1040-ES form 2023. This requirement often applies to freelancers, self-employed individuals, and those with significant unearned income. Making estimated tax payments helps in spreading tax payments over the year, making it less burdensome than paying a lump sum during tax season.

How to Calculate Estimated Taxes

Calculating estimated taxes begins with estimating your total income for the year, followed by deductions and credits to ascertain your taxable income. Next, use the current tax rates to calculate your tax liability. After accounting for expected withholdings and credits, divide the annual estimated tax into four parts for quarterly payments. Form 1040-ES 2023 comes with comprehensive instructions and a worksheet to assist in these calculations, making the process manageable.

How to Fill Out Form 1040-ES 2023

To correctly fill out Form 1040-ES 2023, follow these detailed steps:

- Gather Financial Records: First, compile all necessary financial documents, including income statements and receipts for potential deductions. This provides a clear picture of your financial standing for the year.

- Determine Estimated Income and Taxes: Estimate your total income and deduce taxes owed using the provided worksheet in the IRS form 1040-ES 2023 instructions. Consider all potential income sources and applicable deductions.

- Calculate Self-Employment Tax: If self-employed, utilize the "Self-Employment Tax and Deduction Worksheet" to determine how much you owe for Social Security and Medicare taxes, ensuring you adjust your gross income accordingly.

- Fill Out the Estimated Tax Worksheet: Using your calculated figures, complete the Estimated Tax Worksheet included in the 1040-ES form 2023. This form calculates your estimated tax obligations and helps divide them into quarterly payments.

- Record Estimated Tax Payments: Keep a meticulous record of each estimated tax payment. The 1040-ES form 2023 includes a section for documenting these payments, aiding in maintaining accurate financial records.

- Prepare the Payment Voucher: If a payment is needed, fill out the corresponding Payment Voucher. Ensure you note the correct due date and payment amount for every quarter.

- Submit Payment and Voucher: Mail your payment along with the filled Payment Voucher to the IRS. Follow the mailing instructions provided with the form to avoid any processing delays.

By adopting this meticulous approach, taxpayers can successfully fill out and submit the 1040 es form 2023, leading to a well-organized financial year regarding tax payments and avoiding any unforeseen penalties.

Navigating Due Dates and Avoiding Penalties

Timeliness is critical when filing your 1040 es form 2023. Understanding the due dates and using strategies such as overestimating payments or adjusting withholdings can mitigate the risk of penalties, ensuring a smoother tax-paying experience. The IRS offers resources such as the Electronic Federal Tax Payment System (EFTPS) for easier payment submissions, heightening the convenience for taxpayers across the board.

Fillable online Form 1040-ES (2023)